MetFi Review: 1000% a year NFT cash grab Ponzi scheme

MetFi fails to provide company ownership or executive information on its website. Official MetFi marketing videos are dubbed over with robo voices.

MetFi fails to provide company ownership or executive information on its website. Official MetFi marketing videos are dubbed over with robo voices.

MetFi’s website domain (“metfi.io”), was first registered in March 2021. The private registration was last updated on March 12th, 2022.

Given the May 21st 2022 launch date cited on MetFi’s whitepaper, it’s safe to assume the current owner(s) took possession of the domain in March.

Despite representations nobody is running MetFi, MetFi’s owner(s) communicate to investors through a Discord chat group.

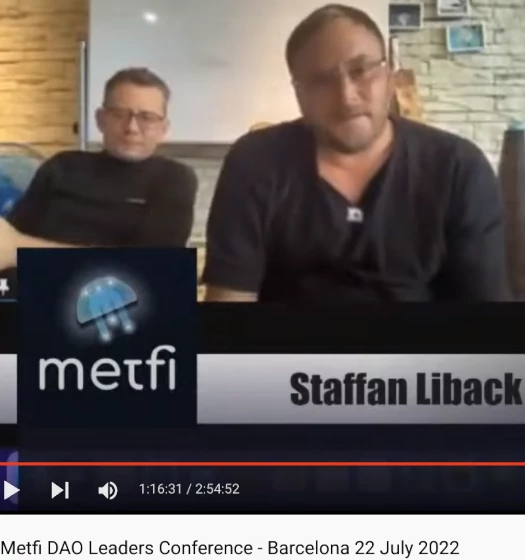

Update 20th August 2022 – Following a reader tip, I’m noting MetFi’s ties to OneCoin scammers Staffan Liback and Stephan Steinkeller.

In a webinar targeting Spanish investors, held on or around July 20th (different webinar below), Staffan Liback claimed to have been involved in MetFi for 40+ days.

This puts Liback in Metfi right around the late May launch.

Liback is joined in MetFi by the Steinkeller brothers…

…who are believed to be wanted by Italian authorities on OneCoin criminal fraud charges.

The Steinkellers fled Italy for Dubai as OneCoin was collapsing. Liback is based out of Thailand.

Earlier this year the Steinkellers were promoting the WinWheel Ponzi scheme.

WinWheel was a reboot of Algotech, set up by Klas Magnus Nilsson and Daniel Grenon. Nigel Allan, a former OneCoin executive, oversaw Liback and the Steinkeller brothers.

Winwheel launched in late 2021 and collapsed in Q1 2022.

The July MetFi webinar cited above was put together by Jairo Cornago Moreno (below), also a former Winwheel promoter.

While there’s been no public acknowledgement of who’s running MetFi, the ties to Winwheel are too numerous to ignore.

I suspect MetFi is a reboot of Winwheel, with the same cast of characters running the show.

SimilarWeb traffic analysis for MetFi’s website reveals recruitment in Spain collapsed over June and July.

Top sources of traffic to MetFi’s website are currently the Dominican Republic (44%), Martinique (25%) and Italy (10%).

MetFi has likely migrated from Spain to the Dominican Republic through Spanish speaking scammers.

Martinique is a tiny island of less than 400,000 in the Caribbean currently plagued by MLM Ponzis. Most of MetFi’s Martinique investors are likely Decentra victims.

Decentra is a collapsing Ponzi scheme run by Jonathan Sifuentes. Martinique made up 88% of traffic to Decentra’s website in July 2022.

Wanted by local authorities and currently in South America (Colombia), the Steinkeller brothers and their associates are likely behind MetFi recruitment in Italy. /end update

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

MetFi’s Products

MetFi has no retailable products or services.

Affiliates are only able to market MetFi affiliate membership itself.

MetFi’s Compensation Plan

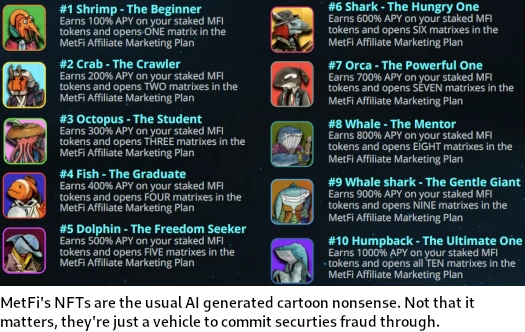

MetFi runs a ten-tier investment scheme in Binance USD (BUSD).

