Holton Buggs sanctioned for Traders Domain non-cooperation

![]() Holton Buggs has been sanctioned for failing to cooperate with the Traders Domain Receiver.

Holton Buggs has been sanctioned for failing to cooperate with the Traders Domain Receiver.

As detailed by the Receiver in his February 5th Second Report;

Defendant Buggs refused to provide information regarding his assets as required by the Court’s orders, and he refused the Receiver’s attempts to depose him regarding his assets.

As a result, the Receiver filed a Motion for Order to Show Cause against Buggs .. that was heard by Magistrate Enjolique A. Lett on December 18, 2024.

After hearing, on December 27, 2024, the Magistrate issued an Order for Sanctions finding that Defendant Buggs violated the SRO and ordering that Buggs provide the information required under the SRO to the Receiver, appear for an asset deposition, and pay a monetary sanction of $9,583.40.

Under threat of further sanctions, Buggs (right) finally complied with the court’s orders on January 13th.

Under threat of further sanctions, Buggs (right) finally complied with the court’s orders on January 13th.

On January 13, 2025, Defendant Buggs provided the Receiver with a financial statement and supporting documents that he labeled a “work in progress” and an “interim report”.

On January 16, 2025, Defendant Buggs gave his asset deposition to the Receiver.

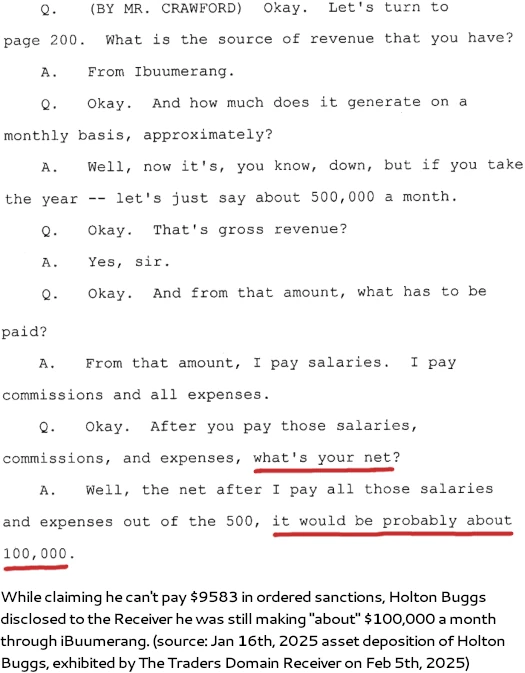

The Receiver notes that, as of February 5th, Buggs hasn’t paid his sanctions penalty to the Traders Domain Receivership.

Through his attorney, Buggs claims his “assets are frozen and therefore he cannot pay the sanction”.

In response to this the Receiver cites Buggs asset deposition, wherein Buggs claims confirmed he was still earning “about $100,000” a month through iBuumerang.

Whether the court takes further action against Buggs remains to be seen.

In the meantime, the Receiver has identified the following assets of Buggs that may be subject to forfeiture:

- two residential properties in Houston, Texas

- three “Fifth Ward” vacant lots in Houston, Texas

- a residential property in Tampa, Florida

- a Muhammad Ali painting

- “a number of luxury branded watches”

- “several items of jewelry Buggs identified”

- a 2020 Tesla

- a Spyder GS motorcycle

- a SeeDoo speed boat

- money put down on the purchase of 3 condos in Miami, Florida

- a glock gun

- an undisclosed amount of cash

- equity investment in various start-up companies

- money owed to Buggs from Organo Gold

- designer clothes and furniture

- potential business assets and

- business interests

Other points of interest in the Receiver’s report include:

- defendant Juan Herman, aka JJ Herman, has fled to Dubai, leaving two properties behind that could be subject to forfeiture;

- Fredirick Teddy Joseph Safranko and David William Negus-Romvari remain in violation of the court’s orders and are in hiding; and

- Alejandro Santiestaban, aka Alex Santi and Archie Rice have failed to provide complete financial information to the Receiver, prompting filing of a contempt motion on January 29th.

It should also be noted that a number of The Traders Domain defendants, including Mike Sims, asserted their Fifth Amendment right when pressed on details of their assets.

This suggests some of The Traders Domain Defendants are anticipating related criminal charges.

On that note, Teddy Safranko (right) David Negus-Romvari appear to still be trying to defraud consumers through TrueBlueFX.

