Ronald Aai & Faith Sloan misrepresent Cloud Token securities fraud

It’s well-established by now that if you’re dumping money into an MLM company and collecting a passive return, it’s constitutes a securities offering.

It’s well-established by now that if you’re dumping money into an MLM company and collecting a passive return, it’s constitutes a securities offering.

Securities are strictly regulated across the world and for good reason.

It’s one thing to say you’re doing something and provide social media proof. Registering your securities offering (legally required) and providing documented proof to authorities is another.

Naturally, MLM Ponzi schemes come up with all sorts of reasons as to why they haven’t registered their securities offering.

Today, courtesy of Cloud Token, Ronaly Aai and Faith Sloan, we examine one of the most blatantly misleading excuses for securities fraud I’ve ever seen.

For those unfamiliar with the company, Cloud Token sees affiliates invest in CTO points.

CTO points are not publicly tradeable and hold no value outside of Cloud Token itself.

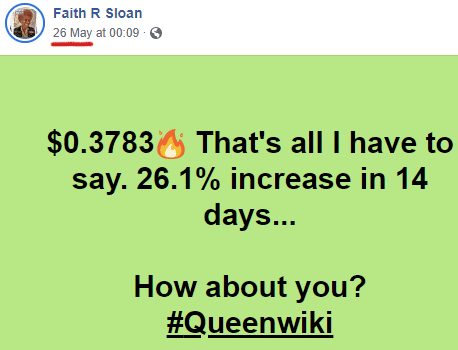

Over time Cloud Token increases the internal value of CTO points, allowing affiliates to cash out.

When an affiliate puts in a withdrawal request, Cloud Token pays them at the current CTO rate with subsequently invested funds.

Although he’s officially credited as Cloud Token’s CTO, Ronald Aai appears to be running the company.

With concerns of potential regulatory action mounting, yesterday Aai enlisted the help of Faith Sloan to address securities fraud.

Aai primarily communicates to Cloud Token affiliates over Facebook.

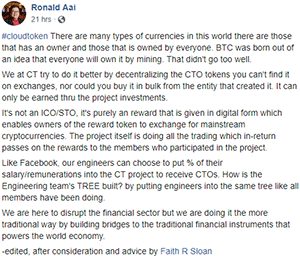

In a post published yesterday, Aai described Cloud Token’s investment scheme as follows:

In a post published yesterday, Aai described Cloud Token’s investment scheme as follows:

It’s not an ICO/STO, it’s purely an reward that is given in digital form which enables owners of the reward token to exchange for mainstream cryptocurrencies.

The project itself is doing all the trading which in-return passes on the rewards to the members who participated in the project.

At the conclusion of the post Ai thanked Sloan for helping him edit it.

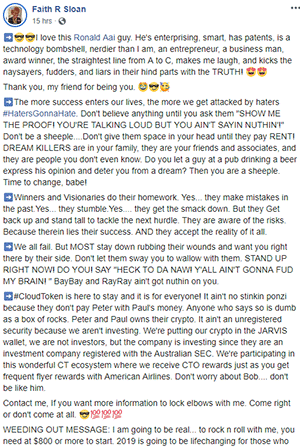

Sloan herself went on a rant a few hours later;

Sloan herself went on a rant a few hours later;

CloudToken is here to stay and it is for everyone!

It ain’t no stinkin ponzi because they don’t pay Peter with Paul’s money.

Anyone who says so is dumb as a box of rocks.

Peter and Paul owns their crypto.

It ain’t an unregistered security because we aren’t investing.

We’re putting our crypto in the JARVIS wallet, we are not investors, but the company is investing since they are an investment company registered with the Australian SEC.

We’re participating in this wonderful CT ecosystem where we receive CTO rewards just as you get frequent flyer rewards with American Airlines.

I know, I know… anyone who is familiar with securities law wants to jump right in. But let’s break this down step by step.

First off while Cloud Token has registered itself with the Australian Investment and Securities Commission;

- that’s an extremely low bar (pay a fee, provide some details); and

- it only pertains to the solicitation of investment in Australia.

As I write this Australia isn’t a significant source of traffic to Cloud Token’s website. Meaning investment activity there is little to none.

Alexa currently pegs the US as the largest source of traffic to Cloud Token’s website (20%).

In order to ascertain whether Cloud Token’s income opportunity constitutes a security, the existence of an investment contract must be established.

