Civil fraud charges filed against US EmGoldex investors

A review of EmGoldex earlier this year revealed it to be a seemingly European based Ponzi scheme.

A review of EmGoldex earlier this year revealed it to be a seemingly European based Ponzi scheme.

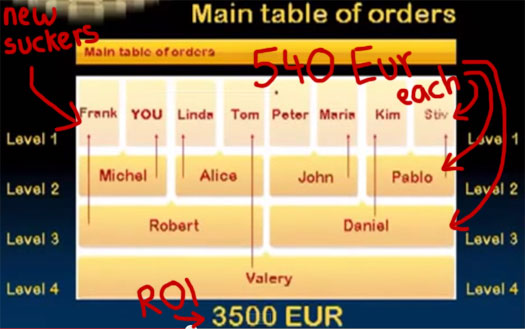

Investors bought in for 540 EUR and EMGoldex promised them a 3500 EUR once enough new investments had been made by subsequent investors.

As is common with European based Ponzi schemes, gold was used to front the scheme. The reality however is that gold had nothing to do with the scheme, with EmGoldex simply taking new investor funds and using it to pay off existing investors.

Shortly after we published our EmGoldex review, the Massachusetts Securities Division announced they had launched an investigation into the scheme.

The state Securities Division “has an open investigation and is actively looking at the issuer and individuals associated with it,’’ said Brian McNiff, a spokesman for Galvin. He declined to provide details of the probe.

That “probe” yesterday culminated in civil fraud charges being laid against four individuals involved in the promotion of EmGoldex in the US.

The Administrative Complaint names five defendants; EmGoldex Team USA, Inc., Matthew Michael D’Agati, James Vincent Piemonte, Jonathan Herman Siegler and Joseph Zingales.

The Enforcement Section alleges that Respondents, acting individually and collectively, fraudulently offered and sold unregistered and non-exempt securities

in the Commonwealth.The Enforcement Section further alleges that the offers and sales of securities were part of a pyramid scheme and Respondents’ promotion of such scheme defrauded Massachusetts investors.

The four named men are together co-founders of EmGoldex Team USA.

Specifically, the complaint focuses on their promotion of EmGoldex within Massachusetts.

Respondents offer investment opportunities in a pyramid scheme called EmGoldex. Respondents are the most visible and active promoters of EmGoldex in the Commonwealth and have recruited hundreds of investors into the scheme.

EmGoldex is an illegal pyramid scheme disguised as a legitimate multi-level marketing company targeting investors both in Massachusetts and around the world. EmGoldex is purportedly registered in and maintains an administrative office in, the Seychelles, an island nation off the eastern coast of Africa.

While representing itself as an internet-based store specializing in the sale of gold, EmGoldex has no discernable retail sales activity and relies on new investor funds as its primary source of income.

The substantial returns promised by EmGoldex to investors are based exclusively on the recruitment of new investors into the pyramid scheme.

Investors have no incentive to sell EmGoldex’s purported product, gold bars. Instead, investor efforts are focused on recruitment, which guarantees profits in excess of 1,105%.

What of particular interest in this case is that neither D’Agati, Piemonte, Siegler nor Zingales run or own EmGoldex, but rather they are promoters of it in the US.

EmGoldex do not disclose who owns or runs the company, with their offshore owners remaining at large. Nonetheless, in what is hopefully a trend set to continue, promoters of Ponzi schemes are now actively being targeted by US regulators.

Respondents are at the forefront of recruiting efforts in the Commonwealth through an elaborate marketing and social media blitz. Respondents have ensnared hundreds of new investors from the Commonwealth into the EmGoldex scheme, with promises of fast, easy, and risk-free profits.

While’ holding itself out as a “training center” to help investors understand and succeed in the EmGoldex network marketing program, Respondents are in reality a major cog in the EmGoldex marketing and recruitment machine.

Through the use of websites, social media, and live events, Respondents have created a complex web entangling investors throughout the Commonwealth. The extensive recruitment efforts of Respondents serve to benefit Respondents, who eam substantial passive income by recruiting new investors.

Respondents have built their own empire within the EmGoldex pyramid scheme. Respondents’ investor empire can earn Respondents even more passive income through the EmGoldex leadership program, which rewards investors based on the recruitment successes of downline investors.

Through the creation of their vast team of downline investors, Respondents are eligible to receive massive returns.

Respondents receive these massive returns at the expense of later investors, who will be left with considerable losses when the EmGoldex pyramid scheme inevitably collapses.

Respondents advertise and promote the EmGoldex pyramid scheme using promises of quick riches, with little to no risk involved. Some advertising materials created by Respondents are emblazoned with bags of cash, gold, and phrases such as “NOW YOU GET PAID!!!”

Investors are even encouraged by Respondents to buy positions for their children in the pyramid scheme.

At one point Respondent Team USA’s webpage boasted, “Yes, even your children can get paid!!” The Team USA webpage also includes pictures of smiling investors, holding cashier’s checks issued by Respondents.

The purchasing of multiple positions under family member’s names is a common practice in the online scam world.

As to the gold smoke and mirrors EmGoldex use to market their Ponzi scheme,

The focus of the EmGoldex pyramid scheme.and Respondents is, and has always been, solely on recruiting. Respondents built their own lucrative financial pyramid within the EmGoldex pyramid scheme through their recruitment efforts.

