Uulala Review: Oscar Garcia triples down on securities fraud

Uulala operates in the cryptocurrency MLM niche. The company is based out of California in the US.

Uulala operates in the cryptocurrency MLM niche. The company is based out of California in the US.

Heading up Uulala is CEO Oscar Garcia, a resident of California.

As per Garcia’s LinkedIn profile;

For the past 20 years as an entrepreneur, Mr. Garcia has built companies, and accelerated the growth of small businesses.

Mr. Garcia has over 20 years in technology and web development.

Circa 2014 Garcia held the Executive Vice President position at the Lucrazon Global Ponzi scheme.

Prior to Lucrazon Global, Garcia was a Melaleuca affiliate.

In January 2014 Garcia was a named defendant in a lawsuit filed by Melaleuca.

In the suit filed last week in U.S. District Court in Pocatello, Melaleuca is alleging that one of its former “marketing executives,” Oscar Garcia, now a vice president with Lucrazon Global, a network marketing e-commerce company based in Irvine, Calif., is pitching his newest business to current and former Melaleuca marketing executives.

“Lucrazon seeks to swell the ranks of its brand partners by raiding Melaleuca’s marketing executives,” the suit alleges.

In October 2016 Garcia settled with Melaleuca. A $5000 judgment was entered against him.

Lucrazon Global collapsed by the end of 2014. As revealed in a civil lawsuit filed in 2016, Lucrazon Global targeted elderly victims and fleeced them out of millions.

After Lucrazon Global Garcia reinvented himself as a crypto bro. This brings us to Uulala’s launch in 2017.

Uualala’s original business model saw the company sell UULA and EUULA tokens.

The company’s ICO raised over $9 million dollars.

In August 2021 the SEC announced a civil complaint against Uulala, Garcia and co-founder Matthew Loughran.

From December 2017 through January 2019, Uulala sold UULA tokens, which were allegedly to be used to record transactions in a financial application (“app”) that Uulala was developing and promoting to those without access to traditional banking services.

Uulala, Garcia, and Loughran made materially false and misleading statements to investors throughout their offering of UULA about having “patent pending” technology that had been incorporated into their app and having a proprietary algorithm to assign credit scores to users of their app.

Uulala, Garcia and Loughran settled the lawsuit.

Uulala, Garcia and Loughran respectively paid civil penalties of $300,000, $192,768 and $50,000.

If you’re wondering why those amounts are tiny compared to the $9 million raised, Ualala claims;

The revenue generated from the ICO was put back into the company to continue to enhance our technology, to pay our employees, our operating expenses and to help sustain us during the first three years of our business.

Today there is no mention of Matthew Loughran on Uulala’s website. The SEC’s complaint states Loughran stood down as Uulala’s Chief Marketing Officer shortly before it was filed.

Whether Loughran is still involved with Uulala is unclear.

Despite its initial UULA and EUULA token scheme being “dismantled”, Uulala is still around and operating as an MLM company.

Read on for a full review of Uulala’s MLM opportunity.

Uulala’s Products

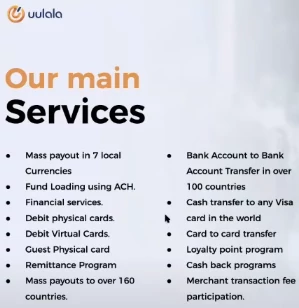

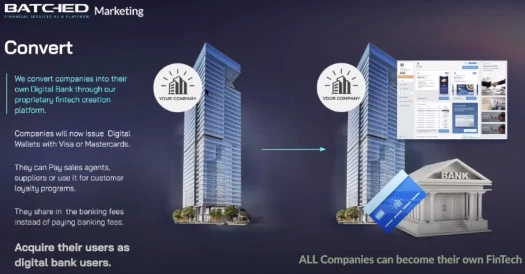

Uulala markets a finance alternative platform they’re calling Batched.

Uulala markets a finance alternative platform they’re calling Batched.

Oscar Garcia claims the Batched platform can “turn any company into their own digital bank”.

Batched is intended to be sold to third-party companies looking for a cheaper payment processing solution.

