AWS Mining Review: Cloud mining unregistered securities Ponzi

AWS Mining provides no information on their website about who owns or runs the business.

AWS Mining provides no information on their website about who owns or runs the business.

According to a 2018 business presentation hosted on the AWS Mining website domain, the founders of the company are Daniel Beduschi (COO) and Alexandre Campos (CFO).

Daniel Beduschi maintains two Facebook profile. In one he claims to live in Sydney, Australia and the other in Santa Catarina, Brazil.

Beduschi first popped up on BehindMLM’s radar as a top investor in the Brazilian BBOM Ponzi scheme and its InterBBOM reboot.

Prior to BBOM Beduschi was an Amway Brazil affiliate.

Possibly due to language-barriers, I was unable to put together an accurate MLM history on Alexandre Campos.

The AWS Mining website domain (“awsmining.com”) was registered on April 8th, 2018.

“AWS Mining Pty Ltd” is listed as the owner, through a residential address in NSW, Australia.

AWS Mining Pty Ltd is registered as an Australian corporation through ABN 87 619 297 077. The company is also registered with ASIC through ACN 619 297 077.

AWS Mining Pty Ltd’s corporate registration ties the company to MyCoinDeal. MyCoinDeal appears to have something to do with bitcoin withdrawals through AWS Mining.

For all intents and purposes, AWS mining Pty Ltd appears to be a shell company. AWS Mining doesn’t seem to have any actual physical business operations in Australia.

Supporting this is Brazil cited as the top source of traffic to both the AWS Mining and MyCoinDeal websites (Alexa).

Read on for a full review of the AWS Mining MLM opportunity.

AWS Mining Products

AWS Mining has no retailable products or services, with affiliates only able to market AWS Mining affiliate membership itself.

The AWS Mining Compensation Plan

AWS Mining affiliates invest funds on the representation they’ll earn a daily ROI:

WHAT IS MY EXPECTED RETURN ON INVESTMENT?

Cryptocurrency mining depends highly on the prices and difficulties of the coins you mine.

AWS Mining marketing strategy is to reward our customers with as much as possible and as soon as possible.

Advertised investment contracts on the AWS Mining website are as follows:

- 0.1 CMP – $40

- 1 CMP – $400

- 3 CMP – $1200

- 5 CMP – $2000

- 10 CMP – $4000

Each investment is charged a monthly 20% fee, which is taken out of ROI payments.

AWS Mining Affiliate Ranks

There are seven affiliate ranks within the AWS Mining compensation plan.

Along with their respective qualification criteria they are as follows:

- Miner – sign up, invest and recruit at least two affiliates who also invest

- Coordinator – generate $10,000 in downline investment volume

- Supervisor – generate $50,000 in downline investment volume

- Manager – generate $100,000 in downline investment volume

- Director – generate $500,000 in downline investment volume

- Vice President – generate $2,000,000 in downline investment volume

- President – generate $10,000,000 in downline investment volume

Recruitment Commissions

AWS Mining affiliates are paid 10% of funds invested by personally recruited affiliates.

A 1% bonus ROI rate is also applied per affiliate recruited.

Residual Commissions

To qualify for residual commissions, each AWS Mining affiliate must recruit at least two affiliates who invest.

AWS Mining pay residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each day AWS Mining tallies up new investment volume on both sides of the binary team.

Affiliates are paid between 4% to 10% of matched volume, based on how much they have invested:

- affiliates who have invested in the 0.1 CMP contract receive a 4% residual commission rate

- affiliates who have invested in the 1 CMP contract receive a 6% residual commission rate

- affiliates who have invested in the 3 CMP contract receive an 8% residual commission rate

- affiliates who have invested in the 10 CMP contract receive a 10% residual commission rate

Note the AWS compensation plan doesn’t specify how much affiliates who have invested in the 5 CMP contract earn (9% would be an educated guess).

How much an AWS Mining affiliate can earn in daily residual commissions is capped based on rank:

- Miners can earn up to $500 a day

- Coordinators can earn up to $700 a day

- Supervisors can earn up to $1000 a day

- Managers can earn up to $1500 a day

- Directors can earn up to $2000 a day

- Vice Presidents can earn up to $2500 a day

- Presidents can earn up to $5000 a day

Maintenance Fee Commissions

AWS Mining take 20% of contract fees and use them to pay a commission.

