Fintoch admins arrested in China and Thailand

![]() Two Fintoch admins have been arrested in China and Thailand.

Two Fintoch admins have been arrested in China and Thailand.

As reported by Khaosod English on October 29th; [Continue reading…]

Bit Mining Review: Crypto mining “click a button” Ponzi

Bit Mining fails to provide ownership or executive information on its website.

Bit Mining’s website domain (“betmee.com”), was privately registered on August 12th, 2025.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Betronomy Review: AI betting bot ruse MLM crypto Ponzi

![]() Betronomy fails to provide ownership or executive information on its website.

Betronomy fails to provide ownership or executive information on its website.

Betronomy’s website domain (“betronomy.com”), was privately registered on May 22nd, 2025.

In an attempt to appear legitimate, Betronomy provides a company registration certificate for “Betronomy Limited”. Betronomy Limited was purportedly registered in Hong Kong on June 4th, 2025.

Due to the ease with which scammers are able to incorporate shell companies with bogus details, for the purpose of MLM due-diligence these certificates are meaningless.

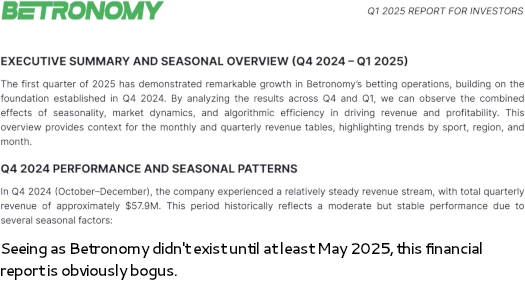

Betronomy also provides quarterly financial reports on its website:

These reports are meaningless at face value given they are neither audited nor filed with financial regulators (legal requirement).

Additionally, the reports are backdated to Q4 2024, which is roughly six months before Betronomy even existed.

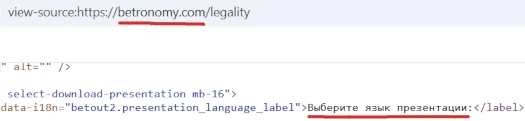

In Betronomy’s website source-code we find a hidden label with Russian as the default language:

This syncs with Betronomy holding staged marketing events in Moscow:

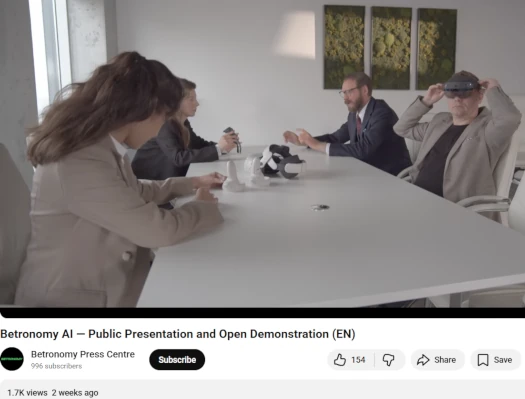

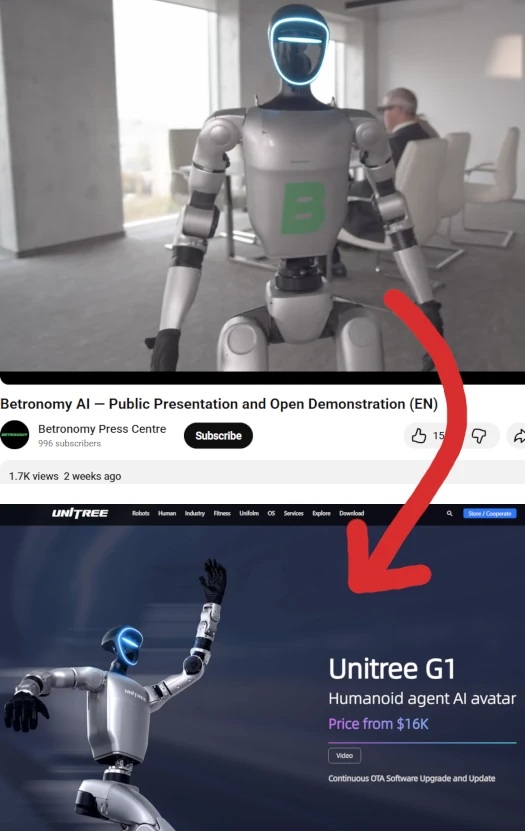

On Betronomy’s official YouTube channel, we find an obligatory rented office marketing video featuring at least one actor with an eastern European accent:

The video also features a Unitree G1 humanoid, sold by the Chinese robotics company for $16,000 as of August 2025.

Betronomy also represents it has held at least one staged event in Vietnam:

Putting all of this together, Betronomy is likely run by Russian scammers working with Chinese scammers.

It’s possible Russian crime groups are operating solo across Asia (Thailand), but they are unlikely to be doing so in Vietnam (a long established proxy for Chinese organized crime groups).

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Cory Kromray pleads guilty to Driven Trading charges

Driven Trading’s Cory Kromray has pled guilty to wire fraud and money laundering.

Driven Trading’s Cory Kromray has pled guilty to wire fraud and money laundering.

Following an indictment back in May, Kromray’s guilty plea was submitted on October 10th. [Continue reading…]

Hassan Mahmoud accused of raiding Iqonic to launch Noa

A lawsuit filed by Brian McMullen has accused former business partner Hassan Mahmoud of raiding Iqonic to launch Noa.

A lawsuit filed by Brian McMullen has accused former business partner Hassan Mahmoud of raiding Iqonic to launch Noa.

McMullen’s lawsuit also fills in some gaps with respect to the formation of Iqonic, which we’ll go over before getting into the lawsuit itself. [Continue reading…]

Scammers resurrect Traffic Monsoon Ponzi, again

Scammers have resurrected the collapsed Traffic Monsoon Ponzi scheme for a second time. [Continue reading…]

Scammers have resurrected the collapsed Traffic Monsoon Ponzi scheme for a second time. [Continue reading…]

Jifu founder alleges “legally risky business practices” (FTC?)

In a lawsuit filed against fellow Jifu co-founder Kyle Copeland, Bradley Boyle has made allegations of “legally risky business practices”.

In a lawsuit filed against fellow Jifu co-founder Kyle Copeland, Bradley Boyle has made allegations of “legally risky business practices”.

Boyle’s lawsuit also seems to suggest the FTC and State of Nevada are actively investigating Jifu. [Continue reading…]

Win On Wealth founders indicted, sued by SEC

Trong Hoang Luu and Linh Thuy Le, Win On Wealth’s husband-and-wife co-founders, have been indicted.

Trong Hoang Luu and Linh Thuy Le, Win On Wealth’s husband-and-wife co-founders, have been indicted.

The pair, who are based out of California, have also been sued by the SEC on civil fraud charges. [Continue reading…]

DAO1 & Apertum securities fraud warning from Lithuania

DAO1 and Apertum Foundation have received a securities fraud warning from Lithuania.

DAO1 and Apertum Foundation have received a securities fraud warning from Lithuania.

The Bank of Lithuania added DAO1 and Apertum Foundation to its list “of entities without the right to provide financial services (including investment, insurance)” on October 30th, 2025. [Continue reading…]

Zionix Global loses two domains, lies to investors

Zionix Global has lost two website domains over the past week. The investment scam has rebooted on a third .AI domain.

Zionix Global has lost two website domains over the past week. The investment scam has rebooted on a third .AI domain.

Rather than be honest about losing its first two website domains, Zionix Global is lying to its investors. [Continue reading…]