US fed prosecutor tells court OneCoin is a $4 billion Ponzi scheme

A court transcript has provided the clearest picture of the ongoing international investigation into OneCoin yet.

A court transcript has provided the clearest picture of the ongoing international investigation into OneCoin yet.

The transcript in question is that of Mark Scott’s bond appearance on September 13th, 2018.

Scott (right, with wife) was indicted in August 2018, on charges relating to his laundering of over $400 million in stolen Onecoin investor funds.

Scott (right, with wife) was indicted in August 2018, on charges relating to his laundering of over $400 million in stolen Onecoin investor funds.

Although the hearing was a months ago, the transcript has only recently been made public.

Representing US regulators at the hearing were a DOJ attorney for the Southern District of New York, two federal prosecutors and an FBI agent.

When asked for details about the case early into the hearing, one of the federal prosecutors described OneCoin as “a fraudulent cryptocurrency”.

This fraud scheme was international in scope and brought in approximately $4 billion worldwide from victims.

To which the Judge replied;

Can I just ask a question about that.

Is that cryptocurrency fraud scheme in the nature of a pump and dump or Ponzi, or do you know?

The answer to the court’s question confirmed what has been known about OneCoin for some time.

It is (a) hybrid Ponzi pyramid scheme.

It is a fraudulent cryptocurrency that does not have, as far as the investigation has determined, a true blockchain, and most investors have not been able to recoup or take their money out of the scheme once they invest in these coins.

There is some degree of Ponzi scheme here simply because there are commissions paid to promoters and recruiters in order to bring in more victims.

OneCoin’s blockchain controversy began in early 2017, following a report the company was using a SQL database to track affiliate investment.

OneCoin has denied the claims, going so far as to claim investigations in Germany certified the company has a blockchain.

To date no evidence or reference to any specific investigation has surfaced. Yet that hasn’t stopped OneCoin’s investors from incessantly parroting OneCoin’s claims.

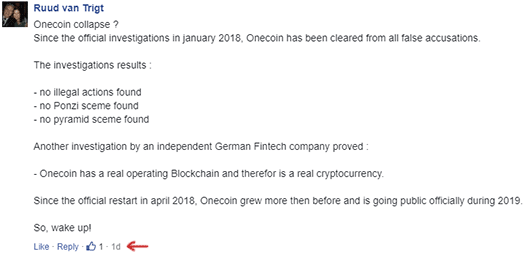

While the above example from OneCoin investor Igor Krnic is somewhat dated, the most recent instance I can provide you is barely 24 hours old.

In a comment posted on an January 20th BusinessForHome article lambasting BehindMLM’s reporting on scams like OneCoin, Ruud van Trigt claimed

Another investigation by an independent German Fintech company proved:

– Onecoin has a real operating Blockchain and therefor is a real cryptocurrency.

The author of the article Ted Nuyten, CEO and owner of BusinessForHome, is believed to have received undisclosed sums of money in exchange for favorable OneCoin coverage.

Nuyten has also personally appeared in OneCoin promotional material.

The investigation the US federal prosecutor is referring to is believed to be an ongoing joint international effort.

Getting back to Mark Scott, as alleged by US federal prosecutors, his

role in this scheme was he’s a licensed attorney, and he joined the co-conspirators and formed hedge funds, international hedge funds, with accounts in the Cayman Islands as well as Ireland.

And through those hedge funds, he laundered the proceeds of the cryptocurrency fraud scheme.

In order to do that, he lied to banks, he lied to fund administrators, and he misrepresented where the funds were coming from.

In order to secure OneCoin banking channels, Mark Scott represented that stolen investor funds

were coming into the hedge funds … from a select group of European families and entities that were investing who (Scott) had known for many years.

US federal prosecutors allege their investigation

revealed that the money that was coming into the hedge funds that (Scott) formed were solely the proceeds of this fraud scheme.

In exchange for assisting Ruja Ignatova with hiding stolen OneCoin investor funds, Scott was allegedly rewarded with

$15.5 million in fees … used … to buy beachfront property, luxury vehicles, luxury watches.

