Crypto Advice Review: QuickX QCX token lending Ponzi scheme

Crypto Advice provides no information on its website about who owns or runs the business.

Crypto Advice provides no information on its website about who owns or runs the business.

Crypto Advice’s website domain (“cryptoadvice.com”) was first registered in 2016. The domain registration was last updated in February 2018.

Mark Andrews is listed as the owner, through an incomplete address in California.

Given the generic name, lack of information on Andrews in relation to Crypto Advice and incomplete address, there’s a high chance Mark Andrews doesn’t exist.

Supporting this is a UK incorporation certificate for Mended Minds LTD on Crypto Advice’s website.

UK incorporation is dirt cheap and for the most part unregulated. It is a favored jurisdiction for scammers looking to incorporate dodgy companies.

As for Mended Minds, it appears to be a shell company that doesn’t exist outside of its UK incorporation.

Supposedly the CEO of Mended Minds and Crypto Advice is Jordan Lucas (another suspiciously generic name).

Research into Mended Minds and Lucas lead me to QuickX who, on their own website state Crypto Advice is

developing and promoting the market and community for QuickX Protocol.

CryptoAdvice purchased token in bulk from QuickX and after that it is selling to the small and big investors with a minimum lock-in period of one year, this lock-in period would prevent the dumping of token.

QuickX is supposedly a Maltese shell company.

QuickX are behind the QCX token, which is primarily promoted through Crypto Advice’s MLM opportunity.

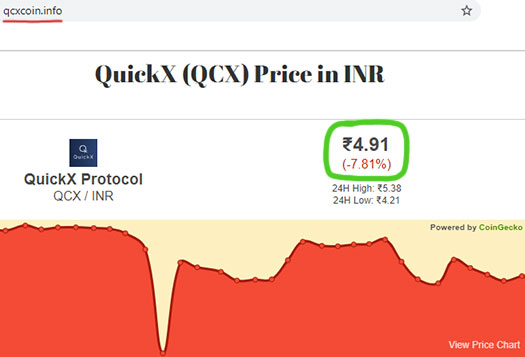

Despite the Maltese shell incorporation, QuickX appears to be run by Indians, as evidenced by its default Indian rupee QCX value chart:

On the corporate side of things Secugenius Pvt. Ltd. is cited as the company behind QuickX.

Secugenius is an Indian company that claims to be an “IT Risk Assessment and Digital Security Services provider”.

A blog post on QuickX’s website caught my eye, pertaining to a “head-office opening in Malaysia”:

We are also pleased to inform you that company has opened this office with collaboration of two of its partner in QuickX , Mr. Marcus Dato and Mr. Najib Razak.

The Founder CEO and COO of QuickX Protocol Mr. Kshitij Adhlakha & Mr. Vaibhav Adhlakha and the CEO of *CryptoAdvice* Mr. Jordan Lucas were also present there along with all the achievers of the recent Malaysia tour.

It appears that Jordan is a token white guy, but otherwise QuickX and Crypto Advice are run by a group of Indians, Indians living in Malaysia and Malaysians.

Oh and if it’s not obvious by now, Crypto Advice, Mended Minds, QuickX and Secugenius are all the same company.

Any illusion of separation through shell corporations is smoke and mirrors.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Lecun Wallet Review: NBY token mobile app Ponzi scheme

Lecun Wallet provides no information on its website about who owns or runs the company.

Lecun Wallet provides no information on its website about who owns or runs the company.

Lecun Wallet’s website domain (“lecunwalletinfo.com”) was privately registered on June 25th, 2019.

Marketing videos on Lecun Wallet’s website suggest the company is based out of Asia.

Lecun Wallet marketing material claims

the operation headquarter of LeCun is set up in Thailand.

It is a digital asset management alliance owned by JD Exchange, Lefumei, Mastercard (prepaid card), Singapore EM, SCL companies.

Obviously take all of that with a grain of salt. The Mastercard claim, for example, mentions the prepaid card without identifying who the merchant is.

Mastercard as a company has nothing to do with Lecun Wallet.

One marketing video shows Lecun Wallet’s “big boss” (guy in the middle), which suggests he might be running the show:

The language spoken in the video is Chinese, which means whoever “big boss” is and whoever he’s working with are likely based out of a Chinese-speaking country.

Supporting this is the use of “yuan” in Lecun Wallet’s marketing material:

Twenty years ago, if you put 10,000 yuan in your cupboard, You’re the local rich at that time! The Million households!

Now, twenty years later, if all you have is 10,000 yuan in your cupboard, you are the local Five Guaranteed.