Uulala claims it charges much less than traditional banks. Companies can also set their own fee rates, collecting these back as profit as opposed to paying fees to a bank.

Uulala prices Batched between $5000 to $150,000.

- Plan 01 – $5000 and then $500 a month for up to 100 users

- Plan 02 – $25,000 and then $3000 a month for up to 5000 users

- Plan 03 – $50,000 and then $5000 a month for up to 5000 users

- Plan 04 – $150,000 and then $5000 a month for up to 10,000 users

In addition to user limits, Uulala offers additional services the more a company pays in fees.

Uulala’s Compensation Plan

Uulala’s compensation plan pays on referral of companies to its Batched finance platform.

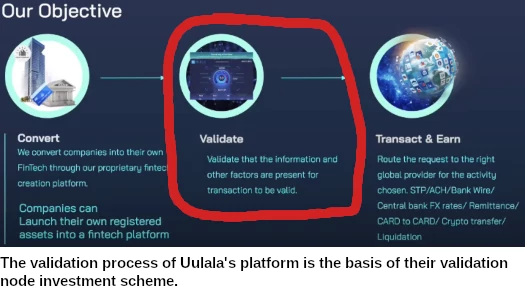

Attached to this is a “validation node” investment scheme.

Batched Referral Commissions

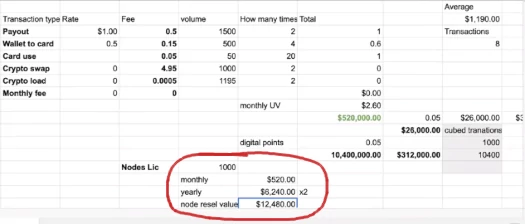

Uulala affiliates receive a 5% transaction fee override on any companies they personally refer to the Batched platform.

Validation Node Investment Scheme

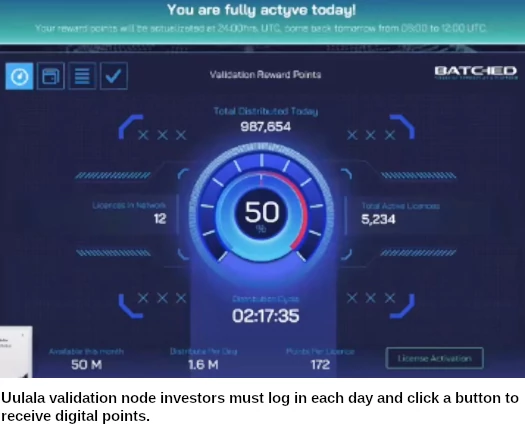

Uulala represents validation of transactions is a key component of Batched.

Rather than just validating transactions in the background, Uulala has made it the center of an investment scheme.

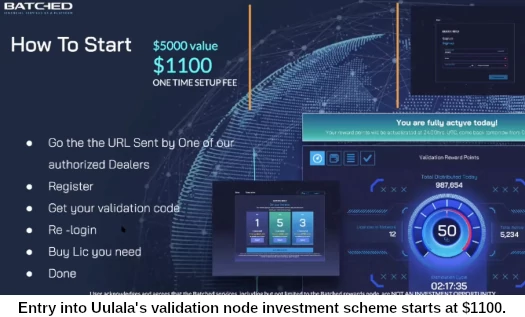

Uulala affiliates sign up and invest $1100 into a validation node position.

Having a validation node position allows a Uulala affiliate to log in and click a button.

This generates an unspecified amount of “digital points”.

Once acquired, digital points are parked with Uulala on the promise of a return.

- park up to 15,000 digital points and receive 5 cents per point redeemed

- park 15,001 to 99,999 digital points and receive 7 cents per point redeemed

- park 100,000+ points and receive 10 cents per point redeemed

Digital point redemption occurs in an arbitrary manner controlled by Uulala.

The company claims digital points are redemption is tied to transactions within the Batched platform.

Referral commissions are available on validation node investment, paid down two levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 30%

- level 2 – 10%

Joining Uulala

Uulala affiliate membership is tied to investment in a $1100 validation node position.

Note that Uulala marketing material states the required investment amount will increase with every 500 positions invested in.

Conclusion

Lucrazon Global’s marketing schtick was a finance alternative platform.

