Akashx: My Daily Choice’s “social trading” securities fraud

BehindMLM reviewed My Daily Choice back in 2015.

BehindMLM reviewed My Daily Choice back in 2015.

At the time the company marketed Peak, a deer antler velvet supplement.

Fast forward five years and My Daily Choice has since branched out into CBD, essential oils, discount travel and… securities fraud.

My Daily Choice markets Akashx as a “social trading” platform.

Akashx is a revolutionary education platform providing tools and solutions to help traders master their Forex and Cryptocurrency portfolio.

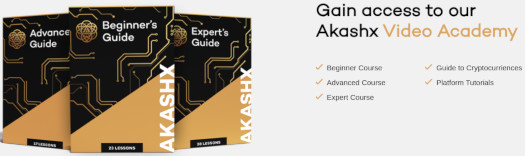

Within Akashx is “Akashx Academy”, providing access to a video library with 145 lessons on trading.

Akashx members also gain access to a “digital banking solution” and trading signals, provided ‘on your desktop or directly to your phone on Telegram.’

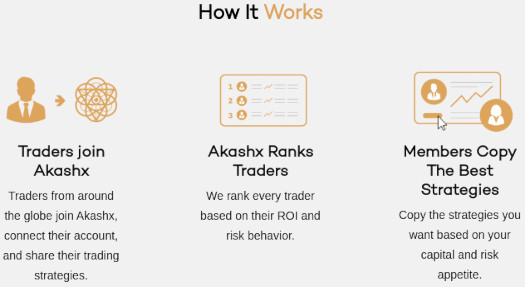

That’s all pseudo-compliance waffle though. The actual drawcard of Akashx is the promise of passive returns through trading. Specifically, automated copy trading.

My Daily Choice offers passive returns through Akashx through an “autocopy expert traders” service.

Despite the name, passive returns are derived via “algorithms”.

Copy trading is characterized either by utilizing other Traders’ signals via the Akashx Social Trading platform or by using algorithms.

Trading bots by any other name, in Akashx they’re referred to as “trader combos”.

The Combos are automatically created following a point-based algorithm that has been set up for identifying profitable combinations of trading strategies.

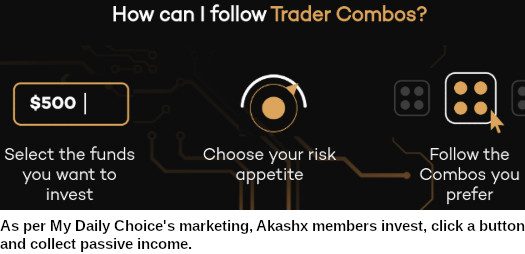

Akashx members set up a trading account, fund it and then use trading bots provided by Akashx to receive passive trading returns.

Just so we’re crystal clear, this is an entirely passive return as confirmed by My Daily Choice on Akashx’s website;

By converting the advice of professional and talented Traders globally, our autotrading Platform executes trades rapidly and automatically in your account.

With Akashx Social Trading, you don’t have to study or monitor the Market, because hundreds of Traders world-wide are doing it for you.

This is of course a securities offering. And as I write this, neither My Daily Choice or Akashx are registered with the SEC.

This is a major regulatory compliance issue for My Daily Choice, who on their website provide a corporate address in Nevada.

There are no corporate or contact details provided on the Akashx section of My Daily Choice’s website.

Also in violation of securities law, who exactly is behind Akashx and who runs the trading bots is not disclosed.

Akashx membership costs $299 and then $149 a month.

In addition to that, members are expected to fund their accounts with a few hundred dollars.

Typically, your investment account connected with Akashx should always exceed a $200 balance.

No compensation plan is provided on the Akashx section of My Daily Choice’s website. Such to the extent Akashx is part of My Daily Choice’s MLM opportunity, those details are not disclosed.

What we do know is Akashx is being marketed as part of My Daily Choice, meaning the onus is on them to register the securities offering with the SEC.

That hasn’t happened, meaning My Daily Choice and Akashx are committing securities fraud in the US.

Considering the US is the most tightly regulated jurisdiction in the world when it comes to MLM related securities fraud, we don’t anticipate this ending well.

This is the dumbest thing I’ve read. Companies that are legitimate in the space are paying commissions on the monthly education subscription not on the actual mining, investing or trading of the currency…

MDC is paying that commission on the subscription. You should research better, prior to posting nonsense like this.

You can’t legitimize securities fraud with “education subscriptions”.

“autocopy expert traders” = passive investment opportunity = securities offering.

That securities offering is marketed and sold through Akashx, which is My Daily Choice.

You should research better, prior to commenting pseudo-compliance waffle.

Can’t these MLM scammers think something new and not always the same old ‘you understood it wrong, we are selling education’ bull? Lol.

Do the scammers really believe that someone actually still believes that s***?

You’re wrong it’s only software. You choose from registered brokers to coy and set up an account directly with them.

Keep going, you left out the securities fraud bit.

You hook up your money to a third-party, therefore pooling it under the third-party’s control. Said third-party then generates you a passive return.

As per the Howey Test that’s an investment contract. MLM + investment contract = securities offering.

Why have MLM then? If the returns are so good and it’s registered brokers then they’d make more just going direct.

Some corporate details here

businessforhome.org/2021/09/well-beyond-merges-into-mydailychoice/

Thanks, covered here – https://behindmlm.com/companies/whats-left-of-well-beyond-sold-off-to-my-daily-choice/

I am surprised you are not taken to court when you make these claims about companies with no real proof.

You outright say they are committing fraud…bold I’d say.

Quoting you here: “Fast forward five years and My Daily Choice has since branched out into CBD, essential oils, discount travel, and… securities fraud.”

Wow.

You can confirm the existence of an investment contract as per the Howey Test.

The SEC’s Edgar database is open to the public. You can confirm neither Akashx or My Daily Choice are registered with the SEC (or CFTC for that matter).

By confirming neither Askashx or My Daily Choice are registered with the SEC, you yourself can confirm securities fraud.

Something tells me this is way over your head. Sit down please.

If they were a real company and not committing fraud, they would sue anyone that had “no real proof,” as you claim. Therein lies your answer. They ARE committing fraud, but more importantly Oz has “proof” they are committing fraud. It makes no difference if you don’t see it or understand it.

The last place any of these crooks want to be is in a courtroom trying to defend themeselves. While you are at it, ask an attorney to explain “discovery” to you. It’s another reason why none of these crooks will ever file a lawsuit.

No proof? Too funny.

Come back when it collapses or rebrands and then go through the comments , reviews, as well as numerous other accurate reviews, to confirm if OZ is making false claims.

You make as if the company that you are promoting is the most legit one out of them all. Until you realize whats going on, you will always be the victim.

Akashx gold bot has crashed. Zeroed out everyone’s accounts. This is the company announcement:

Ponzi go bye-bye!

That’s a kaboom vote from me. Thanks for the update, will add to the news queue today.

So this article was written over 3 years ago. Akashx started a few years before then.

If they’re committing fraud, then why haven’t they’ve been shut down yet? The feds would’ve gotten to them by now.

Either they’re legit or you’re just sounding off through junk journalism.

You can verify yourself that neither Akashx or My Daily Choice are registered with the SEC. Securities fraud is securities fraud.

As to “the feds”, you’ll have to direct your question to them. Not getting shut down for securities fraud though doesn’t mean it’s not being committed.

By that logic nobody would ever be busted for breaking the law because nobody could break the law until they were busted. I’ll raise your junk journalism with junk logic.

Ernie Madoff would like a word about your skill at handwaving away actual logic and law for this absolute gem of an argument