Profits are paid to investors in the pyramid from the significant membership fees of new recruits.

Respondents make no effort to sell or advertise any product, and marketing materials fail to mention any possible compensation earned through retail sales.

Seemingly aware that he was participating in a Ponzi scheme,

On April 25, 2014, Respondent D’Agati sent an email to EmGoldex support services asking how Team USA should respond to questions regarding whether EmGoldex was a pyramid or Ponzi scheme.

Specifically, Respondent D’ Agati asked about the fact that EmGoldex is unable to actually send its product to participants in the United States, which makes EmGoldex’s alleged marketing program essentially just an exchange of money.

The reply from EmGoldex makes no sense, containing little more than legal jargon and citations to European internet commerce laws regarding enforceability of electronic contracts.

No doubt those running EmGoldex didn’t care, because they figured nobody in the US was able to hold them accountable and “enforce” the bogus contracts they were selling investors.

Here at BehindMLM we’re forever combating the nonsensical replies and justifications Ponzi proponents concoct in defense of their schemes.

Despite Respondent D’ Agati’s concerns and EmGoldex’s evasive, non-responsive reply, Respondents continued advancing their own personal financial interests by recruiting investors all over the Commonwealth.

Shocking. D’Agati and his cohorts knew they were involved in a Ponzi scheme, yet still they continued to recruit new investors into the scheme.

And wait till you read the extent these fraudsters went to to circumvent the obvious road bump of EmGoldex not being able to ship their fictional product to the US:

Investors trade payouts received in the EmGoldex online system for activation codes, which activate membership positions in the pyramid scheme. Respondent Team USA purchased activation codes directly from investors and sold them to new recruits.

Respondents have in essence created an uncontrolled secondary market where investors can freely exchange fraudulent EmGoldex securities.

Instead of wiring money to EmGoldex, new investors simply paid Respondent Team USA directly to get involved in the EmGoldex pyramid scheme.

Here the whole “we sell gold” smoke and mirrors totally falls apart, with the revelation that EmGoldex are indeed selling nothing more than matrix position codes.

Buy a code, wait till enough codes have been purchased after you and get paid. Just don’t forget to make up a bunch of bullshit about selling gold if anyone dares question the company’s legitimacy.

Luckily this time around, the damage to investors wasn’t all that much:

D’Agati established bank accounts in his name d/b/a EmGoldex Team USA to further facilitate this process. As of July 14,2014, over $473,000 has been deposited in Team USA bank accounts, while over $282,659 has been wired to EmGoldex financial institutions overseas.

In a four month period from March 2014 through mid-July 2014 Respondents facilitated over 370 investments in the EmGoldex pyramid scheme.

While hundreds of thousands of dollars is nothing to sneeze at (especially when you consider a standard EmGoldex buy-in is 540 EUR ($682 USD), it’s a far cry from the hundreds of millions figures we’ve seen when some of the bigger MLM Ponzi schemes have gone bust.

A major contributing factor to that is Massachusetts Secretary of State William F. Galvin and his Securities Division’s quick initiation of an EmGoldex investigation and resulting charges being filed.

Full points to Galvin and his team for that. I only wish other US states were as diligent and fast acting.

The bottom line?

As an illegal pyramid scheme, EmGoldex is destined to collapse, harming investors all over the Commonwealth.

With this action, the Enforcement Section seeks to stop Respondents Team USA, D’ Agati, Piemonte, Seigler, and Zingales from offering and selling fraudulent securities in the Commonwealth, thus preventing further financial harm to Massachusetts investors.

A job well done.

For their part in facilitating the promotion of the EmGoldex Ponzi scheme, Matthew Michael D’Agati, James Vincent Piemonte, Jonathan Herman Siegler and Joseph Zingales have been charged with violations of the Massachusetts Uniform Securities Act”.

The Massachusetts Securities Division has requested they, in relation to their participation in EmGoldex,

- cease and desist their fraudulent activities

- provide an accounting of all proceeds received

- disgorge all proceeds and other direct or indirect remuneration received

- offer remuneration to fairly compensate all investors who suffered losses

The Division has also requested the court ‘impose an administrative fine‘, the amount of which will be determined at a later date.

Good news re: going after some of the promoters.

These folks should be sharing the same consequences as the scheme originators/owners.

Would be rather amusing to see a judge’s response to a defense based on “I was just trying to help others achieve success” and the other malarkey these folks spew.

Normally it will be wiser to start from the top = sue the organizers and the company = the group of people where most of the money has ended up. But that may be different from case to case.

They have actually started from the top in this case too = sue the local organizers, the ones who organized the payments.

As part of the Emgoldex fallout, James Piemonte has resigned from two positions he held on city boards in Methuen, Massachusetts.

http://www.eagletribune.com/news/man-implicated-in-ponzi-scheme-resigns-from-methuen-boards/article_1f78678d-e6ff-5e32-8ca8-00ba98818cae.html

Throwing away ten years of your professional life and reputation for a shot at Ponzi riches.

How depressing.

Hi, I currently work in dubai, and have a great team of Fillipina staff who are all going crazy for this scheme.

Nobody has yet to recieve money-so i have been urging them to be cautious, but the big promise is persuading for them.

What can i do to stop my team being scammed?

