OneCoin’s Golden Gate Investments ICO is a sham

By definition, an ICO is

By definition, an ICO is

an unregulated means by which funds are raised for a new cryptocurrency venture.

In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, but usually for Bitcoin.

Further differentiating itself from legitimate cryptocurrencies is OneCoin, who claim their planned 2018 ICO ‘will not include or in any other way involve issuance of any currency‘.

OneCoin’s ICO in and of itself is a mess.

The initial plan was to “go public” back in 2015, when a certain number of premined Ponzi points had been distributed to affiliates.

That plan was thrown out the window (along with a planned US launch and public exchange listing), with OneCoin’s “go public” date pushed farther and farther back since.

Earlier this year Ruja Ignatova encouraged affiliates to invest in OFC shares. This was on the promise of OneCoin as a company going public on an undisclosed stock exchange sometime in 2018.

That was scrapped within days of China announcing it was banning ICOs.

At the same time it was announced OneCoin would instead launch an ICO, with a goal of going public by October, 2018.

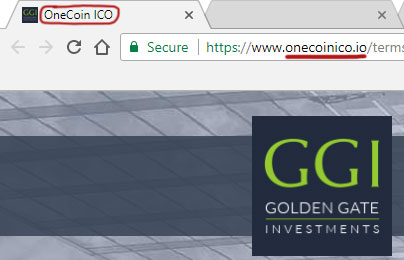

In the last twenty-four hours a website has emerged (“onecoinico.io”), purportedly sharing details of OneCoin’s ICO plans.

Following tradition of OneCoin doing business through shady shell companies, the ICO appears to be branded “Golden Gate Investments”.

No explanation about why OneCoin isn’t launching an ICO under their own company name is provided.

In fact initially you might be forgiven for thinking the Golden Gate Investments website has nothing to do with OneCoin.

The OneCoin ICO website domain was recently privately registered on September 21st, 2017.

The website is hosted on the same CloudFlare name-servers as the official OneCoin and OneLife websites, strongly suggesting both are proxied through the same OneCoin corporate CloudFlare account.

Additionally, a footer message on the OneCoin ICO website reads;

OneCoin Ltd. was founded in 2014 with the vision to become the number one cryptocurrency in terms of coin utilization and number of users.

That should be enough to confirm the OneCoin ICO website was set up by OneCoin, despite the Golden Gate Investments branding.

Moving onto the ICO itself, the presented Terms and Conditions is where OneCoin’s ICO falls apart.

As per the quote at the start of this article, OneCoin claim their ICO ‘will not include or in any other way involve issuance of any currency‘.

This is an odd claim to make, seeing as OneCoin have been insisting it’s a bona fide cryptocurrency since launch.

So if OneCoin’s ICO has is not the company issuing a cryptocurrency, what the heck is it for?

The tokens to be sold during the ICO are merely cryptographic tokens existent, that enables usage of and interactions with services enabled, if successfully completed and deployed.

Such tokens are not redeemable, associated with financial return or backed by any underlying asset or repurchase commitment and do not necessarily have market price.

Tokens? You mean the same Ponzi points OneCoin affiliates have been investing in since 2014?

Having already issued worthless OFC shares, OneCoin appear to be attaching them to an ICO, which itself isn’t really an ICO.

Affiliates will still invest in OFC shares, which OneCoin are now referring to as OFC tokens.

Confused? Yeah… that’s by design.

In a legitimate cryptocurrency, affiliates would invest in a OneCoin cryptocurrency. Once the ICO period is over, that cryptocurrency would launch publicly and whatever happens happens.

Instead, with millions of dollars invested in worthless Ponzi points OneCoin has represented are internally worth billions, they’ve come up with this mess:

Strictly speaking, the OneCoin cryptocurrency Coin Offering is not an INITIAL coin offering.

In a peculiar turn of events, OneCoin’s ICO would appear to be funded by ethereum and bitcoin.

In case a Participant sends Etherium [sic] from a wallet where the participant does not possess the control private key for, then the Participant can not claim OFC (name of tokens) and a new ones can not be generated.

By using Bitcoin and/or Etherium [sic] to purchase the OFC (name of tokens) (…)

This isn’t so unusual, save for the fact OneCoin affiliates won’t be able to cover OFC shares with their Ponzi points (OneCoin know the points are worthless).

Oh and uh at one point OneCoin was marketing itself as the “bitcoin killer”. Awk-ward.

So anyway, what happens next?

According to the OneCoin ICO website affiliates will be able to start investing in the ICO from October 25th, 2017 through to October 8th, 2018.

After October 8th the company will ‘start converting OFCs into ONE‘.

On October 8, 2018 all participants that own OFCs will be able to convert them into coins.

That means that OneCoin cryptocurrency will become publicly traded; second, that people who hold OFCs will be able to exchange them for OneCoin cryptocurrency.

Advertised investment amounts for OneCoin’s ICO are

- 150 EUR for 1500 OFC

- 1100 EUR for 20,000 OFC

- 5500 EUR for 100,000 OFC

- 11,000 EUR for 300,000 OFC

This time around there’s no “education materials” ruse or attempt to mask OneCoin affiliates are investing directly in Ponzi points.

