DesertGreener Review: DGRX token NFT Ponzi

DesertGreener operates in the cryptocurrency MLM niche. The company provides a corporate address in Austria on its website.

DesertGreener operates in the cryptocurrency MLM niche. The company provides a corporate address in Austria on its website.

Heading up DesertGreener we have the “inventor” of the company Carl Albrecht Waldstein.

As far as I can tell, Waldstein doesn’t appear to have an MLM history.

As far as I can tell, Waldstein doesn’t appear to have an MLM history.

Waldstein abandoned his personal FaceBook profile in 2021. Possibly due to language-barriers, I was unable to find any other information on Waldstein.

DesertGreener operates from two known website domains; “desertgreener.sale” and “desertgreener.io” (redirects to .SALE domain).

Both of DesertGreener’s website domains were registered on January 18th, 2024. The owner of both domains is Klimates AG through an Austrian address.

Read on for a full review of the DesertGreener MLM opportunity.

DesertGreener’s Products

DesertGreener has no retailable products or services.

Affiliates are only able to market DesertGreener affiliate membership itself.

DesertGreener’s Compensation Plan

DesertGreener affiliates invest euros into DGRX tokens:

- Bronze – invest €250 EUR and receive 2500 DGRX tokens

- Silver – invest €500 EUR and receive 5000 DGRX tokens

- Gold – invest €1000 EUR and receive 10,000 DGRX tokens

- Platin – invest €2500 EUR and receive 25,000 DGRX tokens

- Hero – invest €5000 EUR and receive 51,250 DGRX tokens

- HeroPlus – invest €10,000 EUR and receive 105,000 DGRX tokens

- HeroPro – invest €25,000 EUR and receive 268,750 DGRX tokens

- HeroVIP – invest €50,000 EUR and receive 550,000 DGRX tokens

Once acquired, DGRX tokens are used to invest in DesertGreener NFT positions. This is done on the promise of passive returns:

The DGRX token is an e-money token that you can use to buy products and services.

DGRX Sales GmbH will offer an NFT (Non-Fungible Token) that you can directly purchase with DGRX tokens.

This NFT entitles the holder to receive further DGRX tokens in the future depending on profits and based on the number of NFTs held.

The MLM side of DesertGreener pays on recruitment of affiliate investors.

Note that DesertGreener withholds 20% of paid MLM commissions. These funds must be used to invest in DGRX tokens.

Referral Commissions

DesertGreener affiliates earn a 7% commission on euros invested by personally recruited affiliates.

Residual Commissions

DesertGreener tracks residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

DesertGreener pays residual commissions on invested euros.

A 14% coded residual commission is paid out on all EUR investment, based on the following criteria:

- generate 1000 EUR in downline investment and receive a 1% residual commission rate

- generate 2500 EUR in downline investment and receive a 2% residual commission rate

- generate 5000 EUR in downline investment and receive a 3% residual commission rate

- generate 10,000 EUR in downline investment and receive a 4% residual commission rate

- generate 25,000 EUR in downline investment and receive a 5% residual commission rate

- generate 50,000 EUR in downline investment and receive a 6% residual commission rate

- generate 100,000 EUR in downline investment and receive a 7% residual commission rate

- generate 250,000 EUR in downline investment and receive an 8% residual commission rate

- generate 500,000 EUR in downline investment and receive a 9% residual commission rate

- generate 1,000,000 EUR in downline investment and receive a 10% residual commission rate

- generate 2,500,000 EUR in downline investment and receive an 11% residual commission rate

- generate 5,000,000 EUR in downline investment and receive a 12% residual commission rate

- generate 10,000,000 EUR in downline investment and receive a 13% residual commission rate

- generate 25,000,000 EUR in downline investment and receive a 14% residual commission rate

The coded nature of DesertGreener’s residual commissions sees higher qualified affiliates paid the difference on residual commissions earned by their lower qualified downline.

E.g. a newly recruited DesertGreener affiliate invests 100 EUR. The affiliate who recruited them qualified for a 7% residual commission rate, so that is what they are paid.

This leaves 7% still left to be paid out in residual commissions (14% minus the 7% paid out).

The system searches upline for a higher ranked qualified affiliate to pay the remaining 7% out to. This can be a single 7% payment or multiple smaller percentage payments, depending on how qualified the upline affiliates are.

World Pool Bonus

DesertGreener takes 4% of monthly company-wide investment volume and places it into the World Pool Bonus

The World Pool Bonus is made up of two smaller bonus pools; WP1 and WP2.

DesertGreener affiliates qualify for shares in WP1 and WP2 as per the following criteria:

WP1

- generate 3500 EUR in downline investment volume (1400 EUR from outside your strongest unilevel leg) and recruit one affiliate investor = one share in WP1

- generate 7000 EUR in downline investment volume (2800 EUR from outside your strongest unilevel leg) and maintain one recruited affiliates investor = two shares in WP1

- generate 17,500 EUR in downline investment volume (5600 EUR from outside your strongest unilevel leg) and recruit two affiliate investors = four shars in WP1

- generate 35,000 EUR in downline investment volume (11,200 EUR from outside your strongest unilevel leg) and maintain two recruited affiliate investors = eight shares in WP1

- generate 70,000 EUR in downline investment volume (22,400 EUR from outside your strongest unilevel leg) and recruit three affiliate investors = sixteen shares in WP1

WP2

- generate 175,000 EUR in downline investment volume (56,000 EUR from outside your strongest unilevel leg) and maintain three recruited affiliate investors = one share in WP2

- generate 350,000 EUR in downline investment volume (112,000 EUR from outside your strongest unilevel leg) and recruit four recruited affiliate investors = two shares in WP2

- generate 700,000 EUR in downline investment volume (224,000 EUR from outside your strongest unilevel leg) and maintain four recruited affiliate investors = four shares in WP2

- generate 1,750,000 EUR in downline investment volume (448,000 EUR from outside your strongest unilevel leg) and recruit five affiliate investors = eight shares in WP2

- generate 3,500,000 EUR in downline investment volume (875,000 EUR from outside your strongest unilevel leg) and maintain five affiliate investors = sixteen shares in WP2

Joining DesertGreener

DesertGreener monthly affiliate membership fees are tied to how much an affiliate earns in commissions:

- earn up to 14.99 EUR a month in commissions = no fee

- earn 15 to 149.99 EUR a month in commissions = 2.50 EUR a month fee

- earn 150 to 499.99 EUR a month in commissions = 5 EUR a month fee

- earn 500 EUR or more a month in commissions = 7.50 EUR a month fee

DesertGreener

It should be obvious that a random Austrian old fart with not much of a digital footprint isn’t running DesertGreener’s MLM crypto scheme.

