Odecent Review: Validus securities fraud reboot

Odecent fails to provide ownership or executive information on its website.

Odecent fails to provide ownership or executive information on its website.

Odecent’s website domain (“odecent.com”), was first registered in 2022. The private registration was last updated on May 22nd, 2024.

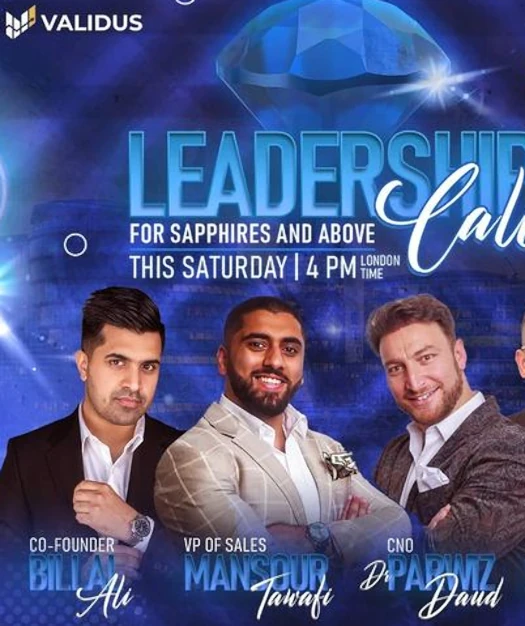

Odecent came to BehindMLM’s attention courtesy of a reader tipoff. Said tipoff led us to a September 12th recording featuring Validus co-founder Mansour Tawafi.

Validus was a Dubai Ponzi scheme that collapsed in April 2023. In the September 2024 video, Tawafi states he’s “moving on” from Validus investor losses with Odecent.

This video today is to inform everyone about … my decision to move on with a new company called Odecent and join my old partners as part of what we believe will be a good solution.

Tawafi goes on to reveal Odecent was actually a failed Validus reboot launch in late 2023;

So around two months ago my partners from Validus, Billal and Salman, they came to me and they started speaking about the product that they were working on even before we met.

So before Validus they already started working on some very good products and they had a team that was developing these products for the last three years.

We also tried to launch this in Validus. Some of you may remember Fingenius was a product towards the end of Validus.

Towards the end of 2023 we got a stage where we wanted to… we actually gave it to some leaders to test but it didn’t run very successfully at the time.

In January we wanted to launch this but of course after the cease and desist order from the DFSA in mid December, the company became, y’know, operationally inactive.

Tawafi is referring to a Validus securities fraud warning issued by the Dubai Financial Services Authority on December 22nd, 2023.

So my partners, they came to me and said they want to start with this product now again, and they have created a whole system for it and they’re ready to do something.

Tawafi states he will be “taking a position, taking a role” within Odecent. As of filming however that role hasn’t been finalized.

The “Billal” and “Salman” Tawafi refers to are Billal Ali and Salman Shahzad.

Validus marketing cites Billal Ali as a co-founder of the Ponzi scheme:

Salman Shahzad appears to be a top Validus Ponzi promoter from the UK:

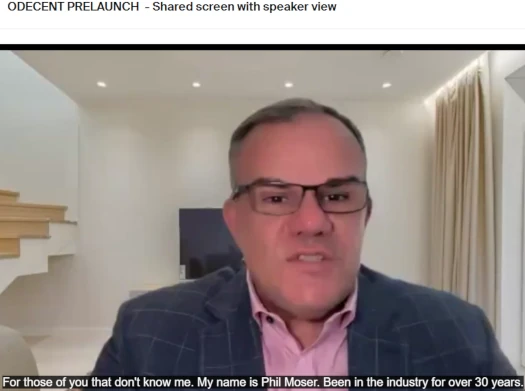

Another name we can attache to Odecent is Phil Moser, aka Philippe Moser. Moser hosted the Odecent prelaunch webinar, held on or around September 1st.

Moser, who appears to have ties to Canada, the US and Colombia, was a Validus executive.

Moser was instrumental in recruiting Validus victims across Africa and South America.

Prior to Validus Moser made a name for himself in ACN. At some point Moser split from ACN to join NeXarise, an MLM company launched by former ACN promoters in 2020.

Conspicuously absent from Odecent marketing is Parwiz Daud and Howard Friend.

Following the collapse of their post-OneCoin Ponzi AuLives, Parwiz Daud and Mansour Tawafi launched Validus in 2021.

Howard Friend was Validus’ CEO and, at least at the time he surfaced, appeared to be a random finance bro from Europe.