Do you agree?

The same marketing presentation also mentions Xu Liwei;

LeCun Fund is the first blockchain extension application which is based on the blockchain technology V3.0 and developed by Mr. Xu Liwei, the president of Universal Internet Technology Corporation.

Mr. Xu Liwei is a architect of the first major computer in the world and a computer scientist from silicon valley, he was the NASDAQ-listed company, EveresSystem’s founder, has won the title of “the global 50 outstanding Chinese science and technology entrepreneurs”, the current Internet Foxconn Universe Company’s founder and the chief scientist.

Since 2010, Mr. Xu brought back many other cross-international laboratory from silicon valley, the China optical valley in Hubei, and etc., to conquer one after one technical challenges blockchain faced, taking a variety of hardware and software method, he developed the underlying backbone of the blockchain- super universe blockchain platform, That’s the universe’s main chain (PAC).

Mr. Xu Liwei is currently the director of blockchain research institute, China electronic commerce association of ministry, industry and information technology.

Given I wasn’t able to verify any of that, take Lecun Wallet’s claims about Xu Liwei with a dumpster truck full of salt.

It seems most of the information Lecun Wallet has published about itself and Xu Liwei is highly questionable, if not outright fabrications.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

PMV & John Souza to keep $600,000 of Digital Altitude victim funds

A decision on the beef between the Digital Altitude Receivership and Paradise Media Ventures, will see owner John Souza keep $600,000 of victim funds. [Continue reading…]

A decision on the beef between the Digital Altitude Receivership and Paradise Media Ventures, will see owner John Souza keep $600,000 of victim funds. [Continue reading…]

Gelios Trade Review: Fraudulent trading Ponzi targeting Asia

Although Gelios Trade has gone to some effort to present an executive team on their website, there’s a big question mark over the legitimacy of the information provided.

Although Gelios Trade has gone to some effort to present an executive team on their website, there’s a big question mark over the legitimacy of the information provided.

Gelios Trade claims to be headed up by William Svensson, supposedly a Norwegian

investor, philanthropist, manager of a hedge fund and a large range of financial services for private individuals.

His hedge fund, Gelios investering front, an asset management group with its headquarter in Lillehammer, Norway, was established in 2001.

Trouble is, outside of Gelios Trade’s website and marketing material, Svensson doesn’t exist.

Gelios Trade’s marketing material is fronted by “Kristian Berg”, who also doesn’t exist outside of the company.

In Gelios Trade marketing videos, Berg can be seen touring what appears to be a rented office space.

Gelios Trade claims the space is in Dublin, Ireland – yet everyone in the video, including Berg, has a distinctive eastern European accent.

Perhaps the most concrete example I can give you that something is up is Berg’s interview with “Thomas”, supposedly Gelios Trade’s “most experienced” trader.

In the footage above, the following exchange plays out:

Berg: Hi again Thomas. Tell me, how old are you?

Thomas: I am thirty-two years old.

Berg: Okay, and how long have you been trading at Gelios?

Thomas: I have been trading at Gelios since 2011.

Through the Wayback Machine, I can confirm that up until late 2018 the “gelios.com” domain was for sale ($3750 USD asking price).

The Gelios Trade website domain registration was last updated in February 2019, which is when the current owners took possession of it.

Gelios Trade as represented on their website didn’t exist up until a few months ago.

And if you scroll up to the quoted text from Gelios Trade’s website at the start of this review, you’ll note the company claims to have been founded i 2001.

Obviously this founding date, the staged “office tour” and executive information provided on Gelios Trade’s website are complete baloney.

Whoever is actually running Gelios Trade doesn’t want you to know who they are.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Crowd1 Review: “Owner rights” virtual shares investment fraud

![]() Crowd1 provides no information on their website about who owns or runs the business.

Crowd1 provides no information on their website about who owns or runs the business.

Crowd1’s website domain (“crowd1.com”) was first registered back in 2007. The domain registration was last updated in October 2018.

Stelios Piskopianos of Crowd1 Network Europe Ltd is listed as the owner, through an address in Cyprus.

Cyprus is a scam-friendly jurisdiction with little to no MLM regulation.

According to his LinkedIn profile, Stelios Piskopianos has a financial services background.

A commercially aware, hands-on Senior Finance Professional with considerable experience of financial and business control across a broad spectrum including strong IT skills and extensive knowledge of computerised information systems.

Piskopianos (right) is currently Finance Director of AOS Fluency Limited (“business process outsourcing”) and Northfield Petroleum Limited (private equity investment firm).

