KIWIsmart Review: Crypto trading bot securities fraud

![]() KIWIsmart provides no information about who owns or runs the company on its website.

KIWIsmart provides no information about who owns or runs the company on its website.

KIWIsmart’s website domain (“kiwismart.org”), was privately registered on August 20th, 2021.

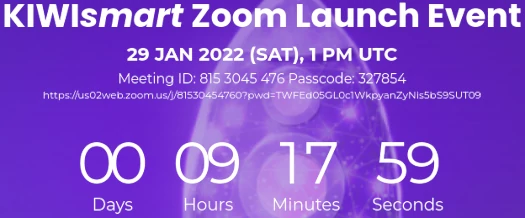

At time of publication KIWIsmart’s website advises a “zoom launch event” taking place on January 29th.

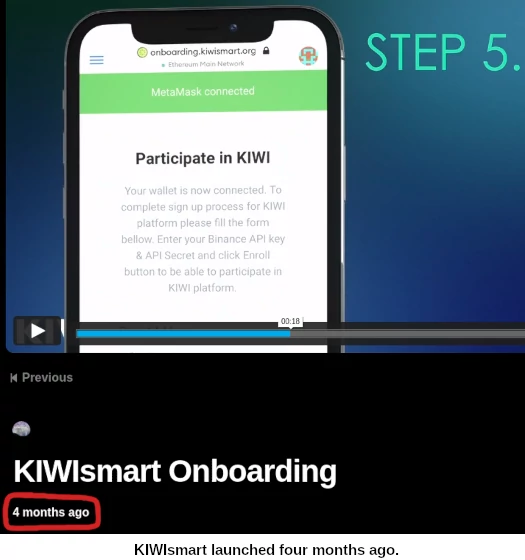

This seems odd, seeing as KIWIsmart promotion videos started going up four months ago:

If I didn’t know any better, KIWIsmart already launched and it flopped. They’re now rebooting with a second launch.

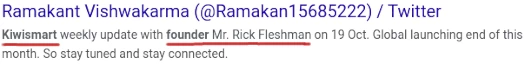

In any event, names attached to KIWIsmart’s launch webinar are Rick Fleshman, Alex Ruiz, Syed Jawad Haider, “Tatjana”, Jonas Todorovic, Mike Soh, Malik Atif, Christi Chitic and Gian Luca Gallo.

Of the group, Rick Fleshman appears to be running KIWIsmart as its founder:

Rick Fleshman is based out of California in the US.

Fleshman (right) first popped up on BehindMLM’s radar in 2017, as one of Ormeus Global’s founders.

Fleshman (right) first popped up on BehindMLM’s radar in 2017, as one of Ormeus Global’s founders.

Ormeus Global was a Ponzi scheme that went through three incarnations, Ormeus Global, IQ Chain and IQ Legacy.

The Ponzi scheme collapsed in 2019, following John Barksdale’s arrest in Thailand that same year.

Following his release, Barksdale has continued to maintain the scheme as “Ormeus Ecosystem”

Interest is virtually non-existent.

Rick Fleshman is tied to John Barksdale through iAM Marketing.

Fleshman is iAM Marketing’s CEO:

Barksdale is iAM Marketing’s founder and Chairman:

If Barksdale is involved in KIWIsmart he’s keeping a low profile.

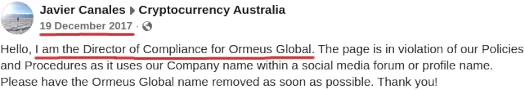

Update 30th January 2022 – Another former Ormeus Global executive involved in KIWIsmart is Javier Canales.

Canales headed up Ormeus Global’s compliance department:

What we also learn from the first screenshot above is that KIWIsmart went into soft launch in August 2021. /end update

Read on for a full review of KIWIsmart’s MLM opportunity.

KIWIsmart’s Products

KIWIsmart markets an automated trading bot and access to third-party passive investment schemes.

KIWIsmart has named their trading bot Ki100.

Ki100 is

a simplified trading assistant for cryptocurrency, connected to your crypto wallet through a trade-only API connection. Control or adjust your risk level and withdraw your funds at any time through a user-friendly interface.

No technical or ownership details of Ki100 are provided.

Ki1000 feeds KIWIsmart affiliates and customers into “opportunities in liquidity pools and yield farming.”

“Liquidity pools” and “yield farming” are crypto bro terms for passive investment opportunities. These are typically run as Ponzi schemes.

