Lecun Wallet Review: NBY token mobile app Ponzi scheme

Lecun Wallet provides no information on its website about who owns or runs the company.

Lecun Wallet provides no information on its website about who owns or runs the company.

Lecun Wallet’s website domain (“lecunwalletinfo.com”) was privately registered on June 25th, 2019.

Marketing videos on Lecun Wallet’s website suggest the company is based out of Asia.

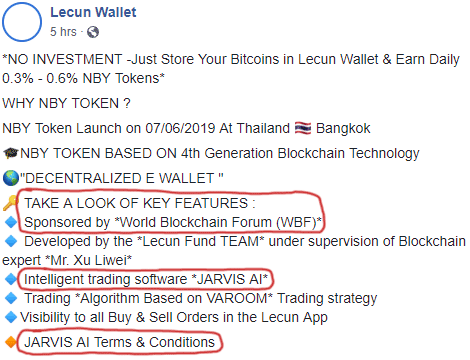

Lecun Wallet marketing material claims

the operation headquarter of LeCun is set up in Thailand.

It is a digital asset management alliance owned by JD Exchange, Lefumei, Mastercard (prepaid card), Singapore EM, SCL companies.

Obviously take all of that with a grain of salt. The Mastercard claim, for example, mentions the prepaid card without identifying who the merchant is.

Mastercard as a company has nothing to do with Lecun Wallet.

One marketing video shows Lecun Wallet’s “big boss” (guy in the middle), which suggests he might be running the show:

The language spoken in the video is Chinese, which means whoever “big boss” is and whoever he’s working with are likely based out of a Chinese-speaking country.

Supporting this is the use of “yuan” in Lecun Wallet’s marketing material:

Twenty years ago, if you put 10,000 yuan in your cupboard, You’re the local rich at that time! The Million households!

Now, twenty years later, if all you have is 10,000 yuan in your cupboard, you are the local Five Guaranteed.

Do you agree?

The same marketing presentation also mentions Xu Liwei;

LeCun Fund is the first blockchain extension application which is based on the blockchain technology V3.0 and developed by Mr. Xu Liwei, the president of Universal Internet Technology Corporation.

Mr. Xu Liwei is a architect of the first major computer in the world and a computer scientist from silicon valley, he was the NASDAQ-listed company, EveresSystem’s founder, has won the title of “the global 50 outstanding Chinese science and technology entrepreneurs”, the current Internet Foxconn Universe Company’s founder and the chief scientist.

Since 2010, Mr. Xu brought back many other cross-international laboratory from silicon valley, the China optical valley in Hubei, and etc., to conquer one after one technical challenges blockchain faced, taking a variety of hardware and software method, he developed the underlying backbone of the blockchain- super universe blockchain platform, That’s the universe’s main chain (PAC).

Mr. Xu Liwei is currently the director of blockchain research institute, China electronic commerce association of ministry, industry and information technology.

Given I wasn’t able to verify any of that, take Lecun Wallet’s claims about Xu Liwei with a dumpster truck full of salt.

It seems most of the information Lecun Wallet has published about itself and Xu Liwei is highly questionable, if not outright fabrications.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Lecun Wallet’s Products

Lecun Wallet has no retailable products or services, with affiliates only able to market Lecun Wallet affiliate membership itself.

Lecun Wallet’s Compensation Plan

Lecun Wallet affiliates invest in NBY tokens, which are then parked through a mobile wallet app in exchange for monthly returns.

- invest $500 to $2999 in NBY tokens and receive a daily 0.3% to 0.4% return for 30 days

- invest $3000 to $9999 in NBY tokens and receive a daily 0.4% to 0.5% return for 45 days

- invest $10,000 or more in NBY tokens and receive a daily 0.5% to 0.6% return for 60 days

Returns are paid in NBY tokens, which can be converted back into USD via Lecun Wallet’s app.

If an affiliate withdraws into USD prior to the maturity period a 5% fee is charged.

The withdrawal fee is reduced to 1% outside of the maturity period.

Referral Commissions

Lecun Wallet pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Lecun Wallet caps payable unilevel team levels at ten, based on how many investors an affiliate has recruited:

- recruit one investing affiliate = 100% referral commission rate on level 1 (personally recruited affiliates)

- recruit three investing affiliates = 100% referral commission rate on levels 1 to 5

- recruit five investing affiliates = 100% referral commission rate on levels 1 to 10

Referral commission rates can be increased if the following rank-based criteria is met:

- One Star (generate $200,000 in investment volume across ten unilevel team levels) – 105% referral commission rate on level 1, 15% on levels 2 to 10 and 5% from level 11

- Two Star (personally recruit at least three One Star ranked affiliates) – 110% referral commission rate on level 1, 20% on levels 2 to 10 and 10% from level 11

- Three Star (personally recruit at least three Two Star ranked affiliates) – 115% referral commission rate on level 1, 25% on levels 2 to 10 and 15% from level 11

- Four Star (personally recruit at least four Three Star ranked affiliates) – 120% referral commission rate on level 1, 30% on levels 2 to 10 and 20% from level 11

Note that the reduction from 100% to 15% to 30% on levels 2 to 10 is not a typo.

Joining Lecun Wallet

Lecun Wallet affiliate membership is free.

Participation in the attached income opportunity however is tied to a minimum $500 investment in NBY tokens.

Conclusion

Lecun Wallet is yet another entry into the crowded app wallet Ponzi niche sweeping Asia.

The company claims to generate external revenue through automated bot trading, however no evidence of external revenue being actually used to pay affiliates is provided.

Furthermore, despite clearly offering a passive investment opportunity, Lecun Wallet is not registered to offer securities in any jurisdiction it solicits investment in.

App wallet Ponzi schemes conduct fraud through a worthless token. In Lecun Wallet this is their NBY token.

Lecun Wallet creates NBY tokens on demand, solely to track investment through.

NBY token is not publicly tradeable and holds no value outside of Lecun Wallet’s app.

Given Lecun Wallet can generate NBY tokens on demand at little to no cost, it’s hardly surprising that returns and commissions are paid in NBY token.

Withdrawals to actual money are processed through the app, and payable for as long as newly invested funds exceed withdrawals.

As with any Ponzi scheme, eventually withdrawals exceed new investment and that’s when Lecun Wallet will collapse.

Given the close proximity between Plus Token Wallet (collapsed), Cloud Token, S Block and Sacuwa (collapsed), there’s probably some overlap on Lecun Wallet’s backend.

To that end I found multiple references to “Jarvis AI bot” in Lecun Wallet marketing efforts:

Jarvis AI is the ruse Cloud Wallet uses to solicit investment into their CTO token. World Blockchain Forum meanwhile has firmly established itself as a curator of app wallet Ponzi schemes.

Ultimately however whether there are any concrete ties between Lecun Wallet, Cloud Token and the World Blockchain Forum is unclear.

For some reason though Lecun Wallet affiliates seem to be using the same marketing pitch.

In any event be it Cloud Token, Lecun Wallet or any of the other app wallet Ponzi schemes, the math behind them guarantees that when they collapse, the majority of participants lose money.

Wait wait wait… So these guys invented Blockchain 3.0 AFTER Cloud Token already invented Blockchain 4.0 ??

sIr… i FiNk TheY’rE LaGiC iS a BiT mEtHeD uP tHeIr Me ThInKs…..

Naw. Cloud Token is also running logic 5.0. You just haven’t upgraded yet.