Holton Buggs files to dissolve The Traders Domain Receivership

![]() Holton Buggs has filed motions seeking dismissal of the case against him and dissolvement of a court-appointed Receiver.

Holton Buggs has filed motions seeking dismissal of the case against him and dissolvement of a court-appointed Receiver.

Buggs is one of sixteen The Traders Domain defendants sued by the CFTC last month.

Based on leaked investor data, The Traders Domain was a Ponzi scheme estimated to have defrauded consumers out of ~$3.3 billion.

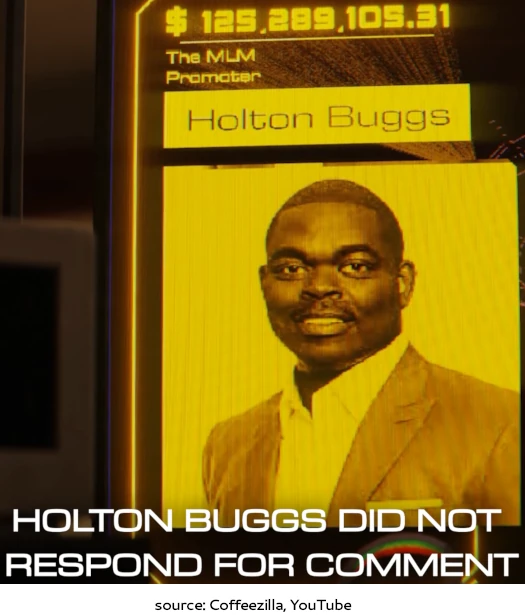

Buggs is believed to have personally stolen over $125 million through the scam.

In his November 11th filed motion to dismiss, Buggs argues the CFTC’s case against him

is based on nothing more than a single incidental appearance at a conference in Miami and vague, generalized allegations of promotional activities accessible nationwide.

Buggs argues this “isolated contact” fails to establish “constitutional due process requirements”.

In his November 12th filed motion to dissolve the The Traders Domain Receivership, Buggs pleads ignorance.

Defendant Holton Buggs, Jr., by and through undersigned counsel, respectfully moves this Court to dissolve the receivership order issued against him in the above-referenced case.

This motion is based on Defendant Buggs’ limited, good-faith involvement in Traders Domain and his lack of knowledge or intent regarding any alleged fraudulent activity.

In an accompanying affidavit, Buggs throws Ted Safranko (right), The Traders Domain’s founder and co-defendant, under the bus.

In an accompanying affidavit, Buggs throws Ted Safranko (right), The Traders Domain’s founder and co-defendant, under the bus.

I have no formal education, experience, or training in commodity trading, securities trading, or any related financial field.

As such, in making investments, I have sought opportunities through reputable channels and have relied on professionals in my network for investment-related advice and introductions.

I became aware of Traders Domain FX Ltd. (hereinafter “TD”) through an introduction made by one of my trusted employees, who recommended TD as a potential investment opportunity.

Upon learning of TD, I decided to arrange a meeting with Ted Safranko, the principal of TD, to better understand the nature of TD’s business and trading approach.

During out meeting, Mr. Safranko presented himself as a conservative and disciplined trader.

He argued me that his trading strategy involved isolating one trade entry per day to minimize risks, which he emphasized was fundamentally different from high-risk, high-frequency trading strategies that often result in losses for less experienced traders.

Mr. Safranko explained that he had nine years of trading experience and seven years in compliance.

It should be noted that at no time was The Traders Domain or Safranko registered with the CFTC. Buggs could have confirmed this with a five-second search of the NFA’s public BASIC database.

[Safranko] further explained that many amateur traders suffer substantial losses by engaging in multiple trade entries throughout the day.

He assured me that his single-trade-per-day strategy was effective in mitigating these risks. Additionally, he stated that he executed his once-a-day trade personally, and that his method was designed to preserve investor capital while still aiming for consistent returns.

The cautious approach that Mr. Safranko described appeared credible to me.

Mr. Safranko also discussed his own conservative lifestyle, mentioning that he lived simply in Vancouver.

His straightforward manner and lifestyle reinforced my impression that he was a responsible individual operating a legitimate business with integrity and caution.

In addition to not being registered with the CFTC, The Traders and Domain weren’t registered with the SEC either. This is again something Buggs could have confirmed with a five-second search of the SEC’s public EDGAR database.

Based on Mr. Safranko’s representations and assurances, I decided to invest passively in TD.

I believed in good faith that TD was a legitimate trading enterprise and had no reason to suspect otherwise or that anyone related to TD was engaging in any misconduct.

On his personal involvement in The Traders Domain, Buggs states;

My involvement with TD was limited to a passive participation role, in which I shared information about my experience with a close circle of family and friends who expressed interest in it.

I have no official role in TD’s management, operations, decision-making, or fund administration.