You can try to explain what a Ponzi scheme is to them. If they don’t understand or don’t care then they might be lost causes.

Might be worth going after the ringleader (there’s always one) if they’re part of your employee group too. I’m sure participating in Ponzi schemes is likely to be illegal in Dubai just as much as anywhere else.

To DAVID, EMGOLDEX physical office is at DMCC Unit No. 705, Indigo Tower, Plot No. D1, Jumeirah Lakes Towers.

It is of great help from your end if you could personally visit their office and ask them if they are legit or not.

As I was also working in the middle east, I believe it would be impossible for them to operate such scam. Since no companies could exist in Dubai without being subjected to strict procedures and certifications. I would like to hear from you.

Or you could just look at their Ponzi business model.

Asking scammers whether or not they are scammers probably isn’t going to be that helpful.

Right. Because the Dubai govt has pre-approves any and all business models before they can open up shop there.

Cmon son…

Hello everyone,

I just find it funny but in defense for the company i did my own research and they are actually operating under Dubai Multi Commodity Center. You can search it your self by doing step.

1. dubaided.gov.ae/en/Pages/default.aspx

2. Go to e-service

3. Select “Search Trade Name” (option at the bottom left side of the screen)

4. On the “English Trade Name” field type “EMGOLDEX”

5. Enter the captcha for security.

And also their office address:

Sheikh Zaued Road,

Jumairah Lake Towers,

Indigo Tower ,704

PO Box 340531 Dubai UAE

So i am not sure why people are saying that this is scam.

That’s just for me, at least i verified that the company really exist in Dubai. Cheers

Herp derp look up the definition of a Ponzi scheme?

An address in Dubai doesn’t negate a fraudulent business model.

And you quoted a PO Box address. Do you even know what that is?

Talk about fail…

That’s actually the office for “MY BUSINESS CONSULTING DMCC™ – Offshore company registration”.

Think of it as a virtual office for companies that want to be registered in Dubai but don’t want people to know who they really are and/or don’t have a physical location in Dubai.

Somebody offered me this business also, so I conducted my initial research about them.

They’re claiming that their parent company is Gold & Silver Physical Metals and that EmGoldex was registered in UAE territory last 2010 as an online shopping portal trading smaller quantities of gold commodities under DMCC. I just can’t confirm if the office held in Dubai is just virtual.

The company referred Michael Ryss as the head of Gold & Silver Physical Metals and EmGoldex, Sergei Fremeev also serve as the Marketing Director.

I am searching facts about Federal Registration No. HRA 93019 any information about this you may share will be a great help.

Somebody quoted a PO box address in Dubai a few comments back.

You can’t run a business out of a PO Box office, so obviously it’s virtual.

As for the reg stuff, it’s just smoke and mirrors. Unless you’re a regulator, the Ponzi business model EmGoldex use should be all the research you need.

Many people use a P.O. Box as a mailing address. Often it’s because they work at home and don’t want to give out their home address. I’m on a board that uses a P.O. Box as the business address.

In this case, the rest of the address is a virtual office for off-shore companies. Getting a P.O. Box number is included in the services the v.o. offers.

That’s all fine and dandy, but we’re talking about an MLM company here.

Not good enough.

The only time an MLM company uses offshore company registration and PO Box addresses in the middle of nowhere is when something suss is up.

Let the members of EMGOLDEX confirm that it’s a scam.

And it’s better to get more honest investigation and not just theories. Be fair in accusing. Get more evidence and proofs.

And how do you think they’re going to do that?

The same way everybody else will, by looking at the compensation plan and realizing newly invested affiliate funds are used to pay off existing investors.

All the evidence you need is in EmGoldex’s business model. It’s a Ponzi scheme through and through.

I’ve googled the address of EMGOLDEX and found out that the said address is registered to MY BUSINESS CONSULTING JLT. They have the exact address and PO BOX number.

It state and i qoute

Emgoldex will let few members to enjoy the reward to lure more people and join the scheme. In the end, if they have enough money, they’ll be gone like bubbles in the air.

You can google it yourself. Link is provided below;

mybcjlt.rusmarket.com/europe/

Having a physical address for a business in Dubai doesn’t guarantee a business to be legit or a scam.

Few yerars back, i became a victim of a scam with an office in oud metha. Members will go there to claim the money and it was opearating for more than a year until the day came when it was revealed that it was a scam.

You can still find some articles in gulfnews. Some members even committed suicide. The company is Sunfeast Infotech.

A new one has recently started with a very similar website and setup called swissgolden, no doubt ready to take over after the imminent demise of emgoldex.

Not so new – https://behindmlm.com/companies/swissgolden-review-220-9850-eur-gold-matrix-scheme/

They don’t have an office here in Dubai.

There was a company that promotes travel which has a similar structure and operation of Emgoldex and I can tell you that it just disappears like one wakes up from a bad dream.

Travel Ventures sells codes to new recruits for a spot in the matrix board then whoever is on top position exits when that board is filled.

Same snakes. Just different color and sizes.

If this is legit there should be a proof that they are operating legitimately as when you become a member they should issue some sort of proof for you to hold on if it fails, something that make someone comfortable when they invest.

Because as long as that nobody from the creators of this business model would pop up and will give assurance to all members that he will be held liable if something happens with the business, then this is a scam after because that means they are avoiding liabilities.