It should be obvious that a random Austrian old fart with not much of a digital footprint isn’t running DesertGreener’s MLM crypto scheme.

This brings us to DGRX Sales GmbH, an Austrian shell company Alexander Braun claims to be the CEO of.

DGRX Sales GmbH is a limited liability company in Austria. The company is 100% owned by KLIMATES AG in Switzerland, which controls and steers the fortunes of the company. KLIMATES AG, in turn, is closely linked with HEMPMATE AG in Switzerland.

DesertGreener’s website cites two founders of the “DGRX sales team”; Alex Braun and Thomas Pfeifer.

The ruse behind DesertGreener is solar-powered desalination.

DESERT GREENER technology represents a groundbreaking method for optimally bundling solar energy. Heated water is evaporated and freed from salt, minerals, impurities and other deposits.

What does that have to do with investing in a shit token, buying an NFT, getting more of said shit token and cashing out other subsequently invested funds?

Absolutely nothing.

DesertGreener fails to provide verifiable evidence it is generating revenue to fund DGRX token withdrawals.

On the regulatory front, DesertGreener’s passive returns NFT investment scheme constitutes a securities offering.

As of June 2024, SimilarWeb tracked top sources of traffic to DesertGreener’s website as Germany (38%), Austria (19%), Switzerland (18%), the Netherlands (14%0 and Hungary (11%)

DesertGreener fails to provide evidence it has registered with financial regulators in any of these countries. Thus, at a minimum, DesertGreener and its associated shell companies are committing securities fraud.

Funds invested into DesertGreener appear to be laundered through Malta.

Why is the IBAN of the bank connection so long?

The IBAN is composed differently in different countries and can therefore have different lengths. Our bank is based in Malta. IBANs in Malta consist of 31 characters.

Regulation wise Malta is a dodgy jurisdiction with little to no active regulation of MLM and/or cryptocurrency related securities fraud.

DGRX is an ERC-20 shit token. These can be created in a few minutes at little to no cost.

DesertGreener creates DGRX on demand and flogs it off to affiliate investors. This works as long as new new investment doesn’t exceed withdrawals.

Once it inevitably does, DGRX goes into deficit and eventually collapses.

Ponzi math thus guarantees that when DesertGreener inevitably collapses, the majority of participants will lose money.

However long it takes, this will ultimately manifest itself in DesertGreener affiliates bagholding yet another worthless Ponzi token.

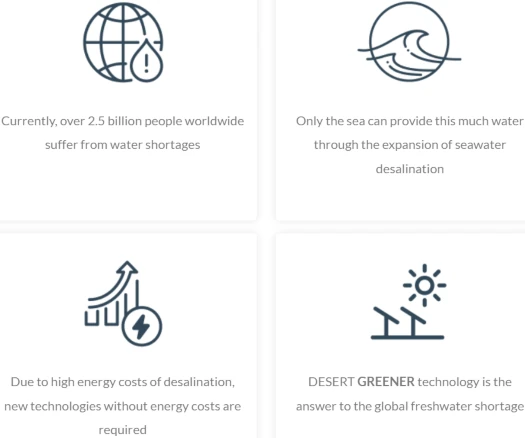

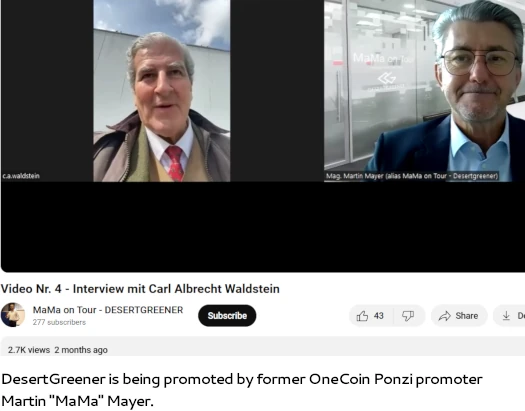

One final thing I’ll leave you with is DesertGreener’s indirect connections to OneCoin.

In researching Carl Albrecht Waldstein I came across notorious OneCoin Ponzi promoter Martin Mayer:

This isn’t the only OneCoin connection. From DesertGreener’s whitepaper we have;

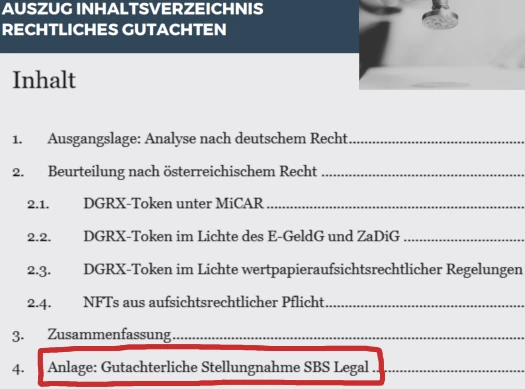

A very renowned and recognized law firm has prepared an expert opinion on the business model under German, Austrian and EU law.

DesertGreen’s “very renowned and recognized law firm” is none other than SBS law.

SBS Law, formerly Schulenberg & Schenk, are best known in the MLM industry for giving OneCoin the all-clear in 2015.

OneCoin would of course grow to become a $4 billion dollar plus Ponzi scheme before collapsing in 2017. OneCoin’s founder, Ruja Ignatova, is currently the world’s most wanted woman.

Regardless of SBS Laws’ DesertGreener legal opinion, securities fraud is very much illegal in Germany, Austria and the wider EU.

Despite Schulenberg & Schenk’s OneCoin legal opinion, Germany would eventually go on to arrest and imprison OneCoin scammers.

To be clear, SBS Law providing DesertGreener doesn’t automatically make it a fraudulent investment scheme. Why that is so is detailed in this review.

