OneCoin fraud SARs featured in FinCEN Files leak

The FinCEN Files leak contains two Suspicious Activity Reports (SARs) pertaining to then suspected OneCoin fraud.

The FinCEN Files leak contains two Suspicious Activity Reports (SARs) pertaining to then suspected OneCoin fraud.

The leaked SARs reports flagged $137.6 million in OneCoin related transactions.

The twenty-nine transactions took place between 2015 and 2016 and spanned thirteen banks, one of which was the Bank of New York Mellon.

The bank wrote that the companies appeared to be engaged in “layering” — a technique used to disguise the source of illicit funds by routing it through multiple transactions.

Another was Associated Foreign Exchange Inc., who flagged $50,000 transferred from an Australian woman to “two OneCoin companies”.

We don’t know who this person is for sure, other than she owns/owned an “organic skin care company”.

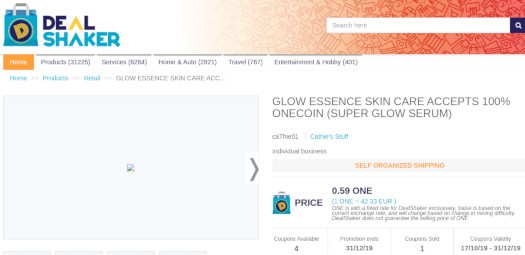

One possibility is OneCoin distributor Catherine Olarte (aka Cathie Louchloecha), who sells Glow Essence Skin Care on OneCoin’s Deal Shaker platform:

Olarte’s provided DealShaker contact details is a street address in Queensland, Australia.

Based on Glow Essence Skin Care’s Facebook page activity, Olarte was an active OneCoin distributor up until late 2019:

Whether the OneCoin SARs assisted US prosecutors put together their case against OneCoin found Ruja Ignatova and her money laundering co-conspirators is unclear.

Whether the OneCoin SARs assisted US prosecutors put together their case against OneCoin found Ruja Ignatova and her money laundering co-conspirators is unclear.

Although indicted and wanted by US authorities, Ignatova remains a fugitive on the run. She hasn’t been seen since late 2017.

The FinCEN Files are a series of leaked SARs initially provided to BuzzFeed.

BuzzFeed shared the leak with ICIJ and other organizations, who together processed the leaked information for publication.

Unfortunately a decision has been made not to share the full reports. As such we have to rely on redacted reporting for now.

By “connecting the dots” it is possible to get more details about the banks and transactions of one of the two SAR cases related to OneCoin.

Download a zip file named download_data_fincen_files.zip via the “DOWNLOAD THE DATA” link on this page:

icij.org/investigations/fincen-files/download-fincen-files-transaction-data/

Unzipping results in two files:

download_bank_connections.csv

download_transactions_map.csv

These files can be opened in any text editor, or imported in a spreadsheet for better readability (in Excel: Data – From Text/CSV – browse to the file – and then during import chose something like “Comma separated file”).

Go to the first “leaked SARs report” link in Oz’s article above, and on that page to FOLLOW THE MONEY. In the orange box on the right a “July 13, 2016” transaction of $30 million is mentioned.

Then use search string “Jul 13, 2016” in file download_transactions_map.csv and you will find a matching transaction with a 30000000 transaction_amount (the last field in the line).

The second field in the same line is icij_sar_id with value 3381. Five subsequent lines have this same SAR id 3381. The very first line in the file contains the field names, separated by commas.

For instance, the second line represents:

– 4 transactions (next to last field in the line)

– for a total amount of 64017260, about $64 million (last field in the line)

– from filer The Bank of New York Mellon Corp.

– originator bank DMS Bank & Trust Ltd in Cayman Islands

– beneficiary bank Bank of Ireland in Ireland

Mark Scotts transcripts will probably also contain info about these transactions.

Ah so that’s what you can do with those CSV files. I got as far as opening them in Calc, realized it didn’t have any names and fell asleep.

BNY Mellon apparently reported more than the $137 million.

This was said during the testimony of BNY Mellon AML boss David Wildner at Mark S Scott’s trial:

(p. 149 / Tr 1432; .courtlistener.com/recap/gov.uscourts.nysd.482287/gov.uscourts.nysd.482287.201.0.pdf)

So in January 2017 BNY Mellon reported over $200 million OneCoin money that Frank Ricketts (and Manon Hübenthal) laundered through their IMS entities. In February 2017, they apparently found & reported $137 million more.