Well, a lot people say its fake, its a scam but majority of them are non members.

I am a legit member, and I invested and got my returns after 45 days, It not a scam. Well that’s for me. Its all about perspective.

@Mike

You managed to steal funds from people who invested after you.

That doesn’t negate EmGoldex’s Ponzi scheme business model. That’s what makes it a scam, not whethre or not you got paid.

Typical scammer mindset…

its not Scam. to those people, who is saying this is scam show to the public the evidence.

You invest $x, new investors invest $x and you get paid the funds they invested.

Herp derp.

The Republic of the Philippines issued a 2015 investor alert advising its’ citizens not to invest in Emgoldex

NOLINK: sec.gov.ph/notices/advisory/2015_SEC_Advisory_EMGOLDEX_PHILS.pdf

The Superintendence of Companies of Colombia on May 7, 2014, ordered the immediate suspension of operations of Emgoldex in the Republic of Colombia and intervention involving taking possession of the property, assets, business and heritage of the same

NOLINK: centralamericadata.com/en/article/home/Intervention_in_Emgoldex_Operations_in_Colombia

Massachusetts Secretary of State William F. Galvin on October 22, 2014, filed civil fraud charges against EmGoldex Team USA Inc.

NOLINK: bostonglobe.com/business/2014/10/22/galvin-files-civil-fraud-charges-against-emgoldex/7GPhHjAZdkFmxraXezNDqL/story.html

I did invest 540 euros waited 60 days to get payd and i got the money. Its not a scam!!

You Mr Oz is a scam

Emgoldex is easy. you pay 540 euro and finde 2 peole they do the same.

Thats all. Yes they make alot of money.

Why are you bitching about this? Is it becaus you did not try this? and if you did! you didn invite 2 friends to invist also 540 euros

And thats a must !!! Stop talking bullshit

You are full of shit. Get your game straight.

If people do what its told then there wont be a problem. If they start reading your stupid theories then they stop and break the chane and people start to get in problems becaus theres an assholl that took a spot in the piramed and didn invite 2 people so someone else has to invite again 2 people!!!

MY POINT IS IF YOU DO NOT KNOW HOW IT WORKS THEN DONT TALK SHIT AND GET A LIFE !!!!

And where do you think this money came from?

Hint: It didn’t come from all the retail sales you didn’t make.

Why do you have to find new investors? Oh right… Ponzi scheme.

All Ponzi schemes are scams. Whether or not you personally stole funds from later investors is neither here nor there.

that you are a silly little twat. Noted.

It seams like everybody but you knows how it works.

Its not the matter of true or not, becoz they will really pay you when time comes, dependent on how many recruits ur recruits will have.

540 uero per person; or P36t per person plus the 2 recruits and the total 4 recruits of ur 2 recruits will give them P252T.

Capable for them to pay u the P180t exit payment and give them a profit of P72T per person. And could generate them P1,116,000.00 up to the 5 levels only.

What about more than 5 levels? Lots of money for the people who invented the scheme.

What is horrifying here is what about if there are no more recruits? What about those who are not yet paid? We know how networking/pyramiding works. When it reached the proper time, it will declare collapse.

And because of our selfish desire for gain, lots of people will suffer in the end!

I won’t be surprise if one of these days emgoldex will be featured on “American Greed” show…

I just want to know. How will they collapse if the investors will just continue to invest every exit?

@rose

A Ponzi scheme where nobody withdraws funds? Pull the other one…

How you probe it that emgoldex is realy scam theres any article you can show. I’m working here in dubai and so many of my friends is member most of them get pay out.

Sure, look at EmGoldex’s business model – it’s a Ponzi scheme.

Whether you and your friends are successfully ripping off subsequent EmGoldex investors is neither here nor there.

I joined several MLM since the 80’s. Not successful with all of them.

The last one was a company in Dubai selling travel certificate. When I claimed my certificate they asked me for aditional fees for them to process the claim. I did not recieve my vouchers.

A lot of Filipinos here in Jeddah are crazy about EMGoldeX. Lets wait and see.

Can somebody explain to me why the members and leaders are conducting their payout and orientations in restaurants and hotel here in Dubai? Why not in their registered office address in JLT?

And why I am receiving a lot of offers that i don’t need to invest 3000aed to be a member, i just to invite 2 investor.

I don’t have anything bad against Emgoldex, I just have these questions in mind.

Two words: “plausible deniability”.

If the authorities catches them, they’ll just pull an IMF on them, “we will disavow any and all actions undertaken by your team…”

Pyramid or not. Will you make money? Anyone investing hard earned money should do their own re search then research some more.

If you think you can make money by joining this pyramid why not. It is a gamble that you took and should take the consequences when it comes.

Make sure you are ahead of the game. If you got your rewards, hooray to you. If your table got stagnant and not moving well then accept the loss.

Please don’t think pyramids as investment, think of it as gambling. If gambling is legal they should make pyramids Ponzi scheme legal as well.

Whether you can successfully rip people off in a Ponzi scheme is neither here nor there. Nobody but you cares.

And inevitably reach the conclusion: EmGoldex is a fraudulent Ponzi scheme.

Because scamming people is not something to strive for.

Gambling is a heavily regulated industry and you know the odds.

Ponzi schemes are fraudulent investment scams. There is a marked difference between the two.