What I’m getting at is be wary of any MLM company with a legal opinion that runs contrary to common sense and logical application of the law.

Carl Albrecht Waldstein isn’t the inventor of that “Desertgreener”. From the patent filings it’s Matthias Budil from Vienna. Waldstein would be the ideal Boris, well dressed with an aura of seriosity 😉

@catweazle

Have you read this comment?

https://behindmlm.com/companies/onecoin/onecoins-ruja-ignatova-added-to-interpols-red-notice-list/#comment-483099

Obviously, Carl Albrecht Waldstein is not an entrepreneurial personality and has delegated the implementation of his idea to Alexander Braun.

Thanks Melanie, that video from the “Magister” Mayer confirms clearly that it’s a Techno-Scam.

Waldstein states at the beginning that they could start with 2-3 Mio. Euros but than scaled quickly up. Selling Token for 100 Mio. Euros makes it hard to believe that they have calculated anything about this Desertgreener business.

No ready to run maschine can be shown nor any pilot project. But having “talks” with all kind of potential customers from sheiks in the desert to the water minister in egypt?

Waldstein is only a bullshit bingo talking sockpuppet. Having a patent dosn’t mean that the technology works.

Press release from May 1, 2024 by Joachim Kölmel from Schachen in Switzerland. Partial quote.

The contact details of Joachim Kölmel without email address.

ibb.co/6mSX8CQ

presseportal-schweiz.ch/pressemeldungen/desertgreener-startet-network-marketing-konzept-der-schweiz-oesterreich-und

Boris CEOs don’t use their own names :D.

I don’t dispute Waldstein is a puppet though. TBH I didn’t look too closely into DesertGreener outside of the attached MLM crypto scheme.

It’s just a cover ruse to market a typical shitcoin which has clearly been put together by other individuals, so didn’t see much point.

Oz wrote:

Thomas Pfeifer plays an important role in all three of Alex Braun’s companies. We should keep a close eye on his activities.

ibb.co/B6phcDy

klimates.org/en/team/

ibb.co/ZXLfnzP

hempmate.com/de-gb/ueber-uns/team/

In an email dated July 9, 2024, Thomas Pfeifer described the DesertGreener project as a crowdfunding platform.

ibb.co/fd7hNT8

This form of financing is highly risky and can lead to the total loss of the capital invested. In a detailed article, the German BaFin warns against investing money in crowdfunding projects.

bafin.de/DE/Verbraucher/Finanzwissen/Fintech/Crowdfunding/crowdfunding_node.html

Thomas Pfeifer in a 15-minute video from April 29, 2024.

ibb.co/xGCQ8y7

youtube.com/watch?v=CoFcVAzrABg

Is DESERTGREENER just a branch of HEMPMATE? On the DesertGreener registration page you will find this information:

ibb.co/hVHTF3g

my.desertgreener.io/de/login

I did note the HempMate stuff in my research. Name didn’t ring a bell though and again, due to the underlying crypto fraud, didn’t look into it.

I figured HempMate was just some CBD shop DesertGreener had a partnership with or something.

It is still possible to order cannabis products on this website.

cannabisnormal.hempmate.com

The consumption of cannabis products in small quantities has only been permitted in Germany since the beginning of July 2024.

The domain hempmate.com was registered on June 10, 2015 and updated on June 11, 2024.

ibb.co/rdgxF0J

The number of visitors to hempmate.com is in sharp decline. Perhaps that was the reason why Alex Braun started a new business with DesertGreener and his new company DGRX Sales GmbH?

In June 2019, hempmate.com had 358.5K visitors.

ibb.co/cNfJg9r

In June 2024 hempmate.com had only 5.1K visitors.

ibb.co/mFfLWn9

Daniel Schollerer uploaded this video to his YT channel UpTrend on June 18, 2024.

youtube.com/watch?v=S-9_050rwNU

Co-founder Stefan Pfeifer (left), Daniel Schollerer (center) and inventor Carl Albrecht Waldstein (right) present this new project and also mention crowdfunding as a financing model.

ibb.co/N1gp3LZ

Because the uploader Daniel Schollerer is known to be an associate of German serial scammer Dennis Nowak and has his own website promoting his Flyback Solutions scam, I will not trust any recommendation from him. I have recorded the details in this comment:

https://behindmlm.com/mlm-reviews/flyback-solutions-review-flys-token-pump-dump-ponzi/#comment-481229

Oz wrote:

In a press release dated May 5, 1999, it was reported that Carl Albrecht Waldstein had founded a party in Austria called CSA (Christian Social Alliance).

ots.at/presseaussendung/OTS_19990505_OTS0156/parteigruender-carl-albrecht-waldstein-im-news-interview-oevp-wie-ein-esel-der-gegen-zwei-rennpferde-antritt-

I’ve searched hard for this party, but Google finds nothing… 😀

The former website of this party – csa.or.at – no longer exists. Screenshot of csa.or.at from February 20, 2003 from the web archive.

ibb.co/XYrRYyD

The big white cross obviously symbolizes that the party had already been buried at this point.

web.archive.org/web/20030220193718/http://www.csa.or.at:80/

After February 20, 2003, csa.or.at redirected to a dubious portal called fontanari.com.

ibb.co/d0rB89W

web.archive.org/web/20030927191422/http://fontanari.com/

The fontanari.com portal still exists. The contact details do not mention Carl Albrecht Waldstein, but Thomas Fontanari. Is this guy still collecting donations for Carl Albrecht Waldstein?

ibb.co/St9D7vc

fontanari.com/zur_person.php

Because of the redirection from csa.or.at to fontanari.com, there is no doubt in my mind that these two fraudsters know each other.

Fontanari KG, founded in 2001, is supposedly based in Vienna, but Thomas Fontanari collects donations in a bank account in Dornbirn. Does Thomas Fontanari drive 607 km from Vienna to Dornbirn when he has banking business to do?

As is usual with fraudsters, no telephone number is given on fontanari.com.

ibb.co/wBZXhtR

A photo of Thomas Fontanari.

ibb.co/NK1ynXg

Note. The ÖVP (Austrian People’s Party) criticized by Carl Albrecht Waldstein still exists and has the most members of all parties. Donkeys sometimes live longer than lame racehorses!

