Jan Gregory to keep scamming consumers after BitHarvest

![]() In the wake of the BitHarvest Ponzi collapse, top net-winner Jan Gregory has vowed to continue scamming consumers. [Continue reading…]

In the wake of the BitHarvest Ponzi collapse, top net-winner Jan Gregory has vowed to continue scamming consumers. [Continue reading…]

It’s a Lifestyle Outlet Review: Tava reboot pyramid

It’s a Lifestyle Outlet fails to provide ownership or executive information on its website.

It’s a Lifestyle Outlet fails to provide ownership or executive information on its website.

It’s a Lifestyle Outlet’s website domain (“itsalifestyleoutlet.com”), was registered on March 14th, 2024. The private registration was last updated on March 15th, 2025.

Further research reveals It’s a Lifestyle Outlet “relaunch” marketing material from September 2025:

Featured in the promo above are Kenny and Chante Lloyd.

The Lloyds made a name for themselves as co-CEOs of Tava, a LaCore Enterprises MLM company.

Following a copyright infringement lawsuit filed in 2023, Tava collapsed later the same year or early 2024.

With respect to the copyright infringement lawsuit, there have been no case docket updates since May 2025.

After Tava collapsed the LLoyds began promoting Govvi. That doesn’t seem to have worked out, which brings us to It’s a Lifestyle Outlet’s launch.

Why the Lloyds fail to disclose ownership on It’s a Lifestyle Outlet’s website is unclear.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Axiom Review: Trading ruse MLM crypto Ponzi

![]() Axiom fails to provide ownership or executive information on its website.

Axiom fails to provide ownership or executive information on its website.

Axiom’s website domain (“axiom.trade”), was privately registered in December 2024. The private registration was last updated on November 24th, 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

De Spend Review: DSG token staking node Ponzi

De Spend, also going by DeSpend, fails to provide ownership or executive information on its website.

De Spend, also going by DeSpend, fails to provide ownership or executive information on its website.

De Spend’s website domain (“despend.com”), was privately registered on August 28th, 2025.

Over on De Spend’s official English Telegram channel we find Chinese:

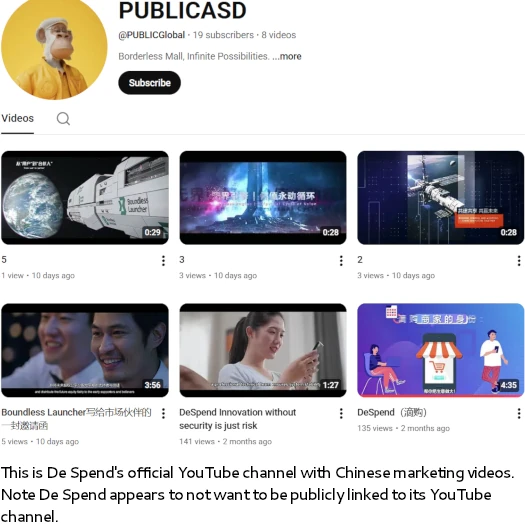

This ties into official De Spend marketing videos also being in Chinese:

This strongly suggests whoever is running De Spend has ties to China.

Despite the obvious ties to China, Chinese scammers behind De Spend falsely represent ties to the US:

This is the typical “register a US shell company with bogus details –> register shell company with FinCEN” legitimacy ruse scammers outside of the US use.

Any company can be voluntarily registered with FinCEN. FinCEN is not a financial regulator, registration of a company with FinCEN is meaningless with respect to MLM due-diligence.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

My Daily Choice holding earned commissions hostage

As part of its merger with Immunotec, My Daily Choice is holding earned commissions hostage. [Continue reading…]

As part of its merger with Immunotec, My Daily Choice is holding earned commissions hostage. [Continue reading…]

Luiz Goes claims Alessio Vinassa ran WeWe Global Ponzi

LyoPay CEO Luiz Goes claims Alessio Vinassa ran the WeWe Global Ponzi scheme.

LyoPay CEO Luiz Goes claims Alessio Vinassa ran the WeWe Global Ponzi scheme.

On November 22nd, Goes sent BehindMLM an email with the subject “URGENT Request for Name and Photo Removal – Luiz Goes / Multiple Articles (8 URLs)”.

It was typical of emails BehindMLM receives from scammers looking to hide their crimes. [Continue reading…]

Andre & Monique Vaughn ordered to pay $1.7M in taxes

![]() Andre and Monique Vaughn have been ordered to pay $1,776,626 in taxes. [Continue reading…]

Andre and Monique Vaughn have been ordered to pay $1,776,626 in taxes. [Continue reading…]

PoolPay$ Review: Gaming ruse MLM crypto Ponzi

![]() PoolPay$ fails to provide ownership or executive information on its websites.

PoolPay$ fails to provide ownership or executive information on its websites.

PoolPay$ operates from two website domains:

- poolpays.com – privately registered on September 9th, 2025

- poolpays.app – privately registered on an unknown date

Despite only existing for a few months, on its website PoolPay$ falsely claims it

has already moved over $80 million during its pre-launch from 2023 to July 2025.

Of note is PoolPay$’s website defaulting to Portuguese. This suggests whoever is running PoolPay$ is probably fluent in Portuguese.

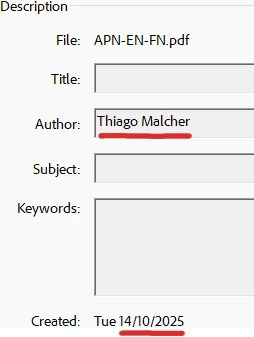

One name we can tie to PoolPay$ is Thiago Malcher, author of PoolPay$’s official marketing presentation:

I wasn’t able to find anything further on Malcher with respect to PoolPay$. Thiago however is a common Portuguese name.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

iBuumerang sold off to Dubai-based Risen Live

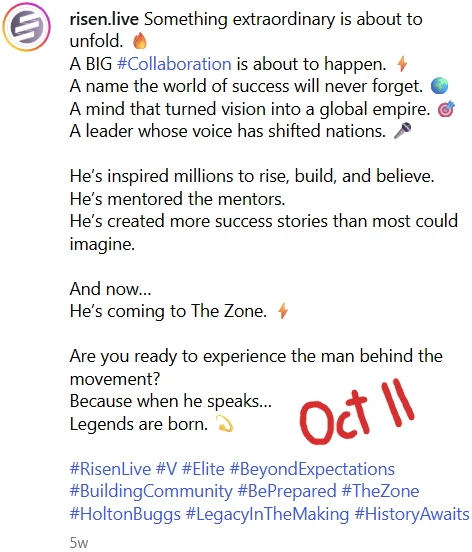

Holton Buggs appears to have sold what’s left of iBuumerang to Risen Live.

Holton Buggs appears to have sold what’s left of iBuumerang to Risen Live.

While Buggs began appearing in Risen Live marketing material in early October…

…Buggs waited till October 20th to break the news on an iBuumerang marketing webinar. [Continue reading…]

BitHarvest collapses, Dubai FTT token exit-scam

![]() The Bitharvest Ponzi scheme has collapsed.

The Bitharvest Ponzi scheme has collapsed.

Withdrawals have been disabled, plans to flee to Dubai have been revealed and there’s talk of an FTT token exit-scam. [Continue reading…]