Terrible advice. Best of luck with the scamming. “Openminded”, you’re not fooling anyone.

Not exactly sure if most of these people defending EMGOLDEX understand the Ponzi Scheme.

A recruiter (investor/scammer) convinces you about EMGOLDEX investment.

You (potential investor/sucker) think it’s a good investment. You decide to join the opportunity.

The recruiter/investor/scammer gets or convinces 3 people to invest. Recruiter/investor/scammer gets paid with these 3 investors’ money.

You (investor) become a recruiter/scammer. You must find, convince, scam 3 people to invest to EMGOLDEX if you want to get your money back plus commission. If you do not get new investors, YOU WILL NOT GET YOUR MONEY BACK!

Bottom line, you are paying EMGOLDEX to become a recruiter. By becoming a recruiter, you become a scammer.

How about in Philippines? A lot of people invest, and some they said they earn well? How long this company can hold their drama?

Phillipine’s SEC has issued a warning. Haven’t seen anything further to that though.

I was impressed the way everybody saying EMgoldex is really scam & as they said it is another Ponzi scheme.

My questions are “Have you ever (Ozedit: looked at the business model? Yup, and it’s a Ponzi scheme. Everything else is irrelevant.)

I am active about 6 months and I can say that this is a amazing system!! earned a lot of money!!

@Jona There’s nothing “amazing” about stealing funds from subsequent investors.

You are a Ponzi thief, nothing more.

Are you talking about withdrawals?

The only money people “make” is the money they receive, i.e. a transaction of money. It will also need to be based on legitimate sources of income

People often incorrectly report back office transactions as “making money”, probably because they don’t know the difference between a bank account and a back office.

Some just ask me to join her team and showing me a video with the cash she said she got.. I ask a lot of questions but seems the answer is not clear.

So I tried to investigate and searches anything about the scheme. At the start I knew it is a pyramid and the lady keeps telling me it is not.

Good thing I am a type of person than don’t get fool too easy..

It’s a scam. No business entity will promise an ROI of 1105% in a few days. It’s plain thievery.

The business model itself is fraudulent. Every time someone asks me to invest in EMgoldex I always ask “Why is it that I have to recruit new members or so called investors to earn?” “Can I just be a retailer and put a mark up on the supposed gold bars that the website is selling?”

The answer I get? UTMOST SILENCE…

By the way. The address they have for Dubai is a sham.

This address:

Is owned by MPH Consulting Services. I had my wife visit it for me since she is currently working in Dubai. She even got the local phone number for the firm which is (Ozedit: removed).

The WARNING:

If you are the last person in this SCAM, you are dead, you will cry hard but that’s all you can do.

If you are the first 12.5% of the joiners, you will be rich but you are an accomplice to a crime, for scamming 87.5% of the population, that’s the actual figures based on calculations(binary downlines).

In most cases, many of the 12.5% are unaware that it is a scam, but that does not mean they are not liable under the law.

A big portion of the victims (87.5%) will not hesitate to take somebody’s life when they have become desperate.

If you received your exit Money, that does not prove its not a scam, that only means the time you joined you still belong to the top 12.5% of the joining population.

You will start to feel and believe that its a scam at level 21 (2M people of the population is recruited), starting at the level when it was first introduced to your country.

Up to 16-20th level you will feel its legitimate, but at after that it will start to really slow down and at 27th, a population with a large population of 137M joiners will be depleted, note that Philippines is currently 100M (including those in their very young and old age).

If people can recruit 2 each day, population is exhausted in 26 days. But in reality it takes them 3 to 4 months to complete the exit. As you get near the 26th level, it becomes slower as the people start to become fully aware that its a scam even before the population is exhausted.

You don’t need to be a mathematical genius to know its a scam, just some common sense. Emgoldex offers 700% gain(500 investment, 3500 return) in 3 to 4 months.

If you put your money in a bank or other financial institutions, you are very very lucky to get 18% interest and thats annually (per annum) or 4.5% every 3 months.

Now high yield investments can give you a 100% to 300% revenue if you have your own business that you manage yourself, that usually takes a lot of pain and effort and money.

Emgoldex do not own their own mining, which means that they can gain only from buying and selling. Now, go back to their site and see how much can you gain by comparing the buy price of the gold vs the sell price.

Are you surprised? Even if their MLM advertising program is 1000% successful to recruit the whole world their total revenue will not match the 700% payback they give every time one person exits the table of order.

If buy and sell of their commodity is not good to support their promise, what if they invest the money into some other business. Stable Financial institution first receive the money from investors, then at the end of the investment you get a dividend out of the profit. But Emgoldex gives back the bonus right after 1st level’s exit. Does it clear your mind now?

So where are they getting the rewards/bonus they give to those who exit… Obviously by now, you know the answer…

Now its obvious who is doing research and who are not. Let me explain how they(Emgoldex) can get away with their loot.

After 25 levels:

Total binary downlines recruited: 33M of the popoulation.

The 4th of the 25th level (level 28) will need 260M to recruit,for Philippines with 100M population it will no longer be possible because at level 27, 134M is already impossible.

In short, level 25 is the last 1st level to exit the program, no person can ever exit from that point given a population of 100M. That being optimistic assuming even aged people and infants can invest in Emgoldex.

