Scott Warren endorses Crypto World Evolution unregistered securities?

![]() Scott Warren is a named partner in the Wellman & Warren law firm.

Scott Warren is a named partner in the Wellman & Warren law firm.

Warren is widely recognized as an attorney that focuses on MLM related matters… which makes his alleged “endorsement” of Crypto World Evolution all the more puzzling.

Crypto World Evolution is an MLM company that popped up on BehindMLM’s radar earlier this year.

Up until recently Crypto World Evolution was soliciting investment of up to $10,000 per $500 to $2000 position, on the promise of “automated … consistent, significant 24/7 earnings”.

In our Crypto World Evolution review we of course pointed out this was a blatant securities offering, and that neither Crypto World Evolution or CEO Tomas Perez-Quevedo are registered to offer securities in the US.

Which is a problem, because Alexa estimate 39% of traffic to the Crypto World Evolution website originates out of the US.

To date our Crypto World Evolution review has generated almost 300 comments, most of which are back and forth between myself and Crypto World Evolution investors.

After clearly explaining how giving a third-party control of up to $10,000 who then generate a passive ROI is a security, the best CWE investors have been able to come up with is “but muh trading bots!”.

Now it appears Crypto Wealth Evolution have roped Scott Warren into representing them, with that relationship now being used to promote the company.

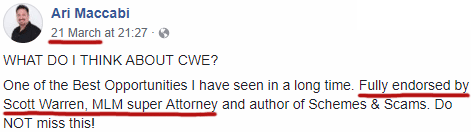

According to Ari Maccabi, Crypto World Evolution is “fully endorsed by Scott Warren”.

Maccabi also claims Scott Warren has authored a “legal document proving (Crypto World Evolution) is 100% legit!”, however he’s only providing it to potential investors.

I wasn’t able to find any mention of Warren’s purported endorsement of Crypto World Evolution on either the company’ website or that of Wellman & Warren.

Nor was I able to find a copy of the “legal document” Warren purportedly authored.

Considering the document, which Crypto World Investors are using to market the scheme, supposedly proves the company is “100% legit”, this was at the very least a bit odd.

Amid flashbacks of USI-Tech’s infamous “unregistered securities are legal in the US” legal opinion, I for one would be very interested to read Scott Warren’s spin on it.

After all, we all know how that turned out for USI-Tech.

What I can offer you in the meantime is a reiteration of why Crypto World Evolution’s investment platform is a security and break-down of Maccabi’s marketing claims.

One of the common defenses raised by Crypto World Evolution investors is that it’s not a security because funds are held in investor trading accounts.

MLM securities regulation in the US is rooted in the Howey Test.

Under the Howey Test, a transaction is an investment contract if:

1. It is an investment of money

2. There is an expectation of profits from the investment

3. The investment of money is in a common enterprise

4. Any profit comes from the efforts of a promoter or third-party

If we apply the Howey Test to Crypto World Evolution, this is how it plays out:

- Crypto World Evolution affiliates pay a $500 to $2000 fee, which enables them to place up to $10,000 per position under the control of Crypto World Evolution

- Crypto World Evolution affiliates are obviously investing funds on the expectation of profit (as represented by Crypto World Evolution itself on their website)

- all Crypto World Evolution affiliates place invested funds under the control of Crypto World Evolution, thus satisfying the criteria of a “common enterprise”

- any profits derived by Crypto World Evolution are generated entirely passively by the company’s purported trading bot, which at all times is operated solely by Crypto World Evolution

There is nothing about an exemption in the Howey Test or Securities Act for invested funds held in trading accounts. Nor are there any exemptions granted for cryptocurrency trading.

From here it becomes an elementary matter of applying previously issued cryptocurrency cease and desists to Crypto World Evolution.

Common violations cited in recent securities fraud cease and desists issued to USI-Tech, BitConnect, DavorCoin, Swiss Gold Global, Power Mining Pool include a lack of disclosure.

