Go Luck Review : Resurrecting the USFIA amber Ponzi corpse

There is no information on the Go Luck website indicating who owns or runs the business.

There is no information on the Go Luck website indicating who owns or runs the business.

The Go Luck website domain (“ezgoluck.net”) was registered on the 14th of October 2015, however the domain registration is set to private.

Despite the Go Luck website being entirely in Chinese, Alexa surprisingly estimates that over half of the traffic to the domain originates out of France.

Various Go Luck affiliate marketing presentations cite the company’s headquarters as Hong Kong (China), which is likely where the admin(s) of Go Luck are operating from.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

The Go Luck Product Line

Go Luck has no retailable products or services, with affiliates only able to market Go Luck affiliate membership itself.

The Go Luck Compensation Plan

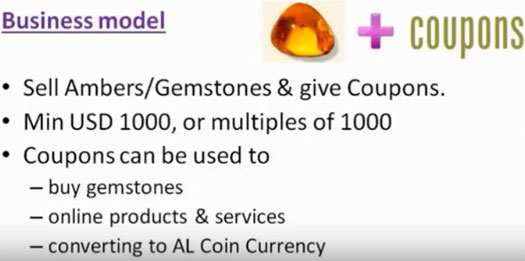

The Go Luck compensation plan sees affiliates invest at least $1000 on the promise of a ROI.

Funds invested into Go Luck are matched with “vouchers”, which are then converted into “Alcoins”.

Alcoin is a pseudo-cryptocurrency Go Luck use to track affiliate investment. The company arbitrarily assigns a value to each Alcoin point, with affiliates able to convert their Alcoins back into cash based on this value.

Alcoin is a pseudo-cryptocurrency Go Luck use to track affiliate investment. The company arbitrarily assigns a value to each Alcoin point, with affiliates able to convert their Alcoins back into cash based on this value.

Alcoin is not publicly traded, it is only traded internally within Go Luck. The current value of an Alcoin within Go Luck is around 50 cents US.

25% of all Alcoin withdrawal requests must be re-invested back into more Alcoin points. Go Luck affiliates are also capped from withdrawing a maximum 5% of invested funds at any given time.

Residual commissions are available on invested funds by a downline, paid out via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The binary team starts with two positions, with each splitting into another two positions each to make up the second level of the binary team.

In this manner the binary team expands down a theoretical infinite depth.

Positions in the binary team are filled via recruitment of new Go Luck affiliates. Investment volume is tracked on both sides of the binary, with affiliates paid a percentage of funds invested on the weaker binary side.

Specific details on what percentage Go Luck pay out or how frequently were not publicly available at the time of publication.

Joining Go Luck

Affiliate membership with Go Luck is tied to a minimum $1000 investment in Alcoin points.

Conclusion

China… amber… Ponzi points and a pseudo cryptocurrency. Haven’t we been down this path before?

USFIA launched in 2013 and was pitched to primarily Chinese investors in China and the US. Secondary markets existed across southeast Asia (the Chinese community in Singapore in particular).

USFIA operated GemCoin Ponzi points, which were purportedly backed by, you guessed it, amber.

On the 22nd of September 2015 the SEC shut down USFIA. According to the SEC, USFIA was a $22 million Ponzi scheme.

The news was made public on October 2nd. A day later Chinese USFIA investors were calling for the assassination of those who cooperated with authorities.

On October 6th, a preliminary injunction was granted against USFIA and owner Steve Chen. A Receiver was also appointed to begin the task of marshaling assets with the eventual aim of distributing seized assets and invested funds to victims of the scheme.

The SEC USFIA trial has currently been scheduled for January, 2017. Criminal charges have not yet been laid against Steve Chen but are believed to pending.

Long story short, USFIA is history and Steve Chen is probably going to be locked up for a considerable length of time.

Of note is the October 6th date on which the USFIA preliminary injunction was granted. The Go Luck website domain was registered just under two weeks later on the 14th.

Over the next few months whoever is running the scheme commenced preparations to continue scamming people where USFIA left off. Promotion of Go Luck began in earnest around January, 2016.

By now the similarities between USFIA and Go Luck should be obvious.