When queried on the evidence the DOJ had to back up its claims, the federal prosecutor told the court US authorities had

voluminous discovery materials, which include both hard copies and voluminous electronic evidence.

Those categories are broadly defined as bank and financial records, emails, fund administration records, pen register records, phone records, WhatsApp and email account records, GPS records, the cryptocurrency promotional materials, and the cryptocurrency account materials.

We have real estate records, corporate entity organization records.

We have photos of a phone of his and information on that phone.

We have FBARs that (Scott) filed with the IRS this past summer.

We have a list of accounts that were seized or restrained.

We opened an undercover account in the cryptocurrency scheme, and so we have materials from that.

Key to apprehending OneCoin founder Ruja Ignatova (right) and her co-conspirators, are communications between them and Scott.

Key to apprehending OneCoin founder Ruja Ignatova (right) and her co-conspirators, are communications between them and Scott.

This is evidence that was seized as part of Scott’s arrest warrant.

Unfortunately analysis of that evidence has been delayed, on account of Scott representing to at least one co-conspirators that he was acting as their attorney.

This has resulted in potential client attorney privilege, requiring the use of a privilege review team.

For that reason, the investigative team does not have all of the materials that are now in the possession of the privilege review team.

Once the priviledge review team has finished sifting through it, US regulators will have access to Scott’s OneCoin data on ‘at least 17 phones, six laptops, two iPads and three memory cards and five flash drives‘.

Bear in mind that this was as of October 2018. Since then there have been no public updates regarding the ongoing OneCoin investigation.

Ruja Ignatova’s second in command, Sebastian Greenwood, was arrested in Thailand and extradited to the US sometime during the 2018 4th quarter.

Other than confirmation of the arrest via Thai authorities, US authorities have yet to release anything public regarding Greenwood’s current status or whereabouts.

Ruja Ignatova’s whereabouts weren’t discussed at the hearing, however this paragraph might provide a clue as Ignatova’s disappearance since mid 2017.

The investigation has revealed that one of the co-conspirators most likely has fled to a jurisdiction where there is no extradition treaty with the United States.

As for Mark Scott, US authorities have revealed he has German dual citizenship.

Owing to Scott’s “significant foreign ties”, they see him as a flight risk.

If Scott managed to escape the US while on bail, federal prosecutors asserted

no combination of bail conditions will assure his return and appearance in court.

Nonetheless Scott was released on a $2.5 million bond later that month.

BehindMLM continues to track Scott’s case but, as of January 23rd, 2019, there are no further updates on Scott’s case docket.

@Oz – Paragraph 3: you said: “Scott (right, with wife) was indicted in late 2017…”

You meant 2018?

(you can delete now)

The case was made public in late 2018 but from memory the indictment case files began in late 2017.

Edit: Ah I read what I had open wrong. Case files did begin in late 2017 (charges?) but he was indicted in August 2018. Thanks for the pickup.

Only $4 Billion? Seriously I know people who dropped hundreds of thousands into that scheme.

One of the promoters in the US is obviously enjoying his stolen money as I see him on FB flying all over the world with his family. Wow.

Do you think they’ll go for clawbacks? This is going to get REALLY ugly!

$4 bill is as of Oct 2018. There’s money that was sent off to the UAE that’s unaccounted for and who knows what else.

Going off memory but the TelexFree estimate $1.6 bill initially but ballooned out to $3 bill by the end.

Can’t really say anything as to clawbacks. I think the US will pursue this on a criminal level, not so much securities fraud.

OneCoin were pretty selective about scamming people in EU and Asian countries whose regulators don’t care.

Coincidence that Toxic Ted’s Bullshit For Homies article came out only just days prior to this info becoming Public?

If Scott were able to relay a message to Sofia Orifices tipping them off that the contents of this court transcript would be Public, the fraudsters would likely fly into panic mode trying to put out the fire. And what better way than put out a bullshit hit piece on BMLM?