Maintenance Fee commissions are paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

AWS Mining cap Maintenance Fee commissions at five unilevel team levels.

How many levels Maintenance Fee commissions are earned on is determined by how much an AWS Mining affiliate has invested:

- 0.1 to 0.9 CMP worth of investment = commissions on levels 1 and 2

- 1 to 2 CMP worth of investment = commissions on levels 1 to 3

- 3 to 4 CMP worth of investment = commissions on levels 1 to 4

- 10 or more CMP worth of investment = commissions on levels 1 to 5

Note that the sum total of CMP invested in is the total number for each plan an affiliate has invested in.

E.g. Three separate 0.1 CMP investments of $40 would result in 0.3 CMP worth of investment.

The AWS Mining compensation plan doesn’t state the exact percentage payouts for each level.

If we assume the 20% is split evenly, the maximum percentage payout on each unilevel team level would be 4%.

Rank Achievement Bonus

AWS Mining reward affiliates for qualifying at Coordinator and higher ranks with a one-time Rank Achievement Bonus:

- Coordinator = $100 bonus

- Supervisor = $400 bonus

- Manager = $800 bonus

- Director = $4000 bonus

- Vice President = $10,000 bonus

- President = $100,000 bonus

Joining AWS Mining

AWS Mining affiliate membership is free.

To participate in the attached income opportunity however, a minimum investment of $40 to $4000 is required.

Conclusion

AWS Mining claim to generate external ROI revenue through cloud mining operations.

From the AWS Mining website FAQ;

WHERE ARE YOUR MINING FARMS LOCATED?

For safety reasons, we don’t provide this information. However, since April 2016, we have been operating some mining farms that are located in Europe, America and Asia.

In true MLM cryptocurrency fashion, the only “evidence” AWS Mining provide of mining operations are YouTube videos of mining hardware featuring “AWS Mining” stickers.

Hardly conclusive.

What would be conclusive is required regulatory disclosures, which AWS Mining does not provide.

AWS Mining do not disclose specifics of their mining operations in their ASIC filings. It’s pretty much the equivalent of a pointless UK incorporation.

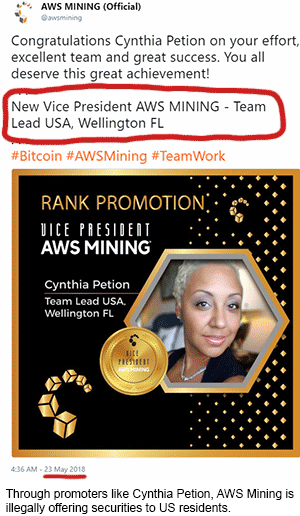

In markets it’s actually active in, primarily the US and Brazil, AWS Mining is not registered to offer securities.

In markets it’s actually active in, primarily the US and Brazil, AWS Mining is not registered to offer securities.

This tells you all you need to know about the legitimacy of AWS Mining’s supposed mining operations.

And while some token mining might be taking place, you can bet it’s not enough to sustain AWS Mining’s compensation plan and pay affiliates a daily ROI.

For an explanation on that you need only look at co-founder Daniel Beduschi’s Ponzi past.

The only verifiable source of revenue entering AWS Mining is new investment. Using new investment to pay existing investors a daily ROI makes AWS Mining a Ponzi scheme.

On top of that nothing is marketed or sold to retail customers, which adds an additional pyramid layer to the business model.

As with all MLM Ponzi schemes, once affiliate recruitment dies down so too will new investment.

This will starve AWS Mining or ROI revenue, eventually prompting a collapse.

The math behind a Ponzi scheme guarantees that when it collapses, the majority of investors lose money.

Update 24th April 2019 – AWS Mining has officially collapsed. The company is planning to reboot as AWS Capital on or around May 1st, 2019.

I have read your article and have found you to be off on a few topics.

First 20% is not taken from the ROI. Second the bonuses are higher for Ranks AND Third I and thousands of our members have been to the farms.

You dont even bother finding out where the farm are.

I based the compensation plan analysis off an official copy of AWS Mining’s compensation plan (2018).

If the plan has since changed fine but you’re going to need to cite a source.

The comp plan I viewed clearly stated the ROI is ‘approximately 20% of Mining Bonus‘.