Both scheme’s business models have affiliates invest in Ponzi points, with a cryptocurrency backed by nothing more than the rate of new investment into the scheme used as bait.

As is typical with Chinese Ponzi schemes, all sorts of promises have been rolled out. This includes the usual partnerships with third-party merchants and infinity returns based on the constantly rising value of Alcoin.

That bring to amber, which Go Luck would have investors believe Alcoin is backed by.

The same nonsense was pushed in USFIA, complete with trips to non-existent amber mines in the Dominican Republic for social proof.

Upon investigating USFIA’s links with amber, the court-appoint Receiver found

instead of mines located around the world, millions of dollars in precious gems, and houses and cars available to be awarded to investors, the Receiver has found only costume jewelry, boxes of rocks, and bins filled with tens of thousands of little rings of nominal value.

It was all lies, with USFIA operating the same as any other Ponzi points scheme out there (uFun Club, OneCoin etc.)

So, with Chen likely facing pending criminal charges and an SEC lawsuit, who’s running Go Luck?

You won’t find that information anywhere on the Go Luck website or in current affiliate-made marketing material for the company.

That said, Singapore appears to be a prime candidate in addition to the purported Hong Kong base of operations.

When Steve Chen caught wind USFIA was under investigation by US authorities, he sent “large retainers” to a law firm in Singapore.

The USFIA Receiver is currently trying to get those funds back, however Chen’s lawyers are arguing they were paid to defend USFIA Singapore, which they claim has nothing to do with USFIA.

Here’s the thing though, Steve Chen owns 80% of USFIA Singapore. Furthermore, when the Receiver asked for proof USFIA Singapore was unrelated to USFIA, Chen’s lawyers went quiet.

One law firm has since returned over half a million dollars, the other is still holding out.

Meanwhile who owns the other 20% of USFIA Singapore has not been disclosed, but it’s a good bet they’re either running Go Luck or are in close contact with those that are.

Tze Hong Sim, a resident of Singapore, has emerged as a primary link between the two Ponzi scams.

Tze Hong Sim, a resident of Singapore, has emerged as a primary link between the two Ponzi scams.

According to SEC attorney Peter Greco, Sim was a top investor in USFIA. Through the now-defunct website “investgemcoin.com”, Sim recruited victims into GemCoin and profited handsomely.

Sim is currently heavily promoting Go Luck on a new YouTube and various websites he’s set up.

According to Sim, the “Singapore office” of Go Luck is an entity named Global GC Pte Ltd.

Global GC Pte Ltd. is “the first and only branch” (of Go Luck) since it’s launch. The company gets “first hand information” directly from Go Luck’s CEO and joining Go Luck through Global GC Pte Ltd. creates an “unfair advantage”.

Whether that’s just Ponzi smoke and mirrors to cover up Go Luck being run out of Singapore, or whether they really are just a large cog in an otherwise Chinese-run Ponzi scheme, who knows.

The point is that Go Luck is probably being filled with a large contingent of Chinese investors who lost money in USFA.

Plumbing new depths of gullibility, once again they’re being strung along on promises of amber riches and faux cryptocurrency techno-babble.

If you search “alcoin” or “go luck” on YouTube, you can watch the same cringey Chinese banquet dinner presentations USFIA held for its GemCoin investors.

You know the type, hosts with a mic, overly-dramatic background music, an audience of starry-eyed investors being whipped up into a frenzy by those on stage…

The most recent Go Luck event was apparently held on March 14th in Hong Kong.

In footage of the event (around the [5:30] mark) a woman introduces “Alexander” onto the stage.

Alexander’s speech in English is cut out of Sim’s video, however the Chinese translation is left intact (anyone want to translate?).

Alexander does look vaguely European, which might explain France’s interest in Go Luck.

Another video of Sim’s features two more unidentified individuals of Caucasian appearance:

In any event and while who is running Go Luck might be murky for now, what we can tell you is Go Luck will end just as badly as USFIA.

Whether Go Luck is being promoted in Chinese communities in the US yet is unclear but, given how easy it was for USFIA to spread its tentacles, I wouldn’t be surprised if it was.

No matter what anyone tells you, no matter how many memorandum of understandings are signed by business you’ve never heard of and no matter how many gala events Go Luck stages, at the end of the day they cannot pay out more than is invested.

