GetFit Mining Review: Task-based MLM crypto “staking” Ponzi

GetFit Mining fails to provide ownership or executive information on its website.

GetFit Mining fails to provide ownership or executive information on its website.

GetFit Mining’s website domain (“getfitmining.com”), was registered in March 2022. The private registration was last updated on March 26th, 2023.

A YouTube video embedded on GetFit Mining’s website leads to a YouTube channel titled “GetFit Activity Mining”. There we find GetFit Mining marketing videos hosted by “Lynette”.

“Lynette” corresponds to Shirley Lynette Artin Crawford (right).

“Lynette” corresponds to Shirley Lynette Artin Crawford (right).

On April 16th, Danny Dehek held a livestream covering GetFit Mining on his “The Crypto Ponzi Scheme Avenger” YouTube channel.

At around [1:29:11] DeHek reveals he was contacted by Crawford in her capacity as GetFit Mining’s owner. This tracks with Crawford featuring in GetFit Mining’s marketing videos.

DeHek calls Artin as part of his livestream. She doesn’t answer but did call him back at [2:03:22].

Crawford, a US resident who also goes by “Lynette Artin”, is known to BehindMLM as a net-winner in the Zeek Rewards Ponzi scheme.

How much Crawford stole through Zeek Rewards is unclear, but it was enough to see her targeted through clawback litigation.

After Zeek Rewards was shut down by US authorities in 2012, Crawford’s name popped up in association with numerous reload scams; GoFunRewards, OfferHubb, Uptown Offers, Quick Pay Group and CrowdFundFast.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

GetFit Mining’s Products

GetFit Mining has no retailable products or services.

Affiliates are only able to market GetFit Mining affiliate membership itself.

GetFit Mining’s Compensation Plan

GetFit Mining’s compensation plan combines a passive returns staking investment scheme with referral commissions.

Passive Returns (staking)

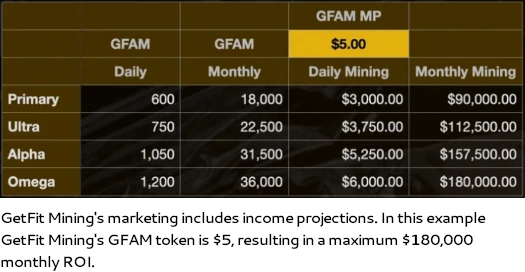

GetFit Mining affiliates invest GFAM tokens on the promise of a passive ROI of up to 25% per investment.

GetFit Mining affiliates can either purchase GFAM tokens through the company, or generate them through a convoluted task process.

Obtaining GFAM tokens through GetFit Mining requires purchase through an internal exchange. GetFit Mining sets the GFAM token value they sell at.

GetFit Mining’s convoluted task process sees affiliates generate GFAM through physical activity.

This begins with a GetFit Mining affiliate purchasing their token generation rate (note the amount spent also correlates to the staking ROI):

- Primary – pay $99 for a 100% token generation rate

- Ultra – pay $199 for a 125% token generation rate

- Alpha – pay $499 for 175% token generation rate

- Omega – pay $899 for 300% token generation rate

GFAM token generation rates are tracked through NFT positions. Note that affiliates can purchase multiple positions to increase the amount of GFAM tokens they can generate daily (and increase their passive staking ROI).

GetFit Mining caps physical activity at 20,000 steps or 10 miles (16,000 km) per 24 hours. Further restrictions include up to 2 hours of daily recorded activity.

There is also a tier system within GetFit Mining, which adds a multiplier to generated tokens:

- Tier 1 – 5% bonus

- Tier 2 – 10% bonus

- Tier 3 – 20% bonus

- Tier 4 – 30% bonus

Note these tiers aren’t defined within GetFit Mining’s marketing material.

The tiers however are named “intensity tiers steps”, suggesting they might correlate to intensity levels tracked during physical activity.

There are additional undisclosed token generation bonuses based on calories burned and tracked sleep time (up to 8 hours a day).

Regardless of whether purchased through GetFit Mining or obtained through the convoluted task based scheme, token generation rate fees must be paid to participate in GetFit Mining’s passive returns staking scheme.

This is because returns within the staking investment scheme are determined by how much in fees have been paid.

GetFit Mining pays staking returns out in tether (USDT). The total ROI per GFAM token investment made is calculated based on the total token generation rate a GetFit Mining has paid for.

This starts at 1.39% for a 100% token generation rate (one Primary NFT position), and increases by 1.39% per 100% token generation rate up to 1700%. 1700% to 1800% adds 1.37% to the daily ROI rate.

Maxxed out at 1800% (six Omega NFT positions @ $5394), GetFit Mining affiliates are able to invest GFAM tokens for a 25% ROI.

The return is paid out through what appears to be a daily variable rate over 90 days.

Once invested, GFAM tokens are unlocked if either

- if the total ROI rate is hit within 90 days (1.39% to 25%);or

- the total ROI rate is not hit at 90 days from the date of initial investment

Residual Commissions

GetFit Mining affiliates pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

GetFit Mining caps payable unilevel team levels at ten.