With respect to MLM companies, this is done via the Howey Test.

As per the Howey Test, an investment contract is defined as

a contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party.

The Howey Test has been around since 1946. It’s been cited in countless cases by the SEC to establish the existence of an investment contract.

To wit the Howey Test is non-negotiable and there are no exceptions.

By their separate own admissions, both Ronald Aai and Faith Sloan openly acknowledge Cloud Token is offering an investment contract.

Ronald Aai;

The project itself is doing all the trading which in-return passes on the rewards to the members who participated in the project.

Faith Sloan;

We’re putting our crypto in the JARVIS wallet, we are not investors, but the company is investing.

And here’s Cloud Token themselves (taken from official marketing material);

Cloud Token Wallet offers its users the option of deploying algorithms and AI systems to trade cryptos and potentially earn a passive income.

JARVIS arbitrage bot delivers attractive monthly returns of 6%-12%, which are paid daily to Cloud Token Wallet users.

(HAL) delivers attractive monthly returns of 18%-30%, which are paid daily to Cloud Token Wallet users.

Just so you’re crystal clear:

- a contract, transaction or scheme whereby a person invests his money in a common enterprise (Cloud Token affiliates dumping money into the company through the app)

- and is led to expect profits solely from the efforts of the promoter or a third party (Cloud Token represents it does AI trading, the returns of which are used to pay affiliates who cash out their Cloud Token points)

Cloud Token is providing affiliates with an investment contract. Which in turn makes it a securities offering.

In order to operate legally, Cloud Token needs to register itself with financial regulators in every jurisdiction it solicits investment in.

Namely the US and Malaysia.

Faith Sloan resides in the US and as evidenced by traffic to Cloud Token’s website, the US is currently Cloud Token’s largest source of investment.

Ronald Aai recently fled to Malaysia after he was booted out of Singapore.

In addition to securities fraud via an unregistered securities offering, Cloud Token also fails to provide investors with details of its supposed Jarvis and Hal AI trading bots.

This lends itself to wire fraud, which is where the Ponzi aspect of the business kicks in.

Paying Peter with Paul’s money as Sloan put it.

Even if Cloud Token was registered with the SEC and Bank of Malaysia, they’d need to provide investors with full disclosure regarding their Jarvis and Hal trading bots.

This includes who created the bot, their expertise, who owns the bot and verifiable trading results.

The results would need to be audited by a third-party, such that returns paid to Cloud Token affiliates can be correlate with trading revenue generated by the Jarvis and Hal bots.

Cloud Token provides none of this on there website. Nor has anything been filed with ASIC.

Just a quick note on that point, ASIC are a somewhat of a joke when it comes to securities regulation. Don’t expect them to chase after Cloud Token for required filings any time soon.

There is one and only one reason an MLM company offering securities fails to register itself with financial regulators:

It isn’t doing what it represents it is.

In this case, using revenue generated by an AI trading bot to pay affiliates a return through an internal points (token) system.

The only verifiable source of revenue entering Cloud Token is new investment.

Cloud Token may have set aside a token amount of funds to feed a bot. Likely just enough to create videos to defraud investors with on social media.

Any revenue generated through token trading however is certainly nowhere near enough to provide returns calculated using the ever-increasing internal CTO point value.

If every single Cloud Token affiliate opted to withdraw every single CTO in their app wallet, in true Ponzi fashion the scheme would collapse.

What makes Ronald Aai taking securities advice from Sloan particularly egregious, is that not even a week ago Sloan was slapped with a $778,455 securities fraud judgment.

Although she might play the role of a confident “queen” on social media, when caught by authorities Sloan’s MO sees her play dumb and roll over.

With Sloan now “advising” Ronald Aai on how to mislead existing and potential investors with respect to securities law, any legal defense on their part will be a hard case to make.

The self-incriminating evidence is out there on social media for anyone to document.

The only thing left is for the SEC, DOJ or Bank of Malaysia to collect it and make a move.

Alternatively, Cloud Token collapses whenever recruitment runs dry and Ronald Aai, Faith Sloan and their co-conspirators make off like bandits.

Everyone else loses out and we record yet another “sorry for your collective losses” entry in the MLM crypto niche.

They need an Australian Financial Services License or AFSL to offer financial products or advice in Australia even.