BUSD is a stablecoin represented to be pegged to the USD, i.e. 1 BUSD = $1 USD.

MetFi’s ten investment tiers are:

- Shrimp – 100 BUSD

- Crab – 200 BUSD

- Octopus – 400 BUSD

- Fish – 800 BUSD

- Dolphin – 1600 BUSD

- Shark – 3200 BUSD

- Orca – 6400 BUSD

- Whale – 12,800 BUSD

- Whale Shark – 25,600 BUSD

- Humpback – 51,200 BUSD

These tiers correspond with NFT investment positions.

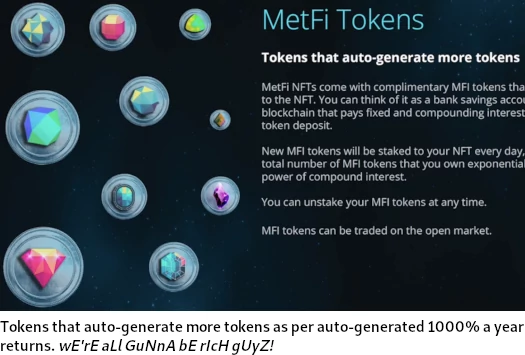

When a MetFi affiliate invests, they receive a set amount of MFI tokens. MFI tokens are then parked with MetFi on the promise of an annual ROI, calculated and paid daily.

- invest at the Shrimp tier and receive $10 worth of MFI tokens, invested on the promise of a 100% annual ROI

- invest at the Crab tier and receive $20 worth of MFI tokens, invested on the promise of a 200% annual ROI

- invest at the Octopus tier and receive $40 worth of MFI tokens, invested on the promise a 300% annual ROI

- invest at the Fish tier and receive $80 worth of MFI tokens, invested on the promise of a 400% annual ROI

- invest at the Dolphin tier and receive $160 worth of MFI tokens, invested on the promise of a 500% annual ROI

- invest at the Shark tier and receive $320 worth of MFI tokens, invested on the promise of a 600% annual ROI

- invest at the Orca tier and receive $640 worth of MFI tokens, invested on the promise of a 700% annual ROI

- invest at the Whale tier and receive $1280 worth of MFI tokens, invested on the promise of an 800% annual ROI

- invest at the Whale Shark tier and receive $2560 worth of MFI tokens, invested on the promise of a 900% annual ROI

- invest at the Humpback tier and receive $10,230 worth of MFI tokens, invested on the promise of a 1000% annual ROI

Note that MetFi do not publish the current internal MFI trading value on their website.

The MLM side of MetFi pays on recruitment of affiliate investors. Note that while MetFi solicits investment in BUSD, MLM commissions and bonuses are paid in tether.

Fast Start Rewards

Fast Start Rewards are paid out during a newly recruited affiliate’s first thirty days.

To qualify for Fast Start Rewards, a MetFi affiliate must recruit at least five affiliates who’ve invested at tier 4 or higher (Fish Tier).

Once that condition is satisfied, and if an affiliate is still within their first thirty day period, they receive a 10% Fast Start Reward on all BUSD invested by personally recruited affiliates.

Residual Commissions

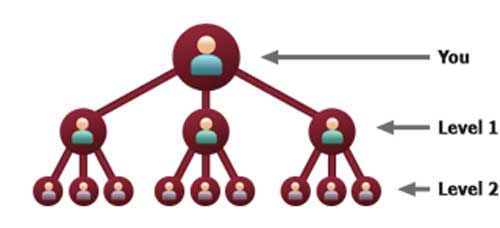

MetFi pays residual commissions via a 3×10 matrix.

A 3×10 matrix places an affiliate at the top of a matrix, with three positions directly under them:

These three positions form the first level of the matrix. The second level of the matrix is generated by splitting each of these three positions into another three positions each (9 positions).

Levels three to ten of the matrix are generated in the same manner, with each new level housing three times as many positions as the previous level.

Each MetFi investment tier corresponds to its own 3×10 matrix tier, resulting in ten 3×10 matrix tiers in total.

Positions in each matrix are filled via direct and indirect recruitment of affiliates who have invested in that particular investment tier.

For each person recruited into a MetFi affiliate’s matrix (on any tier), the receive:

- 5% of the BUSD invested; and

- 1% of any additional MFI token investment made at time of BUSD investment

Note that MetFi affiliates only earn on matrix tiers they have personally invested on.