In a two-hour video from August 25, 2024, long-time OneCoin scammer Martin Mayer (aka “Mama on Tour”) from Liechtenstein is one of the speakers.

The notorious liar and scammer introduces himself as the operator of a seven-year-old Telegram channel and says verbatim that he never imagined he would one day be involved in MLM.

He has produced 900 videos about the Great Currency Reset, digital currencies and digital central bank currencies. He stopped two years ago to protect himself and his family. Of course, he does not mention his involvement in the OneCoin scam.

ibb.co/HP7r9gD

youtube.com/watch?v=t4UnVgzl9lY

A couple from Austria, who have withheld their names, have been promoting DesertGreener with 31 videos since June 13, 2024.

postimg.cc/D4LcK8xs

youtube.com/@maja4gaia/videos

Planning for the DesertGreener scam began back in February 2021 when Carl Albrecht Waldstein uploaded this video in English to his YT channel.

postimg.cc/T5VMjS1W

youtube.com/watch?v=sXjanAIzhnQ

Two years later, on March 4, 2023, the domain desertgreener.info was privately registered and updated on July 28, 2024. The domain holder is the company Seawater Beteiligungsverwaltung GmbH in Vienna (Austria).

postimg.cc/PvJg8xZN

The number of visitors to desertgreener.info is so small that it cannot be measured.

postimg.cc/xkr6SPP6

The imprint on desertgreener.info names the following company.

This is identical to the domain registration. “BV” is the abbreviation for Beteiligungsverwaltung (Investment management).

Karl Waldstein-Wartenberg is named as the managing director. The VAT identification number is missing. Why? Furthermore, the imprint does not include a telephone number. Why? A reputable company would not embarrass itself with an incomplete imprint. It is also unusual that Carl Waldstein spells his name differently.

postimg.cc/kB0QVgt4

PS: I will report later on the numerous companies that were founded in connection with DesertGreener or have existed for some time.

On the new YT channel DesertGreener Info with 175 subscribers, eight short videos with different speakers were uploaded on September 20 and 21, 2024.

Christoph Gretzmacher describes himself as President of Global Connect.

postimg.cc/LJPFnfVW

youtube.com/watch?v=AyZXG88lBh0

Heinrich Waldstein is a son of the founder Carl Albrecht Waldstein.

postimg.cc/H87VSz5g

youtube.com/watch?v=aBipxBYc5Vs

Maximilian Waldstein is also a son of Carl Albrecht Waldstein.

postimg.cc/R3SrX0fC

youtube.com/watch?v=PMkxMMWe6MQ

Dr. Wolfgang Knogler describes himself as a specialist in gynaecology and has known Carl Albrecht Waldstein for 14 years.

postimg.cc/LhTx3VDP

youtube.com/watch?v=OkQybZDpPEQ

Professor Peter Platzer describes himself as the Secretary General of EUREKA.

postimg.cc/bS8FNCTy

youtube.com/watch?v=7c19zckdk1A

Otmar Wendy describes himself as the representative of the newly founded association Aquarius – Friends of the Aquarius Order.

postimg.cc/PvxVwLB9

youtube.com/watch?v=180dqh1-dnM

postimg.cc/47txTdLC

youtube.com/watch?v=mIZth_IhTZY

Several people, whose first names only are mentioned, praise the DesertGreener project. One person is the well-known and long-standing OneCoin scammer Martin Mayer from Liechtenstein.

postimg.cc/QFb60Jhw

youtube.com/watch?v=tcJniGlYkco

This channel also features a two-hour video of an event that took place in Vienna on April 26, 2024.

The picture shows Martin Mayer from Liechtenstein, DESERTGREENER sales partner.

postimg.cc/fSM7tkrX

youtube.com/watch?v=VrVT9SP1b2Q

@thomaslaggner7048 commented:

DesertGreener is launching a roadshow this month.

– On October 7 in Vienna

– On October 28 in Berlin

– On October 29 in Hamburg

– On October 30th in Cologne

postimg.cc/dZ2cg4rc

Quote from today’s newsletter.

Addition to comments #12 and 15.

What has happened now? The former, longtime OneCoin scammer Martin Mayer from Liechtenstein has deleted all videos for DesertGreener on his new YT channel “MaMa on Tour – DESERTGREENER”!

Martin Mayer created the channel on April 12, 2024 and it had 319 subscribers. An old screenshot from my archive:

postimg.cc/1gxPjhmJ

youtube.com/@MoT-DESERTGREENER

Martin Mayer had also created a new e-mail address especially for the scam with DesertGreener:

postimg.cc/JtJX6JNL

When I discovered the new channel by chance, I documented it here on July 8, 2024:

https://behindmlm.com/companies/onecoin/onecoins-ruja-ignatova-added-to-interpols-red-notice-list/#comment-483094

Martin Mayer’s old portal continuum.li is also no longer available:

desertgreener.io had only 818 visitors in August 2024 and all of them came from Spain.

postimg.cc/ZW3DJjy5

desertgreener.sale had only 636 visitors in August 2024 and all of them came from Germany.

postimg.cc/64J8xWs3

desertgreener.info had an unmeasurable number of visitors in August 2024.

postimg.cc/Th3dh506

Will the roadshow in Austria and Germany announced by Carl Albrecht Waldstein (see comment #16) significantly increase these figures?

If the numbers on the homepage are correct, they sold so far 1.022.000 token wich translates into 102.200 Euro minus commissions. Not really a jumpstart.

It has not yet been mentioned that the sales partners at DesertGreener must verify themselves using KYC.

postimg.cc/PpRb66JY

my.desertgreener.io/en/user/user/view?site=3

German police authorities regularly warn against uploading personal documents. There is always a risk that these documents will be misused or traded on the Darknet. An example:

bsi.bund.de/DE/Themen/Verbraucherinnen-und-Verbraucher/Informationen-und-Empfehlungen/Darknet-und-Deep-Web/darknet-und-deep-web_node.html

Addition to comment #6.

Thomas Pfeifer, CSO and Founder, uploaded a video to Vimeo on August 24, 2024.

