Zukul Trader Review: Zukul to reboot as crypto trading scheme

Zukul launched in 2014 and is headed up by co-founders Jeremy Rush and Michael Bloom.

Zukul launched in 2014 and is headed up by co-founders Jeremy Rush and Michael Bloom.

BehindMLM first reviewed Zukul in 2016, finding its business model to be that of a subscription-based pyramid scheme.

When that flopped Zukul reinvented itself as an adcredit “revenue sharing” Ponzi scheme.

When that flopped Zukul reinvented itself as Zukul Gold, which fed Zukul affiliates into Jeremy Rush’s Eagle Aurum Team cycler Ponzi downline.

Zukul Gold was short-lived and also eventually collapsed.

Zukul Gold was short-lived and also eventually collapsed.

As Zukul affiliate losses mounted, Jeremy Rush (right) threatened to sue anyone who publicly criticized him or the company.

Things were pretty quiet over at Zukul throughout 2017.

No doubt watching the rest of the MLM underbelly embrace cryptocurrency fraud, it seems now Rush and Bloom want their share of the pie.

Rumblings of Zukul Trader began about a month ago…

Read on for a full review of the Zukul Trader MLM opportunity.

Zukul Trader Products

Zukul Trader has no retailable products or services, with affiliates only able to market Zukul Trader affiliate membership itself.

The Zukul Trader Compensation Plan

Zukul Trader affiliates invest funds on the expectation of a passive ROI, which Zukuk Trader represents is generated through cryptocurrency trading.

Zukul Trader track affiliate investment through “units”.

- Starter Units are $10, capped at 300 active units

- Beginner Units are $35, capped at 1500 active units

- Intermediate Units are $85, capped at 3000 units

- Advanced Units are $185, capped at 6000 units

Zukul Trader pay referral commissions on invested funds down three levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 25%

- level 2 – 10%

- level 3 – 5%

Residual Commissions

Zukul Trader pay residual commissions via a 3×10 matrix.

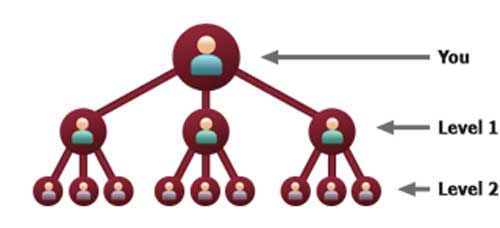

A 3×10 matrix places an affiliate at the top of a matrix, with three positions directly under them:

These three positions form the first level of the matrix. The second level of the matrix is generated by splitting each of these three positions into another three positions each (9 positions).

Levels three to ten of the matrix are generated in the same manner, with each new level housing three times as many positions as the previous level.

Each Zukul Trader unit tier corresponds with a separate matrix tier.

A Zukul Trader affiliate is placed at the top of a 3×10 matrix in that tier upon investment in at least one unit at that tier (Starter to Advanced).

Once placed at the top of a 3×10 matrix, positions in the matrix are filled via company-wide recruitment of new affiliates.

These affiliates are placed into the matrix as they buy into that particular tier.

Residual commissions are generated on unit purchases by affiliates placed in the matrix, as a percentage of funds invested as follows:

- level 1 – 10% (3 positions)

- level 2 – 4% (9 positions)

- level 3 – 3.5% (27 positions)

- level 4 – 2.5% (81 positions)

- levels 5 and 6 – 1.5% (972 positions)

- level 7 – 1% (2187 positions)

- levels 8 to 10 – 0.5% (85,293 positions)

An additional 50% Matching Bonus is paid on matrix commissions paid to personally recruited affiliates.

Joining Zukul Trader

Zukul Trader affiliate membership costs are not provided on the company website.

The Zukul Trader compensation plan does reference “monthly residual commissions”, suggesting there might be a monthly fee charged.

Note that all payments with Zukul Trader are made in bitcoin (both paid and received).

Conclusion

Call my cynical, but Zukul Trader is just their “revenue sharing” Ponzi model rebooted as a cryptocurrency offering.

Zukul Trader claims to generate ROI revenue through a “proprietary software (that) leverages crypto 24/7/365”.

While there is some evidence that trading might be taking place (affiliates need an “approved Gdax account”), Zukul provide no information about who developed or maintains their purportedly “proprietary” trading bot.

Considering the company is quite obviously providing affiliates with a passive ROI through alleged use of the bot, at a minimum Zukul Trader fail to provide legally required disclosures pertaining to an obvious securities offering.

Upon consideration of Zukul’s past offerings, none of which have been even remotely legitimate, the prospect of Jeremy Rush waking up one day to find a crypto trading bot under his pillow seems unlikely.

