Vyb collapses, merged with Conectiv (iGenius)

What’s left of Vyb has collapsed.

What’s left of Vyb has collapsed.

On January 25th remaining promoters were informed Vyb was merging with Connective (iGenius).

Fronted by Aundray Russell and Ragan and Megan Lynch, Vyb pre-launched as a pump and dump pyramid scheme in early 2025.

In May 2025 Vyb relaunched with a less problematic compensation plan. Still lacking however were real retail customers and retail commissions.

Fast forward to December 2025 and SimilarWeb tracked just ~6100 monthly visits to Vyb’s website. This brings us to the January 25th Vyb webinar.

A quick note here, Aundray Russell was nowhere to be seen. Russell appears to have ditched Vyb and is currently promoting Akashx on social media.

Present on the webinar were Ragan and Megan Lynch, David Imonitie and some Vyb promoters.

Imonitie sold his own MLM company off to iGenius’ parent company Investview last December. The Lynchs appear to have done the same and have presumably been given iGenius compensation positions under Imonitie.

iGenius itself is currently going through a weird transition period. Shortly before a $4 million fine for pyramid fraud in Poland became public earlier this month, iGenius revealed to top promoters it was rebooting as Connective.

The Connective reboot will see iGenius pivot to selling diamonds and health supplements, a move some promoters weren’t happy about.

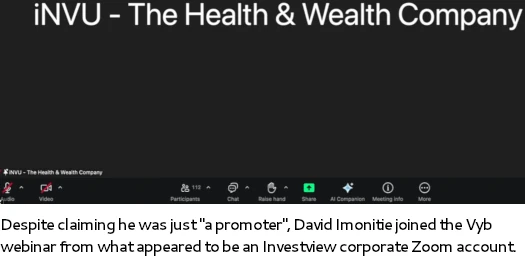

Imonitie referred to himself as just “a distributor” on the Vyb webinar. This was weird as Imonitie’s Zoom account name suggested he was appearing as an Investview (INVU) corporate representative.

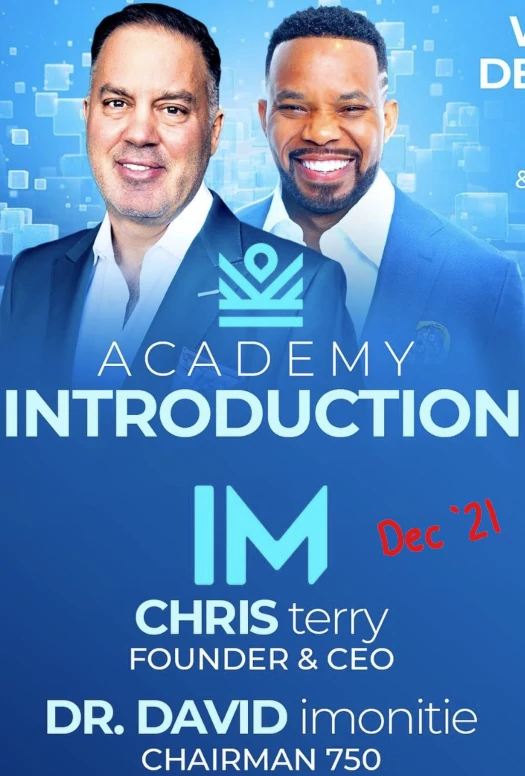

Imonitie opened his pitch to Vyb promoters by recalling past success as Organo Gold and iMarkets Live.

[19:55] When I decided to leave [Organo Gold], Megan, my residual check? You know what they did with it? They snatched it. They did not let me keep my residual check.

[20:24] Well guess what, I joined another company. You guys know this company, iMarketsLive.

When I joined iMarkets Live Megan, they were at twelve hundred people in the company … five years later [the owner] had twenty super cars, he had jets, the company had done over a billion dollars in sales.

Immonite failed to mention iMarkets Live and owners Chris and Isis Terry were sued by the FTC in May 2025. The Terrys’ assets have been frozen and the FTC is alleging over $1.2 billion in fraud, which Imonitie was very much part of.

Imonitie’s pitch primarily to Vyb promoters primarily focused on him acquiring Investview shares and cashing out.

[18:25] In 2008 [Organo Gold] did two million in sales … I joined in 2009, the company went to nine million in sales in 2009.

From 2010 to 2016 … the company did well over a billion dollars in revenue – and I was the number five income earner in the company.

[18:56] If the company was publicly traded, and the stock was at three cents a share, and it did over a billion dollars in a six-year timeframe, do you think I would have been buying shares in that company?