Please can we have a reset here. There is a lot going on amongst the chattering that X bank did so much for OneCoin, etc.

The banks are largely not complicit. They process millions of transactions every day in the case of HSBC or BNY, etc. Their legal duty is to Know Their Customer.

OC hired professional money launderers and lawyers like Mark Scott to get past that. Irina had over 200 legal entities to hide behind and the help of top lawyers.

The FinCen data shows that the banks named have working processes. Stopping the transactions and not reporting is a criminal offence. They reported. They did what they were supposed to do.

Instead of attacking the banks in the FinCen disclosure, rather look at banks who completely f’d up – Bank of Ireland neither reported, nor cared and then wouldn’t let their staff testify as to why the bank sucks.

I do differentiate between HSBC leaving WCM777’s accounts long after regulatory action has been taken, and banks being used by professional launderers.

That said be it FinCEN or the banks, clearly what’s in place isn’t effective enough.

After filing suspicious activity reports you must continue operating the bank account as normal. Closing it at that point – i.e. saying “We think you’re a scammer and we’ve reported you for money laundering, now go away and take your dirty money with you” – is “tipping off” and a serious criminal offence which could land you in jail.

How long after filing SARs you can exercise the normal right of a business to refuse custom is a grey area.

The onus is on the authorities to instruct the bank to freeze assets.

Why is what’s in place not effective enough? Mark Scott is in jail. The receiver for WCM777 managed to return 86% of the amount claimed which is absolutely incredible. Scam victims usually lose everything or get back pennies in the pound. Banks aren’t able to stop scams before they’ve started.

The issue as I see it is what happens on the law enforcement side when a SAR is filed.

It’s all very well to cite OneCoin as an example, but what about all the other SARs we don’t know about that aren’t acted on? I’d be willing to bet there’s filed SARs related to Ignatova that haven’t been acted on.

As for WCM777, Xu primarily scammed victims in China. Liu still managed to run off with $30 mill+, which he obtained by clearing out the HSBC account, which the bank kept open for months after the SEC filed its lawsuit.

Liu was able to clean out the accounts despite WCM777 having supposed to be frozen as per the usual court-ordered injunction.

I worked for an FIU and I’ve been an MLRO. There are different kinds of reports.

The most useful SAR to an FIU is called a “defensive”. An MLRO reads about something or learns that someone is an object of interest, freaks out and has everything their institution ever did with that person reported.

An MLRO can be liable for not reporting personally in many jurisdictions if they subjectively should have known. A “normal” is something a staff member or monitoring system highlights.

The MLRO has the discretion to report to the FIU or not. “Thresholds” have to be reported, as does anything involving a PEP although that isn’t a rule but is expected.

All the info goes into a massive data base where software tries to do matches and determine relationships. That is shared with other law enforcement when they want it and other FIUs.

FIUs have flags on their systems and can demand data. Those are “requests”. Then BTC happened and shadow banking emerged as a result.

Plus you get bad apples everywhere and the pay to beat the system is lucrative.

In the OneCoin victim Class Action plaintifs Donald Berdeaux and Christine Grablis have filed their second Amended Complaint:

courtlistener.com/recap/gov.uscourts.nysd.515064/gov.uscourts.nysd.515064.122.0.pdf

Gilbert Armenta and Bank New York Mellon have been added to the Defendants list.

Konstantin Ignatov was dropped, but still receives an honorable mention in the Related Third Parties chapter, just like Irina Dilkinska and Simon Le.

Here is a long Buzzfeed article in German which includes the original FinCen OneCoin SAR documents:

buzzfeed.com/de/marcusengert/onecoin-banken-fincenfiles

They show that the SAR reports included BehindMLM and Ari Widell’s blog as sources for the IMS-OneCoin connection.

Pretty good overview of the saga, but no crucial new info. Alleges that money laundering reports from a German bank Sparkasse started the OneCoin investigations, and these details about Ruja’s Dubai mansion were new too:

It has some errors such as saying that Finnish police had launched an investigation on OneCoin(never happened) and alleging that Ruja actually bought the Madagascar oil field (unproven and unlikely).

I wonder how many SARs BehindMLM has featured on over the years.