The first speaker is the “initiator and inventor” Carl Albrecht Waldstein.

postimg.cc/MMNcyJwL

The second speaker is Christoph Gretzmacher, who describes himself as “President of Global Connect”. Global Connect is supposedly an association, but this association is not registered in Austria.

postimg.cc/t7XDD7wb

vimeo.com/1002218098/c848372a28

DesertGreener sent me an email about a “special offer”. 😀

postimg.cc/nXNYHFnw

desertgreener.sale/en/leadmanager/Blocherar/

Annegret and Armin Blöcher, a fraudulent couple from Dillenburg in Germany, advertise numerous scam systems such as Club4you, Nowsite, ROXXTTER Club, API Business, DollarTub and also DesertGreener on websites and on YouTube. They were so enthusiastic about DesertGreener that they put four (!) websites online for it.

1. trinkwasserweltweit.de (drinkingwaterworldwide)

postimg.cc/Z94rFQ8Z

postimg.cc/kVTtNgMF (the imprint)

Since the website no longer exists, here is a link to the WebArchive:

web.archive.org/web/20240918124143/https://www.trinkwasserweltweit.de/

2. sauberestrinkwasserweltweit.de (cleandrinkingwaterworldwide)

This website also no longer exists.

postimg.cc/Yh7q9wMp

This website has not been saved in the WebArchive.

3. desertgreener24.com

The private domain registration from August 4, 2024:

postimg.cc/VdQfZ06s

This website no longer exists, hence this link to the WebArchive:

postimg.cc/tYnYcHpy (the imprint)

web.archive.org/web/20240915190535/https://www.desertgreener24.com/

The domain desertgreener24.com can currently be purchased for $899.

postimg.cc/y3Pv4SFg

4. saubereswasserweltweit.de (cleanwaterworldwide)

This website still exists. Partial quote:

postimg.cc/JGqszHFt

The complete imprint of saubereswasserweltweit.de:

postimg.cc/kVTtNgMF

The following YT channel of Annegret and Armin Blöcher no longer exists:

youtube.com/@Geldverdienen-rd9cc/videos

Here is a screenshot from my archive:

postimg.cc/zyFJx4JX

The current YT channel of Armin Blöcher with 5 videos has no subscribers.

postimg.cc/CdhdpDhJ

youtube.com/@ArminBl%C3%B6cher-z1h

The current YT channel of Annegret Blöcher with 37 videos and 10 subscribers.

postimg.cc/TLZbC3bB

youtube.com/@AnnegretBloecher

German serial scammer Armin Blöcher from Dillenburg uploaded a very short video on his YT channel today in which he claims that DesertGreener already has a market value of over 400 million – and rising!

postimg.cc/xJXYyBW4

youtube.com/watch?v=vzm2VZ9QngI

400 million? In what currency? Indian rupees, Thai baht or which currency does he mean? The company behind DesertGreener is DGRX Sales GmbH, which was founded in Mäder (Austria) in March 2024 with just 10,000 euros. The managing director is Alexander Braun.

firmenabc.at/dgrx-sales-gmbh_BBMmm

Annegret and Armin Blöcher from Dillenburg in Germany also link to Telegram on saubereswasserweltweit.de.

t.me/+QPthqji3FKUyZDBk

postimg.cc/JsMhBNLH

Who owns this telegram channel? Annegret or Armin Blöcher? No, it’s the channel of long-time OneCoin scammer Martin Mayer (aka “MaMa on Tour”) from Liechtenstein.

postimg.cc/p9ZwmjBC

DGRX tokens can only be purchased by citizens living in the so-called Schengen area. These are the following countries:

Austria – Germany – Switzerland – France – Spain – Italy – Poland – Czech Republic – Hungary – Bulgaria – Croatia – Luxembourg – Netherlands – Portugal – Romania – Lithuania – Denmark – Estonia – Finland – Greece – Latvia – Slovenia – Slovakia – Sweden – Belgium – Iceland – Norway – Liechtenstein – Malta

I found this restriction in the following video on the YT channel of Alexander Gaal from Germany:

youtube.com/watch?v=f-HDpccMmxc&list=PLUEEqvH6aO_8zwto1srURELtXNzjStfUy&index=26

Addition to comment #16.

DesertGreener today announced by email which people will be taking part in the roadshow in Germany.

– Carl Albrecht Waldstein, inventor and initiator

– Thomas Pfeifer, CSO DGRX Sales GmbH

– Martin Mayer, Independent E-Money Consultant

postimg.cc/dZtrR29V

Apparently, the long-time OneCoin fraudster Martin Mayer from Liechtenstein plays a leading role at DesertGreener.

The following video with Martin Mayer (right) from Liechtenstein and Carl Albrecht Waldstein is no longer visible on the YouTube channel “MaMa on Tour – DESERTGREENER”. Alexander Gaal, a 72-year-old pensioner from Germany, has integrated the video into a playlist of 54 videos for DesertGreener on his own YT channel.

youtube.com/watch?v=87cjbTQRqmE&list=PLUEEqvH6aO_8zwto1srURELtXNzjStfUy&index=29

On his own YT channel, long-time OneCoin scammer Martin Mayer from Liechtenstein uploaded this video on April 22, 2024, but it is no longer listed. This applies to all videos uploaded to the MaMa on Tour – DESERTGREENER channel since April 12, 2024.

postimg.cc/zHpJYWW6

youtube.com/watch?v=iL7agwBnuls

Martin Mayer‘s YouTube channel is empty because he no longer lists his videos. He does this in exactly the same way as he did with his 900 videos for the OneCoin scam, which were also not listed.

postimg.cc/JHHDQMFG

youtube.com/@MoT-DESERTGREENER

DesertGreener charges a monthly back office & support fee. The amount depends on the commissions earned by the sales partners.

From 15 euros, 2.50 euros are charged monthly.

From 150 euros, 5 euros are charged monthly.

From 500 euros, 7.50 euros are charged monthly.

In addition, 20% of the commission earned is not paid out but transferred to the token wallet. DesertGreener calls this “Automated token purchases”.

postimg.cc/RqvfNpBB

Addition to comment #28.

