OneCoin Leaks: Schulenberg & Schenk legal opinion (2015)

The earliest I recall hearing of the law firm Schulenberg & Schenk’s legal opinion on OneCoin was May 2016.

The earliest I recall hearing of the law firm Schulenberg & Schenk’s legal opinion on OneCoin was May 2016.

Turns out OneCoin engaged Schulenberg & Schenk to rubber stamp their Ponzi scheme a whole year earlier.

The latest leak out of OneCoin is an “expert opinion” by Schulenberg & Schenk, dated May 6th, 2015.

I should preface by saying what follows is analysis purely academic analysis. Still, it’s a good example of why commissioned legal opinions by MLM companies are typically meaningless.

The year was 2015 and OneCoin was starting to gain traction. Unfortunately this brought with it unwanted regulatory attention.

Banks and police were starting to take notice and, weary of being tied to the Ponzi scheme, a charity in Canada rejected OneCoin’s donations.

After a paid Forbes advertisement failed to deliver the curated positive press Ruja Ignatova so desperately craved, OneCoin turned to Schulenberg & Schenk.

Presumably sometime prior to May 2015, Schulenberg & Schenk were tasked with putting together legal opinions on OneCoin.

The leaked document in question pertains to Section 16, paragraph 2, and Number 14 Annex pertaining to Section 3, paragraph 3 of the German Act against Unfair Competition.

Section 16 paragraph 2 reads;

Whoever in the court of trade operates to cause consumers to purchase goods, services or rights by holding out the prospect of consumers obtaining specific benefits from the promoter himself or from a third party if they cause other persons to conclude equivalent transactions where, in terms of this kind of advertising, these other persons are, in turn, to receive such benefits for corresponding advertising directed towards further purchasers shall be liable to imprisonment not exceeding two years or to a fine.

In other words; if you run a scheme where people spend money, which in turn qualifies them to get paid to recruit other people who also spend money (i.e. your typical pyramid scheme), as per German law you’re liable for prison time or a fine.

The Number 14 Annex reads covers promotional schemes that create

the impression that compensation can be obtained solely or primarily from introducing other participants into the scheme (scheme with a snowball effect or pyramidal structure).

As per OneCoin’s business model, the company falls short on both counts.

OneCoin had no retail products and thus no retail customers. New investors invested, that money was used to pay existing investors. On top of that you had commissions paid out on the recruitment of new OneCoin investors.

Over time this saw OneCoin grow to a $4 billion dollar plus Ponzi scheme.

This wasn’t some after the fact revelation either. BehindMLM identified OneCoin as a Ponzi scheme in late 2014, months before Schulenberg & Schenk were commissioned.

And that makes the law firm’s “expert opinion” all the more delicious.

In Schulenberg & Schenk’s own words;

(The) subject of the opinion is the question, whether the One Network Services Ltd. distribution system fulfills the requirements to be met by a legal distribution system.

Having been paid an unknown sum by OneCoin, naturally Schulenberg & Schenk concluded the Ponzi scheme was legitimate.

Strong points for the lawfulness of the OneCoin distribution system are in particular, that the main focus of the distribution partner’s commercial activity is on sales or mediation of products.

Furthermore there is no obligation to purchase products.

Without making extensive investments, an IMA can become active within the distribution system and earn commissions.

Further strong arguments for the lawfulness of the system are that there exists no obligation for recruiting new IMA.

In addition, the IMA has a right of return.

Pseudo-compliance at its finest. And some lies mixed in for good measure.

The lie is that OneCoin has ever been about anything but investors recruiting new investors to get paid.

Back in 2015 OneCoin was bundled PDF files with investment. These files were mostly copy and pasted from sources like Wikipedia, which nobody cared about.

Thousands of euros, even hundreds of thousands in some cases, were being invested into OneCoin purely to acquire OneCoin points.

This was on the sole representation by OneCoin that the points would only ever go up in value, eventually permitting investors to cash out far more than they invested.

Through the Matching Bonus, the more a OneCoin affiliate invested also increased their income potential.

That OneCoin had a free affiliate option and that recruitment wasn’t required, doesn’t negate the fact that investment was made and recruitment did happen.

Obviously the notion that free affiliates who didn’t invest anything somehow outweighed actual investment, is absurd.

Already OneCoin can be found to be in breach of both sections of Germany’s Act Against Unfair Competition.

- OneCoin affiliates were paid to recruit new affiliates

- compensation paid out by OneCoin was primarily tied to recruitment of new investors (OneCoin had no other source of revenue)

Instead of acknowledging these two simple facts however, Schulenberg & Schenk trot out three pages of “what about” pseudo compliance justification.

Concerning the OneCoin distribution system, there is also no risk of “narrowing/tightening of the market” or increased product prices typical for systems … because no commissions are being transferred upwards within the structures resulting in increased product prices.

The IMA are also not given the false impression of reaching an exceptionally fast economic success when taking part in the OneCoin distribution system – without the respective work effort.