“Sparkasse” is not the name of one bank. The word itself generically just means “savings bank”, but in Germany is used for a specific, legally defined type of institution: locally operating, publicly owned, not-for-profit banks, the vast majority of them owned by municipal authorities (either one, or several smaller ones), a very few by publicly controlled non-profit foundations.

They have a nationwide cooperative organisation/guarantor, and all use the name and brand identity “Sparkasse”, but that’s always followed by the name of the town(s) or city which owns them, and that’s the only place where they operate.

They offer the exact same kind of services any commercial bank does to private and SME business clients, and they don’t receive any public funds, they have to pay their own way, but they’re not intended to generate profits, just to provide banking services to the local population (who, as local taxpayers, collectively own them).

So the small Sparkasse in a town near the border with the Netherlands mentioned in that article, as the very first to file a OneCoin money laundering SAR, in December 2015, is one of these 431 local banks.

That’s not at all surprising. An amount like the 2.5 million euro in question might not even have been noticed in a big branch of a large commercial bank. But in such a local bank, in a small town, where “Knowing Your Customer” is not so much a legal requirement as an obvious statement of fact, a transaction that size, most likely by a brand-new, non-local client, would probably always be looked at personally by someone at the very top of management.

IOW, trying to use a Sparkasse is a really, really stupid choice for a money launderer – the smaller it is, the bigger the stupidity.

This snippet from the FinCen SAR report refers to an interesting connection I found some months ago with regards to Mark S Scott and his history of scamming with Gilbert Armenta & other Zala Group associates:

SpotFn was an investment scam headed by Mark Suleymanov as described here in a SEC law suit:

(sec.gov/litigation/complaints/2018/comp24364.pdf)

Binary Holdings is a SpotFn linked entity as this State of Missouri Cease & Desist order tells:

sos.mo.gov/CMSImages/Securities/orders/AP-15-12a.pdf

Gilbert Armenta’s Zala Group was the “billing agent” for at least in SpotFN:

web.archive.org/web/20150204052028/http://binaryacademics.com/billingagent.html

It appears that Mark S Scott and Zala folks laundered SpotFN money by establishing a complex network of companies tied to branch offices in Georgia.

This is what I’ve found regarding the Zala-Scott money laundering network for the two FinCen mentioned Spotfn names

1. For “SpotFN” they established

– A Georigian branch office company which had Gilbert Armenta & Diane Lynn Cook as its directors (companyinfo.ge/en/corporations/672479 ; docdroid.net/XDjJ1lE/spotfncom-pdf) for a Florida based company Spotfn.com LLC(opencorporates.com/companies/us_fl/L14000162098 ) which had Mark Scott as its director.

– A Georgian branch office company which had G Armenta & Diane Cook as its directors (companyinfo.ge/en/corporations/672470; docdroid.net/cx0aC3e/spotfnltd-pdf) for a BVI based company Spot FN Ltd (William Morro as director; “ZGL Holdings LTd” as the shareholder))

2. For “Binary Holdings” they established

– A Georgian branch office company which had Gilbert Armenta & Diane Lynn Cook as its directors (companyinfo.ge/en/corporations/672487; docdroid.net/vOAXhmi/binaryholdingswithscott2-pdf docdro.id/vOAXhmi) for a Florida based Binaryholdings LLC (opencorporates.com/companies/us_fl/L14000162086) which had Mark Scott as the director.

– A Georgian branch office company whichh had Gilbert Armenta & Diane Cook as its directors (companyinfo.ge/en/corporations/672469) for a BVI based Binary Hldg’s Ltd[sic!] which had William Morro as the director.

Georgian lawyers Archil Mchendlidze and Valeri Bendianishvili were heavily involved in these schemes.

I may elaborate at some point but William Charles Morro has been a key figure in Armenta’s schemes — including OneCoin related ones. With Armenta, Morro acquired and destroyed banks in Georgia and Zambia for Ruja… I wonder if Morro has been or will be arrested too.

It’s also funny that Armenta’s office lady Giselle Valentin was the Notary Public of Florida in the SpotFN docuements above. (A conflict of intersted?)

Despite being an accomplice in Armenta’s money laundering schemes — as the SDNY court trancripts tell — she is still a Notary Public in FLorida: notaries.dos.state.fl.us/notidsearch.asp?id=1237030

Some of these company strutures may have even used to launder OneCoin money too. I wonder could this SpotFN scheme even be the heavily redacted, mysterious “illegal online gambling platform” used to launder OneCoin money that was mentioned in Armenta’s indictement.