No further details on Ki1000 are provided.

Access to Ki100 and Ki1000 is paid for through “trading credits”. Trading credits are purchased from KIWIsmart affiliates.

Trading credits are sold in packages ranging from $70 to $10,000:

- spend $70 and receive 90 trading credits

- spend $250 and receive 280 trading credits

- spend $500 and receive 540 trading credits

- spend $1000 and receive 1100 trading credits

- spend $5000 and receive 5750 trading credits

- spend $10,000 and receive 12,000 trading credits

New credits cannot be purchased until 70% of already purchased credits are used.

“Estimated” monthly trading credit requirements for Ki100 are:

- 70 trading credits to trade $1000

- 500 trading credits to trade $9000

- 1000 trading credits to trade $20,000

- 5000 trading credits to trade $100,000

- 10,000 trading credits to trade $200,000

How many trading credits are required to access Ki1000 is not disclosed.

KIWIsmart’s Compensation Plan

KIWIsmart affiliates earn commissions selling trading credits to retail customers and recruited affiliates.

KIWIsmart Affiliate Ranks

There are twenty-one affiliate ranks within KIWIsmart’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- K1 – refer/recruit and maintain one retail customer or recruited affiliate

- K2 – refer/recruit and maintain two retail customers and/or recruited affiliates

- K3 – refer/recruit and maintain three retail customers and/or recruited affiliates

- K4 – refer/recruit and maintain four retail customers and/or recruited affiliates

- K5 – refer/recruit and maintain five retail customers and/or recruited affiliates

- K6 – refer/recruit and maintain six retail customers and/or recruited affiliates

- K7 – refer/recruit and maintain seven retail customers and/or recruited affiliates

- K8 – refer/recruit and maintain eight retail customers and/or recruited affiliates

- K9 – refer/recruit and maintain nine retail customers and/or recruited affiliates

- K10 – refer/recruit and maintain ten retail customers and/or recruited affiliates

- K11 – refer/recruit and maintain eleven retail customers and/or recruited affiliates

- K12 – refer/recruit and maintain twelve retail customers and/or recruited affiliates

- K13 – refer/recruit and maintain thirteen retail customers and/or recruited affiliates

- K14 – refer/recruit and maintain fourteen retail customers and/or recruited affiliates

- K15 – refer/recruit and maintain fifteen retail customers and/or recruited affiliates

- K16 – refer/recruit and maintain sixteen retail customers and/or recruited affiliates

- K17 – refer/recruit and maintain seventeen retail customers and/or recruited affiliates

- K18 – refer/recruit and maintain eighteen retail customers and/or recruited affiliates

- K19 – refer/recruit and maintain nineteen retail customers and/or recruited affiliates

- K20 – refer/recruit and maintain twenty retail customers and/or recruited affiliates

- K21 – refer/recruit and maintain twenty-one retail customers and/or recruited affiliates

Referred retail customers and recruited affiliates must be “active” to count towards rank qualification.

An active retail customer or recruited affiliate is one that has purchased 50 trading credits or more in the past 4 weeks.

The other thing to note is KIWIsmart rank qualification counts for six months.

When you qualify for a rank, you hold it for six months regardless of your activity. At the end of the six months you are re-ranked based on your qualification criteria for that month.

This then applies for another six months.

Note if you qualify for a higher rank at any time, that rank is applied and the six month timer is reset.

Residual Commissions

KIWIsmart pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

KIWIsmart caps payable unilevel team levels at twenty-one, subject to the following criteria:

- levels 1 to 3 of the unilevel team are unlocked by referring and maintaining one retail customer

- levels 4 to 6 of the unilevel team are unlocked by referring and maintaining two retail customers

- levels 7 to 10 of the unilevel team are unlocked by referring and maintaining three retail customers

- levels 11 to 21 of the unilevel team are unlocked by referring and maintaining five retail customers

Referred retail customers must be active to count towards residual commission qualification.

Subject to the above criteria, residual commissions are paid as a percentage of 70% of funds spent on trading credits across these twenty-one levels as follows:

- level 1 (personally recruited affiliates) – 30%

- levels 2 to 5 – 10%

- levels 6 to 20 – 2%

- level 21 – 5%

Quick Start Pool

The Quick Start Pool is a monthly bonus pool, funded by an unspecified percentage of “commissions that were not qualified for in the last 30-day period”.

