Validus Ponzi permanently banned in New Zealand

Following two securities fraud warnings and an interim stop order, Validus filed an appeal against New Zealand’s Financial Markets Authority.

Following two securities fraud warnings and an interim stop order, Validus filed an appeal against New Zealand’s Financial Markets Authority.

The High Court dismissed Validus’ appeal, meaning the Ponzi scheme is now permanently banned in New Zealand.

The FMA began investigating Validus following a November 2022 webinar held in New Zealand. At some point this led to the FMA contacting Validus.

In an attempt to stave off further investigation, on March 3rd Validus wrote to the regulator to advise

the Validus Pool promoted at the Seminar had been removed and no longer exists.

Validus would go on to disable withdrawals but at the time, this was a lie.

Consequently, the FMA contacted Validus on March 24th to advise them of their intent to issue a Stop Order.

The FMA issued an Interim Stop Order on or around April 16th. Validus collapsed on April 20th.

Technically, if Validus sent their correspondence to the FMA after April 20th, they wouldn’t have been lying.

Further, (Validus’) letter said “Validus is not, and does not intend to be, a financial product and no person should ever enter into a commercial relationship with Validus intending or expecting to make returns of any sort, as no such returns are promised or guaranteed in any way”.

Now this is very much a lie, as noted by the FMA;

Dr Parwiz Daud, Chief Network Officer of Validus, attended and spoke at the Seminar, during which a key speaker, Souai Tito, advised attendees that:

“… once you purchase a [education] pack you get rewarded … so with the money that you purchased your education packs, we have a team of experts that trade your money in the forex market. And with that you get paid 2 to 3% weekly loyalty points over 60 weeks.”

“We trade in stocks, and gaming, crypto, NFTs, staking… after 60 weeks you get 350% [of your money] back”.

Ironically, Validus’ denial of the returns it marketed through its investment scheme were deemed further evidence of “false and misleading representations”.

Paul Gregory, Executive Director of Response and Enforcement, said:

“Seminar attendees were induced to purchase, purchased or intend to purchase, educational packages in reliance on false or misleading representations.

They will not receive the promoted 2-3% return on their money, or be able to withdraw that money. They are likely to suffer material financial harm.

Validus has made false or misleading representations to the public that had every appearance of an unregulated offer of financial products.”

In dismissing Validus’ appeal, the High Court found Validus sought to

exclude outright scams, baldly inviting participation in non-existent financial products, from the FMA’s enforcement function.

Following dismissal of Validus’ appeal, the FMA’s previously issued Permanent Stop Order is now in effect.

The Order prohibits Validus and Validus-FZCO and associated persons from taking steps that will result in repeat unlawful behaviour that may cause material financial harm, in particular:

- making offers of Validus Financial Products; and

- distributing any restricted communication that relates to the offer of Validus Financial Products; and

- accepting further applications, contributions, investments, or deposits in respect of Validus Financial Products.

The FMA notes that associated persons means anyone promoting Validus Financial Products in New Zealand.

Following its collapse, Validus has only been paying commissions on recruitment of new victims.

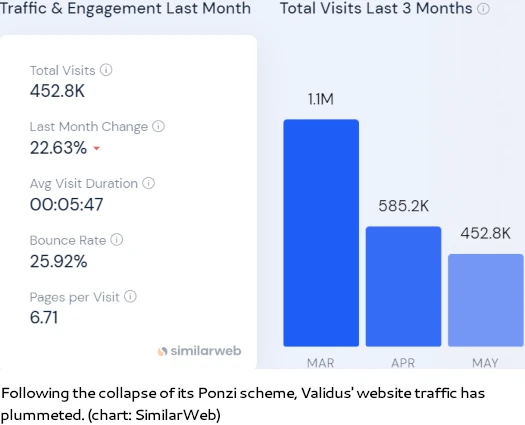

As a result of the Ponzi side of the scheme no longer paying out, Validus’ website traffic has tanked:

Based on traffic analysis by SimilarWeb, the majority of Validus victims are believed to be in France, the Netherlands, Colombia, Belgium and the UK.

Validus is run from Dubai by Parwiz Daud and Mansour Tawafi.

Both Daud and Tawafi are former promoters of the notorious OneCoin Ponzi scheme.

FMA: Yo, you seem to be running a Ponzi scheme.

Validus: Of course not. Our Ponzi is no longer available and we never made representations of returns.

FMA: Yeah so we have you on camera. Lying about your investment scheme is additional fraud.

Validus: anna oop…

Myself and Danny Islam use to talk 2-3-4 time daily. Last he boasted he made £3 million.

Now he ignore me as we haven’t been paid in 6 weeks. He blocked me from 4 groups.

All I’m being told is recruit more if I want to get paid.

I can’t believe they even tried! It took a lot of convincing to get the FMA to label WEWE Global as a Ponzi scheme.

Hopefully, this will lead to more decisive actions. It would be awesome if they allowed us to provide them with a list of all these idiotic scams and help save people. Instead of having to conduct massive investigations to determine the legitimacy of a Ponzi scheme, it should be easier to identify them.

How tricky is it to spot something that has no REAL product or service, and is just promoting and selling thin air?