Piskopianos (right) is currently Finance Director of AOS Fluency Limited (“business process outsourcing”) and Northfield Petroleum Limited (private equity investment firm).

Curiously, Crowd1 does not appear on Piskopianos’ LinkedIn profile.

Whether Piskopianos is working alone or with others to run Crowd1 is unclear.

Update 23rd March 2020 – Stelios Piskopianos appears to be a fall guy. Crowd1’s Spanish shell company records reveal Jonas Erik Werner is running the company from Sweden. /end update

Read on for a full review of the Crowd1 MLM opportunity. [Continue reading…]

AWS Mining confirms illegality, refunds Texas investors

A settlement between AWS Mining and the Texas State Securities Board has confirmed the Ponzi scheme was operating illegally. [Continue reading…]

A settlement between AWS Mining and the Texas State Securities Board has confirmed the Ponzi scheme was operating illegally. [Continue reading…]

Belcorp Review: L’bel branded personal care since 1980

Belcorp has been around since 1980, although you wouldn’t know that from visiting their website.

Belcorp has been around since 1980, although you wouldn’t know that from visiting their website.

Belcorp does a terrible job of providing information about itself on its website.

The “about us” page on Belcorp’s website redirects to information about their “leadership principles”. The “our history” link on their US website redirects to the business opportunity page.

Why does Belcorp have a separate US website? No idea.

Belcorp primarily targets South America and so when you visit their websites, you’ll find Spanish as the default language.

As claimed in their marketing material, Belcorp is the ‘third top cosmetics direct sales company in Latin America‘.

In the US Belcorp operates as L’bel or Belcorp USA. The company runs both Belcorp USA and L’bel websites, with the former branded as L’bel despite the domain name.

L’bel claims to be “supported by Belcorp” but I believe is a subsidiary of the main company.

I tried to suss out why Belcorp operates as L’bel in the US but came up blank.

One significant difference between the two companies is marketed products.

Do you sell Esika & Cy-Zone in Belcorp USA?

No, at this moment we sell the L’Bel brand. In the future we will enter these brands in the United States market.

Again, not really sure why this is the case.

Eduardo Belmont Anderson founded Belcorp in 1980. Anderson (right) is from Peru and in his seventies, still serves as Belcorp’s President.

Eduardo Belmont Anderson founded Belcorp in 1980. Anderson (right) is from Peru and in his seventies, still serves as Belcorp’s President.

A search into Anderson’s background quickly establishes his billionaire status. As at the time of publication, Forbes pegs Anderson’s net worth at $1.7 billion.

Belcorp’s CEO as of February 2018 is Erika Herrero.

The only representation Anderson and Herrero have on Belcorp’s website are two small quotes.

According to her LinkedIn profile, Herrero (right) started at Belcorp in 2015 as a Corporate Vice President.

According to her LinkedIn profile, Herrero (right) started at Belcorp in 2015 as a Corporate Vice President.

Belcorp as a corporation is based out of Lima, Peru. L’bel in the US appears to be based out of Miami, Florida.

Read on for a full review of Belcorp’s MLM opportunity. [Continue reading…]

QNet victim loses $28,900, commits suicide

![]() Adapa Aravind joined QNet back in 2014. In 2017 he quit his IT job to pursue QNet full-time.

Adapa Aravind joined QNet back in 2014. In 2017 he quit his IT job to pursue QNet full-time.

As required by QNet’s business model, Aravind purchased products each month in order to qualify for commissions.

Those commissions never came though, and by 2019 Aravind (right) found himself $28,900 in debt.

Those commissions never came though, and by 2019 Aravind (right) found himself $28,900 in debt.

$7230 was savings Aravind had accumulated whilst working in the IT industry prior to signing up with QNet. He borrowed the rest from his father.

Earlier this week Aravind was found in his home hanging from a ceiling fan. [Continue reading…]

Visalus pyramid scheme class-action settlement options explained

News of the recent Visalus class-action settlement appears to have spread, resulting in a number of queries from victims as to how to proceed.

News of the recent Visalus class-action settlement appears to have spread, resulting in a number of queries from victims as to how to proceed.

Following a spate of enquiries over the last few days in particular, I figured it’d be worthwhile putting up a guide for victims unsure of what their options are. [Continue reading…]

BitConnect web developer extradited from Abu Dhabi to India

A BitConnect web developer has been deported from Abu Dhabi at the behest of Indian authorities. [Continue reading…]

A BitConnect web developer has been deported from Abu Dhabi at the behest of Indian authorities. [Continue reading…]