The “Mining Bonus” is the daily ROI AWS Mining pay affiliates, so the fee is variable based on the ROI paid out that month.

AWS Mining might bill you but it’s still calculated to reclaim 20% of the ROI paid out back (to keep the Ponzi running a bit longer).

You’ll need to cite a source. The dollar figures I quoted are straight from AWS Mining’s compensation plan.

Whether you’ve gone on third-world country video card farm vacations or not is not evidence of external revenue being used to pay affiliates.

Showing investors video cards with AWS Mining stickers on them isn’t a substitute for legally required regulatory registration and disclosure.

Most of the information in this article that have been written on this website is speculative and not factual. Have you even reached out to the company to verify any of the information stated above?

Have you verified the amount of operating cryptocurrency hardware that the company owned and operate to know that it is not enough to sustain the company?

As far as locations of AWS Mining operations, I did not realize that China, Russia were considered to be third world countries as you mentioned above. Sounds like a racist comment made by you if you ask me.

(Ozedit: Offtopic derail attempts removed)

Best,

Eddy Petion

Nah. The Securities Act has been around since 1933. AWS Mining is operating illegally and is not registered with securities regulators in any jurisdiction it actually operates in (no recruitment or operations in Australia).

No speculation, 100% fact.

Do I need to? Are AWS Mining lying to the public in their compensation plan and website?

If AWS Mining was to operate legally in the US, they’d have registered with the SEC and provided full disclosure. That way anything they claimed they were doing could be verified.

That’s on AWS Mining, who having not registered are operating illegally.

As for racism (Russia and China aren’t the only countries listed on the AWS Mining website), instead of creating red herrings how about you actually address AWS Mining’s regulatory failures?

AWS Mining “farm” locations include: Never Never Land, Santa Clause’s Workshop, & Middle Earth.

Hogwarts School of Witchcraft and Wizardry coming soon & Harry Potter is joining & bringing his downline.

Lets not insult everyone’s intelligence that AWS Mining is anything more than a short term $ grab.

Okay, I see that 1/3 of my reply was omitted and the reason for that is quoted “Offtopic derail attempts removed”.

(Ozedit: More offtopic derail attempts removed)

First and last warning. A dictionary can assist you if you’re having trouble understanding the reason I snipped your comment.

This isn’t Facebook, you’re either here to discuss AWS Mining or not. Plain English.

How can I humanly be able to talk about AWS Mining (your own topic) when you can pick and choose what the replies should be and snip out legitimate questions regarding your article?

Simple, by actually discussing AWS Mining and not going offtopic.

ProTip: If you’re not talking about AWS Mining you’re offtopic. I haven’t removed anything you’ve published that actually has something to do with AWS Mining.

Meanwhile your continued ignoring of AWS Mining’s regulatory deficiencies is telling.

My actual thoughts and comments are specific to the company owning the crypto mining operation hardware.

Would you accuse the people who produce and sell the asic mining machines as selling securities? Or is it the company who owns, operate maintains, and send a portion of the profits to its customers considered selling securities in your opinion?

Not unless “the people” you’re referring to were running an MLM company that advertises a ROI.

Not interested in opinions when it comes to established securities law. The company that makes the securities offering, in this case AWS Mining, is legally liable.

Note that it is also illegal for US residents to promote unregistered securities, which puts you and your wife (?) in a regulatory pickle.

Again, you still haven’t answered my two above questions, just being vague as you are in your article. The same way that you are not even sure if that is my wife (?) you are referring to.

I guess this reply will be ommited as well since I’m not referring to AWS Mining as you did not in your second paragraph.

Not sure what your level of English proficiency is but I answered your two questions in full.

Obviously they don’t specify how much hash power you are supposed to get per $400 “CMP” but:

At this point in time, 10 Ths of Bitcoin mining power will return $2.35 per (24h)day.

Using Antminer S9’s (as featured in AWS videos) the electricity consumed to do this will be 24kWh (@ 0.1J/gigahash).

The very cheapest electricity available worldwide is around $0.03 kWh.

Paraguay’s rates are $0.068 kWh for industrial use.

Do the simple math:

24 kWh @ $0.03 = $0.72 = 30.6% of $2.35.

24 kWh @ $0.068= $1.32 = 56.1% of $2.35.

AWS website states

How’s your math, Eddy?