Between now and October, 2018, if the sham goes tits up, OneCoin have included a clause wherein they attempt to conveniently wash their hands of any losses;

Anything related to the ICO or the OFC (name of tokens) could be updated, changed or modified at such time and in such manner as the GOLDEN GATE INVESTMENTS LLC may think appropriate.

In no event Golden Gate Investments LLC shall be liable for any claim, damages or other liability.

Oh and finally there’s this gem:

The OneCoin cryptocurrency is not pre-mined, meaning that the users create the market.

Which begs the question, what on Earth have OneCoin been selling affiliates for the past three years?

Claims of OneCoin running their “cryptocurrency” on a SQL database began earlier this year in February.

OneCoin confirming they don’t and won’t have a cryptocurrency script going till October, 2018 all but seems to confirm this.

Ultimately it seems OneCoin’s latest ICO attempt is a distraction from the abrupt departure of CEO Pierre Arens.

Arens positioned himself as instrumental in OneCoin’s future, but quit amid claims he had a ‘lack of leeway as a leader.’

Or in other words, Arens wasn’t able to run OneCoin as he saw fit.

The takeaway from that is this current OFC tokens/Ponzi points ICO that isn’t an ICO plan wasn’t something Arens signed off on. Such that he’d walk away from however much OneCoin have already paid him and no doubt millions of stolen investor funds had he stuck around.

And after everything you’ve just read, why Arens suddenly quit should be painfully obvious.

Ruja Ignatova meanwhile is believed to be hiding out in a $15 million dollar yacht off the coast of Bulgaria.

Update 26th October 2017 – In the few hours since I began researching this article OneCoin have already begun making changes to their ICO website.

The title of the website was initially “OneCoin ICO”:

In the last hour or so this has been changed to “GGI Coin Offering”.

The OneCoin LTD footer message cited in this article has also been changed to:

Golden Gate Investments LLC is a limited liability company, registered and existing under the laws of UAE, Dubai, possessing a commercial license in Dubai #789666 .

The Company is engaged in various activities, including but not limited to investment and management of commercial enterprises.

This suggests Golden Gate Investments is yet another shell company set up by OneCoin, likely in an attempt to circumvent the company’s financial regulatory blacklisting.

Notice the “clever” trick how they dissociate the original meaning of OFC (Options for Future Certificate; super-arcane financial term orignating from SiteTalk-Unaico ponziscam and copied by OneLife/Onecoin scammers) by (re)defining it as the name of the token in the Terms&Conditions.

They could have chosen any other name or combination of letters for token, but no, they shamelessly chose “OFC” in order to maximize the confusion for scamming.

That’s probably why they always write “OFC(name of tokens)” in these legal documents hoping people won’t notice or care. Get it, its not OFC (Options for Future Certificates) but OFC (name of the tokens).

tl;dr: OFC is not OneCoin

OZ, it should be “Etherium (sic)”, because the cryptocurrency is called Ethereum.

Also, the paragraph outlined above “In case a Participant sends Etherium from a wallet …” strongly suggests that this is going to be a token on the Ethereum network, i.e. an ERC20 token (not to get too technical, but if e.g. a user sends his Ether from a crypto exchange address, the OFC tokens will be delivered to the exchange address over which the user has no control).

As it is quite safe to assume that OneCoin is NOT a token on the Ethereum network, it follows that OneCoin and the OFC token are two completely separate entities.

The wording “The ICO performed will not include or in any other way involve issuance of any currency, securities (whether equity securities or otherwise) or other kind of investment certificates and/or instruments.

The tokens to be sold during the ICO are merely cryptographic tokens existent, that enables usage of and interactions with services enabled, if successfully completed and deployed.” is actually quite fair.

OFC is a token on the Ethereum network and no such token is a currency. Remember: OFC =! OneCoin.

Also, it’s quite fitting the masterminds decided to name their token exactly the same as the Options for Future Certificates (for the IPO that never happened).

Very interesting, you might be onto something. Notice how on the Terms and Conditions page there is no mention of “OneCoin”, the word is only mentioned in reference to url: “…Participant must keep attending the website onecoinico.com “.

The official legal document doesn’t indeed explicate any relationship between OFCs and OneCoin, supporting your view.

But OTOH, in the new FAQ they write that OFCs will be converted to OneCoins and overall it paints a picture that everything is tightly related to OneCoin and OneLife Network:

OZ.. how about this new info they give to members in the backoffice:

sb is trying to profit from the OC ICO confusion ??

Redefining a term is normal tactic for a cult.

Latest update from OneLife .Havent had time to read it yet.

mailchi.mp/cc66153d4582/jxkey6m9c9-701105?e=a0e0b3336a

Yeah. It looks like game over for the doubters now. Their insiders let them down. Onelife, Onecoin, oneworld.

@garden thanks for the corrections.

@ziomal

I’ve seen chatter about a non-MLM “onecoin” cryptocurrency over the past 6 months. It isn’t an MLM companies and has nothing to do with the Ponzi scheme.