I have summarized new findings about Alexander Gaal in this commentary:

https://behindmlm.com/mlm-reviews/cryptex-review-daily-roi-smart-contract-ponzi-scheme/#comment-486667

Alexander Gaal’s playlist with 54 videos for DesertGreener.

youtube.com/watch?v=UxZNZxQhCn4&list=PLUEEqvH6aO_8zwto1srURELtXNzjStfUy

An Austrian private broadcaster interviewed the inventor of DesertGreener. Video from September 1, 2024.

postimg.cc/ZWQJ4KvZ

youtube.com/watch?v=TtiIodR7ozg

In the video, the thesis “swarm financing through tokens” (or crowdfunding) was mentioned several times and CSO Thomas Pfeifer was praised. I have already described Thomas Pfeifer’s activities in comment #6.

There are now two registration links from radiosol to DesertGreener on the radiosol.at website.

postimg.cc/KKDPVzYc

radiosol.at/desertgreener-infomeeting/

On October 31, 2024, a DesertGreener event took place in Lucerne (Switzerland). In this video by Chris Richard Plaschy from yesterday, only the participants are shown, nobody speaks, only musical accompaniment.

The picture shows long-time OneCoin scammer Martin Mayer from Liechtenstein.

postimg.cc/tngSzcF5

youtube.com/watch?v=CAH3Cb54uR8

Who is Chris Richard Plaschy? His YT channel with 1,080 subscribers contains 217 videos and he links to his website treuhand-beratungen.ch based in Zug (Switzerland). He runs an employment agency and a recruitment agency. He was also a speaker at the event in Lucerne. His personal link:

desertgreener.sale/de/leadmanager/ChrisRichard/?action=kontakt

youtube.com/watch?v=lR3j-kxhlxc

youtube.com/watch?v=7kKgTJAKvcI

A photo of Chris Richard Plaschy:

postimg.cc/JGKLQwJf

Chris Richard Plaschy in the video mentioned first:

youtu.be/CAH3Cb54uR8?t=239

Addition to comments #12, 15, 17, 25, 27, 28 and 32.

Long-time OneCoin scammer Martin Mayer (aka “MaMa on Tour”) from Liechtenstein has his own website for DesertGreener:

wasserentsalzung.at (water desalination)

On his website, Martin Mayer only gives his name and an e-mail address and links to his Telegram channel and his registration page at DesertGreener.

postimg.cc/k2JRfc3p and postimg.cc/7J5F593Q

But in the domain registration of wasserentsalzung.at his complete data is available:

postimg.cc/k2T6Zb7X

Why is he hiding the fact that he uploads videos for DesertGreener on his YouTube channel, but they are not listed?

youtube.com/@MoT-DESERTGREENER

On August 30, 2024, an unknown person in Germany privately registered a domain with the same term as Martin Mayer in Austria:

wasserentsalzung.com (water desalination)

The domain registration was updated on October 19, 2024.

postimg.cc/YjtnNnkF

A private website does not exist, as visitors are redirected to desertgreener.sale/en/leadmanager/Zwigger/.

postimg.cc/vxmtJKHS

On December 15, 2024, a DesertGreener Infomeeting will take place in Taufkirchen, a small town with 18,000 inhabitants near Munich. Thomas Pfeifer (CSO) and long-time OneCoin scammer Martin Mayer from Liechtenstein have been announced as speakers.

postimg.cc/svNW7myg

The token-part is now removed from the Desertgreener website.

@catweazle

This screenshot from November 24, 2024 still contained the topic of Tokenomics.

postimg.cc/GH09Kt77

web.archive.org/web/20241124032851/https://desertgreener.sale/en/

Oz wrote:

That has now been changed. Currently desertgreener.sale redirects to desertgreener.io. There is also the website desertgreener.info (see comment #14).

In a two-hour webinar held on January 23, 2025, it was claimed that 65,640,410 DGRX tokens have already been sold. The webinar was recorded and can be viewed in the DesertGreener back office.

I guess there’s no more crypto bros left to scam.

DesertGreener AI grift launch when?

Thanks Melanie. So i think that only 15,640,410 Token are solde because the other 50 Mio. where the intitial pump for the management crew shown on the website. That means they made only $150K and have to pay commission? What a lame SCAM.

@catweazle

Other numbers were also mentioned during the webinar. DesertGreener reportedly has 5,381 customers and support has already answered 1,253 queries.

This information was also interesting. 😀 DesertGreener tried to open a bank account in Austria or Switzerland for several months. That didn’t work. Four days before the KickOff event on April 26, 2024, a bank in Malta was finally ready to open an account.

I took some screenshots during the webinar on January 23, 2025. The webinar ran via HempMate‘s Zoom channel. The main speaker was CSO Thomas Pfeifer.

postimg.cc/gx2ryKfd

Another speaker was the “inventor” Carl Albrecht Waldstein.

postimg.cc/zL9BrY3X

Long-time OneCoin scammer Martin Mayer from Liechtenstein is now responsible for International Investor Relations. His personal website continuum.li is currently unavailable again (HTTP ERROR 500).

postimg.cc/Q9Q7tJB7

Apparently there is a patent for the planned DesertGreener seawater desalination plant with the number US1182067482.

postimg.cc/hfdXP0Ht

DesertGreener plans to set up several shops.

postimg.cc/23JqDt9t

The team behind DesertGreener.

postimg.cc/rRtZPbz4

The webinar also discussed critical reporting on BehindMLM. The following lies were spread.

postimg.cc/N217Tw5d

It was also mentioned that it is possible to have critical reports on BehindMLM removed by affordablereputationmanagement.com. 😀

postimg.cc/hQbTvb5w

Carl Albrecht Waldstein always mentions the collaboration with the renowned Fraunhofer Institute, but many people apparently doubt this. It was therefore announced in the webinar that there would be an official website with or from the Fraunhofer Institute in February 2025.

A day after this review was published, the following video was uploaded to the YT channel LegitDiv.

postimg.cc/vDxsd3Nq

youtube.com/watch?v=OxzpRNE0Pwo

postimg.cc/9RKr1bx4

web.archive.org/web/20241103032601/https://desertgreener.sale/en/

DGRX wallet? A wallet for a token with no value? All I read on coinmarketcap.com is:

Addition to comment #23.