If a KIWIsmart affiliate refers ten retail customers within thirty days of signing up, they receive a share in that month’s Quick Start Pool.

NFT Bonus Pool

The NFT Bonus Pool is funded by an unspecified percentage of “commissions that that were not qualified for in the last 30-day period”.

There are “Aldermen NFTs” and “Ambassador NFTs”.

Aldermen NFTs are awarded when a KIWIsmart affiliate

- qualifies in the top 300 based on unilevel team volume (across 21 levels, min 300,000 GV each month); and

- maintains a top 300 position for three consecutive months.

Ambassador NFTs are awarded when a KIWIsmart affiliate

- qualifies in the top 13 based on unilevel team volume (across 21 levels, min 3,000,000 GV each month); and

- maintains a top 13 position for three consecutive months

As far as I can tell KIWIsmart’s NFT Bonus Pool is the equivalent of a traditional share-based pool, paid monthly.

Joining KIWIsmart

KIWIsmart affiliate membership is $49 annually.

KIWIsmart Conclusion

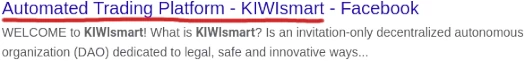

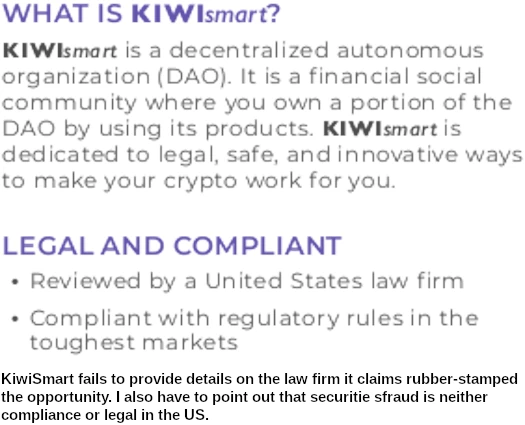

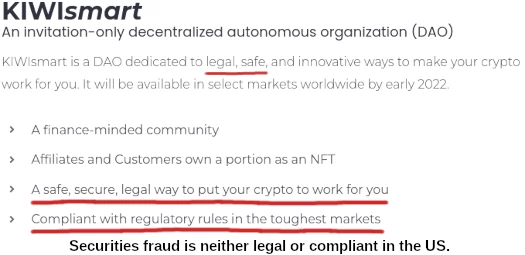

KIWIsmart describes itself as

an invitation-only decentralized autonomous organization.

As an MLM opportunity, KIWIsmart is your typical trading bot securities fraud scheme.

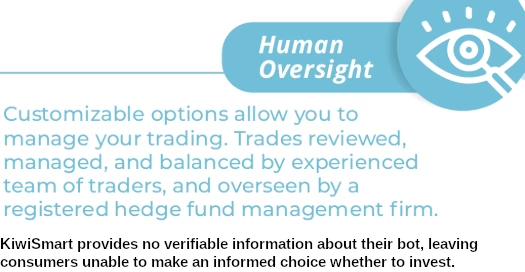

This is one of those bots created by who knows who with no verifiable trading history.

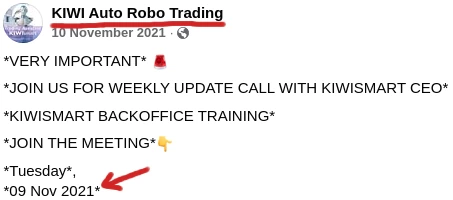

KIWIsmart launched their trading bot on or around November 2021.

It’s suspicious then that there’s no trading history mentioned anywhere.

KIWIsmart failing to disclose ownership, development and past trading details of their bot is a potential violation of the FTC Act (deceptive marketing).

Securities fraud takes place by way of passive returns generated via KIWIsmart’s Ki100 trading bot.

To establish the existence of an investment contract, regulators in the US rely on the Howey Test.

Under the Howey Test, an investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

In KIWIsmart we have affiliates placing funds under control of a bot.

The bot is a “common enterprise”. And funds are obviously invested with the bot “with a reasonable expectation of profits”.

The bot is run by Kiwismart, satisfying the profits are “derived from the efforts of others” criteria.

At time of publication KIWIsmart are not registered with the SEC, or a financial regulator in any other jurisdiction.

This means that at a minimum KIWIsmart is committing securities fraud.