Affiliates invested $1000 to $15,000 and collected a passive return, purportedly generated via use of its platform.

In reality Lucrazon Global was a Ponzi scheme, primarily recycling invested funds to pay returns to affiliate investors.

Uulala is essentially that same model but with cryptocurrency and “digital points”.

The original plan was probably to use UULA and EUULA tokens, but the SEC put a stop to that.

Still, regardless of whether UULA, EUULA or digital points are used, Uulala’s validation node investment scheme is still a securities offering.

Oscar Garcia himself represents that validation node positions are worth $5000.

Garcia goes on to state validation node positions are “worth quite a bit of money”.

He represents Uulala affiliate investors will be able to sell the positions at a profit in the future.

Uulala having affiliates sign in and click a button to receive digital points, is akin to Zeek Rewards having its affiliates log in each day to enter in advertising URLs.

We can earn these daily points by logging in, hitting the start button and helping validate these transactions.

They validate the transactions and get a percentage of everything being done.

By earning those points, you can then put it into our transaction gateway.

It’s busy-body work that has nothing to do with generation of returns.

And even if it did, clicking a button is entirely passive – the “work”, whether anything actually happens or not, still takes place passively via Uulala’s systems.

Thus the criteria of an investment contract is satisfied.

Uulala affiliates invest $1100 (or more) on the expectation of a passive return derived via the efforts of others (Uulala).

Parking digital points with Uulala and waiting for them to get “used” is simply a mechanism to control the rate of withdrawal.

Should new investment dry up, Uulala can reduce or altogether stop usage of digital points. All they have to tell their affiliates is there’s not enough transactions taking place.

No doubt Uulala will point to their Batched platform and claim actual transactions are taking place and this is all above board.

The problem is that is Uulala’s validation node scheme is still an investment contract. This makes Uulala’s MLM opportunity a securities offering.

Companies that offer securities in the US are required to register with the SEC and periodically file audited financial reports.

Those reports are the only way consumers can verify Uulala is generating external revenue to pay digital point returns with.

Perhaps not surprisingly, as I write this neither Uulala or Oscar Garcia (right) are registered with the SEC.

Perhaps not surprisingly, as I write this neither Uulala or Oscar Garcia (right) are registered with the SEC.

There are no financial reports, and thus the only verifiable source of revenue entering Uulala is new $1100 investments.

Any MLM company marketing a securities offering should absolutely not be taken at face value regarding any revenue claims made.

With Uulala this is even more important.

This is from the SEC’s filed August 2021 complaint;

This case involves the fraudulent and unregistered offer and sale of digital asset securities known as UULA tokens by Defendant Uulala, Inc. (“Uulala”), and its subsequent fraudulent and unregistered offer and sale of promissory notes that could be converted to equity (the “Convertible Notes”).

Uulala purports to be a “financial solutions platform that provides the world’s underbanked populations access to the financial inclusion tools they need to change their future.”

Uulala represented to investors that it had developed a functional mobile phone application (“app”) that allows users to store, transfer, and borrow money, pay bills, make purchases, earn rewards for this activity, and establish a credit history to qualify for microcredit loans.

The UULA White Paper contained false claims about Uulala’s technology, including that it incorporated “Proprietary Patent Pending Decentralized Database Technology.”

This technology was actually owned and patented by a different company, Uulala had no rights to the technology, and Uulala had not in fact incorporated that technology at the time of the UULA offering.

Starting in 2019, Uulala and Garcia raised an additional $500,000 from four U.S. investors through its Convertible Notes offering.

Garcia created a presentation slide deck to promote the offering, which they showed to potential investors.

This offering document contained false financial information about Uulala, including claiming that it had over $250,000 in revenue in 2019, which Garcia admitted was false.

Uulala’s co-founder and chief executive officer, Defendant Oscar Garcia (“Garcia”), was the primary architect of both fraudulent offerings.

We know Uulala has no problem with using 40% of validation node investments to pay referral commissions (a pyramid scheme in and of itself).

Even using a tiny percentage of what’s left to fund digital point withdrawals would make Uulala a Ponzi scheme.

The more pressing matter however is securities fraud.