Now finally whats the final figure at level 25:

Total donwlines: 33.55M people

Total exits: 4.19M people

Total victims: 29M people can no longer exit because populaiton is exhausted

Total fees paid to Emgoldex): 1.3B euros

Total gold investment received by Emgoldex: 16.78B euros

Total amount given to those who exit: 14.68B euros

Remaining Balance: 3.44B euros (including the fee)

Now this is the crazy part:

29M people who cannot do the exit: their best solution is to refund.

If you watch youtube, they said they can refund the 500e, but in the site it does not. You can only sell it back at the price they have on the site which they can control.

Another deception?

So lets assume they will refund 500 eurosback to those 29M people to avoid scandal.

Required refund=29M x 500 = 14.68B

Do you think they will do that? Note that they now have only 3.44B left, that will give them 11.24B in debt if they indeed refund.

So what’s Emgoldex options to do:

1) They can ship to you your gold investment: do you imagine how small the gold you bought for 500 euros? Do you think its a big gold bar? The people aim for investment, they were lured instead buying a very expensive gold when they need food to eat.

2) They can also bring the price of the gold to 100, they can do that because it their business, its not stocks which is subject to government regulations. They can do anything with their site.

At 100 buying price, they get 503M euros legally. So they can move to another country and harvest the innocent public.

3) Worst scenario, if they lost legally against the people, they can just run away with the whole 3.44B (balance + fees).

So what’s next. They will move from one country to another. On the last prospect country, they will just disappear. And wait for another 5 or 10 yrs to come with another scheme and the memory of the past has healed.

New name, new set-up, new faces, but still the same scheme. And then a new naive guy, will be defending it until he crashes the hearts of the people once again.

So think, before you bring the population down. Raise your financial IQ and it will help a lot, that’s how God wants you to help yourself.

Emgoldex has changed its name to Global Intergold. They found a new supplier of “gold” due to according to them “huge demand of supplies” and UAE is not connected anymore.

And it is now the Swiss company. “Swiss gold”? Does that sound familiar?

I don’t know about being Swiss specifically, but EmGoldex was always a EUR based scam.

The article said:

It is clear that this is another company violating the copyright protection of EMGOLDEX. That’s why it became fraud.

You see they have an INC in their company name. This four people are not the owners of the real EMGOLDEX. These are the real owners: Michael Ryss, Sergey Eremeev, and Gyorgy Fuzesl.

Nobody said they were. They were the top investors in the US trying to scam Brazilians.

EmGoldex is now dead in the US as a result of the complaint filed against them.

The complaint is here (disabled link):

sec.state.ma.us/sct/current/sctemgoldex/EmGoldex-et-al-Complaint-Docket-No-2014-0056.pdf

The defendants are listed on page 8 in the complaint.

The main EmGoldex scheme seems to be registered in the Seychelles.

It claimed to be registered in Dubai.

As I have noticed on the comments section.. I can clearly state that majority of the Pro-Emgoldex are from the Philippines (I am a Filipino), and mostly they said rude comments when you are an Anti-Emgoldex, maybe due to the fact that they cannot accept the truth that they have been scammed & turned into scammers as well.

They are blinded by the huge amount of money.. Philippines have been badly hit by this Pyramid/Ponzi scheme specially the one’s working outside the country (Overseas Filipino Workers).

I, myself is a victim, until now I cannot refund my money when i backed out.

It is prevalent in Taiwan, Japan, Korea & the Middle East. I hope more articles & more complain will surface so that many people will be aware and stay away from this scam.

Ok, Now I don’t know if this is a scam or not but Just blah blah its a scam and tralala is not really doing it.

Emgoldex did actually not force anybody to invest money as far as I can see and search. Neither the recruiters. If you want to invest money into the scheme than do it. If not than don’t. I don’t really see the problem here.

Who has been actually scammed???

I searched for hours in google and could not find a single person who did not get paid! I mean hello!!! If there are 1000’s of investors and nobody gets paid there would be blogs, websites and what do I know online but… all I find is actually teams who got investigated. It’s easy to call others scammers and so on.

It’s also easy to talk people down with negative comments. In my opinion it’s simple. If you think you want to invest money in it than do it. That’s business!!

Same as ebay and others. I buy something cheap and sell it for 500% profit on ebay. Does that mean I am a scammer. No!!!

Now from this profit iIgot from this buyer I buy 10 more and sell to them to 10 with each 500% profit!!! am I am a scammer now?? I used the money from the first buyer though!!!

It’s a ponzi scheme. I did not force anybody to buy it. It was their own decision. Just for my own profit.

I could do the same with using others to promote my items and give them money back after they found two buyers as I still have enough profit from the item he bought. Does that make me now a scammer??? … mmmm

Why not? Are you unable to read a business model?

Irrelevant to the fact EmGoldex is a Ponzi scheme.

Anybody who invests in a Ponzi scheme and fails to steal enough subsequently invested funds.

Ponzi schemes are illegal the world over for good reason.

Perhaps, but a Ponzi scheme business model is irrefutable fact. Your opinion again does not matter…

Ditto whether or not people are getting paid (irrelevant to the fact EmGoldex is a Ponzi scheme), and what you do or don’t do on eBay…

Why does my opinion not matter and yours does Oz?