That’s because

A company offering securities that are not exempt must register them, a process that also involves disclosure of certain information, including:

- A description of the company’s properties and business purpose

- A description of the security being offered

- Information about the company’s management

- Financial statements about the company, certified by independent accountants

Again, up until recently, Crypto World Evolution was run by persons unknown.

The provided address for Crypto World Evolution on their website belongs to Pacific Mail, a mail box rental service in Irvine, California.

Crypto World Evolution do claim to generate returns for their investors through cryptocurrency trading bots, however no details about the bot itself is provided.

With respect BitConnect, one of the violations cited by the Texas Securities Division was failure to ‘disclose the identity and qualification of the person(s) who developed BitConnect’s purported trading bot‘.

The only information Crypto World Evolution disclose about their bot, is a suite address in Panama for “CWE SOFTWARE DEVELOPMENT, INC.”

Panama, the country you turn to when you want your MLM opportunity to scream “legitimacy”.

As for Crypto World Evolution providing financial statements audited by independent accountants… zip, nada, zilch.

But yeah, I’m sure Scott Warren’s “Crypto World Evolution is 100% legit” document clears all of that right up.

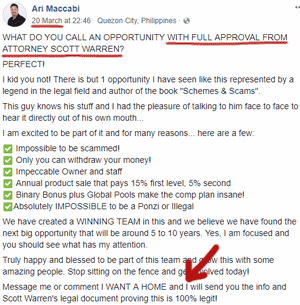

With respect to Ari Maccabi’s Crypto World Evolution marketing claims beyond Warren’s “legal document”, here’s where we’re at as of March 20th.

With respect to Ari Maccabi’s Crypto World Evolution marketing claims beyond Warren’s “legal document”, here’s where we’re at as of March 20th.

Impossible to be scammed!

There are a few ways Crypto World Evolution can scam their affiliates… but here’s the most obvious way:

The bot is controlled by Crypto World Evolution at all times. There’s nothing stopping them from rigging trades in their favor for a worthless altcoin they buy up big in.

Or quietly set up themselves and get listed on a few exchanges, which these days is ridiculously easy to do (coughcough ERC20 scams for days coughcough).

Such is the reality of handing over 100% control of up to $10,000 in invested funds to a common enterprise you know little to nothing about.

Only you can withdraw your money!

This is true of the trading account itself. But as per the scenario above, an altcoin with legitimate value could easily be traded for a worthless altcoin at Crypto World Evolution’s discretion.

The best hope an investor would have in this scenario is realizing and cutting off Crypto World Evolution’s API access to trading accounts under their control.

Impeccable Owner and staff

Up until recently Crypto World Evolution was run by persons unknown.

It was then disclosed that the CEO of the company is Tomas Perez-Quevedo.

Over the past few years Perez-Quevedo has been involved in the BitClub Network, AirBit Club and Zhunrize Ponzi schemes.

By that yardstick, despite his promotion of Ponzi scam after Ponzi scam over the years, even Ari Maccabi has an “impeccable” reputation.

Annual product sale that pays 15% first level, 5% second

Binary Bonus plus Global Pools make the comp plan insane!

These claims are neither here nor there, unless you consider the majority of Crypto World Evolution investors are also likely to be affiliates (pyramid recruitment commissions ahoy!).

Absolutely IMPOSSIBLE to be a Ponzi or Illegal

And there you have it folks, according to Ari Maccabi, who reckons Scott Warren sez so, unregistered securities in the US are totally legal.

And there’s no possible way Crypto World Evolution could be rigging trades through the trading accounts they have access to, in order to juggle invested funds around between accounts for as long as they can get away with it.

Maccabi is so sure unregistered securities in the US are legal, that in a March 21st Facebook video promoting Crypto World Evolution he claims;

[2:30] You’ve seen the SEC making moves, this is a company making moves (that) the SEC ain’t gonna touch.

Consider: After scamming victims in no less than three Ponzi schemes what, Tomas Perez-Quevedo woke up one day and found a profitable crypto trading bot under his pillow?

And the bot’s returns are so bulletproof he wants to share it with anyone who’ll hand over a few thousand dollars?

Please.