Matching Bonus

MetFi affiliates earn a 50% match on residual commissions and daily ROI amounts paid to personally recruited affiliates.

To qualify for the Matching Bonus, a MetFi affiliate must recruit five affiliates who’ve all invested at tier 4 or higher (Fish Tier).

Joining MetFi

MetFi affiliate membership is free.

Full participation in the attached income opportunity costs 102,300 BUSD ($102,300 USD equivalent).

MetFi Conclusion

MetFi pitches itself as a

collectible NFT ecosystem focused on incubating metaverse and Web3 unicorns and sharing the financial returns with all MetFi NFT owners.

Once the crypto bro marketing jargon is distilled, MetFi reveals itself to be a simple Ponzi attached to a matrix-based pyramid scheme.

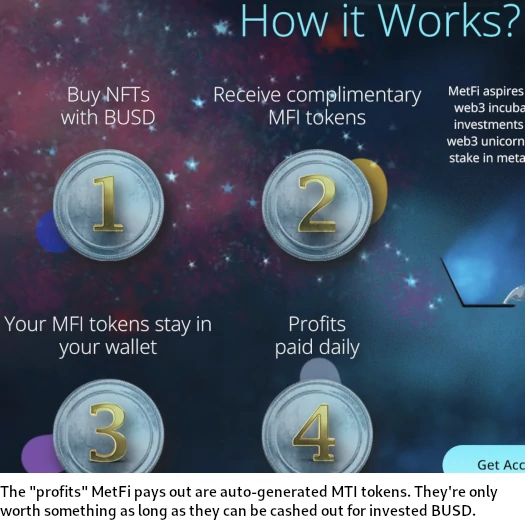

The Ponzi side of MetFi is relatively straight forward: You invest BUSD, you get MFI tokens and a daily ROI is paid on your invested MFI tokens.

MetFi NFTs generate rewards every 12 hours per the staking protocol.

MetFi affiliates are able to cash out as long as there’s invested BUSD left to steal.

MFI is a BEP20 token. These take five minutes to set up at little to no cost.

MFI tokens are generated on demand and have no value outside of MetFi’s Ponzi scheme.

MetFi’s pyramid scheme is as straightforward as its Ponzi scheme. Through a series of matrices, affiliate investors are rewarded on direct and indirect recruitment of affiliate investors.

Both components of MetFi are fraudulent and both rely on the unsustainable constant recruitment of new affiliate investors to fatten the withdrawal pot.

In an attempt to reassure investors MetFi isn’t a scam, the scammers behind the scam ironically lay out their fraudulent business model in MetFi’s whitepaper;

The regulatory environment in the blockchain and cryptocurrency sector is loosely defined and open to abuse by unscrupulous actors and even well intentioned actors that jumped in way over their heads with other people’s money.

Outright scams and project failures occur far too frequently, tarnishing the reputation of the blockchain and crypto sector, and giving regulators more reasons to clamp down hard on the sector.

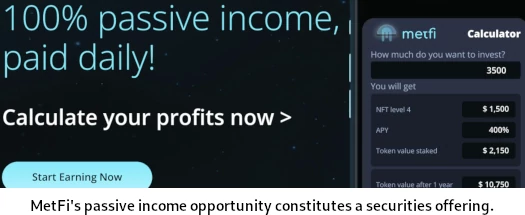

“Regulation of blockchain and cryptocurrency” is entirely irrelevant. MetFi’s passive investment opportunity constitutes a securities offering, the regulation of which offers no ambiguity.

Either MetFi and its owner(s) are registered with financial regulators and providing audited financial reports, or they’re not and are committing securities fraud.

The reason MetFi opts to commit securities fraud is because it’s a Ponzi scheme; a fraudulent business model illegal the world over.

The scammers behind MetFi further seek to reassure investors a collapse is impossible, by bending the laws of mathematics;

On June 9, 2022, MetFi locked 25,005 LP tokens to a smart contract for 5 years that were valued at approximately $2.5M at the time of locking – making MetFi rug proof for 5 years.

MetFi is a Ponzi scheme that will collapse when withdrawals inevitably exceed new investment. That puts the scam in the red, eventually leading to a collapse, or “rug pull” in crypto bro jargon.

Locking up worthless tokens in some bullshit smart contract doesn’t change basic principles of mathematics.