Ironically for Ted, this new revelation further implodes the credibility of his finger pointing and attempted cover-up article attempting to discredit Consumer Protection Advocates, in general.

I wonder if such bombshell new conclusions from the U.S. Govt Prosecutors Office will get any mention in BS4Home? Either Ted eats crow on it, or he reveals himself as an even more obvious ponzi shill. Should be interesting to watch!

Personally I don’t think so. There’s a 90 day redaction period for transcripts then they go public.

I usually don’t bother with them because after 90 days there’s usually more up to date filings. This is an exception, with full credit to Capital for keeping track of it.

I think Nuyten’s outburst is more likely to be due to some of his secret promo deals with companies falling through and/or him finding it harder to attract paying companies. Gotta blame someone.

I’m still stunned about the silence in mane stream media on this story. How can it be that a 4.000.000.000 $ fraud still running all over the world, is of no interest for newspapers, tv-shows and online media?

If onecoin scam, all over the world, enterprise company, individual who’s know The vision and mission of ONELIFE.

all of them can make money and Helping others. That only the lazy members don’t want to understand will said ONELIFE Scam.

For me ONELIFE is the greatest company as I know. Dedication group world wide standard.

@Santa Maria

Because “people lose money in scam” is a “dog bites man” story.

It doesn’t affect the general population’s lives and it doesn’t tickle any tribal buttons (like politics or sport).

BehindMLM regulars like us who find pyramid scams inherently interesting are in a minority.

Add to that, an international scam like OneCoin has the greatest effect in developing countries without a particularly free press. Who wants to write a boring dog-bites-man story when it might get you hung from a meathook and your fingernails pulled out if your local councillor happens to be a OneCoin investor?

By contast, in countries with a free press, the impact of OneCoin is very limited. In the UK, despite the total indifference of the authorities towards scams, OneCoin barely made a ripple outside ethnic minority enclaves. The UK and USA public are not interested if Germans, Ugandans and Vietnamese get scammed.

@Santa Maria

For the press in Germany the scam of OneCoin / OneLife is a hot topic, as Ruja’s “lawyers” like Schulenberg & Schenk from Hamburg prevent any reporting and threaten with lawsuits.

I can not judge how it looks in other countries, but who likes to adapt to mafia structures?

I contacted several German press portals in 2018, but never received an answer. If you want to know more about the so-called “lawyers” Schulenberg & Schenk and how they work, you should search Google.

It’s a shame these guys are still allowed to work as lawyers. Obviously, they live by this motto: “Money does not stink!”

However, there are also German lawyers who warn on their websites before the OneCoin fraud and offer their help to the deceived.

Not to forget: Even the controversial :gerlachreport has repeatedly dealt with this dubious law firm from Hamburg. 😀

The act of MLMing is responsible for many, many billions of dollars lost. Four billion is just a dent in the grand “scheme”.

Oh my.

There is no way to say for sure how many open deals there are in New Dealshitter as the site is so crappy, but all valid numbers go between 1 047 and 1 305.

However, one single merchant:

NOLINK://newdealshaker.com/QTBCGROUP

currently has 195 open deals. That means 14.9% to 18.6% of all open deals are made by one single merchant.

@char this has nothing to do with MLMing as you declare. Those so called Crypto / Forex / Mining / Tokens / ICO / Gold / Trading scams that cover up their act well by selling training packages or education use a valid business model which Network marketing and direct sales is to ripp off people nothing more nothing less.

All people involved in this industry in valid product or service companies seling products to outside customers, not only proper consuming by the network, wouldn’t ask for more if all these companies were closed and owners and leaders taken into custody.

Unfortunately to accomplish this you need the help of regulators and local governments.

If I would have lost money in a scam (not knowing it was one of course), I wouldn’t wait a second to go and file a complaint with the police.

That’s were the shoe doesn’t fit for many because they are so afraid if they would, they lose all options to see at the end some of their money back.

Most are ignorent to the fact that they have lost it all already, often because hwo it would look to their families and the public eye. It’s never a nice thing to be called an IDIOT at the end.