Neither Friend or Daud have made any public appearances since Validus’ collapse. They are both presumed to be laying low in Dubai.

As with Validus, Odecent appears to be operated from Dubai:

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to Odecent, read on for a full review.

Odecent’s Products

Odecent has no retailable products or services.

Affiliates are only able to market Odecent affiliate membership itself.

Odecent affiliate membership provides access to an automated trading bot.

Odecent’s Compensation Plan

Odecent affiliates pay a subscription to access a purported AI automated trading bot:

Managed trading subscriptions

- A50 – $50

- A100 – $100

- A250 – $250

- A500 – $500

- A1000 – $1000

- A3000 – $3000

- A5000 – $5000

- A10000 – $10,000

Own exchange trading account subscriptions

- B500 – $500 for 50 weeks access, can invest up to $5000 with the bot

- B1000 – $1000 for 60 weeks access, can invest up to $10,000 with the bot

- B3000 – $3000 for 60 weeks access, can invest up to $30,000 with the bot

- B5000 – $5000 for 70 weeks access, can invest up to $50,000 with the bot

- B10000 – $10,000 for 70 weeks access, can invest up to $100,000 with the bot

- B20000 – $20,000 for 70 weeks access, can invest up to $200,000 with the bot

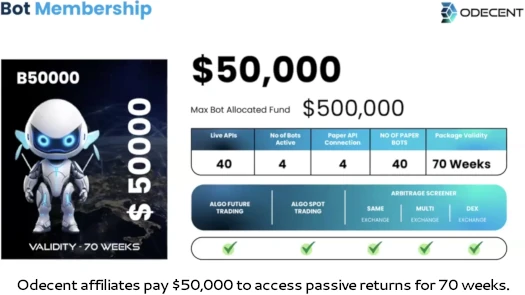

- B50000 – $50,000 for 70 weeks access, can invest up to $500,000 with the bot

Note that, depending on which subscription is selected, a 600% ROI can expire a subscription early (note there appears to be a 500% to 700% range but specifics aren’t provided).

Note the 600% ROI cap includes commissions and bonuses earned through through Odecent’s MLM opportunity.

If a 600% ROI is reached before an Odecent subscription expires, the subscription ends regardless. In this instance subscription renewal is required to continue earning.

The MLM side of Odecent pays on recruitment of affiliate subscribers.

Odecent Affiliate Ranks

There are ten affiliate ranks within Odecent’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Team Leader – generate $5000 in subscription fee volume on both sides of the binary team

- Team Manager – generate $15,000 in subscription fee volume on both sides of the binary team

- Senior Manager – generate $30,000 in subscription fee volume on both sides of the binary team

- Director – generate $60,000 in subscription fee volume on both sides of the binary team and have two Senior Directors in your downline

- Senior Director – generate $150,000 in subscription fee volume on both sides of the binary team and have ttwo Directors in your downline

- Global Director – generate $300,000 in subscription fee volume on both sides of the binary team and have two Senior Directors in your downline

- President – generate $600,000 in subscription fee volume on both sides of the binary team and have three Global Directors in your downline

- Senior President – generate $1,500,000 in subscription fee volume on both sides of the binary team and have three Presidents in your downline

- Global President – generate $5,000,000 in subscription fee volume on both sides of the binary team and have three Senior Presidents in your downline

- Crown President – generate $8,000,000 in subscription fee volume on both sides of the binary team and have four Global Presidents in your downline

Referral Commissions

Odecent affiliates earn a referral commission on the first subscription paid by recruited affiliates.

- recruit an automated trading subscription affiliate and receive a 10% referral commission

- recruit an own exchange trading account subscription and receive a 15% referral commission

Referral commissions on subscription renewals are paid as follows:

- renewal of an automated trading subscription pays 6%

- renewal of an own exchange trading account subscription pays 15%

Residual Commissions

Odecent pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each week Odecent tallies up subscription fee volume across both sides of the binary team.

Residual commissions are paid as a percentage of subscription fee volume on the weaker binary team side, based on rank:

- Team Leaders through Senior Directors earn a 7% residual commission rate, capped at $35,000 a week

- Global Directors and Presidents earn an 8% residual commission rate, capped at $40,000 a week

- Senior Presidents and Global Presidents earn a 9% residual commission rate, capped at $45,000 a week

- Crown Presidents earn a 10% residual commission rate, capped at $50,000 a week

Matching Bonus

Odecent pays a Matching Bonus via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Odeccent caps the Matching Bonus at four unilevel team levels.