I’ll believe it when all the required evidence is filed with the SEC, as per legally required disclosures when offering securities to US residents.

Until then, securities fraud cease and desist or bust.

Your trading account that is, not mine.

If anyone has a copy of Maccabi’s “100% legit” document, feel free to send it in and I’ll be more than happy to publicly tear it apart.

edit: Got a copy, will publish a tear down tomorrow.

This Ari Maccabi? In failed scam after scam and a sex offender.

The worst…

“Indiana Sex Offender Archive Record For:Schlomo Aryeh Maccabi”

sexoffendersarchive.com/zipdirectory/IN/46038/Schlomo_Aryeh_Maccabi_661905

Maccabi is a master scam promoter. Invest via him at your peril.

Is it? Pretty much all attorneys focusing on MLM appear to be frauds, who make their money by offering spurious legal justifications for scams, which the scammers then use to say “look, an attorney said we’re legit”.

As long as there are pyramid and Ponzi schemes, there’ll be people who’ll pay good money for an attorney who’ll say whatever words are put into their mouth, with some spurious pseudo-legal claptrap attached.

Attorneys are not likely to specialise on MLM if they’re on the side of the punter and not the scammer, because there’s no money in it.

People very rarely recover anything from pyramid and Ponzi scams (if a receivership is set up, you don’t need to pay an attorney to obtain redress) and reputable attorneys won’t take money off you when there is no hope of being able to get it back.

For those who are new to this, 50% of attorneys are always wrong. In any legal dispute, both sides get an attorney and they can’t both be right. This means “look, an attorney said it’s legit” is a crap justification for anything. It adds no weight whatsoever.

Imagine that you were caught standing over your spouse, covered in blood with the knife in your hands. And there was CCTV footage showing you did it. In front of fifty witnesses.

And when the judge asks “what is your defence?” you answer “Well, my defence attorney here says I didn’t do it, and he’s an attorney so he must be telling the truth.”

Attorneys will defend absolutely anything if they’re paid enough. It’s their job.

Well said Malthusian.

You are so off base it isn’t funny. I know Ari personally and know for a fact he is not a sex offender.

I have know him 30+ years. You can verify that yourself at nsopw.gov.

Second of all I know how CWE works and they are nothing more than a software company that leases you software.

They do not choose the coins you trade, you do.

They are not a security by any means and for some MLM failure to call it so when a top rated attorney in the MLM AND CRYPTO space (yes, Scott also specializes in Crypto and should, since he himself is a participant in the crypto space and does mining and more).

You lease the software and you set it up, choose the coins and it trades for you and the winning percentage is great. I am using it AS A CUSTOMER.

There are currently less then 6000 distributors and over 11,000 customers total. Clueless people say clueless things… evidenced from your post.

PS. Why don’t you actually message Ari direct on Facebook and ask him for the document.

He is a good guy and I am sure he would give it to you gladly.

@Brian Ski… fake name of course so you can slander someone and avoid a legal case. Nice.

I looked at the website you are referring to and are you aware it’s not a real website meaning it’s not actual records?

Fact. Undeniable. The site slanders you then wants you to pay to have your name removed.

Lastly, don’t you think if it was a REAL site that was using a REAL COURT CASE to slander someone that they could at least get the spelling of the person’s name right?

They have 4-5 names on that record with a photo of him when he did get in trouble. If memory serves me right, it was for assault and it wasn’t in Indiana.

He is NOT from Indiana. We grew up in Missouri and both now live in the Philippines where sex offenders cannot get in.

He is a permanent resident and had to undergo a full background check to get that status here.

Next time, before you bash someone… Get your story straight.

so why is ari maccabi only sharing the legal document with potential investors?

why doesn’t he post it openly as there’s nothing ‘secretive’ about a lawyer providing a legal opinion on the legitimacy of CWE’s business model?

legitimate businesses don’t function this^^ way.