Armenta used the same Georgian branch office schme with OneCoin related entities too, at least in a known OneCoin money laundering entity One Eux Ltd

GE: companyinfo.ge/en/corporations/672275

US: opencorporates.com/companies/us_fl/L15000201559

UK: opencorporates.com/companies/gb/09976228

And Ruja herself established a Georgian company for OnePay:

companyinfo.ge/en/corporations/281666

docdroid.net/tplg7uy/onepay1-pdf

Seeing the name William Morro(w) pop up reminds me of the following blast-from-The-past Onecoin story, as it was the name chosen by a scammer “journalist-for-hire” in Africa who published Onecoin propaganda for Huffington Post (also mirrored on Yahoo), at the behest of Ruja & Co., some years back under the deceased profile and image of one Morrow Willis:

MORE:

https://behindmlm.com/companies/onecoin/stolen-deceased-identity-used-to-promote-onecoin/

Either total coincidence (most likely) or just more Onecoin weirdness.

Long form article from the Miami Herald based on the OneCoin SARs that’s worth a read (no new information):

miamiherald.com/news/local/crime/article245623470.html

Here is a bio of William Morro;

(erieri.com/executive/salary/william-morro-1pg2)

Here is another bio with a photo: aeepower.com/our-people/william-morro/

So William Morro was on board of directors in the bank that Gilbert Armenta acquired for Ruja Ignatova & OneCoin in late 2015.

In late 2016 — possibly after JSC Capital had run into trouble for launding OneCoin money –, Armenta and Morro bought InterMarket bank in Zambia, which in turn went bust pretty soon after they arrived: lusakatimes.com/2016/12/01/intermarket-bank-customers-cry-money/

Armenta and Morro were indeed key figures in that bank:

(diggers.news/business/2017/04/20/intermarket-probe-exposes-boz-negligence/)

In addition, Zala Group’s 2016 contact info lists “Intermarket Banking Corporation (Zambia) Limited” as one their offices –> web.archive.org/web/20161214234159/http://www.zala-group.com/contact

Being Zala Group-affiliated in 2016 makes it pretty certainly part of OneCoin money laundering structures. Too bad for poor Africans who lost their money for these crooks.

There is also the UK based MoneySwap Plc which Armenta and Morro went on to buy in early 2017 through their Dutch company Wraith Holding B.V:

markets.ft.com/data/announce/detail?dockey=1323-13175109-1ES822R6TCIIFF9FQENT07IJPH

From at least the summer of 2017 to this day Zala Group has listed MoneySwap as its UK & Hong Kong offices:

zala-group.com/contact

PRetty sure MoneySwap was used to launder OneCoin money too.

In addition to the SpotFn connection I uncovered in previous post, this further shows that William Morro has been a key partner for Gilbert Armenta and Zala folks — and by extenstion Ruja Ingatova — during these years.

I wonder could it even be that Gilbert Armenta is the junior partner and henchman for Mr Morro, who has is more experienced and reputable than Armenta…

buzzfeed.com/de/marcusengert/onecoin-banken-fincenfiles

The “SÜDDEUTSCHE ZEITUNG” from Germany writes:

share-your-photo.com/aa5d70eb71

projekte.sueddeutsche.de/artikel/wirtschaft/fincen-files-die-milliardenbeute-der-kryptoqueen-e902472/?reduced=true

Ken is back:

youtu.be/AY02dpQolss

Ken Labine: i HaVe A wEiRd WaY oF bEiNg AbLe To ExPlAiN tHiNgS!

Also Ken Labine: Still can’t explain how OneCoin wasn’t a Ponzi scheme he promoted for years.

eDuCaTiOn PaCkAgEs! tHe Us GoVt ArE hAtErZ! aMeRiCaN pRoPaGaNdA! i’M rEsPeCtEd In 199 CoUnTrIeS!

Ah, the Ken “I haven’t met a Ponzi I can’t pimp” Labine… or was it Ken “Sunk Cost deeper than the Titanic” Labine?

Maybe it should be Ken “All Ponzis Matter” Labine, or Ken “No Ponzis Left Behind” Labine?