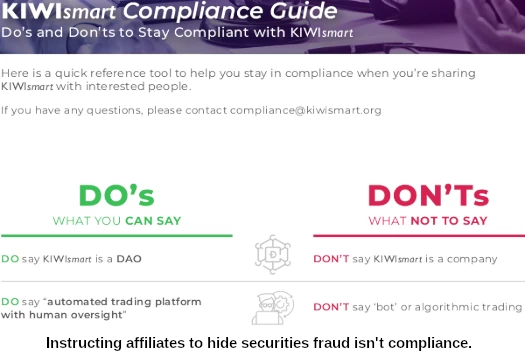

For their part KIWIsmart appears to be aware of what it’s doing.

In place of acknowledging their financial regulatory obligations, we have nonsense like this in KIWIsmart’s Policies and Procedures;

Governing Law, Jurisdiction and Venue

Jurisdiction and venue of any matter not subject to arbitration shall be determined by vote, handled by the DAO.

“The DAO”is neither a governing law, jurisdiction or legal venue.

KIWIsmart also don’t want their affiliates openly promoting the scheme for what it is:

In place of registering with the SEC and disclosing crucial due-diligence information, KIWIsmart instead focuses compliance on not operating as a pyramid scheme.

But even this is wonky.

KIWIsmart’s compensation plan first suggests retail customers are required to earn residual commissions:

A page or two later however it becomes evident that recruited affiliates can be swapped in:

If for some reason your not fazed by securities fraud, KIWIsmart do make it easy to verify your upline isn’t running their business as a pyramid scheme.

5.9 Retail Sales Records

All Affiliates are required to keep records of all sales for a period of three years.

KIWIsmart will randomly monitor compliance with sales requirements from time to time.

Each product purchased by a customer is automatically counted on a monthly basis towards qualification requirements.

Personally I’m inclined to believe retail across KIWIsmart will be virtually non-existent outside of ties to affiliates.

8.2 No Refunds

Due to the nature of the Trading Credits product, there shall be no refunds on any products.

A lack of disclosures and anti-consumer practices like “no refunds”, puts a big question mark on KIWIsmart’s retail viability.

To summarize, KIWIsmart is a “lulz can’t touch our money!” MLM trading scheme.

While it is true traded funds are sourced from an affiliate’s/customer’s own account, the affiliate/customer doesn’t own the bot – leaving their account wide open for abuse.

There are three ways a “lulz can’t touch our money!” trading scheme end:

- regulators shut it down;

- the bot cleans out accounts; or

- the admins perform a rigged trades exit-scam.

Either way participants are eventually left with losses, if not completely cleaned out.

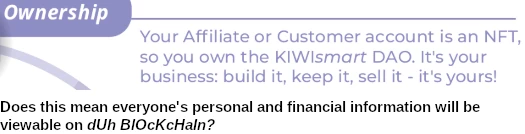

One last thing I’ll touch on is KIWIsmart’s use of NFTs. As far as I can tell this is a gimmick.

NFTs are used as bonus pool positions, offering no benefit over a traditional share-based system.

Well, at least not any practical benefit. The use of NFTs does allow KIWIsmart to use crypto buzzwords in its marketing and appear trendy.

KIWIsmart is also using NFTs to further assist those who get in early with ripping off those who join after them:

That’s on top of the people who joined KIWIsmart last year, who are hoping you’ll join the reboot so they can recoup any losses.

Review updated to note former Ormeus Global Compliance Director Javier Canales is also involved.

From September 2, 2021 to October 10, 2021, the KIWIsmart scammers uploaded 22 videos to YouTube. The channel has only 672 subscribers.

ibb.co/1qGB4sC

youtube.com/@kiwismart8387

The following video was uploaded to Facebook on December 29, 2021.

ibb.co/3cppvmJ

facebook.com/globalihub/videos/kiwi-smart-plan-kiwi-smart-business-plan-what-is-kiwi-smart-trading-software-kiw/307356727822316/

The speaker in this video is definitely not an American, but rather an Indian. Rick Fleshman is also mentioned as CEO in this video, which is not available on YouTube.

The website kiwismart.org is not accessible for me:

This is incomprehensible, as kiwismart.org has more than 736,000 visitors per month, 37% of whom live in Georgia, a small country between Europe and Asia with 3.8 million inhabitants. It’s all very puzzling.

ibb.co/LgR9SYQ