The non-MLM OneCoin has been around for over a year IIRC. Long before OneCoin the MLM company came up with the ICO exit strategy.

@Orondo12

Game over for who?

There’s literally nothing backing OneCoin Ponzi points and no legitimate public supply and demand.

If they ever manage to convince some shady exchange to list ONE it’ll crash, same as all the other MLM altcoin scams.

The Ponzi phase of the business is/was still very much financial fraud. Ignatova and her family are living on OneCoin investor dollars, minus whatever is paid out in recruitment commissions.

@oWrongo12y/o – you just got Ruja’d!

If this doesn’t wake up the believer’s that OneCoin has been lying to them since day one, I’m afraid nothing will. They have just told everyone they have been lied to all these years.

Sadly there will be those who will buy this BS and purchase these worthless Ponzi points. Losing even more money.

As the old saying goes, “A fool and his money are soon parted.”

Ah, they’re resorting to blaming a phantom “evil twin” now. Tsk tsk.

@taysh good one. Ruja’d. Thanks to ONE I got involved with BTC, ETH and REX.

I had previously decided Bitcoin would not work. I now believe. OME might be a scam but not for any of the reasons I’ve read about here.

@kasey go to coinexchange.io there is an OC/BTC on there. There’s even a few people hating on it already thinking it’s the real coin. Lol.

OneCoin is and has always been a Ponzi scheme. Combined with pyramid fraud, those are the only reasons it’s a scam.

If you’ve made up some other bs reasons, they’re irrelevant.

ONE is now self labeled as an investment for the first time ever allowing people to buy in without purchasing through the MLM affiliates.

I guess we’ll see how things shake out as it goes hybrid and then full non-MLM. (Ozedit: Offtopic derail attempt removed)

OneCoin was always an investment opportunity, through which affiliate investors received Ponzi points from the company. Nothing has changed, other than the acknowledgement OneCoin is an investment opportunity (bye bye pseudo-compliance).

Still the same Ponzi scheme that launched in 2014. New coat of paint and hopefully new investors to fund new gowns for Ignatova. That’s all “the ICO that isn’t an ICO” is.

Your drum is a little out of tune, Oz, but I totally get why you say what you do.

If it ever does perform I certainly will not have time to be on here sparring like I’ll mannered children.

The OneCoin Ponzi scheme has already performed as designed.

Your invested funds are being spent by OneCoin’s owner(s). Unless you recruited new victims, you’ve already lost out.

You’d be better served spending what time you have looking for real work instead of chasing Ponzi dreams.

@oWrongo – RE: “If it ever does perform…”

The ENTIRE “market value” of ALL 1,204 cryptocurrencies listed on coinmarketcap.com totals $168 Billion.

OneCULT members have already begun counting down the 354 days until every one of them can sell their collective 54,425,450,000,000 Ponzi coins (which Dr. ScRud’ja had told you are €15.95 each).

Ever heard the term “SELL WALL?”

Putting aside the fact that Onecoin price has never gone down; and that Ruja has a full year to drive it up to €35, €50, €100, whatever…. Let’s just assume this SELL WALL is based on today’s €15.95 (which would make the CULT followers even more anxious to sell than they already are)!

I believe that’s €868,085,927,500.00, which in U.S. Dollars is: $1,026,459,524,113.10 !!!

A Sell Wall of over a trillion dollars?

Ummm. Well, where ya gonna find the other $835 billion dollars after you liquidate bitcoin total cap, followed by the test of the remaining 1,203 currencies?

There, fixed it for you.

Just in case anyone should be clinging to the hope OneCoin could possibly / somehow has at least some legitimacy.

Oz, there is also address onecoinico.eu which redirects to onecoinico.io. Now for the .eu we can check eurid WHOIS and get this publicly available info:

How conveniently, only one “ONS, Sofia” come into my mind: One Network Services – the shell company that owns several other OneCoin web addresses (oneacademy.eu, oneworldfoundation.eu and onelife.eu) as well as it owned the German bank accounts that were frozen.

My 2c.

Yeah, ONS has to be One Network Services.

That confirms Golden Gate Investments is just another OneCoin shell company sham.

Kind of mind-boggling authorities in Dubai and Bulgaria have the jurisdiction to shut down the largest MLM Ponzi scheme today, but don’t.

Can only wonder what it costs to keep Dubai and Bulgarian authorities at bay each month.

They have also removed the “The OneCoin cryptocurrency is not pre-mined, meaning that the users create the market” part. Google cache still shows it.

Well OneCoin does reserve the right to “update, change or modify … anything related to the ICO of OFC” (paraphrased).

With all the editing and covering of tracks, by October 2018 the current website will likely be unrecognizable.

I have no idea if it is of any importance, but looking at the website’s css file, you will notice this

They are probably referring to something I discovered the other day calling itself “ABCDe Onecoin” on Facebook.

Here it is: facebook.com/ABCDeCoinCompany/

It’s actually pretty funny to read the warnings about this being a “fake Onecoin” in the reviews. Oh the irony…

Irony?