Oscar Garcia got away with security fraud with Lucrazon Global.

With Uulala Garcia doubled down on securities fraud with his own platform and got busted.

Now he’s tripled down with the Batched validation node investment scheme.

This likely isn’t going to end well.

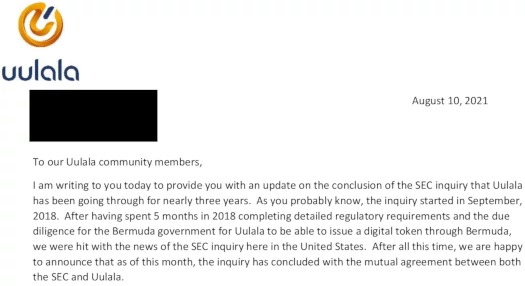

By their own admission, in an August 10th email sent out to Uulala investors, the company acknowledged;

The inquiry has concluded with a settlement between Uulala and the SEC whereby Uulala has agreed to abide by the Securities Act of 1933, like all other companies, and unless and until a registration

statement is in effect as to securities Uulala cannot sell any unregistered Securities.

Given Garcia’s history of fraud, I’m confident all we’re looking at here is a variation of the “staking” MLM crypto Ponzi model.

That is participants invest in tokens/coins (digital points), park those tokens/coins with the company (staking) and collect a passive ROI.

Returns are either wholly or primarily paid out of subsequently invested funds, making the model that of a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Uulala of ROI revenue (either in part or full), eventually resulting in a collapse.

The math behind Ponzi schemes guarantees the majority of participants lose money.

Update 22nd January 2023 – In late 2021 Uulala was abandoned and rolled into Batched.

Batched prevented affiliate investors from logging into their accounts in early January 2023 – thus preventing them from intiating withdrawals.

In researching Uulala and the Batched reboot collapse, I was able to confirm an active SEC investigation into Batched and Oscar Garcia.

I am an investor in the Uulala token offering during the ICO Stage.

Now that the whole project has been thru the SEC suing the CEO and the coins are barred from being used, what happens to our investment? any class action possible ?

Garcia told the SEC he spent practically everything invested. Wasn’t any recovery.

Class-action is a question for a lawyer. Not liking your chances this many years after the fact.

UUlala was actually presented as a partner of the gifting scheme Up2Give in February 2020.

1 + 1 = nada

youtube.com/watch?v=H1ETnLCOy4s

Wtf and I just bought four more nodes fml.

I am an investor in the Uulala token offering during the ICO Stage.

I find out about all Garcia’s history of fraud with UULALA but he promise us that we will get our money back one way or other but is been one year and I have not hear from him.

So reading about the third business probably will be another scheme. So now what happens to our investment?

Your investment stays with Garcia, because you invested in a Ponzi scheme and inevitably got scammed.

Your best bet is filing a complaint with the SEC.

As of January 2022, many that purchased Nodes with Batched (formerly known as Uulala) are unable to log on and click “start” to run their node and generate points because the 2-Factor verification won’t work.

You never receive the email with the code so you can’t log in to click “start.”

Also, there was a telegram group ran by Oscar right hand person (Kathy), and everyone could post and reply, but about a week ago, she suddenly blocked everyone and now she’s the only one that can post and reply.

She cited too much negativity (which I get) and not having the time to keep up, but it’s interesting timing because on a conference call with Oscar (the CEO of Batched) two days ago, we found out the following:

Here is what someone posted in another group regarding the conference call held on zoom:

Long story short alledgedly Oscars partner the COO altered financials, stole some of the technology for personal gain and sold the company.

The Batched technology and software is proprietary so they will be trying to revamp the company and keep all existing partners

They are in the midst of a legal battle so if you have had any correspondence with the COO or the compliance team in regards to your node please forward any emails to (removed) to help the cause

They have a record of all node points as of December 2022 and are asking all to continue running their nodes to have the more records for lawsuit.

If you go to the telegram group for information, there really is none. Kathy basically pleaded for the 100’s of people to stop DM’ing her. What does she expect?

After that conference call many people will have questions, want to chat, air their grievances, comment, reply, etc…. But she locked everyone out of the group, so of course she’s getting tons of DM’s.