[19:14] Heck yes, right? My best year in that company was $2.2 million. So I would have been buying up the shares like you wouldn’t believe it.

And on top of that, we would have made sure the company had some way to award leaders shares as well.

And guess what? That’s what we’re going to do with [Connective/iGenius]. I’ve already put it to the board, “You guys go figure that out. You’ve got to figure out how, at a particular level, you give a certain amount of shares to leaders.”

[If I had Organo Gold shares], I probably wouldn’t be on this call with you right now. Right? Because I would have had millions… and the company would have grown.

So guess what, they weren’t publicly traded. When I decided to leave [Organo Gold] Megan, my residual check? You know what they did with it?

They snatched it. They did not let me keep my residual check.

[20:51] Do you think if [iMarketsLive was] publicly traded, you think I’d be on this call right now? No, right?

So here I am thinking I’ve helped two companies do over a billion dollars in sales, why not, with [Connective/iGenius], do it again over the next three to five years … and do what we do from a network marketing standpoint, but at the same time have equity.

To where, [Investview’s] stock [is] just at a dollar. My goal is fifty million shares over the next three years. If it takes it three years to go to one dollar … that’s fifty million dollars.

[43″37] Three to five years. I’ve given myself eight years … but what I’m telling you is three to five years, and let’s help the company get to a hundred million. Let’s help the company get to a quarter of a billion. Let’s help the company get to five hundred million.

And while we’re helping them do that, you’re gonna be making money by the way, just so you know, take ten percent of that, take twenty percent of that and get ownership of the company. Get the stock.

Specific to Connective/iGenius as an MLM opportunity and how he’s building his own downline, Imonitie states;

[29:21] To speak to the compensation plan … there’s a three-step process that they have actually just perfected on how to actually grow the business. Short-term and long-term.

And then they have some bonuses that allow people to earn, you know five figures, out the gate. Anyone that has a little desire can earn five figures in their first month.

[29:57] That three-step process of helping people get on fast-track, helping people get their membership for free and getting to the “Pro” status level in the company … teaching people those three steps and developing five to seven people that just do those three things, puts you at eight to ten thousand dollars a month.

So in my mind I’m like, “Okay, we’re gonna help a hundred people earn eight to ten thousand dollars a month within the next twelve to eighteen months”.

[31:15] We’ve put about seventeen hundred people in so far. A little less than seventeen hundred people have actually paid to actually get involved in twenty-five days.

At no point does Imonitie reference retail customers or selling Connective/iGenius products and/or services to retail customers.

This speaks to Imonitie’s previous company, Nvisionu, being a pyramid scheme. It also speaks to Vyb’s pyramid scheme roots and iGenius’ recent $4 million pyramid fraud fine in Poland – which again, was not disclosed on the webinar.

Not expecting any further updates now that Vyb is over but stay tuned as BehindMLM continues to track iGenius’ transition to Conectiv.

Update 11th February 2026 – BehindMLM published a Conectiv review on February 9th, 2026.

The chance that Investview will compensate Imonitie with stock is some extremely small number close to zero.

It goes from one sketchy Ponzi scheme to yet another. Some people just won’t learn. It it walks & talks like a duck, then it’s likely a duck.

*pyramid scheme. There was never any indication Vyb or iGenius have launched a Ponzi scheme (securities fraud often does but does not always equate to a Ponzi scheme).

Well that escalated quickly ^^

Ack, thanks for catching that. Fixed.

How many MLMs does one have to collapse before they get the hint?

I’ve published over a dozen exposés on VYB, Megan Lynch, Ragan Lynch, Toni Marek, and their ever-mutating scam machine. From fake $442K income claims to $25 join-now gimmicks that required 30-slide PowerPoints just to get paid — every iteration has been worse than the last.

We crashed their latest Zoom party ourselves — and what a circus. Megan claimed 80,000 people in her database but couldn’t fill a 50-person Zoom call. By the end, there were only 39 left… and seven of them were my Avengers.

Now they’re merging into another collapsing scam (iGenius/Connective) like it’s a promotion. These people are not building anything — they’re scavenging what’s left of broken systems to stay relevant.

Let’s call this what it is: desperation dressed up as a reboot. They live-streamed their own downfall and still think we’re not watching. We are. And we will continue exposing them until they stop preying on vulnerable people with their faith-based manipulation, fake success stories, and pyramid pay plans.

You don’t fix fraud by merging it with more fraud. You bury it. And that’s exactly what’s happening here.

This was Megan/Ragan’s former company which sold to iGenius.

@Vivian, there was no sale. Money did not change hands. What was left of Vyb joined iGenius.