In the case of Bulgaria, probably a Christmas card to Ruja’s uncle or second cousin once a year. Given what we know about the links between OneCoin leadership and Bulgarian organised crime, and how deeply the Bulgarian mafia has its tentacles in the state.

Dubai (Earth’s answer to Mos Eisley) probably doesn’t cost much more.

The address in #23 is a City and Postbox in The Netherlands.

Why on Earth it ends with “Sofia, BG” then?

Some crazy person wrote a song singing the praises of onelife. You have to see this!

youtube.com/watch?v=Orc8rykLqKc

TelexFree flashbacks ahoy!

Low-key pro-tip though: If you’re going to go to that much effort don’t record the audio on your cell phone.

Tsk, tsk, tsk. At least Wazzub hired a real musician.

OMG! ONECOINS ICO ADMITS IN WRITING THAT ONECOIN’S IS NOT A CRYPTOCURRENCY!!!”

(SEE #2)!!!

(does anyone read this differently? Am I missing something???)

‼️‼️‼️RECENT ONELIFE NETWORK UPDATES‼️‼️‼️

OneCoin == OneLife == One Network Services == Golden Gate Investments kek.

To further make this point:

Video (2nd Source): youtu.be/-orR5UJGAco

Can anyone s’plain why point #2 says that OFC’s will be converted to Onecoins after October 2018 ….and then 30 seconds later (immediately after point #3) the narrator says that coins can STILL be converted to OFC’s pretty much anytime before that date?

So, if I get this correctly:

A.) you have onecoins

B.) you can purchase OFC’s with them

C.) you will then have OFC’s which you can LATER convert into Onecoin’s

Just Lovely… I fear for the future of our children.

absolutely true. no more arguments left for “onecoin owners” who lost money, friends and credibility. the laugh is at those above them/you – they got your money. what you got to do is pretty clear now.

@ Timothy Curry

So, if I understand right:

A) you have coins with price 15,95 eur

B) you will purchase OFC’s at that price

C) you will convert then OFC’s LATER, at 8-th Oct.2018 in onecoins at price of 50-100 eur

Even most hipnotized onecoin believer will notice this. I think Ruja is testing stupidity of people.

Maybe this is some big, world psychiatric project, who knows…

@Tim, this is the way I see it:

1. Everybody can buy OFC the token now

2. You are no longer able to exchange OneCoin for OFC the options for future certificate

3. You will be able to exchange OFC the tokens and OFC the options for future certificates for OneCoin after 8 October 2018.

OFC the tokens shall be in parity with OFC the options for future certificates, i.e. 1 OFCtoken = 1 OFCoption.

There is no way in hell OneLife is implementing a real Ethereum-based ERC20 token and/or smart contract. They are just going to post a BTC/ETH address for incoming payments and adapt the Onelife backoffice so there is a unified balance for OFCtokens and OFCoptions.

Time to write to Jean Claude Junker, President of EU.

Time to put a great pressure on the Bulgarian President…..

Start Acting against one of the Worst PonziScheme, ever.

Okay. Time for some Onecoin “math” again!

Onecoin/OLN had placed the exchange rate of 1.00000000 ONE = 200,000 OFC, for which many converted (and Ruja most strongly recommended EVERYONE do, at Macau)

One of many Sources spread across social media: m.facebook.com/onecoinoneworld/photos/a.150768162049053.1073741829.149872495471953/228588840933651/?type=3

Based on the amount of *coins produced since Oct. 1, 2016 plus the original 1.865 billion from (fake) blockchain #1, this is over 28,875,000,000 coins in circulation.

Assuming everyone listened to Ruja and converted their ONE to OFC, this would be over 5,635,000,000,000,000 OFC’s available inn the supposed FIRST ROUND of the ICO raise (if my math is correct).

That’s 5.635 QUADRILLION OFC’s available on the OPEN market in just Round 1.

But there are FOUR ROUNDS and a full year left! Do I dare ask?: What if Onecoin price goes to €100 over the next year, as Ruja and top leaders have “predicted” in the past?? What’s after a quadrillion? And do numbers even matter to investors anymore as long as they’ll all be gazillionaires?

We know the exchange rate from ONE to OFC is 200,000. But what will the return rate be from OFC back to ONE? I’m confused! I thought Onecoin was “easier” than bitcoin and other cryptos? Want that the pitch? You didn’t have to be a “technically savvy computer geek,” etc???

Maybe this VIDEO explains it?

“New Onecoin and Cryptocurrency Made Easy for Beginners:” youtu.be/fDSydB0_Izg

Computer geek? Maybe not.

Mathematician? Probably.

The narrator in the video ( around 1:55) says “Remember, conversion from coins to OFC will stop after Oct 25th 2017″, so it seems coins cannot be converted to OFCs anymore.

I suspect the reason for this is that the old OFCs(Option for Future Certificate) were a way to convert the coins to these (scam) instruments for the (scam) IPO, and now that the IPO is cancelled, there is no need for this anymore.

For the Golden Gate Investments ICO-universe they redifined OFC to mean “name for the tokens”, so they can be only converted to coins like the promotianal tokens in OneLife MLM/education-universe. So: new OFC == token, and the tokens are the thing that unite the OneLife and Golden Gate universes.

