Tori Belle files for Chapter 11 bankruptcy (again?)

Tori Belle has filed for Chapter 11 bankruptcy.

Tori Belle has filed for Chapter 11 bankruptcy.

BehindMLM previously reported Tori Belle filing for Chapter 11 bankruptcy in August 2022.

That filing pertaining to parent company LashLiner, which technically is a separate entity. Practically speaking though, both LashLiner and Tori Belle are the same entity run by the same people.

The courts recognized this and so we just classified LashLiner and Tori Belle as one and the same.

It took a year, but nonetheless we now have Tori Belle itself having filed for Chapter 11.

A Profit and Loss Statement filed with Tori Belle’s bankruptcy reveals an $456,867 operational loss as April 2023.

Tori Belle claims to have $4.6 million in assets, $4.5 million of which is unsold inventory.

On June 26th Tori Belle filed a motion seeking permission to sell off its assets.

Tori Belle filed this proceeding because continued operations have not been profitable and a sale in bulk of most of its assets while operating will generate a greater return than a wholesale liquidation.

Tori Belle’s assets consist of :

• Tori Belle web sites and content

• Sales and marketing collateral

• Product data

The buyer of the assets was Kannaway.

Tori Belle, subject to Court approval, has entered into a multi-party Assets and Inventory Purchase and Licensing Agreement, between LashLiner, Tori Belle; Laura Hunter and Bob Kitzberger, on one hand, with LashLiner and Tori Belle collectively referred to as “Sellers,” and Kannaway USA, LLC, on another hand as a “Buyer.”

Kannaway was prepared to purchase certain Tori-Belle non-inventory assets for $1.5 million.

In exchange, Tori Belle would receive

10% of monthly gross sales by Buyer of Tori Belle products across all Buyer’s markets worldwide, payable monthly (the “Sales Override”) and will receive proceeds from the monthly consigned sales of its Inventory at Cost.

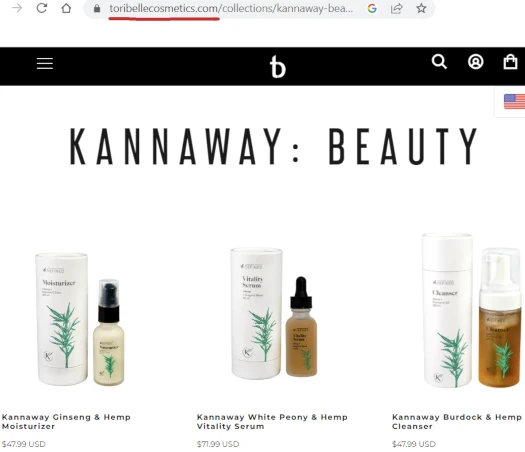

I don’t know what agreement Tori Belle and Kannaway have already entered into, but I do note that Kannaway’s products are currently available through Tori Belle:

Following a hearing on July 7th, the court denied Tori Belle permission to sell its assets to Kannaway.

I’m not really sure what this means for Tori Belle going forward. I figured CEO Laura Hunter would have addressed the new bankruptcy, as she did the original bankruptcy last year.

Tori Belle did host a live on its FaceBook page on June 16th, the same day Tori Belle filed for Chapter 11.

In the video though Hunter didn’t address Tori Belle’s bankruptcy. The bankruptcy wasn’t addressed the following week either (Hunter seems to host a live Tori Belle broadcast once a week).

It’s unclear whether Tori Belle distributors have been informed of recent developments regarding the business.

To differentiate between Tori Belle’s two bankruptcies, I’ll be referring to the original one as the LashLiner bankruptcy going forward.

On LashLiner’s bankruptcy, the court-appointed Trustee filed a motion requesting LashLiner’s Chapter 11 be converted to a Chapter 5 on July 19th.

A Chapter 11 bankruptcy allows for a business to restructure its debt. A Chapter 7 is a straightforward liquidation.

In submitting her motion, the Trustee cited a breach of the approved reorganization plan.

Tori Belle has failed to make its May, June and July 2023 payments to Creditor PIRS Capital and Lashliner failed to docket this default as required by the Plan.

It is my business judgment that the conversion to Chapter 7 at this point is more likely to result in a distribution to Creditors, rather than dismissal of the case. I hereby respectfully request conversion of this case from Chapter 11 to Chapter 7.

A hearing on the Trustee’s motion has been scheduled for August 11th.

Bankruptcy proceedings do tend to get confusing but we’ll do our best to keep you posted.

Update August 12th 2023 – There’s a minute entry for the August 11th hearing but nothing on what, if anything, was decided at the hearing.

I’ll check the docket mid next week for an update.

Update 10th November 2023 – Tori Belle’s Chapter 11 bankruptcy has been converted into a Chapter 7 liquidation.

You might want to update this. Even though the CEO & husband filed personal bankruptcy, they also filed a Tori Belle revised plan.

While the plan states “this plan is a liquidating plan under which most of the debtor’s assets will be sold and the Debtor will cease operation”, they also proposed purchasing all of the inventory, websites and assets for $325,000.

They volunteer to use money from their retirement to purchase the inventory, but they wont use it to pay their own bills.

Thanks for the update. I am keeping loose tabs on the proceedings (I find bankruptcy proceedings incredibly confusing to follow).

I think I might have marked this one as waiting for approval of the plan before looking at it.

That said, what on Earth are they going to do with $325,000 of Tori Belle inventory? Not start another MLM company I hope.

If the original business failed, starting it up again under a different name isn’t going to yield different results (unless I’m missing something).