Even if we assume the bot isn’t just smoke and mirrors, if you had a trading bot capable of generating returns to the point others might consider investing, would you be flogging it for as little at $10 a pop?

I’m certainly not suggesting charging more would legitimize Zukul Trader’s offering, but the unit price-points and tier caps certainly seem suspect.

Artificially funneling investors into spending more and more is a calling card of fraudulent schemes. Certainly a legitimate trading opportunity would have no reason to do so.

After all, it shouldn’t make any difference to a bot if it’s generating a ROI for 300 units belonging to one affiliate or 100 belonging to three separate affiliates.

Another aspect to consider is the significant percentage of invested funds recycled to pay commissions with.

This is money the bot doesn’t have access to, meaning it’s being expected to perform well and above the competition.

Again, if you had such a bot would you be flogging it to randoms over the internet.

And this being a “proprietary” bot no less.

Without legally required disclosures, one can speculate on Zukul Trader’s MLM offering all day.

What we know for sure is that at the time of publication the top two sources of traffic to Zukul Trader’s two websites are the UK (78% and 59%) and the US (16%).

Neither Zukul Trader, Jeremy Rush or Michael Bloom are registered to offer securities in either country.

Update 14th June 2021 – Zukul Trader became Zukul Trading sometime after this review was published.

BehindMLM revisited Zukul for an updated 2021 review, only to discover Jeremy Rush pushing other Ponzi schemes on YouTube.

This is a great business. Can’t wait to get access to the trading bot. The Bot never loose a trade.

YAY !!!!

You’ll be a squillionaire in no time.

I’d pre order my Lamborghini now, if I were you, those waiting lists can be a right pain in the rectum.

This guy never gives up..

Anytime I see “BOT” along with Trading – it is already suspect.

You would think anyone that offers such a bot that there biggest selling point would be PROVING 100% that it works.

Here we have the same type pitch that it is so great and wonderful just dump your money in and relax it will do all the work and you collect the commissions.

Do these people think that anyone can’t recognize by now how often this type of junk comes along and failed before they put yet another one out there?

What happened to “PADLOCK INCOME” that Jeremy was so happy about?

80% of trading in the stock market is done via the use of Bot”s. Should not be something that anyone is suspect about as it is very common throughout all trading environments now.

Yeah and 73.6% of all statistics are made up.

Stop pulling nonsensical figures out of your anal orifice without the slightest shred of proof

I got this info from the Washington Post Article on Feb. 7th 2018.. Here is a blurb below..

So how did that turn into 80%?

Let me recall that all the so called MLM TRADING BOTS have turned out to be JUNK!!

Your right.. only 10 percent are made by real life humans… so 90% of trades are done by artificial intelligence…ie…a BOT that has been programmed….

Wrong. 40%, according to the article, represent passive funds that replicate an index. No bots or AI are involved in these.

Humans decide what to include in the index and the fund manager simply buys what’s in the index. No management decisions, whether by a human or a bot. No trading, except to keep the fund’s components in line with the index.

You have no idea what you’re talking about, you’re embarrassing yourself, and everyone is laughing at you. Stick to the private Facebook and Telegram scammer echo chambers.

Jason, I apologise, I shouldn’t have jumped to the conclusion you were defending the scam. I can see that you’ve been a commenter here for a while.

I read the thread too quickly and thought that John’s comment and your comments were from the same person.

The point being that many of the worlds financial trading markets are run by Bots.. what exact percentage is irrevelant…it is ALOT!!!

How can that be your point when you said, and I quote:

The largely unregulated world of bitcoin, which has attracted scammers from far and wide with fake trading bots, isn’t exactly the same as the highly regulated stock exchanges in major economies around the world.

In fact Jason 99.23% of people in this forum think 100% of mlm trading bot companies are in fact thinly veiled Ponzi schemes.

The Bot wait when the price go down and buy when it going up again…so it not loose if you don’t stop it…pure awesomeness

John is a moron! I can’t wait until this scam implodes….AGAIN!

lol. you’re not going to get your money back no matter how many lies you have to tell to suck new rubes in.

I agree that “what exact percentage is irrevelant”.

What scammers want everyone to forget is that over time, these trading markets average returns of about 10% per year.

That is 0.027% per day … if you count all 365 days.

SD

I suspect John is on the wind up whereas Jason McRiffle truly believes that 100% of trading bots are legitimate.

Dude u are saying trash.

The Zukul Trader website has an Alexa rank of 11.7 million.

The Zukul.trade website redirects to Zukul.com, which is in a downward spiral of 200,000+ since December 2018.

Ouch. And sorry for your loss.

Big scam. Jeremy Rush should be in jail.