Not that it matters with respect to the CFTC’s filed charges, but Buggs admitting he promoted The Traders Domain whilst claiming he was only a passive investor is, at a minimum, contradictory.

As a general matter, I would never engage in or participate in any activity that I knew or had reason to believe was fraudulent of illegal.

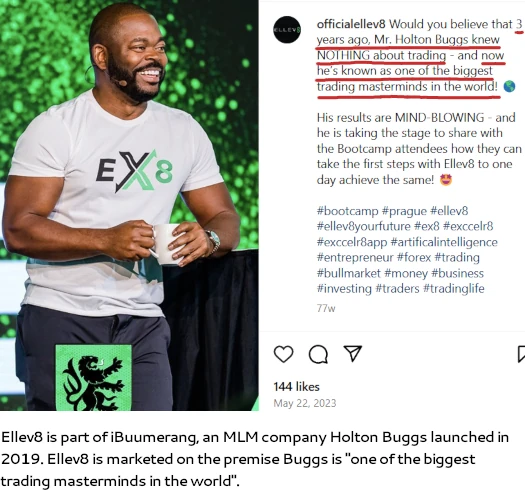

In addition to directly investing into and promoting The Traders Domain, Buggs co-founded the Meta Bounty Hunters and Meta Bounty Huntresses Ponzi schemes.

It’s believed Buggs fed his Meta Bounty Hunters/Huntresses Ponzis into The Traders Domain. Both scams collapsed in February 2023, a few months after The Traders Domain collapsed in late 2022.

In light of his claims, Buggs asks the court to “relieve [him] from the receivership order”.

As part of its lawsuit, the CFTC is seeking injunctive relief against the The Traders Domain defendants. Several defendants have already consented to preliminary injunctions.

On November 7th the court continued a pending TRO show cause and preliminary injunction hearing, scheduled for November 12th, to December 10th.

It’s expected the court will also address Bugg’s filed motions as part of the hearing.

Update 27th November 2024 – Due to an attorney scheduling conflict, the preliminary injunction hearing will now take place on January 6th, 2025.

Update 8th December 2024 – The CFTC has filed its response to Holton Buggs’ motion.

Update 7th January 2025 – Citing the need to “depose key witnesses and narrow… contested issues before the Court”, on December 30th the parties requested the January 6th preliminary injunction be continued.

The court granted the motion later the same day. The Traders Domain preliminary injunction hearing is now scheduled for January 24th.

Update 25th January 2025 – Holton Buggs’ dismissal motion was denied on January 17th.

Empire Crypto Trading was selling themselves as an educational group in Australia and actively promoted and sold the Meta Bounty Hunters and Meta Bounty Huntresses Ponzi schemes. A lot of people lost money.

Well, they definitely learnt a lesson.

If Holton can show that his accounts were frozen by traders domain, just like everybody else and show his victimhood just like everybody else he can definitely get this dismissed or at least his penalties reduced, but if it shows that he was commissioned while everybody else was losing he’s in trouble.

Huh? We’ve got MLM Ponzi promoters getting twenty year prison sentences in criminal cases:

https://behindmlm.com/companies/forcounts-juan-tacuri-sentenced-to-20-years-prison/

Whether Buggs’ account was frozen or not is irrelevant. Also you don’t steal $125 mill plus whatever his wife stole and get to cry victim. Buggs is a net-winner and a top one at that.

That just means he’s a great recruiter. They have to prove other things in order for him be considered in full participation with the ponzi operation. They have to prove nefariousness intent in his recruiting.

Buggs hasn’t been sued for “full participation with the Ponzi operations”. He’s been sued for multiple violations of the Commodities Act.

Ignorance of the law isn’t a valid defense for civil or criminal fraud charges.

Holton Buggs is one of the network marketing industry’s all-time greatest smooth-talking hustlers. He’s a chiseler, a scammer, and a shyster, as are so many of the industry “leaders” involved with Traders Domain.

What’s amazing to observe over the years is the “hypnotic magnetism” that Buggs holds over his followers. Buggs’ followers literally worship him and the ground he walks on, and they follow him blindly from one scam to another.

Holton Buggs claimed he sold it to friends and family. He is lying. I don’t know him and put so much money on Meta Bounty Hunters for the promise of monthly returns which he promoted in their then groups with Travois Bott and company.

There were so many of us in Australia who were lured to buy the Meta Bounty Hunters and Huntresses. Empire Crypto Trading was the name of the Trading group and they changed it to ELLEv8.

There were so many people who lost so much money from Holton Buggs and his Ponzi scheme. He knew it would go down before Feb. 2023 but he still sold it to us.

Now he is washing is hands. He needs to pay us back the money the money that we put in it! So many lives were affected because of their evilness and lack of concern for others for the sake of money!!