The Matching Bonus is paid as a percentage of residual commissions earned across these four levels based on rank:

- Team Managers earn a 5% match on level 1 (personally recruited affiliates)

- Senior Managers earn a 5% match on levels 1 and 2

- Directors earn a 5% match on levels 1 to 3

- Senior Directors and higher earn a 5% match on levels 1 to 4

Note that regardless of rank, the Matching Bonus is capped at $15,000.

Rank Achievement Bonus

Odecent rewards affiliates for qualifying at Team Leader and higher with the following one-time Rank Achievement Bonuses:

- qualify at Team Leader and receive $50

- qualify at Team Manager and receive $200

- qualify at Senior Manager and receive $400

- qualify at Director and receive $800

- qualify at Senior Director and receive $150,000

- qualify at Global Director and receive $4000

- qualify at President and receive $8000

- qualify at Senior President and receive $20,000

- qualify at Global President and receive $100,000 or a Porsche Cayenne

- qualify at Crown President and receive $200,000 or a Lamborghini

Promotional Bonus

Odecent offers affiliates several time-based Promotion Bonuses:

- purchase a B20000 subscription within 30 days of joining Odecent and receive a Dubai retreat

- qualify at Senior Manager within 30 days of joining Odecent and receive a (another?) “Dubai retreat”

- qualify at Senior Director within 30 days of joining Odecent and receive a Rolex watch

Joining Odecent

Odecent affiliate membership is tied to a subscription payment:

Managed trading subscriptions

- A50 – $50

- A100 – $100

- A250 – $250

- A500 – $500

- A1000 – $1000

- A3000 – $3000

- A5000 – $5000

- A10000 – $10,000

Own exchange trading account subscriptions

- B500 – $500 for 50 weeks access

- B1000 – $1000 for 60 weeks access

- B3000 – $3000 for 60 weeks access

- B5000 – $5000 for 70 weeks access

- B10000 – $10,000 for 70 weeks access

- B20000 – $20,000 for 70 weeks access

- B50000 – $50,000 for 70 weeks access

In addition to the subscription length, the more an Odecent affiliate pays in fees the higher their income potential.

It should be noted that although I’ve quoted USD in this review to keep things simple, Odecent appears to operate in the cryptocurrency tether (1 USDT = $1).

Odecent Conclusion

Hiding out in Dubai is expensive. And so we have Validus ringleaders back with another fraudulent investment scheme.

Mansour Tawafi explicitly pitches describes Odecent as a “side solution” for Validus victims to recover their losses through.

Expanding on Validus’ securities fraud, Odecent offers a clone of the original offering with an added “lulz can’t touch our money!” component.

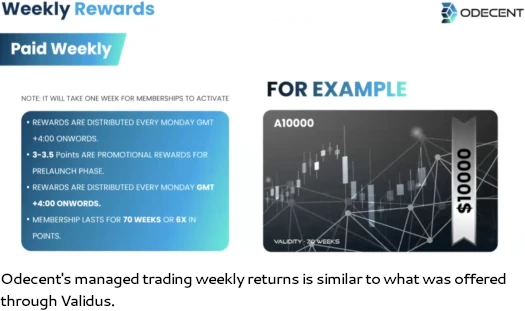

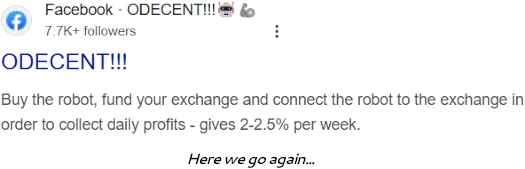

Odecent’s managed trading subscriptions are a repeat of Validus’ offering. Affiliates sign up, invest and receive a weekly passive return.

The “lulz can’t touch our money model”, tied to Odecent’s own exchange trading account subscriptions, allows affiliates to invest funds in their own exchange account with Odecent’s purported AI trading bot.

Under this model, investors are duped into believing that because funds are traded in their own broker/exchange accounts, they can’t be stolen.

This is false. Typically “lulz can’t touch our money!” schemes exit-scam through blowing the bot up or rigged trades.

In addition to Dubai, during its run Validus received securities fraud warnings from New Zealand, Australia and Belgium.

Curiously, for August 2024 SimilarWeb tracked 100% of Odecent’s website traffic from Morocco.

Given the low sample size (~984 monthly visits), this could just be a geo inaccuracy on SimilarWeb’s part. It could also reflect one of more of Odecent’s co-founders relocating from Dubai to Morocco.