- OneCoin had no products.

- commissions were paid upline.

- “narrowing/tightening of the market” did occur (as it does in any pyramid scheme), such to the extent that OneCoin stopped paying ROI withdrawal requests in October 2017.

As to the last point, literally the only reason anyone invested in OneCoin was because the company continued to increase the internal value of its points.

These price increases were widely circulated on social media by OneCoin and its affiliates.

Obviously from a legal perspective, investing in a Ponzi scheme and convincing others to invest isn’t “work effort”.

Any more so than robbing a bank or skimming credit card numbers can be considered work.

Not really sure why, but Schulenberg & Schenk divide their opinion between OneCoin and One Network Service (shell company used to launder funds).

Part two of the opinion, which begins on page 3, addresses One Network Service.

The One Network Service is a direct selling company.

(The) purpose of the company is the trade with cryptocurrency or the respective Token and the corresponding education and training material which are distributed by independent and legally separate IMA.

We’ve already addressed how OneCoin’s plagiarized PDF file “education” were irrelevant, so let us continue.

Both using these OneCoins and Token, exchange activities can be realized via the trading system called “OneExchange”.

The prices are governed by the free market principle of supply and demand.

This is false. OneCoin’s internal value was set by OneCoin staff, typically at the direction of Ruja Ignatova (see “OneCoin was conceptualized as manipulable Ponzi points, there was never a cryptocurrency”).

There was no public demand for OneCoin’s Ponzi points. How could there be?

And supply was infinite. OneCoin simply generated points to give out as required (see “OneCoin created points on demand, they were not mined” in link above).

As summarized by Schulenberg & Schenk;

The key question is, whether the arrangement of the system primarily serves the product sale, or whether it is typically designed to integrate new participants into the sales structure.

To answer this I’d like to quote a conversation between Ruja Ignatova and Sebastian Greenwood (mid 2014, prior to OneCoin’s launch);

You should be able to sell this.

I also added an Extra Bonus for all members joining the Presales … they can do actually 3 splits.

Which means they will actually have 10x their investment.

2 splits is 5x your money. So of course, everybody who is greedy will go in with 5.000 USD.

It was only after the investment opportunity was fleshed out that Ignatova and Greenwood added PDF files to investment.

OneCoin’s “education” was never anything more than a pseudo-compliance afterthought.

Nonetheless, Schulenberg & Schenk concluded

the overall assessment of the different components of the OneCoin distribution system results in the fact, that the OneCoin distribution system is, in our opinion, a lawful system and not a progressive one (pyramid scheme).

How much Schulenberg & Schenk were paid for their OneCoin legal opinions has never been disclosed.

Following their commissioning, Schulenberg & Schenk are believed to have been retained by Ruja Ignatova to represent herself and OneCoin in Germany.

Ignatova used Schulenberg & Schenk to threaten anyone in Germany publishing negative information on OneCoin with legal action.

Two years after their initial commissioned opinion, BaFin, Germany’s top financial regulator, would ban OneCoin over securities fraud concerns.

In early 2019 US authorities would arrest Ruja Ignatova’s brother, Konstantin. Criminal charges were also filed against Ruja.

Details of the investigation would confirm, despite Schulenberg & Schenk’s “expert opinion”, that OneCoin was a Ponzi scheme from inception.

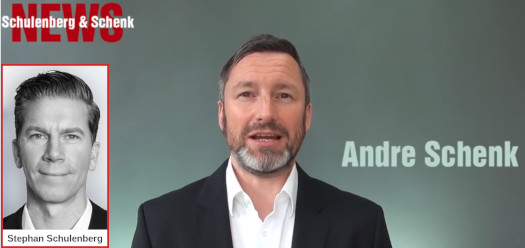

In mid 2016 Schulenberg & Schenk attorney Andre Schenk, appeared in a YouTube video to defend OneCoin.

Despite Schulenberg & Schenk taking on a blatant MLM Ponzi scheme as a client, Schenk claimed to be specialized in MLMs.

The video has since been removed from YouTube.

Earlier this month Schulenberg & Schenk began redirecting their website traffic to SBS Legal.

Update 5th February 2020 – Despite having no web presence and SBS Legal consisting of the same lawyers under a different name, Stephan Schulenberg has been in contact to advise

SBS Legal- the company was registered in January 2019.

Schulenberg and Schenk still exists. The website is forwarded to SBS, but Schulenberg and Schenk acts in behalf of several clients connected with the crypto business.

I’ve edited the last sentence of this article, which stated Schulenberg & Schenk renamed itself to SBS Legal, to reflect Schulenberg’s claim.

Wow. Excellent coverage and summary. Brought back all kinds of memories in following this. Completely accurate and exactly on point.

That was a fun read. Thanks again!

Well, the legal opinion seems to be the same that has already been available in OneCoin’s backoffice for years. There should be eight more from various European law firms.