Until recruitment dies down, expect insufferable gloating from MetFi crypto bros jacking off to their exponentially growing MFI token balances.

By the time they realize there’s nothing left to withdraw, it will of course be too late.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

Hi,

I’ve been following you for ages…

Your analysis are most of the time quite acurate…

NOT THIS TIME !!!

I think you did not study nor the white paper nor the basic information as there are a lot of FACTUAL errors in your analysis.

I think you should check the documenation (available to anybody as all information is transparent on the blockchain).

I gonna answer point by point to all the FACTS !

FACT 1 : We are a DAO !

DECENTRALISED AUTONOMOUS ORGANISATION 100% run by 30 smart contracts on the block chain.

We are NOT a company run by a CEO and corporate TEAM.

The entire comunity, through votes decide what we do and how we do it !

Any member of the DAO as a full acces to all the information including the exact amounts of money, where money come from, where the money is, where the money goes.

For example we just spent $60 000 to have all our smart contracts audited by CERTIK. Details of the transaction are available to anybody on the blockchain.

The smart contracts that runs the company are way more reliable than a CEO and corporate who can make bad decisions or decide to change the rules for any reason including their own or top leadership profit.

We are anonymous just like satoshi nakamoto is !

This protect us from strike back of financial major players or institutions when we collectively come to play in their game as a unicorn incubator.

If you understand the purpose of our DAO, then you must admit that the compensation plan is just chicken feed compared to the profits we can make incubation metaverse + web3 projects in the early stage.

FACT 2 : We sell NFT and MFI

YOU SAY : « MetFi has no retailable products or services. »

FACTS ARE : We sell NFTs and Tokens MFI.

There are essentially 2 types of NFTs today…

1. Collectible NFT – subjective and speculative digital art that has the potential to increase in value if demand is higher than supply.

2. Utility NFT – additional perks that add value to a collectible NFT such as community membership and staking rewards.

MetFi NFTs are collectible NFTs with built-in utility from day one – the best of both worlds!

The MetfI token (MFI) is listed on coingecko + coinmarket cap.

It is over $5000 in less than 2 month !

The audit of all our smart contracts from the number one and most respected company = CERTIK will add respectability and truthworthyness to our project !

I will come back with this when the audit will be released = less than one month !

YOU SAY :

Note that MetFi do not publish the current internal MTI trading value on their website.

THE FACTS :

The value is public on coinmarketcap !!!

YOU SAY :

The MLM side of MetFi pays on recruitment of affiliate investors. Although not explicitly clarified, it is assumed all commissions and bonuses are paid in MTI tokens.

THE FACTS :

The MLM side pays 10 x 5% of the value of the NFTs bougth buy the team menbers.

Bonuses and commissions are paid in USDT (binance stable coin) instantly on your wallet !

YOU SAY :

MetFi affiliates earn a 50% match on residual commissions and daily ROI amounts paid to personally recruited affiliates.

THE FACTS :

50% matching bonus is on commissions earned by your personally sponsord when a NFT or MFI tokens are bougth in their 10 levels.

YOU SAY :

Both components of MetFi are fraudulent and both rely on the unsustainable constant recruitment of new affiliate investors to fatten the withdrawal pot.

FACTS : there is not such thing as a withdrawal pot !

If you studied how the money is managed you would understand that the only pot the DAO has is the treasury (which is controlled by the comunity vote for any withdrawal).

The APY is based on METFI tokens = there is no money to pay to keep a profit promise.

When $100 are paid to buy a NFT 3 things happens :

1 = the 10 people upline reciebve each $5 = for a total of $50

2 = each member who sponsored one of the above 10 people and who are qualified for matching bonus recieve 50% of $5 = $2.50.

Not everybody will qualify for the matching bonus but even if 10 did…

This will take a maximum of $25 from the initial $100.

3 = anyway our treasury recieves $25 (mini) ti $50 (max).

4 = the treasury investments are what produces value for the members !

YOU SAY :

MetFi is a Ponzi scheme that will collapse when withdrawals inevitably exceed new investment. That puts the scam in the red, eventually leading to a collapse, or “rug pull” in crypto bro jargon.

FACTS :

AS explained above, There is no way the system can collapse because all withdrawals are made upfront !

YOU SAY :

Locking up worthless tokens in some bullshit smart contract doesn’t change basic principles of mathematics.

FACTS :

The MFI token = $5.200 USD today.