Annegret Blöcher links on X to her fifth (!) website for the DesertGreener scam:

investierenjetzt.com (investnow)

postimg.cc/bdyNnG2N

x.com/AnnegretBl86475/status/1847207556466217409

The domain investierenjetzt.com was registered on September 15, 2024, but the website no longer exists and was last saved in the WebArchive on January 17, 2025.

postimg.cc/qtN24b4S

The WebArchive shows that the website was never completed. It contained English and Latin texts from a website template. An example:

postimg.cc/D4dBZV8M

web.archive.org/web/20250117222839/https://investierenjetzt.com/

Annegret and Armin Blöcher are completely uneducated. Their websites contain numerous errors and of course they do not understand English or Latin. Both are desperately trying to earn some money with numerous dubious MLM projects and do not realize that they are promoting scammers.

Addition to comment #14.

Because of the war in Ukraine, many people have fled to Western Europe, including Germany, Austria, etc. Many of these refugees are looking for work and may find this website:

jobs4ukrains.at

Unfortunately, the Ukrainian refugees will not find paid work here, because this website is a 100% copy of desertgreener.info. Both websites have an identical imprint.

postimg.cc/BtcwLzj7

jobs4ukrains.at/impressum/

The owners of the domain jobs4ukrains.at are Gerhard Maresch, IT Dienstleistung Consulting from Mannersdorf in Austria and Christian Haase, Digimagical GmbH from Mauerbach in Austria.

postimg.cc/9zbH50Yf

These two companies create all websites for DesertGreener.

postimg.cc/8FRnRXyC

If someone is really looking for workers from Ukraine, they will also present their website in Ukrainian or Russian. jobs4ukrains.at is only offered in German and English.

In an email today, DesertGreener wrote, among other things:

postimg.cc/D8nf5Rwg

A new roadshow has also been announced with dates in Austria, Switzerland and Germany.

A webinar will take place every Thursday at 8:15 pm on movementmeeting.com.

The following video with initiator & inventor Carl Albrecht Waldstein was uploaded today on the YT channel DesertGreener Info with 241 subscribers.

postimg.cc/YjXDyWps

youtube.com/watch?v=8HaU-iCXMzY

DesertGreener has announced a new roadshow by email today. The following dates and locations are mentioned.

The following speakers have been announced.

Inventor Carl Albrecht Waldstein, CSO Thomas Pfeifer and long-time OneCoin scammer Martin Mayer from Liechtenstein.

Officially, Martin Mayer is responsible for International Investor Relations at DesertGreener.

postimg.cc/06dHn7t6

On June 13, 2025, a DESERTGREENER GLOBAL SUMMIT 2025 will take place in Vienna (Austria).

postimg.cc/ctsPGncR

Tickets for the event cost 212 DGRX until May 15. This corresponds to a value of 21.20 euros. VAT of 4.24 euros must be paid separately in euros.

From May 16, a ticket will cost 250 DGRX plus 5 euros VAT. If you do not have DGRX, you cannot buy a ticket!

postimg.cc/Vr5YQ2Ls

my.desertgreener.io/en/finanzen/tokenomics/shop

In a video on HempMate‘s Vimeo channel, the DesertGreener scammers explain how to buy tickets for the announced Global Summit event in Vienna on June 13, 2025. The comment function under this video has of course been deactivated.

postimg.cc/p5hM07Nq

vimeo.com/1084069033/274928b487

Apparently there is little interest in this event, as the sale of tickets has been extended by one week – until May 22, 2025.

The desertgreener.io website now shows a different address in Innsbruck (Austria).

postimg.cc/NyDrxF8g and postimg.cc/ZWFL1TPQ

In an email dated May 7, 2025, the old address in Mäder (Austria) was still mentioned.

postimg.cc/mhJ1j09F and postimg.cc/Bjmtkyy3

The following people have been announced as guest speakers for the DesertGreener Global Summit on June 13, 2025 in Vienna (Austria).

– Iwan Graf, Switzerland

– Mohamed Haikal, Egypt

– Essam Hassan, Egypt

Michael Seida from Austria is not a speaker, he will perform as a singer.

postimg.cc/rzRdnppn

nl.desertgreener.io/mailing/220/8399864/2784622/3707/4059e2ed54/index.html

Video from July 13, 2025.

Long-time OneCoin scammer Martin Mayer from Liechtenstein, now International Relations Manager at DesertGreener.

postimg.cc/zbjvHVd3

Iwan Graf, Broker & International Financial Expert.

postimg.cc/9wb92x38

Dr. Mohamed Haikal, International Expert for Water & Environmental Technology. He speaks English.

postimg.cc/SnhW9zdf

youtube.com/watch?v=RXr9ei8KUeU

Dr. Mohamed Haikal from Cairo in Egypt has his own website:

haikalconsult.com

The domain haikalconsult.com was registered privately on October 26, 2024 and updated on April 23, 2025.

postimg.cc/t7px5VVr

I am surprised that the “International Expert on Water & Environmental Technology” Dr. Mohamed Haikal has only had his own website since October 2024. But he has had a YT channel with 8 videos and 46 subscribers since December 2021.

Some of the Egyptian videos have English subtitles. No new videos have been uploaded since July 2022.

postimg.cc/RJwJMKhY

youtube.com/@%D8%A7%D9%84%D8%AF%D9%83%D8%AA%D9%88%D8%B1%D9%85%D8%AD%D9%85%D8%AF%D9%87%D9%8A%D9%83%D9%84%D8%AE%D8%A8%D9%8A%D8%B1%D8%A7%D9%84%D9%85%D9%8A%D8%A7%D9%87

Iwan Graf from Switzerland, who describes himself as a Broker & International Financial Expert, worked as a Senior Relationship Manager at Bank J. Safra Sarasin Ltd until April 2025. He has not yet changed his profile on LinkedIn.

postimg.cc/XpLMQ0MC

linkedin.com/in/iwan-graf-5ab6764a/?originalSubdomain=ch

Correction to comment #6.