All they have done is register a company name / business name. That’s it.

They aren’t registered licensed to offer products or advice in Australia or anywhere else for that matter. Dodgy as.

CT Cloud Token is a JOKE.

First, Ronald claims to just be a “Consultant” to Cloudtoken from WBF’s project.

And NOW??? Doesn’t he look like the INVENTOR of Cloudtoken scam? Defending his project now. Flying to vietnam, thailand, malaysia to meet ex-plustoken members to move to cloud token by hoping $0.40 in CT will become $100 like Plus Token

Even now kicked out by WBF Boss. what a shame. to Ronald

If you FB search Ronald Aai, just look at his FB profiles and posts. Which part of him show he is EXPERT in Crypto??

And now Ronald comes to Malaysia? To lure Malaysians? Just wait for the authorities to raid the office, and the clowns of CT leaders. DODGY.

MLM and Crypto are like fire and water dont mix at all !

Ariel, i did a search on Ronald Aai. It seems like you’re right he is no expert in crypto at all.

But i did find that he was involved in alot of crypto projects as advisors and also there is a particular project called INFINITUS TOKEN which he is listed as blockchain advisor and i check abit on the project it seems like they are on several exchanges.

I also checked more on that by reading the whitepaper it seems like they know what they are doing. So i am confused now.

As a very curious person i wanted to know if we’re just ranting for the sake or ranting or is there sufficient evidence to really nail this guy.

So we say that he is kicked out from WBF. i check with gary who is said to be root of the news but when ask gary sent me this site as the screenshot. so all leads stops on this site.

Don’t waste your time with whether Aai knows or doesn’t know cryptocurrency.

Securities fraud is securities fraud. How investments are set up and tracked doesn’t matter.

All you need to verify Cloud Token is committing securities fraud is their business model.

Affiliates dump money into the company on the representation they’ll passively receive back more than they put it in.

Gary Liu – facebook.com/tofuboyboy/posts/10161853777640646

Check the date.

OZ, sir yes sir. *hic

OZ, thx.

Raaiman,

It doesn’t matter that ronald’s Background is.

A scammer can be experienced in his field, and then use a new project to lure people to get involved. The truth is, who are the leaders of CT now?

Isn’t it the same old people from plus token?

They are just hoping to scam as much people as they could now to buy the CTO at low price now, hold it for 12 months and expect it to increase and become millionaires. STUPID.

Let’s talk about LOGIC.

If Ronald is so “ego” with his CTO project. Why don’t he organise a public event in SG itself?

Truth is. The MAS financial SG authorities will go after Ronald. It’s SINGAPORE.

Malaysia is a half baked land for Ponzi. Anyone can just come here.

Now let’s just gather the top leaders of CT and report to the authorities.

Timing will show what’s real. Ronald or Donald!

If you did a search for Bernie Madoff before you and everyone else knew who Bernie Madoff was, he looked pretty legit, too.

Besides, unless you a total fool, Faith Sloan should be an automatic disqualifier, I wouldn’t trust her with my money any more than I’d trust my dog to fly a helicopter.

I really have tried to keep my congratulations and accolades to a minimum over the many years I have followed your diligent reporting, but this article is among the best of your work, in my opinion.

SD

Thanks, appreciate the support.

Occasional accolades are the best kind. If you’re getting them all the time they lose meaning fast.

It’s funny how to see Facebook of all the arguments of cloudtoken

And the only scammer ones who support the big fat Ronald are the one investing in CT hoping Ronald will stay as long in CT to pump up their price!

Some one please expose whose the leaders name online! And report them!

Did you see the live interview with Faith and Jessie where she said there is no expectation of profit and the members are not investors.. Meanwhile, their “whitepaper” says clearly that the Jarvis bot generates profits for an investor.

But.. according to Faith, the members are not investing, and we’re not expecting a profit or earnings at all, we are just “participating in an ecosystem” because we like the ‘technology’.

Yep.. I’m sure they got a quarter million members to cough up their cash just because they have interesting technology and no remuneration or compensation what so ever… ROFL!!

The interview was… entertaining…

Ecosystem? What ecosystem do they have?

Its just a PUMP and DUMP wallet.

Try see it CT price stay 0.4 cent for the next 3 months and not increasing, will the Ponzi leaders still make noise of their CT. stupid.

Now its just hype.

Based on Cloud Token’s business model, a Ponzi ecosystem.