OneCoin also used the notorious Carter-Ruck firm to initimidate whistleblowers in the UK, as revealed by Private Eye.

But Carter-Ruck appears to have been smart enough not to endorse the scheme and to confine itself to issuing SLAPP letters.

There are 140,000 solicitors in the UK. Based on that population ratio this suggests there are around 2 and a half million lawyers in the whole of the OECD.

If you are trying to find a lawyer willing to endorse a fraudulent scheme, and operating on an international level like OneCoin, you only need to find one out of the whole of those 2 and a half million venal enough to take your money.

This should be considered any time “a lawyer said it’s legit” is being used to justify anything.

This does not just include Ponzi schemes but tax avoidance schemes and any other time you are trying to make money from a novel interpretation of law that differs from everyone else’s.

At any one time 1.25 million of those lawyers will be wrong, as in any legal dispute both sides get a lawyer and only one can win.

Who are Schulenberg & Schenk? Not significant enough to have an article even on the German-language Wikipedia, at any rate. Schillings or Carter-Fuck they ain’t.

@Malthusian

Duncan Arthur has said that when it was his turn to be legally threatened he thought it was insulting that it came from Schulenberg & Schenk instead of a “real” firm like Carter-Ruck.

Apparently in England that is the difference between shopping at Harrods or Poundland.

Article updated with correspondence from Stephan Schulenberg.

Nothing despises me more than dirty lawyers.

Taking money from criminals and writing BS ‘legal opinions’ to advance the criminals’ business.

So the best these shysters can come up with is that they changed their name but no they haven’t? I can’t wait for the next leak.

The “Expert Opinion” from Schulenberg & Schenk can still be downloaded on this website:

onelifesuomi.fi

onelifesuomi.fi/data/Legal_Opinion_Germany.pdf

These clowns should be on trial with Ricketts and the other Beidendag, whatever, tame poodle.

Attorney André Schenk has started his own affiliate program for networkers with two other people. Partial quote from an article dated March 15, 2023:

share-your-photo.com/55d2e1161f

direct-selling-magazine.de/andre-schenk-schafft-mit-legalpunk-rechtlichen-schutzschild-fuer-networker/

So-called “protection packages” cost EUR 7.99 or 12.99 or 27.99 or 39.99 per month:

share-your-photo.com/5e857a11d6

legalpunk.eu/schutzpakete

André Schenk calls himself LL.M.EUR and CO-FOUNDER of LEGALPUNK

share-your-photo.com/f1d2f0a31f

András Hámori calls himself CO-FOUNDER of LEGALPUNK:

share-your-photo.com/0b27a2e7eb

Dirk Ulaszewski calls himself CO-FOUNDER of LEGALPUNK:

share-your-photo.com/34d42e7826

Now we know three co-founders, but who is the actual founder? Stephan Schulenberg? A lawyer like André Schenk should know that naming the founder is mandatory.

The law firm Schulenberg & Schenk (sbs-law.de) is based in Hamburg. However, the “company” LEGALPUNK is hiding in Spain, as the imprint shows. As usual with scammers, the imprint does not contain a phone number!

It also does not name the actual managing director, but Dirk Ulaszewski as the managing director authorized to represent the company:

share-your-photo.com/c7664ab33d

legalpunk.eu/impressum

Legalpunk International SL was founded on November 29, 2022 as an advertising agency in Spain:

empresite.eleconomista.es/LEGALPUNK-INTERNATIONAL.html

Affiliate Program Notice.

legalpunk.eu/partnerprogramm

The domain legalpunk.eu was registered on June 16, 2022 in Budapest, Hungary.

Let me summarize. A company without founder, but with three co-founders, registers its website in Hungary and has its headquarters in Spain. One of the co-founders is a German lawyer in a law firm that has an enormously bad reputation in Germany.

On Facebook, only the street is mentioned in the profile, but not the place in Spain. A lawyer should know that this is not allowed in Germany. However, Hamburg was also mentioned in the first posting:

share-your-photo.com/9a647c2b57

facebook.com/legalpunk

An old screenshot from gerlachreport.com:

archive.ph/dHXqn/bf8cf0c7d7909016e9da725b193e053f338bb479.png

The text means analogously, that these lawyers have silenced critics of OneCoin through dirty dealings. In Germany, we call this a warning notice with costs.

Willi Morant, a very dubious “networker” (Head of the GlamJet Community) from Germany, is friends with lawyer André Schenk:

https://behindmlm.com/mlm-reviews/my-crypto-consult-review-glam-ponzi-points-investment-fraud/#comment-461614

Partial quote:

share-your-photo.com/9315aa2dbb

glamjetsolution.de/ueber-uns

In addition, Willi Morant has advertised many dubious and fraudulent offers in the former German forum mlm-infos.com

OneCoin lawyer starts his own MLM company?

This is going to be an interesting review. Thanks for the heads up.