^^^Baaaahh Hahahahahahahaha!!!!!

We missed you and your amazing ability to take a fact and twist it into false propaganda & fantasy, as per what you became infamous for, Labil!

Welcome back. Hope it solidifies your place in the Ponzi history books for decades to come!

Ps. If you made commission from PONZI FRAUD, it was YOU who got “paid.”

…Not the PPP’s, PCP’s and so-called “haters.”

Police, Prosecutors, Plaintiffs and the rest of us just like to expose the hardcore scammers, like yourself. Good. luck in Life

So Ken says he was only worried about the count 3 – Money Laundering – to which Konstantin didn’t plead guilty of?? 😀

I don’t know if he is again just purposely twisting or did his diet pills have any bad effect, but pleading guilty to Count 1 and Count 2 (the wire frauds), was the one where Konstantin pleads guilty of earning money through illegal activities.

courtlistener.com/docket/15688339/311/united-states-v-scott/

Here’s the 2 first pages of the plea agreement showing that Konstantin pleaded guilty of:

Count 1: (Conspiracy to Commit Wire Fraud)

Count 2: (Wire Fraud)

Count 4: (Conspiracy to Commit Bank Fraud)

i.imgur.com/AlD5FAN.png

But in Ken’s mind the only thing Ken was worried about was the money laundering count, because somehow in Ken’s mind only THAT Count 3, money laundering count is about “earning money through illegal activities”?!? 😀

Sure Ken, nice try.. Or not really. I know you are reading this, you clown. Stop eating those diet pills.

LOL LOL LOL Welcome back Ken, we really missed you!

Yes, keep posting Ken. Keep using that “talent”, not just a little bit, but every day to make us laugh again 😀 😀 😀

Ah, I think we call these in America “credit unions”, though it is not an exact parallel, of course.

They offer same service as the banks, usually have better loan rates, but often restricted to one specific group, social, ethnic, employment, one town, etc.

Just think, if Ken is right about his not pleading guilty to count 3 of the money laundering charge and it only deals with “earning money through illegal activities,” K would be facing 120 years if he had instead of the 90 he is facing now. I am sure K is breathing a big sigh of relief he is only looking at 90 years instead of 120 years in prision.

When you do a plea deal Ken, part of the deal is to avoid having to plead guilty to every count of your indictment. It doesn’t mean that you are not guilty of those charges.

Of course Ken missed the part where K admitted, under oath, that he was part of an illegal company and OneCoin was all a giant Ponzi. Selective reading much Ken?

You are even dumber than I gave you credit for being, and I didn’t think that was possible. But once again you have risen to the top to show your true stupidity knows no bounds.

Now wouldn’t it be ironic if Ken is included in one of the documents that are still sealed in the OneCoin case.

Hi, sorry if I get in the way but we are skipping the crux of all ponzi schemes, and that is human greed and stupidity.

these ignoble characters leverage this and I do not think they threaten people to join these scams, then if the legislature is poorly laid out and allows them to slip into the folds of the laws …

well that it is also our rulers to blame, the truth is that I do not want to solve the problem definitively because they too speculate on us.

The criminal fraud scheme promoters gathered all the biggest leaders yesterday to hype for the Latam market.

Cristi Calina lied that there was a big investigation in cooperation with UK, Germany, Poland and Romania authorities and OneLife in Romania won the case “proving that they are not a ponzi, and they are legal in EU”.

We will see what Cristi is going to show, as he claims to present some kind of “paper” soon.

The talks become more and more arrogant, because the EU authorities get nothing done, and there’s a complete silence about the US case, Konstantin, Sebastian etc. in the network events.

Starting from position: 1:00:15

facebook.com/ONELIFEFUERZALATINA/videos/621506008732279/

Caveat: I’m going on the summary given in the comments above, I’m not going to check Labine’s video, the man’s voice makes it impossible for me to listen to him for more than five seconds.

(1) Does Labine simply ignore the fact that Mark Scott was found guilty of money laundering?

(2) If he says Konstantin didn’t plead guilty to money laundering, he’s either lying, or he’s too thick to understand the plea agreement letter. As it clearly states (such documents by definition must be very clear), K pleaded guilty to all four charges.