CWE is being promoted on facebook as a passive income opportunity:

this^^ is exactly how ponzi schemes are sold.

investors are claiming returns of 39% in 24 hours via the bot.

a blockchain developer Craig MacGregor wrote a review of CWE and notes:

so, this entire premise of a bot emerging from nowhere and making magical trades which are consistently profitable is just BS.

as oz and even craig macgregor warn, one day when the pyramid is about to collapse, this CWE bot will disappear will all your money.

medium.com/@craig.b.macgregor/crypto-world-evolution-scam-alert-1b5ef3f4f71

Investors are not claiming 39% in 24 hours because IF they do, they loose their accounts. There are zero guarantees and CWE does not control the bot, you do. They merely host it.

Impossible to quote what someone will make but they can legally post historical data which they do on their site. The bot tracks every trade therefore has all the correct data to share.

Futhermore the Craig MacGregor post is also completely incorrect. If you want to see it work, message a member and have them show you rather than bash someone or some program with entirely incorrect facts.

Ari gives out the document from Scott to whoever asks. Facebook does not allow you to post a document on your profile or I am sure he would share it. All members should have it so ask one for it.

Not sure if you have ever used an attorney before but they have what’s called Attorney-Client privilege and don’t post documents they give a company online.

Complete stupidity on your part to think it’s a document that should be shared in public.

Does Schlomo Aryeh Maccabi have a twin then? Because in that mugshot he looks like a dead ringer for Ari Maccabi to me.

Whereas I can’t speak to Maccabi’s charge of rape in the third degree or his parole conditions, I can leave you with this:

in.gov/idoc/3285.htm

No you don’t. Without the legally required disclosures a securities offering requires, none of their investors do.

All you know is you invest funds under their control and receive a passive ROI.

As per the Howey Test, Crypto World Evolution’s offering is.

Affiliates invest funds that are put under the control of CWE (a common enterprise), who then generate a passive ROI for their investors.

Clicking some mouse buttons doesn’t generate a ROI, nor change the fact ROI revenue is generated entirely passively through CWE.

Again, I’ll believe it when I see it audited and filed with the SEC.

Why go to the effort of hiring “a top rated attorney in the MLM and CRYPTO space” in an attempt to dodge US securities law?

Surely it’s far simpler to just register Crypto World Evolution’s securities offering with the SEC and providing legally required disclosures?

Of course with the company being run by a serial Ponzi scammer and CWE attracting all of the usual Ponzi suspects, one can see why they wouldn’t want to go anywhere near the SEC and operate legally in the US.

No thanks. I might catch something in the third degree.

PS. Thanks to the readers who sent in a copy of the Warren document. Full break-down tomorrow.

Investors do not control CWE’s bot. Otherwise they’d be able to run it offline and provide evidence of exactly how it works.

The alleged bot is owned and operated by CWE at all times. Clicking a few mouse buttons doesn’t generate a ROI. CWE, as a common enterprise affiliates invest with, take control of your money and passively generate a ROI.

As previously mentioned, so what? There’s no mention of “guaranteed returns” in the Securities Act or Howey Test.

@Oz his name is Shlomo not Schlomo and not all the others listed on the profile. I already told you that mugshot is real but from a charge he got when he smacked someone for grabbing his wife’s ass… so it should look like him.

Most real men would have done the same. As I stated he is NOT from Indiana nor has he ever lived there.

As I mentioned the funds are NOT under their control. You lease software from them and you deposit money into the exchange. You control the bot they merely host it. I do know how it works and in depth because I use it as a customer.

This is directly from the letter from Scott Warren:

(Ozedit: Snip, I’ll be addressing this tommorow)

Since you are not an attorney, I will trust in someone who is and what they say.

Hope you understand but you’ve called other things like ClickFunnels a scam which is also a product company.

Perhaps you should get more familiar which US Law (maybe even become an attorney) since you seem fascinated by it. I know the laws are a lot more lax down under in Australia.

Sorry, and? Given the aliases listed in his third degree rape charge, Maccabi is/was quite the Carmen Sandiego.

Given his active role in Ponzi scam after Ponzi scam over the years, not hard to see why. At the very least Macabbi is a serial white collar criminal.