Are you suggesting OneCoin isn’t MLM? Better tell Oz.

I do agree that scams with only tangible products appear “less bad” and are more difficult to lose higher sums of money in a single hit.

That would be nice but since it’s not happening, so the other option is to educate.

Think of it this way. Does it make economic sense to put a cop on every single corner to catch drunk drivers, or should we educate people about the dangers and cast a wider net? We then hope that people have the sense to police themselves so they don’t get killed committing the act.

People who do MLM are under the same illusion that getting drunk and driving home gives only the “opportunity” of fun – ignoring statistics and consequences.

Seems to me these people also prefer to discuss brand and type which is all moot inside the ambulance.

@cointrust

The only mission OneCoin/OneLife has ever had has been to separate you from your money, which it has been wildly successful at.

Since Jan 2017 the OneCoin Ponzi scheme has collapsed, leaving only the pyramid side of the business.

Throughout 2018 the recruitment pyramid side of OneCoin/OneLife also collapsed.

To put it bluntly, even if it hadn’t collapsed you’re not “helping” anyone by recruiting them into a guaranteed loss pyramid scheme.

Then you either haven’t looked very hard or have the lowest of the low standards.

Write something new. This is a very old and fake story.

There’s nothing fake about an official court transcript.

By all means continue to bury your head in the ground but the prosecution of Mark Scott is very real.

I’m sure mark scott wishes it was. just wait for when he rolls on co-conspirators. you’ll really meltdown then. lmao!

Just like the German investigation, you think they would still allow them operate if they found something wrong as you believe?

Have a rethink and purge yourself of the hatred for Onecoin.

@Frank – hope you like your coffee cold and bitter.

can’t ‘hate’ something that doesn’t exist. you, however, hate being exposed for the scammer you are. that’s the only hate on any of these messageboards. just think, you wouldn’t need to be posting here if it wasn’t a scam.

The fact of the matter is a US federal prosecutor has stated in court that OneCoin is a $4 billion Ponzi scheme.

There is no belief required, facts are facts. As to “allowing” OneCoin to operate, you know as well as I do this isn’t going to end well for Ignatova and the gang.

Not withstanding OneCoin died in Jan 2017 when they turned off ROI withdrawals. There’s nothing much left to shut down, the damage has already been done.

@Frank, OneCoin/OneLife can’t officially operate in Germany, and probably never will.

bafin.de/SharedDocs/Veroeffentlichungen/EN/Verbrauchermitteilung/unerlaubte/2017/vm_170427_Onecoin_Ltd_en.html

@Frank, I see that you bought the lie that the German Authorities found OneCoin had done nothing wrong and was given a clean bill of health.

The multi-national criminal investigation spearheaded by the German Prosecutor is still ongoing. The US Attorney said so in this Bond Hearing.

It’s in the transcript, but I don’t think you have the stomach to even read it because it would prove to you that you have been lied to since day 1 of OneCoin.

I also bet you didn’t know that Ruja pled guilty in a German Court to 23 counts of fraud and is a convicted felon. She even lied to the court at her sentencing hearing about where she lived, what her occupation was, and how much money she was making monthly. A real class act isn’t she.

As for the claim that no-one in OneCoin has been charged with a crime, not any more. Sebastian Greenwood was arrested and charged in Thailand and was extradited back to the US. He was the #2 guy in OneCoin.

Mark and Sebastian are just the beginning. Stay tuned because there are more to come.

By your logic, speed limit is meaningless because you weren’t pulled over. i.e. “you think they would not pull you over if you were speeding”?

How could it not be deemed a Ponzi at this point?

For an organization as big as OneCoin to take years to actually launch a blockchain crypto is frankly unbelievable yet people still believe that Crypto is coming and it’s gonna be huge.

They missed the boat a long time ago and all they have left are the few people who either don’t understand the volatile nature of Crypto vs Hype or those who still don’t believe they were lied to in order to steal money.