Oooops, Paraguay’s electricity cost is actually $1.63 to mine $2.35’s worth of bitcoin, my bad.

That’s nearly 70% of “the result of the mining” just for electric, to come out of the total maintenance budget of 20% of “the result of the mining”.

How does that work Eddy?

World Digital Mining Summit (miningconf.org)

Fake background: facebook.com/awsmining/photos/a.1252575158205124/1691535504309085/?type=3&theater

Real background: twitter.com/AshtianiAbbas/status/1043118193978613760

I’d assume that’s your wife because

a) you have the same surname

b) you are both “Vice Presidents” of AWS

c) you make funny You Tube vids together(1)

c) you were joint debtors in your NY bankruptcy(2)

(1) youtube.com/watch?v=zTdkU-1mEhg

(2) plainsite.org/dockets/jhla3dda/new-york-eastern-bankruptcy-court/eddy-petion/

Is that the same James Corbett who says

Cool ALL CAPS, bro.

@Bernardo

Lol, perhaps Eddy and Cynthia Petion can scamsplain that one to us.

What if AWSMining was willing to submit to an SEC evaluation?

I personally know some people in the USA putting $20,000, $50,000, $75,000+ in cash into AWS mining and I am sure they would feel better if the SEC could give and opinion on AWS mining to reassure them.

Does anyone know AWS can get the SEC to issue an opinion on the AWS mining investment opportunity so that those of us who are on the fence about investing can decide what to do?

The SEC doesn’t evaluate MLM companies. Not unless they’re investigating them.

They can’t. If they wish to operate legally in the US however, the onus is on AWS Mining to register its securities offering with the SEC.

This requires AWS Mining to provide evidence of external ROI revenue, proving they aren’t a Ponzi scheme.

This goes for any country AWS Mining operates in that has a securities regulator.

I’m beginning to feel a little anxious about AWS mining. And I am not sure who to believe. I invested $15,000 recently and was planning to put in another $15,000 next month.

I called the friend who recruited me and he says that the negativity being spread about AWS mining is nonsense.

He is not worried and there’s no convincing him otherwise. But reading your article and these comments above makes me a little concerned, despite seeing the payouts add up in my account.

A friend is trying to borrow $50,000 against his home equity to invest into AWS Mining. Our church pastor has also been encouraging members of our congregation to invest large amounts of money.

Many people (including myself) see Cynthia and Eddy Petion as reasonable people trying to help others get a leg up. They’re very like-able people. It is hard for me to think they would be mixed up in a Ponzi scheme.

I don’t want to pass judgement until I see proof.

I am several weeks into multiple 13 month mining contracts with AWS? Do you think AWS will shut down before my contracts end?

ROSARIO: If you are based in the US, AWS is totally illegal since they are not registered with the SEC.

If the pastor in your church is telling everybody to invest more, that means this person is receiving commissions off these church members and this Pastor should be put in jail for his actions.

This is a flat out PONZI SCHEME and you can already see the writing on the wall to the end of this scam.

This person trying to borrow $50,000 against a home equity line should be shot, you never put funds into a risky investment and definitely not into scam like this with borrowed funds.

Again if it’s the church pastor pushing the person to do this, jail should be his next home.

You can go to the SEC’s Edgar database and see for yourself that AWS Mining is not registered to offer securities.

Although it’s too early to tell definitively, between the religious affinity fraud, people dumping thousands and “reasonable people just trying to help people”, sounds like AWS Mining is shaping up to be the next Zeek Rewards or TelexFree.

This blog is littered with Zeek and TelexFree investors lamenting their due-diligence failures and ultimate losses after the fact.

As to whether AWS will collapse before you withdraw your investment. Who knows. All it will take is one cease and desist and they’ll disappear, along with your money.

Numbers on a screen != money.

Your money is already gone and anything you get out is at the whim of the admins.

Christ on a bike. If you fancy literally saving someone’s life, write a letter to the bank addressed to “Fraud Department” and tell them that your friend is borrowing money to invest in a known Ponzi scheme, so they can withdraw the offer.

Alternatively, if you want to watch your friend ruin his life while knowing you could have done something about it, take no action.

Do you think obnoxious, socially awkward loners would be any good at persuading people to invest in a Ponzi scheme?