On that note, Teddy Safranko (right) David Negus-Romvari appear to still be trying to defraud consumers through TrueBlueFX.

As part of efforts to keep the Ponzi going, towards the end of its run The Traders Domain informed investors it had been sold to TrueBlueFx.

At the outset of this case, the TrueBlueFX website was online and still holding itself out as actively trading.

The Receiver obtained control of the TrueBlueFX website and had it redirected to the Receiver’s website.

TrueBlueFX began a new website with a new host and continues to hold itself out as actively trading. The Receiver has contacted the host and is seeking to obtain control of the new website.

The Receiver believes the TrueBlueFX website is being operated by Defendants Safranko and/or Negus-Romvari in blatant violation of the Court’s orders.

Neither Trader Domain nor TrueBlueFX have turned over any financial information to the Receiver as required by the Court’s orders.

With respect to clawback proceedings against The Traders Domain net-winners, the Receiver writes he is

continuing to gather bank records to identify the recipients of false profits.

Specific to promoters of The Traders Domain;

The Receiver is investigating the investor funds paid in commissions.

Regardless of whether the salespersons knew or should have known that Trader’s Domain or the other Defendant entities were being operated illegally, the commissions the salespersons received are recoverable as fraudulent conveyances.

The Receiver identified approximately 12 “sponsors” who worked with Defendant Sims in soliciting investors to Traders Domain and the Receiver’s attorney sent each of these persons a copy of the relevant court orders and a demand that they each provide an accounting of monies they received as a result of introducing investors to Traders Domain.

Finally, with respect to The Traders Domain victims filing claims, the Receiver writes;

The Receiver is working with his team on a claims process to propose to the Court that will enable investors in Traders Domain to submit their claims to the receivership for participation in the distribution of assets recovered in the receivership.

The Receiver anticipates this proposed claims procedure will be submitted to the Court within the next 30 days. The Receiver expects to receive more than 5,000 claims.

Stay tuned for updates as BehindMLM continues to cover the CFTC’s The Traders Domain Ponzi case.

Update 7th June 2025 – Holton Buggs has agreed to turn over multiple assets to The Traders Domain Receivership.

Do you think think further non cooperation will push it to criminal charges?

And

At what point do criminal chargers get files?

Maybe HB and Earlene should consider visiting Dubai. I hear it’s lovely this time of year.

@Ray

Detainment is a possibility if contempt gets bad enough but this is a civil case in which criminal charges are not possible.

When the DOJ is ready, and that’s if there’s a The Traders Domain criminal case pending. US civil/criminal fraud investigations are non-public till they are filed.

It’s serves him right . He made over $100 million in Organo and Now has his own company. All had to do is focus on building his company but he got cocky and arrogant and thought he could get away with a quick swindle to maintain his and wife’s excessive spending.

With his past credibility and staying on course with building his company, he could have had a billion dollar company but he got greedy. Now his name is in the dirt. A quick google search and he’s now known as the Ponzi Guy.

Now he’s dependent on the ignorant to buy his courses and events where he’ll be spewing nonsense and not telling people the real sauce on how to build a large mlm business.

Maybe he’ll pay the sanction at the end of the month after the training program he’s hosting from his home in Texas. Virtual online tickets are $187, or you can attend in person with a VIP ticket for the bargain price of $2,997 lol.

The VIP ticket also includes drinks, snacks, and being able to hang out with the Buggs family in his homes luxury basement bar and bowling alley.

Traders Domaine has taken in for years a massive amount of investor’s BTC. Hopefully the Receiver will claw this back as well.

The TD scammers & top earners who lie to the court and hide Bitcoin and other asset holdings hopefully will be indicted and incarcerated! Thanks for updated detail OZ!

I’m a victim of this how do I file lawsuits on them as well. I have documents as well as my investment.

Filing lawsuits is best done by a lawyer. Go see a lawyer.

Ok thanks.

He scammed so many people including myself. Meta Bounty Huntress were sold in October 2022 when they know it’s already going down.

I put most of my late husband’s super in it hoping i could get 2 etherium per month as income. We only had one month profit and everything went down.

They knew it was already compromised and still they sold it to us. I want my money back. Putting a claim now as July 28th. Is the last day.

Hope other do the same hope they get to pay back what they stole from us plus interest! The amount of damaged it caused me and my boys mentally and financially is immense!!

Um, you’re filing a Meta Bounty Hunters victim claim in the Traders Domain case?

Don’t think that’s going to work out but good luck I guess.