Either way it’s a pretty sad situation to be in and may teach some people to never follow something you don’t fully research beforehand instead of relying on Yes men.

Lesson in life really. If more people applied that rule to the people we vote in Government instead of listening to mainstream media for an answer the world would be in a less precarious position.

Also: It’s not that US federal prosecutor(!) has frivolously stated that OneCoin is a criminal fraud, they had to prove a probable cause to a grand jury in order to get search warrants and seize to Scott’s money & property.

The probable cause was referred in the transcript:

You’re missing the big point in that sentence: OneCoin has stated that they already HAVE a blockchain up and running – four years ago! It’s not about “launching” a blockchain it’s about frigging showing it to the public!

(Which they completely fail to do as they obviously don’t have a blockchain. Never did.)

One of the promoters in MOROCCO Said Rajeb and his group are obviously enjoying their stolen money as I see them on FB flying,travelling all over Morocco to attract more innocents members, the bad news that Moroccon police are not beginning any investigations!!!

perhaps are prefering to close eyes about OC, cause of its black dirty hands in corruption, sureley they let them promoting OC in Morocco in condition to take their part too!!!!

So they didn’t have a blockchain crypto publicly tradable nor were they ever planning to have one. That’s my point.

Yeah it’s a valid point too. Four years and counting, yet they haven’t been able to put out a blockchain. That alone should tell all that is needed – keep away from this “opportunity”.

The US Attorney has got it all wrong. They are nothing more than “haters” wanting OC to fail.

How do I know this? Why one of Igor’s blog genius posters said, and I quote:

So far Igor has not responded. Sadly there are probably still millions who believe exactly what this poster said. They are soon about to learn a very costly lesson.

By definition a Ponzi scheme can’t “succeed” for its investors. It’s mathematically impossible.

Gotta love scammer logic.

@Lynn

Igor still has not answered. What’s wrong with him? Does his imagination lack new excuses, new visions, new lies? 🙂

share-your-photo.com/275cd51dbf

Here’s another example of how idiotic the OneCoin scammers are arguing: 😀

The OneCoin scammer Peter J. Moser from Austria has responded to a post in which the article in capital.bg has been cited.

share-your-photo.com/a5263a9fef

Well, Igor finally speaks, and I quote:

And there you have it, the definitive answer that OneCoin had nothing to do with Mark Scott.

The US Attorney and their criminal investigators got it all wrong. Too funny!

It seems there will be soon news about the US investigation, Mark Scott and Sebastian Greenwood. And OneCoin is going to post its own “official news” how it has nothing to do with anything. 😀 😀

Especially nothing to do with Sebastian Greenwood who came together with Ruja from BigCoin scam to start OneCoin.

So pathetic, Krnic.. I hope they throw Igor Krnic’s ass to jail in the end as well, for supporting the OneCoin criminals and the OneCoin scam scheme.

Very funny indeed that Igor still pretends that OneCoin has a true blockchain, while he knows for a fact that the only thing that is installed is a blockchain SIMULATOR with FAKE OneCoin “cryptocurrency” and “KYC” transactions.

Strictly separated from the OneCoin Ponzi Points transactions in member accounts.

^ Krnic once assured me he will not be keeping the forum based on his belief, so he will surely go to Sofia and ask to see his transactions from “OneCoin blockchain”.

Then OneCoin announced by itself that their blockchain has been inspected (lol), so Igor got himself a good excuse not to go anymore. He wants to live in this lie. I think deep down he knows very well that something is wrong, but he is too deep in this, and he is beyond that point that he would go by himself to see the alleged blockchain.

It would be like questioning the cult beliefs at this point. It would be too devastating for him to see the truth, and offensive towards Konstantin, so he won’t even risk it.

There is no way in Hades that Igor will ever admit that OneCoin is and always has been a Ponzi. It’s demise will be because of all of us “haters,” governments and banks don’t want it to succeed, and of course neither does any of the other crypto-currencies.

Any law enforcement action is due to the authorities believing all the lies of all of us “haters,” the banking and crypto-currency companies spreading lies about OneCoin.