Thank you all for the feedback. I just heard from a friend that there’s now 70,000+ people in AWS mining world wide. Do you think the fact that they are growing so quickly will keep it afloat for more than a year?

I won’t invest any more money, but I don’t want to lose what I already invested before discovering this message board.

Not the place to ask for personal investment advice. Nobody knows how long you’ll be able to ride the Ponzi wave for.

ROSARIO Any updates on ur friend or aws?

Are you in Africa or?

I am surprised this is still going. But it will collapse.

I give it a few mOre months. 6 at most

But i need data and numbers to make an educated guess as some could go one for much longer.

Show ur friend a pyramid. This is so much an obvious scam, who falls for it?

Steven, I went from being somewhat concerned to being extremely worried about AWS mining.

I still have at least 10 months plus to go on my AWS mining contracts, but I discovered this shocking news today that AWS mining was slapped with a Cease and Desist order by the Texas State Securities Board.

I remember that Bitconnect was also slapped with a similar order from Texas back in 2017, and everyone knows how that story ended.

Despite the fact that I found out about the Texas Cease and Desist order today, it was issued November 6th. 13 days have gone by already but the founding presidents of the AWS Mining MLM division for America (Cynthia Petion, Eddy Petion and Debra, aka Team Nova) have not said a word about it to the thousands of people in their down line.

Cythia, Eddy and Debra have to know because they work directly and travel with the COO and founder Daniel Beduschi almost daily.

Instead of warning us all about this Texas state action, they continue to encourage all of us in their down line to invest more money into AWS Mining.

I find this to be very dishonest on their part. This is pure greed on their part. Oz was right all along.

The story was reported on coin telegraph here:

cointelegraph.com/news/texas-regulator-issues-cease-and-desist-order-to-cloud-mining-company

If the company is registered and have licensed, we don’t need to worry! This is just a negative news against AWS Mining company from the other company!

You said,

(As with all MLM Ponzi schemes, once affiliate recruitment dies down so too will new investment.)

You are not in your mind! With or without an affiliate, you will still earn! AFFILIATE is just an extra income to maximize your earnings! Hahaha… Nahhh enough destroying the name of AWS MINING!!!

Alexa currently cite Brazil (27%), Colombia (10%) and Mexico (7%) as the top sources of traffic to the AWS Mining website.

AWS Mining is not registered to offer securities in either of these countries. Start worrying.

Where do you think the money you earn in AWS Mining is coming from?

You’re stealing it from those who invest after you. If people don’t join and invest after you, kaboom.

Thanks a lot for all this valuable information Oz, ScamAlert, tmfp and Rosario. A close friend is trying to get me into AWS. Thankfully i saw this and said no.

However she has shown me videos of all the mining farms and people who claim they have gone to the farms and have seen true mining devices, even a close friend of hers. Can you help me out with this? Have you guys seen these videos?

It’s par for the course for MLM Ponzi schemes to use videos of graphics card farms to dupe investors. Typically these are investors who are new to the scene.

The videos/photos are not a substitute for regulation with securities regulators, without which schemes like AWS Mining are operating illegally.

@Hash – Also, without registering as a Security and without full disclosures, you cannot be assured that the hashing rate and equipment acquisition of any mining operations are scaling at par with the amount of new customer’s money coming into the system – something crypto n00bs tend to easily overlook.

Therefore, for instance, if the network is adding 5% to its user base every month, than the total hashing power needs to also increase by 5% in order for members ROI not to become diluted based on hash rate stagnation – and this is assuming the RARE instance that the company is actually even mining at all, or if it is simply paying out the old investors with the money coming in from new recruits.

Pretty much just stay away from ALL crypto mining to be safe, and definitely if an unregulated MLM is introduced to it.

You just increase the likelihood that its a scam or even in the best case scenario that the company is only a 3rd party intermediary taking their percentage off the top, further increasing your chances of earning nothing in a “crypto winter” bear market.

@Rosario, today I saw a meeting on zoom from a guy who is trying to get people into AWS, I asked questions about the lawsuit in texas and he said that all the money was given back to the people who deposited money in AWS.

Is this true? Or just another lie to try to get more people in it?

Why would a random affiliate know what’s going on between AWS Mining and the TSSB?

Your best would be could contact the Texas Securities Board and ask for verification. I’m sure they’d be able to clarify.