I still don’t see who actually got scammed? Maybe the team (investors) itself scammed others by taking things in their own pocket to cut Emgoldex out? I really don’t see who got scammed here by Emgoldex?

And yes, I do know very well how to read and understand a business model. As I clearly explained. You just try to talk me down here by picking things out of my comment but not taking my whole comment into the picture.

Have you actually been scammed by Emgoldex? As far as I could search I could not find a single person who complained about Emgoldex. I mean if they are operating since 2010 they must have recruited 10th of 1000’s. Did anybody who exited not receive the reward from Emgoldex? Did anybody not receive the Gold? (Which has high value btw).

I am talking about Emgoldex here and not the Investor-teams. I suspect that some Investor-teams took this into their own hands and lured new clients via Emgoldex into their own ponzi scheme to make more profit but could off course not deliver and that’s what dragging the name Emgoldex into the dirt.

I am not even sure if that is a real Ponzi scheme. As it has certain levels and you exit and they actually sell real Gold. Now I could not find anybody or anything that proofs that they don’t sell and deliver Gold.

However, the teams which are investigated took things into their own hand I guess and off course they did not have Gold to deliver neither where they eager to pay. Now here is my question to which I could not find any real answer.

Does Emgoldex not sell and deliver gold? In that case they did not sell a true product and yes!It’s illegal!!

Or, did some teams use the name Emgoldex to make their own money without the Gold and scam as much as possible in their own ponzi scheme? Like I said, I searched quite a lot around and could not find a single person who was involved with Emgoldex direct and did not get paid or got the Gold.

It’s only illegal if you don’t actually sell a true product. Now does Emgoldex sell Gold to their clients or don’t they? In case they do I don’t see who Emgoldex scammed.

Is their anybody here who can confirm that Emgoldex does not pay rewards and they don’t deliver the gold? A ponzi scheme is only illegal without a real product as far as I know.

As long their is a real product sold and delivered the scheme is legal.

Also, Emgoldex only offers you to invest into Gold And it’s up to you if you exit and take the money, Gold or continue to the next level.

Is their anybody here actually who can confirm this? Anybody who is involved with Emgoldex direct and exited?

Because a business model is not “an opinion”.

EmGoldex solicit investments from investors and use newly invested funds to pay off existing investors, making it a Ponzi scheme. That is not an opinion, that is precisely what EmGoldex do.

Ponzi schemes continue to pay out until new investment funds dry up. You are participating in a scam and whether you think you’ve been scammed is neither here nor there.

Yeah, clearly.

If you truly understand EmGoldex’s business model and can’t see the Ponzi for the trees, then you are a scammer – plain and simple.

Irrelevant. EmGoldex take newly invested funds and use it to pay off existing investors, making it a Ponzi scheme.

Strawman argument. EmGoldex take newly invested funds and use it to pay off existing investors, making it a Ponzi scheme.

Irrelevant. EmGoldex take newly invested funds and use it to pay off existing investors, making it a Ponzi scheme.

Irrelevant. EmGoldex take newly invested funds and use it to pay off existing investors, making it a Ponzi scheme.

False.

And that appears the basis behind your research. Stop peddling blatantly false information.

Ponzi schemes are fraudulent investment scams, irrespective of what they are attached to.

The entire Emgoldex is the scam. They were not authorized by ANY government to conduct gold business in ANY territory, esp. as investment.

In other words, if you believe in Emgoldex, you’ve been scammed and lied to.

Next question?

right! when ponzi schemes get in trouble they blame it on a group of distributors for ‘ruining the goodname of the company for their own monetary interests’.

recently even ufun investors were running around the net, posting that ufun was fully legal but a bunch of thai ufun distributors had caused all the trouble. do you believe that is true too, after all the investigation and evidence against ufun?

currently your brain is in a brainwashed semi shut down mode, you may not process information logically.

educate yourself a bit. your notions about MLM and ponzi schemes are bunkum.

a product means Nothing. it is how and why the product is sold and purchased, and by whom, that constitutes the basis of the inquiry into the legality of an MLM.

Oookaayyy… Now lets put this together. You actually don’t know what Emgoldex is doing and you don’t understand their Business model.

Emgoldex is MLM. Multi level Marketing. Which is totally legal!!

As long you actually sell a true solid legal product which they do. It’s Gold.

It’s not a ponzi scheme though it’s a little very similar.

However some of their teams thought they can just circumvent Emgoldex itself and use their name with fake offices and websites to lure clients into their new created ponzi scheme but without the product.

They collected the money and paid others off but because as ponzie’s will fall fast the groups got exposed and investigated for running illegal ponzi schemes and scamming thousends without Emgoldex.

(Ozedit: Wall of text offtopic derail attempt removed.)

Khm what does the sec have to say?

With all respect Anjali you actually did see that I was pointing to the MLM business model. Sorry I did not see the last comment of yours.

Please accept my apologies 🙂

Emgoldex did not have a registered office in the Philippines as far as I know. or a business license.

I am not so sure which one is the truth. It’s not easy to say what is the truth in the Philippines.

To get things from the government in the Philippines it could take a long time if you go through the right channels. Which could be easily the wrong channels as well.

You pay and get promised and than you don’t get anything hahaha because you paid the wrong person. Anybody who lives and deals in the Philippines probably know what I am talking about.. Its the same in Kenya, Somalia, Tanzania, Nigeria and the list can go on.