That’s also why he is facing a maximum sentence of 90 years, which the letter helpfully breaks down:

1. Conspiracy to commit wire fraud: 20 years

2. Wire fraud: 20 years

3. Conspiracy to commit money laundering: 20 years

4. Conspiracy to commit bank fraud: 30 years

There is only a restriction agreed to as regards forfeiture (paragraph 8 of the letter). For counts 1, 2 and 4 that is always limited to gross personal gains.

Count 3 means they could theoretically try and get the total sum that went through the money laundering scheme from him – which he obviously doesn’t have and never had.

So the agreement is that forfeiture for that, too, will be limited to his personal gains. I imagine that’s a fairly common restriction in such plea bargains.

But at least Labine, unlike quite a few other OC peddlers, seems to understand that money laundering means that the activities from which the money came were criminal.

Pretending that money laundering is just some standalone, highly technical violation of arcane financial rules, has been a standard tactic from the continuing scammers.

OC has moved and still moves a considerable amount of money, and this is tempting to many, as the cases of the banks involved show (it is only the tip of the iceberg).

those of OC have been very clever in using dealshaker as a tip of diamond, making the holders of the alleged crypto believe that they have purchasing power (the owners of the companies that sell on this platform would not be surprised to find them in the upper floors of the scheme).

I will be wrong but to combat these schemes you must not fight them but regularize them, then impose a 25/30% tax on him in Fiat currency, in the long run the market levels everything.

@PassingBy

Thanks for the clarification about the forfeiture, yes of course Konstantin pleaded guilty on all 4 counts. It’s said in the first paragraph of the letter even.

@Semjon

The domain onepay.eu can be bought since March 29, 2020!

share-your-photo.com/0dab34d7d5

share-your-photo.com/0b10fe6006

The original domain registration from onepay.eu

share-your-photo.com/95ebc41ec0

An old screenshot from onepay.eu

share-your-photo.com/e736b56399

Does anyone need a new car? I have decided on a Mercedes Benz Maybach S 560 Premium and will pay 100% for it with my valuable OneCoins.

share-your-photo.com/9d2a5c9148

The next lie from this unknown OneCoin scammer from India:

share-your-photo.com/9601951864

youtube.com/watch?v=c6nPY8AMe2s

Is that possible? I doubt it, because the fraud portal qtbcgroup.com has not been available for 10 days. Here is an old screenshot with the alleged CEO Dr. Kholusi:

share-your-photo.com/2a3a6583a6

In February 2019, OneCoin scammer Sajaval Nadeem had spread a similar lie:

share-your-photo.com/f8dcf939f4

Crypto global INDIA‘s YouTube channel contains 285 videos with similar lies. As is common with scammers, this notorious liar doesn’t give a name or contact details.

youtube.com/channel/UCpbasfUJbNQ1-TX0RLG8toQ/videos

What does OneCoin scammer Thanh Duong from Australia say in this video from October 22, 2020? In the first part he speaks English.

share-your-photo.com/06a91c0046

The start of the OneExchange has been announced since October 2014. During that time a woman could have given birth to six children …

youtube.com/watch?v=b2YHPjVNq48

Now I wanted to order three new cars from the QTBC GROUP, but my email could not be delivered!

share-your-photo.com/4a9edfa297

Do I have to fly to Baku now and hand in my order personally?

share-your-photo.com/05cd68196a

By the way: The country code +44 applies to Great Britain, not to Azerbaijan.

Markus Miller has been warning of OneCoin fraud for years. Here is an excellent contribution from him:

share-your-photo.com/8203f037b5

blog.geopolitical.biz/2020/06/12/onecoin-ein-schneeball-ist-geschmolzen/

This article by Markus Miller is also recommended:

share-your-photo.com/7a92c59c01

krypto-x.biz/2020/09/24/onecoin-der-krypto-scam-in-den-fincen-files/

The OneCoin scammer Günter Lipp does not want to accept the brutal truth and comments:

@ Peter Renner

Ken Labine also hops from one scam to the next. From January to June 2018, he promoted the DagCoin scam:

share-your-photo.com/ef1bde0fda

youtube.com/channel/UC_2UshhO5nOd6hEyDnJ0I5g/videos

@ WhistleBlowerFin

I quote from the current newsletter:

share-your-photo.com/e207630fb5

The following is a statement by Cristi Calina (partial quote):

us9.campaign-archive.com/?u=cf9659fd672fe664d487e7e1b&id=f90cb6d9a2