If you think AWS mining is a scam why don’t you put in $40 and see if you get a return on it. Then wait for the min to withdraw your money.

If you get your money then where is the scarm?

Because whether or not you can successfully steal money from people who invest after you isn’t a metric in due-diligence.

Ponzi math is a zero sum game. At any given time the majority of investors are at a loss.

This guarantees that the majority of investors lose money when scams like AWS Mining inevitably collapse.

Instead of making excuses for scams, why don’t you ask AWS Mining if they’ve responded to the Texas securities fraud cease and desist yet?

Yes they have responded. Have you person ask these questions to AWS Mining.

Have you personal went to see if they have any mining farms? Have you personal talk to anyone that is in AWS Mining? Until you have personal inform then you are just like the rest blowing smoke.

It seem that you are trying to get rating on this blog. Get some personal inform to back up what you are saying.

Texas has always been hard on bitcoin from day one. Get some personal inform that all you needed.

Prove it.

What with the downturn in mining it’s even easier to pay some owner to put your banners up for a day. Nothing is a substitute for registration with the SEC and evidence of external revenue. Nothing.

The only smoke being blown here are the YouTube videos and Facebook posts for gullible investor consumption.

Texas’ cease and desist was issued for securities fraud. It has nothing to do with bitcoin.

VERNON WHITAKER: Per your message below, asking for someone to put $40 into AWS is like asking someone to put on an extra thick pair of knee pads and bend over!

Seriously, this is such a Ponzi Scheme, even the dumbist of idiots can see this. It’s stealing from a fellow member Vernon when you get money back and more, doesn’t take a rocket scientist to see this… Open your eyes….

I did not ask you what the SEC said. The question is have you when and find out for your self if the mining farms are real. (Ozedit: Snip, see below.)

Watching YouTube videos of random gpu farms who knows where is not evidence of mining revenue being used to pay AWS Mining affiliates.

You damn well better pay attention to SEC regulation, because it’s literally the only way you know AWS Mining are actually mining.

If AWS Mining haven’t registered their securities offering with the SEC, then they have no obligation to prove any of their claims (not to mention they’re operating illegally).

You don’t need to lose money in a Ponzi scheme to do your due-diligence on one. Stop making excuses for scammers.

you have it backward here skippy. YOU/AWS are asking people for their money. Therefore it is up to YOU/AWS to prove you are legit and registered with the proper entities. Anythng short of that is a scam.

You made the statement that AWS is a scam this what you are telling me. So, I am asking you what is your proof that AWS is a scam for me to believe you. (Ozedit: Snip, see below.)

As has already been pointed out to you, any statement pertaining to AWS Mining being a scam has been made owing to AWS Mining’s legal compliance failures.

AWS Mining represents it is a legitimate MLM opportunity paying affiliates a ROI through cloud mining.

AWS Mining is not registered to offer securities in any jurisdiction it solicits investment in, without which there is no way to verify it isn’t a Ponzi scheme.

It is illegal to offer unregistered securities around the world. And there is no reason for an MLM company to do so, unless they’re running a scam.

Feel free to provide evidence of AWS Mining having registered with a securities regulator in a jurisdiction it solicts investment in. Along with required accounting audits verifying external ROI revenue.

Otherwise thank you for confirming AWS Mining is a scam.

What “YOU” believe is of no consequence when the evidence is irrefutable – they are selling unregistered securities.

Hey Guys!

There’s another one using the same name but different end on the address: awsmining.uk and I’ve been trying to receive my money back for 3 months, but till now they keep asking me $500 to activate my account after they had offered me to be a representative.

So, those one who is thinking to invest on it, don’t do it.

December 20th they made a new offer to activate my account per $50 and I did as they instructed me, then I proceeded as the amount informed, but at the end they said I did just $49,27 transfer.

It is an endless situation, they will always ask for more and more and I wouldn’t like to see more people being deceived.

DON’T rely on awsmining.uk, they are really fake, just to steal our poor money.

And?

Having some guy speak at a conference in a country you’re committing securities fraud in but are unlikely to get caught due to lower regulatory standards, is not a substitute for legally required registration with securities regulators.

Go.Go..Go..Aws.

Having some guy speak at a marketing event and copy/pasting mining hardware specs isn’t a substitute for AWS Mining registering with securities regulators and providing investors with legally required disclosures.