It’s a shame Duterte doesn’t have as much as a boner for white collar crime as he does narcotics offenses, but I digress.

You can say whatever you want, doesn’t change the facts.

CWE investors hand CWE complete access to invested BTC through API access. From there CWE can do whatever they want with your money.

Anecdotal evidence of alleged trading taking place is not a substitute for legally required securities disclosures.

The ROI is generated passively by CWE. Clicking a few mouse buttons doesn’t generate a ROI.

No you don’t, because your own anecdotal evidence of trading is not a substitute for legally required disclosure with the SEC.

US securities law is the same for attorneys as it is everyone else. Gerry Nehra, Hart David Carson, Howard Kaplan, Kevin Grimes… I could go but hopefully you get the point.

An MLM company with no retail is a pyramid scheme. “But our pyramid scheme has a product” is 1990s pseudo-compliance BS. Get over it. #TheActualTruth

Oh I get your point but (Ozedit: No buts. Anecdotal bullshit removed.)

Best of luck with the whole “scamming people from the Philippines” gig.

Did iPro also claimed to have been endorsed by Scott Warren and that Shark Tank guy, Kevin something?

Well that’s alright then.

If a sex offender can’t get in the Phillippines it’s because they’re stuck in a giant queue of other sex offenders making their way through customs.

Like Thailand, Cambodia, Indonesia, and most other developing South East Asian countries, it is white paedo heaven.

Scamming nonces say the darndest things.

I will be reaching out to Scott Warren on Monday as his office is less than 10 miles from my location. I’ll ask him all about the claim he has endorsed CWWE as being legal and has put it in writing. Stay tuned.

Kevin Harrington is the Shark Tank guy you are referring to. He is supposedly above board and would not be caught dead swimming with these sharks.

His reputation up to this point is stellar, which is what surprises a sane person.

iPro is just another scam like One Coin/ One Life. Here in middle Tennessee, they are still raping the innocent folks out of $$$ thousands weekly.

The Direct Ship Domination boys, ole Sal and Maurice have gotten themselves installed as VP’s of top scammers, eerr money investors. How in the name of The Almighty can these jokers sleep at night.

The mid-South is soaking up this shit at an alarming rate. North America’s $$$ million dollar golden boy (Bob Byrum ) is at the helm, and hawking the virtues of Harrington.

I cannot believe Harrington fell for this crap, must have been his “stellar” reputation.

Before much longer, Thailand will be populated by all these criminals, good riddance!!!

Crypto World, iPro, Wealth Generators, Mining Max, Coinsino, all have Scott Warren in common. Reps in those companies brag about it and claim that he supports them. Scott Warren is the new Gerald Nehra. Maybe he knows it, maybe he don’t, he’s being used to validate several scams right now. He better be saving his money!

Putting on my Hans Christian Anderson hat:

1) Client pays lawyer for legal opinion

2) Lawyer provides opinion

3) Client make opinion public

4) Lawyer says opinion was based on information provided at the time

5) Lawyer says opinion was not for public release

6) Lawyer says legal opinion is not “endorsement”

7) Nothing happens to either lawyer or client.

hmmmm, i wrote to scott warren yesterday asking if as per this article he had ‘endorsed’ CWE and he replied saying:

i think warren is being all lawyerly and technical in his response.

so i’ll reframe my question to him and ask if he provided a ‘legal opinion’ to CWE finding them compliant with US securities and pyramid laws.

i guess his stance is – a paid legal opinion is not an endorsement.

yeah, same difference!

i mean, technically it may be different but from a laypersons perspective it has the same effect.

The “opinion” letter is publicly available and has already been distributed by CWE pimps as proof of legitimacy.

complete dickheadedness on your part to contradict yourself so stupidly.

seeing you’re talking through your ass, i’m going to assume you really have no idea what CWE’s bot is doing at the backend and you’re just blabbering nonsense because you cant tell your ass from your elbow.

A subtle, but important change has been made to the Ari Maccabi facebook post captured above.

The words “fully ENDORSED by Scott Warren have been replaced with “fully APPROVED by Scott Warren”.