What do you mean Faith Sloan misrepresented Cloud Token? Why she has a masters of science degree in software engineering in information management systems, and is a techie and an “expert.”

I know this is true because she tells everyone she is, and we all know she wouldn’t lie…..well just not straight in bed.

How could she possibly misrepresent Cloud Token?

I am here to do my due diligent on CTO!

All said has anyone know why Jim Roger “a billionare fund director investment Co.” is seen promoting and alongside with the CTO team at the Bangkok launch?

You’d have to ask him.

As far as due-diligence goes though you can’t feign legitimacy via association. Doesn’t matter if it’s an individual or a company.

LMAO.. but she can’t answer any of my rather basic tech questions.. only divert and slander and ultimately be louder than anyone asking the tough questions..

She already got nailed for 3 quarters of a Million by the SEC for promoting Ponzis.. HAHAHAH keep believing her all you want.

Ronald Aai has been back to Singapore to hold an event. It was held on 26th July with approx 1,000 people attending.

STRIKE 3 – YOU’RE OUT!!!

STRIKE 1 – LEGAL: They are not legally registered to sell securities.

STRIKE 2 – BUSINESS: They have no proof of revenue generation from arbitrage trading bots.

STRIKE 3 – TECHNOLOGY: The Cloud Token and the Cloud Token Blockchain are nowhere to be found anywhere on the Internet? There is nothing on CoinMarketCap.com, CoinGecko.com, Etherscan.io, Google.com, or even the company website at CTOToken.com.

IT’S TIME FOR THE REGULATORS TO STEP IN, IF THEY DON’T COLLAPSE ON THEIR OWN BEFOREHND…

Can I have 3 really honest answer if this company is reall or fraude?

I have read this 3 times I am really confused. Appreceiate very much.

Ponzi schemes are fraudulent by nature. So are unregistered securities offerings.

A recent topic about antivaxxers got me thinking… that there’s so much overlap between scammers and antivaxxers… in terms of their tactics.

Basically, scammers pretends to be experts in something, in order to get you to believe in their (bogus) product to buy.

In these cryptoscams involving kleptocurrencies, these promotoers don’t know anything about the actual technology underneath. They can blab jargon like tokens and mining and blah blah blah with zero understanding, and often, the analogy they tried to use are totally bogus. All to sell their stuff.

Antivaxxers behave pretty much the same way: they pretend to be experts, but they are using pseudoscience to make their points, not science.

They don’t actually understand the medical science, but they will seize the scariest words off PubMed and misrepresent that to scare others off vaccinations. All to promote antivax ideas.

You know why you are the most foolish hater of Cloud Token? You should have allowed almost 1 million members of Cloud Token to have their own comment shared.

Why deleting positive comments about Cloud Token? Shame on you because Cloud Token results and transperancy have simply made your website a total failure and rubbish.

Our comments are open to anyone but marketing bullshit is obviously deleted as spam.

That said I don’t recall having to nuke comments from Cloud Token affiliates. Might have been one or two but nothing recently (last few weeks).

Not that you care, you’d be just another Ponzi shill making excuses for scammers.

Transparency? Where the fuck is it?

Why isn’t Cloud Token registered with financial regulators are legally required? Where are the audited financial reports confirming external revenue is being used to pay affiliates?

Transparency my ass.

Sloan is not the only leader in Cloud Token you should investigate/report.

Just look at their highest earners – Paul McCarthy and J.Ryan Conley… both were top promoters of Onecoin, then got kicked out of there and made it big in Dascoin, in addition to other scams like Trade Coin Club which Ryan promoted heavily in the beginning and suddenly changed his tune after a dispute over a Rolex watch that he insisted the owners were supposed to gift him.

He called them scammers and launched a hate campaign while at the same time thousands of his downline were having their money in the system and had no choice but to hope they’ll be able to take it out before it collapse, many were not able to…

Oh and let’s not forget he was the top earner and promoter of Future Ad Pro – a ponzi revshare out of Poland that ran for 3 years and of course collapsed like all good ponzis. He helped them launch their own scam token and went on to claim it was better than Bitcoin…

Ryan was also kicked out of there just a couple of months before it collapsed (they couldn’t afford to pay his high earnings).

Then there are other names I recognize from your previous articles like Chris Arena and many more…

This has SCAM written all over it.