Why they need to limit the supply of OneLife tokens (“… upon reguest”, “Less free tokens”) is probably due to fact that all those free tokens and splits make the GCI ICO offer shitty deal for ICO/OFC package buyers, because you can only get 300 000 OFCs(i.e same as OneLife promotial tokens) for 11 000 EUR with no promise(?) of splits.

Ps. These figures (comment awaiting moderation) only account for current Onecoin holders/ OFC members.

1.) When the OFC was announced, victims could also trade tokens directly for OFC’s (79 Tokens = 200,000 OFC at that time). So many traded “Tokens” for OFC’s (which are presumably now “UFC(the Token)”

Furthermore:

2.) the figures also do not account for buyers from the general public. Therefore, the 5.635 QUADRILLION OFC’s “available” was incorrect. That number would have to be MANY QUADRILLION HIGHER!

In fact, more than twice as many as IOTA individual units (machine to machine units): coinmarketcap.com/currencies/iota/

Can you imagine answering the question when presenting the ONE SCAM to someone new who begs to ask the amount of oustanding coins based on today’s market value.

Umm I believe it is “ONE TRILLION, 26 Billion, 459 Million and change.”

….. “But dont worry, that figure is just a small amount compared to what it will be worth a year from now when it goes public.”

Umm “Yes ONE SCAM..I mean ONE COIN is going to take over the world” just give me your money now and wait…

Meanwhile…Ruja was just seen on a Yacht (close to 16 million dollar boat that is) enjoying herself…

Probably the best place for her right now as it is hard to access.

Cheers..

are these token packages going to be sold via pyramid scheme commisions too, or only directly from the ICO website?

because, last night i had a dream that kari wahlroos and muhammad zafar were standing at their sinks washing out their underwear and socks for an impending world tour to sell OFC packages, because they’re sooooo done educating the world with onelife packages…..

muhammad zafar has answered this question on his FB page a few hours ago:

yeah yeah zafar remember to iron your underwear too, so that you can crackle on stage on your new world ponzi recruitment tour.

Anyone who gives money to Onecoin after so much has been revealed about their scheme must be an idiot.

Onecoin now illegal in Mongolia? (Questionable translation?)

Source: news.mn/mobile/13418

I would not care if it was legal in every country, the plan is crap, the leadership is crap and the company is run by scoundrels.

I *think* that Mongolian article is just clarification that any cryptocurrency is illegal in Mongolia.

The end of the article references countries where regulatory action has been taken against OneCoin (used as an example).

@Oz – I have a NEW Court Date coming up on December 1st, 2017 (unexpectedly [initial Trial was set previously set for October 2018, next year, at which time IN MY OPINION, Onecoin/OLN will have either collapsed upon it’s own weight, or have been taken down by the plethora of Authorities (several with whom myself and my loosely connected independent “Team” of volunteers/ “Anonymous Collective” have been providing deep information to Law Enforcement and other entities unmentioned]) and much interesting information is DOCUMENTED from the Plaintiff’s Attorney’s perspective.

While these documents and the specific “complaint” is “Public Information,” my Attorney has advised me NOT to discuss or publish ANYTHING “naming such plaintiff” or related to that specific “Motion,” “publicly.”

I have henceforth excluded mention of any specific characters, characteristics, findings, etc., which have anything to do with “that Case” or The Plaintiff in that Case (due to my now “public” Social Media statements and images published, as documented in that Complaint/ Injunction).

Therefore, I am now forced (by Federal Court Order) to be cautious not to personally mention, link or otherwise publish any images, documents or other alleged “proof/ evidence” against that particular plaintiff which implicates (he/she/they) in situations or circumstances which implicate that person (or persons) in any “Ponzi/ or illegal pyramid” transmissions.

Can you (or anyone else) cite similar diversions (in Case Law) which have inhibited a Consumer Rights/ Consumer Protection Advocate from SHARING intricacies of any similar scandal, which protect either the promoters of alleged economic fraud or the “whistle blowers” exposing it?

This might be most helpful. Thank you.

Uh, you’re still free to say what you want. Your attorney is just looking out for your best interest legally.

There is no case law stating if you get sued you can’t talk about the other party in public.

There’s also no law stating the party being talked about can’t be a fuckwit and bring it up in court to waste time and money.

Chris Principe sounds like a pretty big fuckwit so I’d err on the side of caution.

Point taken. I’ll err on the side of caution and neither confirm or deny that what you said makes any sense to me, whatsoever.

HOWEVER, that said, anyone or any entity attempting to silence either myself or publicly established evidence and FACTS, which are otherwise readily available, including INTERNATIONAL AUTHORITIES who have weighed in on the issue, will not escape the evidence which such Authorities have already weighed in on; including the Cease and Desist Orders, Bans, Fines, roughly 85 ARRESTS in at least 6 countries on 3 continents, and the RULINGS of such Authorities, such as AGCM (Italy), BaFIN (Germany – for which Authorities there have labeled me as a “key witness” in their Onecoin economic crimes investigations – perhaps having been instrumental in BANNING Onecoin therein[?]), as well as UK, Hungary, and numerous other announced or unannounced investigations for which I and others continue to assist).