Ponzi collapsed. Money stolen by admins. Sorry for your loss etc.

Sounds like Uulala is over. I’ll see if I can dig up enough for an article tomorrow.

Invested in Multiple nodes and clicked a goddam button since Sept 2021… I feel like a fool.

If there is going to be a class action lawsuit against Oscar, Kathy and Brandon, count me in. I wanna see them burn.

My mom who has MS put in some of her savings here as well. I get that there is risk… but there is something to be said for “Good Faith”.

He was Name dropping the VATICAN to all of us as well. Saying that the vatican was backing this shit.

I want to be paid for all the f*cking time I spent over 500 days of my life logging in, 2FA, clicking, watching update videos… I wanna be paid back for the Investment and for my continued time and I wont take less than $100/hr.

We need to make some noise on Twitter…. who’s with me?

This video no longer exists 🙁

Wait when did Uulala collapse? I thought it was a recent thing.

Website is gone and Twitter was abandoned in Oct 2021, same month I published this review.

Ray’s comment opens with “Jan 2022”. I think I misread that as 2023 last night.

If Uulala collapsed a year ago, why was the Telegram group only locked down this month?

Have Uulala investors really been strung along for the past year?

They stopped using Uulala and switched to Batched completely. since then most of their “update calls” on zoom are never recorded and if you miss it because you have a business of your own or a life outside of this scam… you cant get the information… especially after Kathy locked the Telegram group.

I missed the most recent video call and the next thing i see from Kathy in the telegram chat is about her crying during the call and apologizing for her being emotional… so in my case im left holding my nodes without access to run them, no access to information and like i said… wasted an hour a day logging in a “running” my node every day since Sept 2021… there are people in the group internationally with 15 nodes… and they are all in the same boat.

I am super embarrassed that I fell for this.. Im even more embarassed that I invited people I know to lose money and waste their time as well. It’s criminal.

It would have been better if it was just a $5000 investment that you set and forget and hope for a good return.. but they had all of us like idiots logging in and clicking a button every day..

Ray’s Comment IS 2023… i missed their Video Call on Tuesday, Jan 17th at 5pm PST All Hands Batched Call.

Thanks for the clarification.

Putting this together then, Uulala abandoned its company name and merged into Batched, an existing fintech company owned by Oscar Garcia.

Before it jumped on the crypto fraud bandwagon, Batched was marketing “traditional” finance services (2015):

prweb.com/releases/batched/ochcc/prweb12841244.htm

Through Batched, the Uulala Ponzi scheme was continued. Investors logged in and clicked a button to generate returns.

Now investors are realizing they’ve been had and nobody is getting paid. That sound about right?

One thing I’m still unclear on is when withdrawal payments stopped. I’m guessing recently?

Yes, in my OP, I meant to say “as of January 2023,” sorry for confusion.

Regarding Batched: here is Kathy’s recent message in their telegram group in regards to not being able to log in and click “start” on your node if you have 2FA set up:

Background:

Those that have 2fa can’t log in because they never receive the code sent to email or text, so that’s what this is about.

Thanks. There’s enough there for a follow up article. I’ll put one together later today.

Now people are trying to sell their nodes to the “highest bidder” claiming the value of all their nodes is $94,000 or $75,000 etc.

These nodes and the reward points are pointless to purchase right now plus nobody is even able to make the transfer happen.

I can appreciate the sense of hope and faith in a project. This one however, is riddled with scandals (past and present) and now no communication with anyone. One live call and no update for those who missed it.

Is Oscar taking legal action against Frank? Is the SEC investigating? How much truth is even known about the current status of this business?

I’m laying down my hopes and my $40K investment and moving on. God is good. He will provide for me. But most likely not through Batched/Uulala.

Just A small update,

This was just posted by Kathy (Oscar’s right hand person) in the telegram group. Keep in mind. Kathy locked the telegram group, a week before Oscar let us know all this bad news (convenient timing), so we can’t reply or post, only Kathy can.

Here is her latest message:

I’ll post again after zoom meeting.

Someone with access please record it send a private video link.

The DOJ are not going to prosecute anyone for recording and sharing a Ponzi webinar.