I don’t defend here Emgoldex but at the same time I can not judge as well. However, Did they actually not pay the rewards to their clients? Did they not deliver the Gold to the Buyers?

I can’t get an answer to that nowhere. Anybody can?

If you start from the conclusion that “All MLM multi level marketing programs are totally legal”, then the rest of it will be completely meaningless.

Several illegal MLM multi level marketing programs have been shut down by authorities.

You won’t find any laws or court rulings with that conclusion?

How similar it is will normally be up to a court or another type of authority to decide?

They used www.emgoldex.com. I quoted from the complaint in post #58.

Is that the fake website?

really!! whodathunkit!!

you also missed the part where i advised you to ‘educate yourself a bit’.

i completely understand your enthusiasm and this ‘eureka’ moment you seem to be enjoying, BUT your’e not putting it together correctly, because you lack basic information about legal and illegal MLM.

study the amway and avon MLM model and come back. read the amway/koscot/omnitrition/burnlounge orders, and then give us your best argument and BOO us out.

if your best argument is that emgoldex has a ‘product’, i’m going to BOO your ass out.

The current article is about the SEC lawsuit in USA (sec.state.ma.us), against top U.S. promoters.

“No registered office in the Phillippines” doesn’t seem to be very relevant. You’re probably talking about some local problems in the Phillipines.

You are arguing things backwards. You have to base arguments on what the company ACTUALLY DO, instead of based on what it CLAIMED it does.

And the facts are simple: the company is NOT authorized to do any thing regarding gold.

There are also questions on whether the company has direct sales license in ANY country, which is required in many countries to do business as MLM.

There is also warnings issued by multiple countries against Emgoldex AND its local followers.

Yet there you argue while armed with just what the company claimed to be, most of which were proven to be false.

You’re starting to sound like Comical Ali from the Iraq War.

@khm

Really?… Really?

GTFO.

Absolutely horseshit. Every modern-day MLM Ponzi scheme attaches itself to a token product.

Using newly invested funds to pay off existing investors makes EmGoldex a Ponzi scheme, it has nothing to do with gold and/or the sale thereof.

1. Nobody requests gold, it’s all cash. The few slithers of gold you might see around were ordered for marketing purposes only (“see we have gold!”).

2. It’s a Ponzi scheme, it’ll pay out as long as new investors invest funds into it.

Many people like yourself here automatically associate a negative connotation with MLM. They just assume that… (snip)

(Ozedit: Newly invested funds to pay off existing investors = Ponzi scheme. Waffle about gold and MLM in general removed.)

This is where you reveal you simply parrot things from your upline without thinking.

Typical MLM product needs at least 40% margin to pay out the commissions. Source: MLMLegal.com (NOLINK://mlmlegal.com/MLMBlog/?p=758)

Since Gold prices are published every day as it’s a commodity, there is NO WAY Emgoldex, or whatever it choose to call itself, can be marking stuff up 40% to pay you all commissions. People would never buy gold at 40% surcharge.

Which proves that Emgoldex is not selling gold at all. They can’t be. They are selling PROMISES of gold, which costs NOTHING. That’s how they can pay you all those extraordinary “commissions”.

Which makes all your blahblahblah about MLM completely irrelevant. It is YOU who don’t understand MLM in general, and Emgoldex in particular.

So let me get this straight.

1) People pay to get into a ponzi pyramid table to either increase funds they have put in, or to collect gold (that there is no proof of)?

2) they then have to introduce people to the table to move up-these people have to do the same until they exit-to either collect the increased money or the fake gold?

3) So the people entering the table are paying the people exiting? yeah? and obviously a big chunk of the entry fee goes to the big bosses (who cannot be found anywhere-as they have fake offices around the world!)

4) So if there are no new recruits, then nobody exits and nobody gets paid-apart from the big bosses who then move to another country where they are not being investigated!

How clever! But totally illegal! I cannot see how people think this is not a scam!

The fact that you cannot visit offices ( fake one in dubai) you cannot meet the bosses, you will get no money back if it folds shows its a scam. The fact it is banned in many countries, and being investigated in more also shows that.

But a very clever one.

I wish everyone success whilst it lasts (we all like success), but what a shame for the people with low incomes when it does fold-such as the people in the Phillipines.

Its an illegal risk. Good luck if you win, sad for you if you dont, and eventually someone will lose. And then they will move somewhere else and start again.

Oh-in Dubai, Emgoldex has changed its name, it is now called GLOBAL INTERGOLD! The online gold shop!

Pretty much, although I believe the owners (Russians most likely) stay and operate the scheme from within Europe.

The gold on comes into existance if an affiliate requests EmGoldex not pay their Ponzi ROI in cash, but rather gold.

At that point EmGoldex take the ROI and purchase gold with it. The ROI, gold or cash, is still derived from subsequent affiliate investment.

Not really. A really clever scam would be so plausible it’d be impossible to pier without government auditing its books.

A “precious metal MLM” is nonsense. The prices of such are published and known around the world. There is no “margin” to pay commission out of.

This is clearly a pyramid scheme / Ponzi scheme that relies on recruitment with false promises of gold.

After all, a certificate of ownership costs nothing, esp. when only a few percent will ever request it. Then they can always fake some problems to delay the process even further.