YOU SAY :

By the time they realize there’s nothing left to withdraw, it will of course be too late.

FACTS :

Anybody can withdraw and sell their MFI on the open market = I did this myself !

Running out of time…

Will continue this later !

Maybe you should double check !

If you need any further information FACTS BASED from the inside, feel free to ask.

Have a nide day !

Everybody loves BehindMLM… until we review your scam.

DAO’s don’t set themselves up.

Someone created MetFi and someone is very much running it.

Feel free to provide audited financial reports detailing any external revenue generation.

Failing which MetFi is operating as a Ponzi scheme.

You sell investment positions paying a daily return. What you bundle with these investment positions (AI generated cartoon NFTs), is irrelevant.

Also there is no retail in MetFi, by way of there being no retail customers (everyone is an affiliate).

Is MetFi flogging MFI to affiliate investors at the public rate though? That’s not clarified anywhere on MetFi’s website or in their marketing materials.

There are no retail customers in MetFi. Everyone is an affiliate therefore any commissions paid out are tied to recruitment.

If you understood basic math you’d understand withdrawals aren’t paid out of thin air. Dress it up in whatever crypto bron nonsense you want.

BUSD in is BUSD out, till it runs out and Ponzi go boom.

Thanks for clarifying that. I’ll update the review.

Literally the only reason anyone is investing in MetFi is the expectation of passive profit. Not in MFI worthless tokens, in something they can actually cash out.

Math is math. Once recruitment of investors drops off withdrawals exceed recruitment and kaboom. Crypto jargon doesn’t change basic math.

If you believe that I have a unicorn defi metanftweb69deepthroatmydaoverse bridge to sell you.

And who do you think is funding withdrawals? Literally nobody outside of MetFi knows or cares about its MFI Ponzi coin.

Ponzi gonna Ponzi till Ponzi go boom.

You have got your appraisal completely wrong.

This is not a Company run by people.

This is something which is moving with the times, and your review should reflect that, and not be blinded by the past crypto scammers.

Fact check first, before exprssing opinion.

Your review is just opinion, and not facts.

MetFi didn’t create itself. It is a Ponzi scheme very much created and run by someone.

Ponzi schemes have been around in modern times since the 1930s. Running Ponzi schemes through dUh BlOcKcHaIn is a coat of paint on a decades old fraudulent business model.

MetFi is a Ponzi scheme. 100% fact, no opinions.

Review updated with MetFi’s ties to former OneCoin scammers the Steinkeller brothers, Staffan Liback and former Winwheel Ponzi promoters.

I don’t believe in coincidences when it comes to MLM Ponzi schemes.

Surely the Steinkellers stole enough through OneCoin to last them each three lifetimes. Why do they carry on?

Criminal Ponzi scams do not set themselves up; fraudsters are behind each and every one of them.

And the MLM crypto shit-coin and crypto shit-NFTs are the Ponzis of the moment.

All those behind them are criminals.

Greed.

People behind metfi is code name “polar bear” he was the founder a lot of scam project ex. Tien Tien.

Some promoter get paid $1 million a month by scammers just to do the talk, metfi, hypernation , hyperverse …. their name gonna change but still gonna be the same bullshit.

I don’t still understand how these is done.

You invest money into MetFi –> money stolen –> sorry for your loss.

Amazing work like always! Can you have a look at Metfis token holders, they are listed on:

bscscan.com/token/0x3e7f1039896454b9cb27c53cc7383e1ab9d9512a#balances

I am worried because lot’s of my entourage has invested with them and their explanation is always that it is listed. It’s at 2 dollars something.

If you look at their top 10 holders they seem to be the only one to have made or invested a good some of money.

All the rest have tokens for a couple of thousand dollars. Which means nobody is making money with the coin only through the affiliate programm.

Can you please have a look at it and their uodated whitepaper. Really trying to get my people out of there! Thanks!

Not a fan of blockchain dumpster diving. MetFi is a Ponzi scheme. The crypto side of it is irrelevant.

Ponzi tokens can be manipulated to any amount. Not like anyone except the admins would ever be able to cash out.

Anything New on this project ?

Still running, and amplifing, anything you could help me with ? My girlfriend imagine can make money with it to be FIRE…

Damn…

Still running and “amplifing”?

The original incarnation of the MetFi Ponzi collapsed in early 2023. The reboot MetFi Ponzi shitcoin is, *checks notes*, down 94.4% since launch.

Sorry for your loss.