For “leaders” like Tze Hong Sim to make money, the majority of Go Luck investors have to lose it. This was the case in USFIA and it will no different in Go Luck.

If you Google “Global GC Pte Ltd.,” you’ll find a PDF for Gemcoinusa.com, which looks to be the Singapore branch of Gemcoin. In fact, in the comments section of the October 9, 2015 article on the USFIA Injunction, Mikey said:

There’s a 1/1/16 YouTube video entitled “Global GC Leaders Meet@Beijing” that says “Institutions & Enterprises are leading digital currencies Bitcoin & Alcoin. 企业带动电子货币的时代开始了”

youtube.com/watch?v=2uqacopsyoo

There is a definite link between Gemcoin (“GC”) and Alcoin. I wonder if the SEC in the U.S. is aware of this. I also wonder what French authorities are doing, since there is a large contingent of French investors/victims involved in both schemes.

The USFIA-Investment website is still up, with a link to a petition with numerous comments written in French:

ipetitions.com/petition/Gemcoin?utm_medium=widget&utm_source=widget&utm_campaign=button

So what’s the bet one or more individuals in Global GC Pte Ltd. are running Go Luck?

On your photo you asked, “Who are these guys?”

The man on the left is the head of USFIA in France, his name is Philippe Dupuis. The other man is Daniel Kaese who has travelled with Dupuis to USFIA in Los Angeles and other places. So yes there is definitely a connection.

I have not heard about authorities in France investigating these men, but they should!

Now we can see there is a definite connection, in this link we see Philippe Dupuis is organizing a conference for Alcoin, the website says the company is GoLuck.

alcoin.eu/alcoin-conferencegr/

The Receiver filed a new report with the court on July 7.

I have not reviewed in detail but there is one very interesting piece of information: the Receiver is now saying that the fraud was $164 million which is much more than the $32 million the SEC estimated at first!

The Receiver has taken control of $28 million so far, and they are planning to sell the golf course property and several residences owned by Chen and colleagues.

However if the $164 million figure is accurate, it seems that Gemcoin investors are only going to recover a fraction of what they put in.

The Receiver has still found no evidence of any legitimate activity. The so-called “amber mine” in the Dominican Republic was simply a residential address.

Thanks for the update (wrong article though!).

I’ll see if the Receiver puts the report up on the Receivership website tomorrow (I have been checking that daily), otherwise I’ll grab it from Pacer and put together a report.

Not surprised the Dominican Republic mine was just a residential address (lol!).

sorry for wrong article, if you are able to attach the information to the correct article I would be grateful.

No big drama, this article does still come up in the USFIA category feed.

Hi I wonder if you can remove this article abusing my name and other leaders’ name like this?

No doubt we invested money and we are also the worst victims being mislead by Steve Chen, providing information verbally told by him via Singapore office. Our intention is to update member with the best and direct info we have.

The business model buying amber with reward point is legal in Singapore and the company is not closed down.

USFIA managers are not running away with “ponzi money” and have refunded money to customers who requested. What happen in USA is sad & beyond our control. Hope you can deal with justice.

Abuse? Grab a dictionary son. You are a serial scammer who has stolen from victims in multiple Ponzi schemes. #facts

Go Luck collapsed and what, now you’re here because you can’t recruit people into whatever it is you’re pushing now?

Or are you trying to slink away after recently deleting your social media profiles? You made your bed Sim, you lie in it.

If the net-result of your participation in a Ponzi scheme is you made money, you’re not a victim.

Ponzi schemes are illegal the world over, including Singapore. USFIA was shut down and doesn’t exist any more. Go Luck appears to have collapsed.

Trying to take credit for the USFIA Receivership’s work? Garbage human being right here…

Could not have put it more succinctly Oz. Skulk away Sim…………

So, which part of the article is inaccurate Sim Tze Hong ?

The part about you being instrumental in promoting the Go Luck ponzi fraud or the part about you being instrumental in promoting the USFIA ponzi fraud ?

Guy on the right in that photo is Dan Debellefon Kaese currently asssociated with Cloud token another Ponzi scam, here is his facebook:

facebook.com/Dan.kaese/about