The video of Thomas Pfeifer (CSO and co-founder) from April 29, 2024 no longer exists.

postimg.cc/XXPTg2Sk

youtube.com/watch?v=CoFcVAzrABg

In a video dated July 15, 2025, Carl Albrecht Waldstein claimed that DesertGreener already had more than 5,000 registered members.

postimg.cc/B8zmsYsQ

youtube.com/watch?v=nXpra-6F5JA

The number of visitors to desertgreener.io is dropping dramatically. In November 2024, the website had 41K visitors.

postimg.cc/XXxhPZjz

In July 2025, there were only 212 visitors.

postimg.cc/8fFhwnPD

How can this be changed? With this email that was sent yesterday?

postimg.cc/V0yyLphH

All new countries in the following screenshot.

postimg.cc/qh6F6QVh

nl.desertgreener.io/mailing/220/8577122/2784622/2680/709f8f8998/index.html

PS: In this context, I must refer to my comment #26!

I don’t know who from the DesertGreener team answered this question. In any case, the reporting on BehindMLM was also mentioned and criticized. 🙂

postimg.cc/30DXDP0s

desertgreener.io/en/

The DesertGreener team includes Martin Mayer from Liechtenstein, a long-time OneCoin scammer. Why should I trust this team?

postimg.cc/1f3HHjhN

If DesertGreener were a reputable company, anyone could watch the DesertGreener videos produced by serial fraudster Martin Mayer – but his YouTube channel with 356 subscribers is empty!

postimg.cc/wRLzMQg6

youtube.com/@MoT-DESERTGREENER

Addition to comment #33.

Long-time OneCoin scammer Martin Mayer (aka “MaMa on Tour”) from Liechtenstein has deleted his wasserentsalzung.at website. Why?

postimg.cc/MnLGkCKy

His old website continuum.li is also unavailable.

Apparently, Carl Albrecht Waldstein can no longer find any suckers in German-speaking countries who will buy worthless DGRX tokens. Therefore, the first DesertGreener Movement meeting will be held in English on September 26, 2025.

nl.desertgreener.io/mailing/220/8619179/2784622/2680/a0da222162/index.html

In an email dated October 28, 2025, it was announced that DesertGreener will commission a pilot plant in Cyprus before the end of this year. Partial quote.

postimg.cc/r0y9XvSS

nl.desertgreener.io/mailing/220/8709506/2784622/2680/d5b0e90dbd/index.html

The link leads to this 48-minute video, which was uploaded to the YouTube channel DesertGreener Info. Former long-time OneCoin scammer Martin Mayer from Liechtenstein (left) asked 13 questions, which were answered by the “inventor” Carl Albrecht Waldstein.

Of course, this is not an interview in the traditional sense, but rather a staged interview!

postimg.cc/QFQ0ZxZM

youtube.com/watch?v=hud8CjJUBSE

As is usual with serial fraudster Martin Mayer, this video is not listed either! Because the video is not public, it only has 443 views.

This photo from the video shows the alleged pilot plant in Cyprus.

postimg.cc/3k8DWKDd

Yesterday, a special webinar with Thomas Pfeifer took place. Quote from the invitation.

postimg.cc/4KpxcpgS

nl.desertgreener.io/mailing/220/8740907/2784622/2680/4bd4c78d22/index.html

Can the pilot plant in Cyprus not be put into operation because no one is buying worthless DGRX tokens? 😀

More details about Thomas Pfeifer in this comment.

https://behindmlm.com/mlm-reviews/desertgreener-review-dgrx-token-nft-ponzi/#comment-483569

An email contained a link to the special webinar with CSO Thomas Pfeifer.

postimg.cc/3y1gRyqL

nl.desertgreener.io/mailing/220/8747451/2784622/2679/b6d444620c/index.html

On Facebook and Instagram, KLIMATES describes itself as an environmental protection company.

facebook.com/klimates.org (121 followers)

instagram.com/klimates_official/ (123 followers)

The 50-minute video from November 12, 2025.

The video was not uploaded to DesertGreener’s YouTube channel, but to the channel of HempMate AG, and is of course not listed!

Members of DesertGreener are requested to shop at stores listed on klimates.org/shoplist. KLIMATES allegedly receives an affiliate commission from such purchases.

postimg.cc/yD8M8Gvm

youtube.com/watch?v=DsJd_MhpphM

We have known since April 2024 that Martin Mayer, a long-time OneCoin scammer from Liechtenstein, set up a YouTube channel for DesertGreener. I documented this in this comment:

https://behindmlm.com/mlm/regulation/onecoins-ruja-ignatova-added-to-interpols-red-notice-list/#comment-483094

As is typical for serial fraudster Martin Mayer, he has not listed the videos on this channel.

postimg.cc/3yqjvtm1

youtube.com/@MoT-DESERTGREENER

Yesterday, I happened to discover this unlisted video by Martin Mayer on his YouTube channel featuring DesertGreener “inventor” Carl Albrecht Waldstein (left). More details to follow later.

postimg.cc/vD7s3kTH

youtube.com/watch?v=flBsCFV3lMg

The video was uploaded on November 11, 2025.

Thomas Laggner from Austria, whom I mentioned in comment #15, has had a private Facebook group with 19 members since October 18, 2025.

postimg.cc/231Wf9Cr

facebook.com/groups/1341057220940120

Thomas Laggner‘s profile as admin of this group on Facebook.

postimg.cc/DW4W3tPb

facebook.com/groups/1341057220940120/user/100000817657189

Thomas Laggner on LinkedIn.

postimg.cc/CzXCnTLH + postimg.cc/w73RkyRQ

linkedin.com/in/thomaslaggner/?originalSubdomain=at

In his Facebook group, Thomas Laggner linked to the unlisted video No. 32 by Martin Mayer from Liechtenstein featuring Carl Albrecht Waldstein, which I mentioned in comment #61.

postimg.cc/MvYTggvg

youtube.com/watch?v=flBsCFV3lMg

In July 2025, “inventor” Carl Albrecht Waldstein claimed that DesertGreener had more than 5,000 registered members (see comment #53), but this video currently had only 744 views in 9 days.

A DesertGreener information meeting will take place in Zurich (Switzerland) on November 23, 2025. Inventor Carl Albrecht Waldstein and CSO Thomas Pfeifer have been announced as speakers.

postimg.cc/75HFXcg3

desertgreener.io/mailing/220/8768616/2784622/2679/33269ea38e/index.html

Why can’t Carl Albrecht Waldstein find a bank to finance his fantastic project? Is he not creditworthy? Or is the credit risk too high for banks? Financing with dubious DGRX tokens is definitely out of the question!