Silverstar Live article leads to lawsuit threat from Michael Faust

Serial scammer Michael Faust isn’t too happy about BusinessForHome’s coverage of his latest gig, Silverstar Live.

Serial scammer Michael Faust isn’t too happy about BusinessForHome’s coverage of his latest gig, Silverstar Live.

In a response published to BusinessForHome’s article Facebook feed, Faust stated he “can see a lawsuit coming your way Ted.”

“Ted” referring to Ted Nuyten, author of the article and owner of BusinessForHome.

BusinessForHome’s article on SilverStar Live was published a few hours after BehindMLM’s own review of the company.

The article reads as a summary of our review and highlights the same points we raised. As is typical of Nuyten however, BehindMLM is not credited.

The most pressing issue regarding SilverStar Live’s MLM opportunity is the offering of an unregistered securities to US residents.

For a fee SilverStar Live retail customers and affiliates gain access to a forex auto-trading bot.

For a fee SilverStar Live retail customers and affiliates gain access to a forex auto-trading bot.

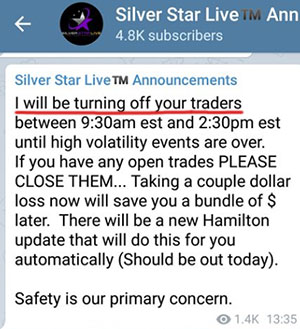

As per the example on the right, the bot is at all times controlled by SilverStar Live and generates a passive return for users.

Specific details regarding the bot and an audited trading history are not provided, both of which are secondary securities fraud violations.

With respect to the primary issue, Michael Faust argues;

SSL are NOT offering a security because they are NOT trading for us.

We only license their software. We trade in our own broker account.

To be clear: Where the funds used by SilverStar Live to generate an entirely passive return for their retail customers and affiliates is irrelevant.

It is the passive nature of the returns generated that makes SilverStar Live’s investment opportunity a security. How they set up those passive returns is irrelevant (think arguing you didn’t commit murder because instead of stabbing someone to death you ran them over with your car).

What makes Faust’s threat of legal action all the more amusing is that he’s no stranger to securities fraud.

Through his “Digital Tycoon” downline branding, Faust (right) is best known for being a top investor in the USI-Tech Ponzi scheme.

Through his “Digital Tycoon” downline branding, Faust (right) is best known for being a top investor in the USI-Tech Ponzi scheme.

Perhaps not so surprisingly, USI-Tech initially used forex trading as a cover. When that went belly up they switched to cryptocurrency trading.

Underlying both ruses was a simple Ponzi scheme that saw newly invested funds used to pay existing USI-Tech investors.

Following a securities fraud cease and desist issued in December 2017, USI-Tech went down in a ball of flames.

To date neither USI-Tech’s owners or top investors such as Michael Faust have been brought to justice.

After USI-Tech Faust dragged his Digital Tycoon downline into Ormeus Global, another trading bot Ponzi scheme.

Ormeus has collapsed twice since launch and is currently limping along as IQ Chain.

Digital Tycoons however has been repurposed to promote Silverstar Live.

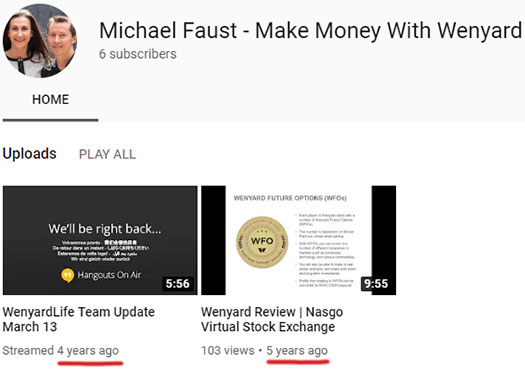

Delving into history, the earliest promotional activity I was able to find of Faust’s was Wenyard five years ago:

Wenyard ran a Ponzi scheme through their internal WFO virtual currency.

Evidently even after five years of pushing scams onto unsuspecting victims, Michael Faust’s securities law education has a long way to go.

From one publisher to another, I don’t think you’ve got anything to worry about Ted.

MICHAEL FAUST: This serial fraudster is nothing but a big PUSS! When someone threatens his illegal schemes he’s promoting, the arrogant piece of shit acts like he’s Mr innocent and threatens to take legal action.

What a joke, he would never want to be in front of a judge with his track record.

When will FAUSTY learn? The guy is a prolific scammer. Only thing I can see in his future is an ARREST.

Ironically Faust might be right about one thing though. Nuyten’s criticism of SilverStar may be 100% factual (albeit only because he copied and pasted it off Oz) but Faust is probably correct to say that he’s only publishing this factual criticism because some other Ponzi scam paid him to.

guess the check didn’t clear. lmao!

How can these people go from one scam to the next and still keep a straight face?

I can understand if you promote a scam, it falls down, you learn your lesson and never promote something like it again.

But this guy, come on. Over and over, you would think at some point he might want to get a clue that doing the same thing over and over is “Insanity”…

Faust struck it big with USI-Tech and has been chasing the glory days ever since.

Unfortunately it seems all he’s learned is that there’s an endless pool of gullible idiots to scam.

“Grit”, they would say. They “learned their lesson” and will strive to be “better”. But what often happens is they got better at scamming.

Just look at Kevin Trudeau (the scammer), who graduated from check kiting to pissing off the Federal courts. Remember, a lot fo these people got the idea that the world “owe” them success, something these get-rich-schemes (and plenty of MLMs) teach.

Just once I wish one of these blowhards would actually follow through with their threatened lawsuit.

Sadly it is all a bluff and trying to sound big and tough, when they are all wimps and wannabe tough guys.

There is no way in Hades they want to be inside a courtroom explaining their actions to a judge and jury.

Proof to a point I like to make: There is no “Self-regulation” of the MLM industry. It seems like the scamming gets worse and bigger by the year. These people are not going to stop until someone else stops them.

If strict regulation comes, they will have zero right to complain.

Xorly

I had known Michael and his family for over 20 years. Bought his kids gifts loaned him cars over extended periods etc.

In 2014 he wrote me an email begging me to help him out as he and his wife and young family were about to be evicted from their rental property.

Feeling for the kids and with his assurance of repayment withing a month. I transferred a requested amount of $4000 plus I put in another $400 so he had food and expenses until his income arrived from some deal he was doing.

I transferred the cash to the Real Estate office and the $400 to him. I suggested that he could pay it off over 3 to six months to take the pressure off.

Following that he wanted to pay me back by offering me a ‘spot’ in some scheme but I said ‘no’.

He did pay back $3000 with alot of pushing over 3 months but I have never seen the $1400.00.

The thing that annoys me the most is that from knowing him and the family for over 20 years he has not to this day even bothered to contact me.

Last I knew he was in Thailand according to linkedin. Sad case from a guy who has never ever had a job. Just drifts from scheme to scam.

He is immune to the stress he has caused and while he promotes himself as a Church loving individual, he is in fact a complete DUD!

This guy has no morals at all. He is so full of shit and takes peoples money like they owe him.

I know so to the tune of 100k.

Its a wonder someone hasn’t got to him by now..

Yep, Michael Faust has just dragged a ton of people into another scam…

OMG this guy is a complete fraud… So many stories to tell about this fraudster. Karma.