Even if OneCoin manages to be traded on some obscure exchange and it fails, it will be because the members did not support it.

Think about that logic for just a minute. The members who have a boatload of cash in this will fail to support their boatload of cash making it fail.

I’m sure that piece of information is in the fantastic, awesome, brilliant educational material they all bought thinking there were buying OneCoins.

It is how he has earned the title Chief Excuse Officer.

I have learned that a Class Action lawsuit has been initiated in Coeur d’Alene Idaho against Onecoin.

Nothing showing up on Pacer (federal). Do you have any more specific information?

The person that shared the info with me now says it is not yet to the point of a class action lawsuit, but that an investigation is going on.

A class-action is civil, there wouldn’t be a related investigation. Unless the person is talking about their own investigation prior to filing a lawsuit.

I apologize, I was given inaccurate information and should’ve gathered more details.

All good, least we got to the bottom of it.

Meanwhile Ruja is sitting in some third world country counting her money, but she has achieved shit. I heard “her” baby is with the “father” (it is not even her baby as you all might know).

Fun fact: Asdis Ran is still much prettier than Ruja ever will be, no matter how much plastic surgery she invests in.

God will judge you and believe me, you will not like it.

Is North Korea a third world country? 🙂

share-your-photo.com/26fb5c423e

If Ruja is hiding there, she’ll definitely never be extradited to the United States like Sebastian Greenwood. Maybe Ruja is financing dictator Kim Jong-un’s next nuclear bomb?

As an alternative, I offer the following countries in which I suspect Ruja: Ukraine, Georgia or Kazakhstan.

My guess is she is still in Bulgaria as they are protecting her, but if she has flown the coop my guess is Dubai. She has to have a place where she can dock her yacht.

One thing is for sure, if she went to a country that had OneCoin members, she made sure they were all paid with a nice return on their investment so they wouldn’t give her up.

@Lynn

With her luxury yacht, Ruja can reach the Ukraine and Georgia very easily.

share-your-photo.com/753c95a75d

New article found, anyone has it in full?

thetimes.co.uk/article/irish-links-to-us-lawyer-in-4bn-onecoin-fraud-q86rjnp7b

The Sunday Times: Irish links to US lawyer in ‘$4bn OneCoin fraud’. Full article:

i.ibb.co/Jdp1zVH/Sunday-Times-Onecoin-full.png

I can’t wait for all the sealed filings in Scott’s criminal case to be made public. They must be full of juicy information…

From Capital journalist Nickolay Stoyanov:

twitter.com/Svrakata/status/1097489457249427457

Here are 5 out of the 6 Irish companies. In two of them Mark Scott is director together with Irina Dilkinska, who used to be presented as Head of Legal and Compliance of Onecoin.

pbs.twimg.com/media/DzsQAo3XcAEo-yc.jpg:large

You can bet your assets that Geenwood and Ruja were the “unnamed founders” of the scheme Mark wired money to from this article.

It is why I think the US extradited Sebastian back to the US. Now hopefully Ruja will be next on their target list, and can extradite her when the time comes.

Now I am beginning to wonder if Irina Dilkinska was one that received the wired money.

She was a Director and Head of Legal, so it is a real possibility.

@Otto

Your research is poor. Fake news? 😀 I only see this:

share-your-photo.com/16b4b8bba7

Another page of the dubious QTBC GROUP:

newdealshaker.com/stores/product/2784/cars-100-ones

share-your-photo.com/f752e4836d

There you could buy an option for a car for 4,477.50 euros, but no car.

Really? I can not find a QTBC GROUP in the UK commercial register. Nobody knows which person is behind this ominous “company”. Also on the website qtbcgroup.com missing this relevant information completely!

share-your-photo.com/ad4a8843bd

Which private person pays almost 300,000 euros for a Porsche? I quote from the extensive sales conditions:

That sounds very strange. If I pay 300,000 euros for a car, I want to be able to use it without any restrictions. For me this is another indication that this ominous car dealer acts very dubious!