Referral commissions are paid as a percentage of token generation adjustment fees paid across these ten levels as follows:

- level 1 (personally recruited affiliates) – 25%

- level 2 – 5%

- level 3 – 4%

- levels 4 and 5 – 3%

- levels 6 and 7 – 2%

- level 8 – 3%

- levels 9 and 10 – 5%

- level 11 – 8%

Joining GetFit Mining

GetFit Mining affiliate membership is free.

Full participation in the attached income opportunity requires payment of token generation fees:

- Primary – pay $99 for a 100% token generation rate

- Ultra – pay $199 for a 125% token generation rate

- Alpha – pay $499 for 175% token generation rate

- Omega – pay $899 for 300% token generation rate

Note that in order to maximize passive returns and GetFit Mining’s compensation plan, multiple fee payments are necessary.

GetFit Mining Conclusion

GetFit Mining is your classic task-based Ponzi scheme. Here the task is physical activity but GetFit Mining could just as easily have investors rub their bellies or count backwards from a thousand.

This is because the task assigned in task-based Ponzi schemes has nothing to do with revenue generation.

Don’t get me wrong, more physical activity is great but shouldn’t be construed as a blanket legitimacy for GetFit Mining as a whole.

That comes down to regulatory compliance which GetFit Mining wholly fails at.

For starters GetFit Mining fails to provide consumers with information that allows them to make an informed decision about joining the company. This includes ownership and compensation details on the company’s website.

Then we have the elephant in the room, GetFit Mining’s staking investment scheme.

Either by completing a task or directly purchasing them, GetFit Mining affiliates acquire GFAM tokens.

GFAM is a BSC-20 token. BSC-20 tokens can be created in a few minutes at little to no cost.

Once acquired, GFAM tokens are then invested with GetFit Mining on the promise of a passive return.

To establish whether US securities law comes into play we need to establish the existence of an investment contract.

This is done through application of the Howey Test.

An investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

In GetFit Mining we have affiliates investing GFAM tokens (whether they were directly purchased or task-allocated is irrelevant).

This investment is done into GetFit Mining through their staking investment scheme (a “common enterprise”), on the promise of a passive return determined by how much a GetFit Mining affiliate has paid in fees (“a reasonable expectation of profits’).

GetFit Mining affiliates acquire GFAM tokens and pay ROI rate fees but returns are generated entirely passively (“from the efforts of others”).

GetFit Mining’s offering satisfies the Howey Test, meaning its GFAM token “staking” investment scheme constitutes an investment contract.

Under US law this requires GetFit Mining and Shirley Crawford to register with the SEC.

A search of the SEC’s public Edgar database reveals neither GetFit Mining or Crawford are registered with the SEC.

This constitutes securities fraud, which the SEC asserts goes hand-in-hand with Ponzi schemes.

From a consumer due-diligence perspective, there is no verifiable source of external revenue entering GetFit Mining.

The only acceptable and legally required form of verification would be audited financial reports filed with the SEC.

It should be noted that securities law globally is, for all intents and purposes, similar to that of the US. In a country where financial markets are regulated, registration of securities offering with financial regulators in mandatory.

For reference, as of March 2024 SimilarWeb tracked top sources of traffic to GetFit Mining’s website as the US (79%), Canada (8%), Mexico (8%) and Norway (5%).

Despite committing securities fraud and having no verifiable source of external revenue to fund USDT ROI withdrawals, on her call with Danny Dehek Crawford asserted GetFit Mining is “not a Ponzi scheme and not a scam, five thousand percent” [2:10:16].

Having been sued for clawback as part of Zeek Reward’s securities fraud proceedings, not surprisingly GetFit Mining tries to brush off concerns on its website.

The GetFit tokens are not intended to constitute, and shall not constitute, securities in any jurisdiction.

- What GetFit tokens are intended or not intended to constitute is irrelevant to what they are; and

- the issue isn’t the tokens themselves being a securities offering, GetFit Mining’s “staking” investment scheme is a securities offering.

I’ll finish up by noting GetFit Mining is pretty similar to SmartSteps, another fitness task-based Ponzi BehindMLM reviewed earlier this year.

At time of publication SmartSteps’ website is no longer accessible. What it was live though, SmartSteps ran the same NFT investment position staking scheme through its BOLTYX BSC-20 tokens.

Taking a step back, task-based Ponzi schemes are nothing new. In Zeek Rewards, which launched in 2011, investors had to dump penny auction bids to qualify for returns.

Due to the nature of compounding, the amount of bids top investors had to dump daily quickly became unmanageable. This resulted in the creation of thousands of dummy accounts to dump bids on to.

Not that it mattered, dumping bids had nothing to do with revenue generation. Like all task-based Ponzi schemes, the assigned task was just busy-body work.

Again putting aside health benefits, with respect to revenue generation the same is true of GetFit and its daily fitness tasks.