I never thought that “Consumer Protection Advocacy,” particularly in the cryptocurrency space, would lead to such s well-funded counter operation against those simply publishing their findings.

To say I am flabbergasted by the “push-back” is an understatement.

The idea that an “individual” who clearly promoted and potentially had corporate affiliation with direct payment channels (ie., “MoonLearning,” and it’s many alleged derivatives) would attempt to legally attack me seems so obscure to me – especially being that the BLOCKCHAIN COMMUNITY is a rather tightly knit group, and the truth of the matter will certainly be revealed, and the community itself seems to have elements of “self-policing” when it comes to persons “credibilities.”

Afterall, the industry itself has voiced a very opposing view to obvious Ponzi and ICO activity fraud which countinues to infiltrate the space and it has attempted “self-regulation” against such VERY OBVIOUS scandals as Onecoin/ OLN.

I often wonder if this Case will go down in cryptocurrency history and the history of “money,” itself?

I wonder whether what exactly the Plaintiff aims to tie his “legacy” to? Cryptocurrency/ blockchain? Or Onecoin, which is a collapsing Ponzi scheme. I assume it could hey embarrassing. Particularly as the original Complaint stated that OneCon is a “competitor to bitcoin,” as I recall.

Only time will tell, I suppose.

Meanwhile onecoinscam.icyboards.net/ was closed. Since beginning of 2016 it’s the third German speaking online forum which has been closed. Attorneys seem to have a lot to do all around the world.

also, affiliates converting their onecoins to OFC’s will allegedly pay roughly double than what people buying OFC’s from GGI will pay:

kari wahlroos hasn’t replied to the question, but then he’s not responding to other uncomfortable questions too, like:

Any word on what happened?

@Mark

The most part of IMAs from German speaking countries (Germany, Austria, Switzerland) were listed with name, surname, address and photo in that forum and some of them reacted legally.

To every person listed you found more or less detailed links of how they were connected to the sceme, which role they had, web links to their onecoin facebook pages or websites created by them.

Let’s say that the common speech in that forum wasn’t always kind and friendly, this was probably the main reason which brought someone to react.

Interestingly nobody never reacted in the forum directly, you only heard sometimes from the admin that he got mails from angry IMAs. T

Octoberfest

hope the list details have been sent to the regulatory authorities in each country.

I get the feeling OneCoin have messed up October yet again—- last year it was the sixty fold increase in OneCoins and this year it is the senseless non existent ICO prospectus.

The Germans are right to ask where did all this vapour come from . What exchanges are the coins going to be traded on etc.

If it lasts that long next October is going to be the coup de grace with crashing values

Kari Wahlroos in his FB page has answered to some questions. More and more of talks of this upcoming “ICO” relate to “conversion” of coins upon ICO – i.e. the coins you have today will not be the coins that can be traded publicly.

AFAIK Ruja, Kari or any other top-of-the-chain person has not said that but it seems evident that there will be a new (yes – THIRD!!!) blockchain launched upon ICO and all coins will be moved to there (allegedly double coins for those who choose the OneCoin -> OFC -> ONE conversion).

Some of the OneCoin Ponzi-pimps have actually said out loud that there will be “a new improved blockchain” involved.

Anyway, reading Kari’s recent answers this once again sounds like what it will be:

NOLINK://i7.aijaa.com/m/00281/14476105.jpg

Q1. Is it true that all OFC’s will be converted into ONEs when we go public (the ones that we have already converted into OFCs through onelife.eu back office as well as those that now will be purchased through packages offered on our new website onecoinico.io?

A1: Correct.

Q2: Members who have their coins in the back office and have not converted them into OFC’s- do they have to convert them in order to get ONEs when we go public ?

A2: No, you do not have to convert your coins if you do not wish to, however – by holding OFC’s you will receive more coins.

Q3: If people are joining through onecoinico.io – will they automatically become a member of the OneLife Network?

A3: Yes, according to my knowledge.

Q4: Will splits work the same way on both platforms (Websites)?

A4: Yes.

OL Newsletter(sick and tired of this ponzi )

mailchi.mp/c17eebae9daf/jxkey6m9c9-701113?e=a0e0b3336a

@MOI – RE: Newsletter

Isn’t it strange that no mention or clarification of “OFC(the token)” or the ICO at all? No clarification on where out of left field “GGI” came from, or data on any individuals from the company/ new alleged partnership.

No clarification WHY OFC’s even still exist of what their carnival rate of exchange might be (other than rumours of yet another “doubling,” as far as I’m aware – even Kari Wahlroos send to be unclear about this. Lol.

Cheers to the most “transparent” company ever 😉

Has Thailand banned the onecoin scam yet?

@Yo

Until now there has been only a warning from the Bank of Thailand.

You can find a complete list of countries where onecoin has been banned or warned from here: onecoinscam.info/prohibitions/

No but sales have slowed dramatically this year. Friend who has made a lot of money selling packages, against my advice I should add, is now waiting for the ICO and has moved on to other opportunities.