Does anyone have the link to the Zoom call for the 9th?

Update:

So tomorrow they are having a zoom meeting to introduce the new company – of which we still have zero clue about – and the zoom meeting is only open to the first 100 people to sign in. Lol ♂️♂️♂️

So everyone has lost their money; we’re given hope that a new company is taking over the technology; we have zero clue whom that company is; we have zero clue if we’re going to be asked to put more money in; we have zero clue if our Nodes we purchased with “Batched” (Aka Uulala) will cary over, and the meeting is a first come first serve (everyone battling to beat each other).

Anyways, I’ll keep you posted as to what happens.

Also, as far as being arrested for recording a zoom!?!! What sort of bull-honky is that? Lol. I highly doubt you can be arrested for doing that. It’s so lame to even say that. ♂️♂️♂️

Sounds like the makings of a shitshow. Popcorn at the ready! *nomnomnom*

Thanks for the updates. Jokes aside it’ll be interesting to see what Garcia has come up with.

Yeah that’s not a thing.

Update:

So I wasn’t able to get into the zoom meeting to hear about this new company that wants to buy/invest in the Batched (Uulala) technology and of course the Telegram Chat group was once again locked and only the moderator (Kathy keen) has access to post, so that’s preventing people from chatting about the zoom meeting.

BUT…. when I tried to join the group the zoom stated that the host was in fact: Micah Theard. Go read a few posts earlier, this is whom I figured was going to be the new big investor in Batched.

Google these things together (“MICAH THEARD” “MIRACLE CASH” “CYPRUS” and “BOOGIE GOPHER CLUB”) and you’ll find a plethora of stuff that this Micah is attached to, they are all Ponzi type things.

This was the big news, the big investor, we were waiting for? That gives me zero confidence that this new direction for Batched will amount to anything at all.

When I learn more about the zoom meeting and they have another one open to those haven’t heard it yet, I’ll get back and post more on here.

Oh p.s. if you go to YouTube, Micah Theard has a bunch of videos. He’s tied to Boogie Gopher Club and his new venture is MIRACLE CASH, well that and now Batched I guess. So you can find videos of him speaking on it.

If Garcia has gotten into bed with Theard then this is relevant for due-diligence:

https://behindmlm.com/companies/cashflow-nfts-founder-is-onecoin-scammer-micah-theard/

https://behindmlm.com/mlm-reviews/cashflow-nft-review-nft-real-estate-themed-securities-fraud/

As of March 2023, SimilarWeb tracked ~15K website traffic visits to CashFlow NFT’s website. That’s up from 4000-5000 over Jan and Feb.

For an MLM crypto Ponzi even 15,000 visits a month is dead. Guess Batched investors are the new bagholders if Garcia’s and Theard’s plan works out.

So the zoom video was released to the rest of the Batched Telegram Group which is now called (NEW COMPANY-HOLDING ROOM).

I’ll sum it up:

You listen to smooth talking Micah Theard. He tells you all about Miracle Cash and More…. And basically it comes down to this… if you were with Batched (which doesn’t exist anymore), then you can buy a Node at a discount into Micah’s Miracle Cash.

If you buy a node right now, it’s about $800. But regular people will be paying about $2000 per node.

So there is NO Batched merger with a new company, that was misleading. Your investment and old Batched Node(s) are gone, and there is no indication that Oscar’s Batched technology is even coming over to Miracle Cash and More; there would be no need for it.

My guess is that Oscar will get a nice commission from Micah for handing him over all these old Batched customers that sign up.

If you all do your research, these are all basically the same:

CashFlow NFT’s = MIRACLE CASH AND MORE = BOOGIE GOPHER CLUB = NEW BOOGIE GOPHER = MICAH THEARD

Here, you can all decide for yourself. This is the first meeting he did after he did his presentation to all the former BATCHED NODE HOLDERS.

youtu.be/PnDpUP54X2c

The old Batched Uulala Telegram group is ending since that went belly up, and they are moving over to a new Facebook group for the new company (Miracle Cash, Cash Flow NFT, Boogie Gopher Club, etc…).

If you want to follow it:

facebook.com/groups/204623599015474/