The primary verifiable source of revenue is pretty obviously GetFit Mining’s token generation NFT position fees – which is why they correlate to how much of a return is paid out via the staking scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment. GetFit Mining affiliates selling GFAM tokens internally without participating in the staking investment scheme will also dry withdrawable USDT up.

Either way this will starve GetFit Mining of ROI revenue, leaving it unable to pay USDT ROI withdrawals.

Given the variable nature of the return rate, this will likely present itself in said return dropping to near-zero before collapsing altogether.

Math guarantees that when a Ponzi scheme collapses, the majority of participants lose money.

In GetFit Mining, this will result in affiliates bagholding GFAM, which outside of GetFit Mining’s staking investment scheme, is otherwise worthless.

Update 9th September 2024 – GetFit Mining flopped. It’s now been repackaged as a “MoveQuest” app.

Once again, great “sleuthing” , Oz. These serial scammers who try and come back for more … and this audio of her at 2:03 … she’s calling other people scammers. Fascinating. And BehindMLM gets a mention! LOL

Thanks. I did the comp breakdown and analysis but full credit goes to De Hek for brining GetFit Mining to my attention.

In case anyone’s wondering, I don’t have anything to ask Crawford. There is no “other side” to securities fraud.

Thank you for exposing this latest scam. This person also ran the infamous fake microgreens upag scam. This is currently under investigation.

Hopefully this article will prevent new people from falling victim.

Thank you so much for the exposure truly is my favourite website, Lynette “seems like a lovely” lady and we did have a nice conversation near the end and she wants to come on and do another interview.

I said you’re guilty by association everybody that promotes multilevel marketing via zoom are just after the commissions they received they don’t care about the products if there is one, they are normally pouting a dream that never eventuates.

And guess where the 25% commission will be coming from when they sign up new members they will be paying them from the membership fees that they get from newbies.

wonderful reporting as usual OZ. thank you!

Everyone always goes behind mlm is there not mlm on it…i always go the true legit ones are never on it….

it be interesting maybe as sub thread if company replies or like Lynette said you showing you reached out because it give you more creditability.

1. Why do we need a separate “thread” for comments on the same review? Company owners can and do respond to BehindMLM reviews.

2. I have nothing to reach out to Lynette about GetFit Mining. I don’t need to know her favorite color, what she eats for breakfast on Tuesdays etc.

Lynette is holding a big bag of tokens. In Bloackchain you can verify this. From the main contract she has moved AVAX to this wallet where she is holding 10,000 MQT Coins. Thats 600,000 Dollars right there.

Also Treasury funds are not locked and in the event of she dumping her own lot. She could easily rugpull this.

Think about why she is not claiming the CMC Page. Its only 5000 dollars. Think about dexscreener listing. Why isnt she doing that? So she will have an excuse to say we got hacked.

Review updated to note GetFit Mining rebranding itself as MoveQuest.

I got in when they had a super sale for omega miners on bsc. I spent my last 1k to my name and the next month they rugged bsc and moved to avax expecting people to spend more money there instead of migrating bsc users.

they used me as exit/startup liquidity for avax chain. I had also gotten some mqt tokens from this sale and have to watch people make 10s of thousands of dollars daily while I’m here fingering my own ass. I can only hope I can roi before the rug.

This is an exact copy of STEPN which scammed everyone.

Can everyone also see how the price is manipulted?

It’s cintrolled by 1 wallet. Everyone the price drops it’s pumped a little by 1 wallet.

Soo. The price will go to zero. Currently at $61.

Everyone needs to sell now.

The same people did STEPN are promoting this. They know it will crash.

People are so dumb and naive, they think they can earn money by walking more and sleeping.

And @Julian yes price is being manipulated for sure, you can easily tell when they are buying trying to withold the price. But a worthless token wont sustain.. people are selling realising that it will come crashing.

So price is dropping daily. Today there was a zoom call introducing some new super duper miners, yes at extra cost to try and pump some new money in to try and hold the price.

They also posted on the Facebook page the following for people not to sell

So… lo and behold.. they want to now to reward you for holding. Typical ponzinomics. The end is near.

Only good thing to come out of this is people are loosing weight.

Crypto bro marketing removed:

Plz baghold while the owner and top recruiters cash out. Thx!

So happy to this information. In the German team social talk, everyone is now worried because the price is dropping so much.

For weeks and weeks they are saying don’t sell, don’t sell. But price is dropping every hour. I decided to sell and cash out now. I just recovered what i put in. leaders are still saying don’t cash out.

I believe your statement to be correct, the leaders are all selling while they tell us to hold.

I think this will go to zero soon…. Even the engish members, they are all saying to hold, but the zoom calls are fooling everyone, they need to cash out what they can.

price is dropping every single day… Don’t listen to the people, sell and atleast recover what you put in. This looks like a scam, all peoples need to read the above information from the behindmlm.com

Thanks for the notice.

Gunter from Germany.

Scam coin is now $13. All those people on the crappy Facebook, YouTube, telegram saying they won’t sell. Bet you wishing you sold.

Price has dropped 70% in a few days. Because Lynette and all leaders are selling selling selling!