The warning from the Thai Govt did nothing to slow sales when it was issued according to my friend.

kari wahlroos is telling affiliates to be hands off GGI as it is a third party entity:

only an idiot would believe GGI is not a product of ruja’s ass.

i think there’s a lot of confusion and no leadership in onecoin now, and no one knows what exactly is going on, including one of the topmost guys, kari wahlroos.

yesterday, he apologized for some clarifications to questions he provided on FB, stating they were wrong [see post#61]:

well kariboy, you have no management at onecoin and your scam is running blind right now. it’s a bit late to complain about information that ‘should have been available long ago’.

you and your scam has always lied, deceived and withheld information about everything from your fake coin and its fake blockchain to IPO’s and ICO’s.

but, kari apologizing and complaining on FB could be a carpet layer for an impending walkout by him – i’m unhappy with the management so tatabyebye. thanks for all your money.

It’s not even a question of belief, the GGI ICO website domain was registered to One Network Services… obviously the same company.

That is the full truth! It was a scam sold by people telling lies and it’s still a scam sold by people telling lies.

@ Santa Maria

Please contact me via melanie.breuer[@]freenet.de

KARICOIN -BORN FROM THE SUCCESS OF BITCOIN AND THE FAILURES OF ONECOIN!!!!

Sounds as if kari might be ready to jump but dont imagimne he will go quietly like Karlsson and Juha are alleged to have done -broken promises don’t sit well with Wahlross as h went public and threatened to take legal action.

I have it o good authority that he sees himself as an Eagle ad not a chicken -ie circling above it as much as possible, swooping in and sqwuarking on those below -ie all “normal” Affiliates who just paid the money for his super cars.

in a recent video uploaded by master distributor sebastian greenwood on 30th oct, 2017, he insists that affiliates should not bother with GGI packages, as GGI is a completely ‘independent’ company from onecoin/onelife.

he says the GGI package offering is to add ‘credibility’ to onecoin. translated, that means ruja is trying to show that people outside the onecoin pyramid scam are also buying into the ICO for investment purposes, and so it’s a genuine ICO offering. some hack lawyer must have advised them to set up an ICO ‘retail’ site for psuedocompliance BS.

greenwood is now promoting the ICO ‘initial launch package’ [ILP] for the network, which of course comes with splits and commissions and a whole new world of fresh scamming for top affiliates.

kari wahlroos was unable to answer this^^ question asked by an affiliate on his FB page – the ICO sham is such a mess, poor kari’s got his knickers in a twist!

after three days of silence he finally wrote yesterday:

y’all think he’ll get an answer and post it? 😉

Sebastian Greenwood spoke for 16 seconds at Lisbon on the upcoming alleged ICO and said that there would be a monthly follow up when we would hear his updates.

He then carried on for an hour and a half along with an Italian cretin called Andrea and our well known INternational Ambassador -Kari Wahlross.

So on 30th October he spoke for another hour and a half and apart from the usual hype and half truths (half my be his favourite number). he has left as many questions as answers –SEE BELOW..

I need some clarification regarding the upcoming ICO and one of you may be in he best position to answer?

Category 1.

For those who transferred all or some of the coins to the OCO offering Sebastian Greenwood on his 30th October has said that they will have to wait between 90 and 140 days to get their coins back. But he explains he can’t tell them when as they can do as the calculations are unknown but we are to trust him.

Whilst suggesting the blockchain is “nearly full” the effect of such delay is that the established OneCoiners (like your own good selves )will or may be ineligible to participate in the 1st round of the ICO offering (although that was what Affiliates were offered some months ago when they signed up some months ago for the OFCs.

That was when an IPO (rather than the subsequent ICO) was offered and the continued closure of the xcoinx exchange was associated with regulations associated with the IPO share offering.

Greenwood explains that the change to an ICO was made for “obvious reasons” and apparently it was for “jurisdictional reasons” I am aware that China (OneCoins biggest Affiliate /Investor base has banned ICO’S so this is questionable. Please explain.

Category 2

For new recruits they are being focused on the ICO packages with double super splits and the education is being phased out.

I see that these guys purchase tokens which increase exponentially but what is a token worth as there are disclaimers in the associated Terms and conditions. They state that the OneCoin ICO will not include or, in any other way, involve issuance of any currency.

Some insight is given into the purpose /role of tokens in that “ The tokens to be sold during the iCO are merely cryptographic tokens existent that enables usage and interaction with services enabled if successfully completed and deployed.”

What does this meAn and what value are the tokens?

Category 3

For established OneCoiners who want to cash in how can they do so? Alternatively, how do they change their current coins into the post October 2018 (supposedly) Coins.

Do they actually have to do anything or will this automatically happen at that time? Please clarify.

As OneCoin is now self labelling as an investment opportunity what is the legal liability for Affiliates to be holding these Coins etc.

i have sent this to the Irish pioneer who has fled to Portugal and offered his attendance at an EGM in December but imagine he will be unwilling or unable to answer?

Where does this “nearly full blockchain” fallacy originate from? Has some leader actually said out loud something like that?