Drilling down into specifically what makes Odecent a fraudulent investment scheme, we defer to Phil Moser;

If you have a $50,000 max bot, it allows you to have 40 live APIs, a number of active bots, it gives you everything.

And then it goes for 70 weeks and it gives you a 7x return mmkay?

[The] centralized option; these are for people who say, “Y’know what, I don’t know how to do this, I don’t know how to connect, y’know these different bots, to monitor it, to all the different things that need to be there.

I would just rather find a place where I can allocate my funds and be able to get a certain amount of returns on a weekly and monthly basis.”

Be it through managed trading or investing funds through an affiliate’s own exchange account, Odecent is soliciting investment from consumers on the promise of passive returns.

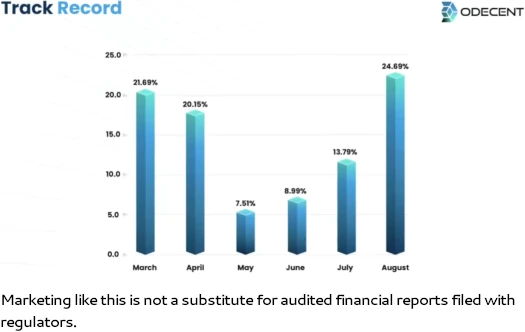

This constitutes a securities offering, requiring Odecent to register with regulators and file audited financial reports.

Like Validus, Odecent fails to provide evidence it has registered with financial regulators in any jurisdiction.

Thus Odecent is a continuation of Validus’ well-documented securities fraud, perpetrated by the same scammers.

As Validus victims came to realize, MLM + securities fraud lends itself to Odecent operating a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Odecent of ROI revenue, eventually prompting a collapse.

Odecent’s collapse will manifest either via disabling of withdrawals, and/or the “lulz can’t touch our money!” bot generating investor losses.

It should be noted that internally Odecent operates in “points”. The company represents 1 point is equal to $1, however this is only true as long as Odecent allows the internal conversion of points to USDT.

Again as with Validus, when recruitment dried up withdrawals were the first thing the company disabled. The same will be true of Odecent, leaving affiliates bagholding worthless points they can’t do anything with.

Kashif Bhatti, the serial scammer is also promoting Odecent now.

Further serial scammers joined Odecent. Here is the list:

Freddy Bakke,

Ronnie John Barrientos,

Artur Rassmann,

Fahad Ahmed,

Benny Akiiki,

Erich Nguyen,

Seyfaddin Aslanov,

SCAM ALERT!!! STAY AWAY FROM THIS EVIL PLATFORM!

These are the same scammers that stole millions of USD dollars from there Validus scam a year ago!

Do NOT trust them or any one that offers you high returns on your money and lives in Dubai.

They are all considered a “Pump & Dump” Ponzi schemes and are low life bottom feeders that have no creative input into this world.

I urge everyone to be hypervigilant as Mansour Tawafi (Top scammer) and Howard Friend (CEO and scammer), Bilal Ali (Low Life scammer), Salman Shahzad ( SSDD scammer).

These are the usual suspect that jump from one SCAM to the next once they dry out your investments with their lavish lifestyle. Do Not trust them!!!

Serial scammers Martin Karus and Wojciech Guzda promoting Odecent too.

There is an event in Thailand at the moment with all scammers. I’m gonna save all pictures and report to police.

Iric Nguyen Has been involved in fraud with them for over 5 years.

facebook.com/profile.php?id=100007779484044

The slave of Martin Karus, Antty Lillepuu is also promoting Odecent.

This guy always promotes the grap that Karus promotes. He brings Karus always money but he’s broke himself.

These are scammers. Bas….s stole our money.

Yes, I would not engage. Validus turned out to be a total scam.

These guys stole so much money from everyone & shut the whole website down.

It’s the same scammers who setup this company.

Serial scammer Ronnie John Barrientos is all over the Philippines with this Odecent scam.

He brought the Dubai scammers to the PH and Shameless runs public meetings.

He owes so much people money but he is just Refurbishing all his victims he owes money in this next scam While he is studying for becoming a lawyer.

When this collapses he will go in hiding again For a while and then pop up with the next scam!

He is already in focus with the PH SEC they will get him!

All the founders of Validus scammed so many people with Validus not even a update as what’s happening so sad what they have done to people.

What’s happening with Validus? Nothing, that’s what. The admins are off enjoying your money.

You invested into a Ponzi scheme and your money is gone. Sorry for your loss.

Daud missing as he is running his Defily.ai

Defily? Well I suppose that’s apt as Daud will most certainly defily your wallet.