Go go go securities fraud.

(Ozedit: copy+paste removed)

This is not a platform for you to copy+paste without adding anything to the discussion.

If you want to be a mindless bot you have Twitter/Facebook for that.

First point AWS is not selling securities the author of this article keeps on talking about. AWS is not selling crypto currency as well. As you may or may not know crypto currency has been declared a commodity by the Commodities Futures Trading Commision by declaring that they are not a currency, investment vehicle or anything else. It’s clear that the debate is far from over.

A security offers the possibility of profit in exchange for risk of loss. Ownership of a security can pass between people, with the owner always receiving the profit or loss. Into this category fall financial products that don’t represent tangible assets, including stocks, bonds, and mutual funds.

For example, when you buy a stock you make money if it rises in value, and lose if it drops. Although it represents a piece of a company, it’s not a physical piece.

So why doesn’t Bitcoin count as a security, in the eyes of regulators? The key distinction is that its decentralized and no one controls it, whereas securities are released by a central authority.

Regulating cryptocurrencies as securities would be problematic because there’s no one to comply with the rules usually imposed on users. Cryptocurrencies are not backed by anything other than trust.

The SEC ruled that Ethereum and Ethereum tokens are not securities.

It has been suggested that cryptocurrencies are simply a whole new category because they’re not quite like anything else. If that’s the case, regulators will need to treat them as unique instead of looking for a home in the existing frameworks.

So my question is Why does AWS need permission from the SEC to sell contracts to mine cryptocurrencies and verify transactions?

Sure they are. I dump money into AWS Mining and they pay me a passive ROI. That’s a securities offering.

With respect to securities law, how a passive ROI is generated is irrelevant.

Because, within the context of MLM regulation, bitcoin isn’t a business providing access to a passive investment opportunity.

What you’re doing is the equivalent of claiming Bernie Madoff didn’t commit securities fraud on the USD itself isn’t a security.

Don’t be a dumbass. MLM cryptocurrency companies are not exempt from securities law.

lab.awsmining.com/team-bonus-announcement/

Translation: recruitment is down so we’re reducing residual commissions.

So you guyz are trying to say, that Aws is an MlM ponzi scheme & not of that an investment company?

Not “trying to say” so much as pointing out there is zero verifiable evidence that mining revenue is being used to pay affiliates.

Social media proof = meaningless.

Why are the persons involved in aws mining never got arrested then? Just curious.

If the implication is that unless there’s an arrest there’s no crime committed, that’s a silly argument to make.

Yeah right, you run out of smart ass answers… Good luck to you

If you want smart ass answers you’ve come to the wrong place. Facts are facts.

Best of luck with the scamming in kind.

PS. It’s OK to feel embarrassed when someone points out your silly argument. Trust me we’ve seen them all over the years.

Hey Oz, good work and thanks for your efforts, and I would love to hear what petion family and mister super awesome beduschi have to say now!

well seems like AWSmining scam is has collapsed now and the members are now being given a run around… they are probably stashing the cash away in bitcoin vaults.

if there is a better time to arrest them and report them to interpol and all the different states detective agencies is now, before they all get plastic surguries or/and hide in some exotic islands and live off the loot for the rest of their lives..

they don’t know just how this scamming is devastating to peoples lives and how many lives they’ve ruined and probably don’t care too. for some people to get into this, they borrow huge sums and get heavily indebt,sell properties,get funds from close ones, withdraw their pensions, invest all their savings. how terrible. this is the stuff that leads people to depression and must be punished.

AWS Mining collapsed in late April. They rebooted as AWS Capital, or has that collapsed too?

Hi I would like to know whether there is any help I can get to be refunded my $1100 that was brutally taken by AWSMINING COMPANY.

I was scammed unknowingly. Now I’m left helplessly, and unemployed. Please help the helpless woman

AWS Mining was a Ponzi scheme. There are no refunds in a Ponzi scheme.

What are the chances that Eddy and Cynthia’s newest venture, Novatech, is also a scam?

It sure sounds similar to the AWS Mining structure. Just curious if you were still looking into this? Great article btw, super informative.

NovaTech isn’t new. Been around since 2019.

https://behindmlm.com/mlm-reviews/novatech-review-n-tech-trading-bot-ponzi-scheme/

Only recently had a recruitment resurrection because scammers.