@Otto

youtu.be/3fp5bLXuz6I

Listen at 3:30:

But remember, “we define the rules (and definitions apparently) of what cryptocurrency is.”

Hahaha!!! Can’t make this up!!!

I’ve tracked a lot of stock scams but not MLM until this one.

There is something that doesn’t seem to have been mentioned with the OFC’s from Golden Gate; but could be a possibility.

In order for the top level promoters to get rid of onecoins, they could be selling them as OFC’s at Golden gate.

Later, next year when they open the market and coins sell for a under a penny, they do the transfer between accounts. They are effecting an early sale to get rid of coins at some price over 0.0001.

If it’s like stock scams with billions of shares, that’s where they end up (with no bid at 0.0001).

Low level newbie promoters such as Ken Labine would not be far enough on the inside for this one.

It’s like shorting the box with unregistered (and unknown to the public) shares that take 6 or more months to get legally registered.

@ Otto

yes it was in Greenwood’s presentation (as Tim confirms in his post) about 3 weeks ago and is included with all the other rubbish stated above–see post 74

This is on a par with increasing the blockchain from 2.3 billion coins to 123 billion last year(October 2016).

I anticipate you may well be more “techie” than I am . Please demolish what Greenwood said in straight forward language.

I think He also said at his dinner speech at Lisbon that the y had already mined 100 Billion Coins and there were only 23 Billion left for the outstanding ICO so I have little idea what that meant as well.

Yes I am dumb but that is why I rely on OneCoin for clear transparent communications (irony!).

THANKS

@crypto kill

Just to be consistent, it was 2.1B to 120B.

The Capital confirmed Ruja was not arrested at Munich airport:

https://twitter.com/Svrakata/status/928342013669453827

Sources say Ruja is still on maternity leave.

Hardly any talk about the big ICO. We all know if it was going well, they would be throwing it in all of us “haters” faces. To me this means it has been a big bust.

Anyone have any news about it?

Perhaps not important, but the husband from Ruja – Dr. Björn Strehl – closed his Domain w.w.w.matunos.de

The domain started at 03. 04. 2017 and actually you can read: “Coming soon”. Why that?

ICO Offering registration gets delayd. New company SILO Capital Group taking over the operations of coin offering. No hits on google about SILO Capital Group…

https://i.imgur.com/r5LkFme.png

Why on earth the ICO would need to be delayed to Q1 2018? They already gave a date for the start of the ICO long time ago and the delay was supposed to be because people wanted more education, not because there are any difficulties in the ICO itself.

(Trick question; they just want to delay everything that even remotely could lead to money escaping the scheme.)

My best guess is that they don’t know what they’re doing.

First IPO OFC, now ICO OFC as a token. And they gonna publish a whitepaper for that token. So they can sell OFC Crypto token that later can be exchanged into OneCoin?

That, by they way is also supposed to be a Crypto token that can only be purchased with educational “free” token?

Not to mention the OneForex, xcoinx, GoldGoldCoin, OneCloud, OneTablet, etc., desasters…

And why can’t the company do an IPO? Because a Crypto Currency can’t do it?

Isn’t OneCoin just a part of that company? Go on, do that IPO… Who the heck understands what’s that all about?

Thinking about it, they might just want to confuse people to say: “See, we tried everything to make this work. It just didn’t. So long… and thanks for the fish.”

can’t offer an ICO for something that doesn’t and will never exist.

complete mess . Someone ought to mention to OneCoin that a white paper(which you and I might understand as a Prospectus)normally starts the process and is not an after thought.

OneCoin has managed to confuse Affiliates with different explanations over the last six months— ipo’s .ofc’s, ico’s and now the alleged white paper will follow by end MARCH 2018!!!

Still must be difficult getting someone to write a prospectus for something which does not exist and/or can’t rationally demonstrate its existence. I think Silo will just give up andenjoy taking the money

Then another 90 -140 days to sort out OFC transitions(Well done for being an early bird!)–Greenwood 30th October explains. Then 4 rounds of ICO purchases (or maybe something else? ) and China -their biggest market has banned ico’s.

THESE DELAYS ARE EITHER MILKING THE CASH COW OR BECAUSE THEY HAVE NO IDEA WHAT TO DO NEXT?

Ruja -the genius -is either in a German jail or locked up in a boat on the Black Sea-or back in Dubai.

Expect the coin value to increase cos we said it would be 25 Euros by year end. Time to buy the bargains off Dealshaker while you can still buy rubbish.

This has become a global Pantomine but a really bad ending seems to be in sight.

Event seems to be most important as always. We want more money we want to fool you as much as we can ..THE ONE’’ is just around the corner and is gathering members from the whole Asia-Pacific region to celebrate the growth of the OneLife Network!

According to ICO documents, there will be 120B onecoins.

You can buy 300,000 OFC for 11,000 euro. That makes each one coin worth .04 euro or $.05 USD.

Since they have been saying it was worth USD7, that is a 99% drop in value. Did they think no one would notice? What a crazy scam. They cannot even do arithmatic right.

Actually, the current fictional value of ONE is 20.65 EUR as shown on dealshaker.

All the top promoters and staff bailed long ago, so what do they care.