Johann Steynberg tried to access $59.8 mill in Dec 2020

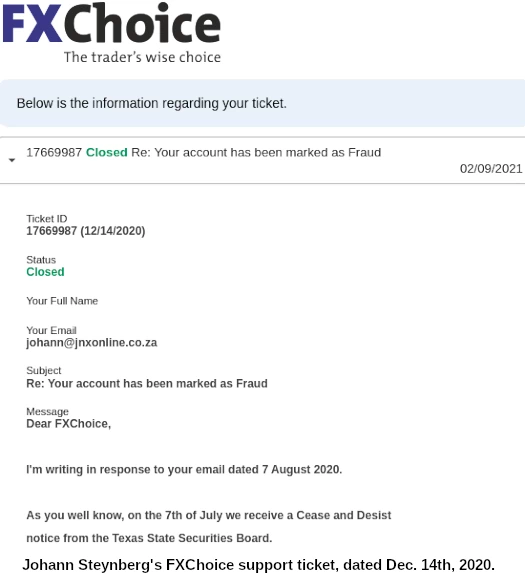

A December 2020 FXChoice support ticket reveals Johann Steynberg, or someone impersonating him, attempted to access 1282 BTC from MTI’s then seized account.

A December 2020 FXChoice support ticket reveals Johann Steynberg, or someone impersonating him, attempted to access 1282 BTC from MTI’s then seized account.

The ticket also reveals Steynberg evidently had a warped understanding of securities regulation in the US.

FXChoice is a third-party trading broker with no known direct ties to Mirror Trading International.

Mirror Trading International represented it generated trading revenue through FXChoice.

This came to an end when FXChoice shut down MTI’s accounts in August 2020.

The following is the support email FXChoice sent to Steynberg on August 7th, 2020;

Dear Cornelius Johannes Steynberg,

We are writing to inform you that your account has been marked as ‘Fraud’.

This means you will no longer have access to your Backoffice or any of your accounts.

The recent Cease and Desist order from the Texas State Securities Board, coupled with your inability to prove the source of your funds, has brought us to this position.

Should you satisfactorily appeal the Cease and Desist order against you, and provide us with financial statements from Mirror Trading International confirming that you have filed Annual Returns, we will remove the ‘Fraud’ status on your account.

Yours sincerely,

FXChoice Affiliate Department

At the time FXChoice revealed MTI hadn’t engaged in any significant trading activity.

FXChoice had shut down MTI’s account following a securities fraud cease and desist issued by Texas.

FXChoice closing MTI’s account(s) effectively saw 1282 BTC in the account frozen.

Steynberg would flee South Africa towards the end of 2020. This followed confirmation of multiple regulatory investigations into MTI.

MTI would officially confirm Steynberg’s disappearance on December 20th. Cheri and Clynton Marks, suspected owners of MTI, claimed they hadn’t heard from Steynberg since December 14th.

That same day Steynberg emailed FXChoice, requesting the broker release the 1282 BTC held in MTI’s frozen account.

Ticket ID: 17669987 (12/14/2020)

Subject Re: Your account has been marked as Fraud

Dear FXChoice,

I’m writing in response to your email dated 7 August 2020.

As you well know, on the 7th of July we receive a Cease and Desist notice from the Texas State Securities Board.

Our legal team have responded to their notice and since then, almost 5 months later, we have not heard anything again from the Commissioner of the State of Texas.

It was a wild goose chase brought up by disgruntled competition in our industry. Our legal team has confirmed that this case is now closed.

For the record, MTI failed to challenge Texas’ notice. This meant that after 30 days it became permanent.

Securities fraud cease and desists issued by US regulators don’t have a timed expiry.

In response to queiries about the source of MTI’s frozen bitcoin, Steynberg directed FXChoice to MTI’s filed “annual returns”.

I have also attached screenshots that shows the filing of our annual returns.

I hereby formally request that our account status be rectified and that the account balance of 1282 BTC be sent to our wallet address below.

34FuYYSWbikidcYRgfMfvoddnzXeGTqqLj

I trust that everything is in order and await your reply.

Kind regards,

CJ Steynberg

The supplied bitcoin wallet hasn’t been used. It appears to be a new wallet Steynberg set up specifically to receive bitcoin from FXChoice.

FXChoice forwarded Steynberg’s request to their legal department.

As of February 5th they hadn’t got back to him, prompting Steynberg to reach out again.

Good day

I still have not received a reply on this ticket.

Regards,

Johann Steynberg

FXChoice responded on February 8th;

Dear Cornelius Johannes Steynberg,

Thank you for your email.

The FSCA of South Africa has informed us that you are subject to a criminal investigation. We are not allowed to disburse any funds to you pending the investigation’s outcome.

We strongly recommend you contact them with any questions you may have regarding the funds deposited to your account.

Best wishes,

FXChoice

News of the FSCA, South Africa’s top financial regulator, investigating MTI seemed to upset Steynberg.

Wow. This is insane. FSCA does not have any jurisdiction over you.

FXChoice responded by closing Steynberg’s support ticket without further comment on February 9th.

Seeing as the FSCA confirmed a criminal investigation into MTI on December 17th, we’re not sure why Steynberg was still in denial come February 2021.

In any event nothing has come of the FSCA’s investigation to date. Last July the FSCA announced they “might” fine MTI – evidently six months later that decision is still under consideration.

At the time of his December 14th, 2020 request, bitcoin was trading at $46,481. This meant had FXChoice of released the bitcoin, Steynberg would have made off with $59.8 million USD.

In March 2021 liquidators announced they had recovered 1200 BTC from FXChoice.

Civil liquidation proceedings pertaining to MTI are ongoing.

Steynberg was arrested in Brazil last month.

We’re still unclear on whether he’s being extradited to the US or South Africa.

In related news Louis Nel, a blogger from South Africa, has published “MTI – The Missing Pieces”.

In his post Nel explores various aspects of Mirror Trading International, with input from an anonymous source.

“On 20 July 2020 Johann Steynberg and Tom Fraser, business advisor to MTI, had a meeting with Gerhard van Deventer and Andrea Coetzer from the FSCA”, Anonymous relates about the regulators stepping in.

“Both Steynberg and Fraser stated under oath that they partook in criminal activity and nobody at MTI was qualified to be working there, but I am focusing more on the subtext here and flagged a few things.”

Worth a read if you’ve been following the MTI saga.

JS: “I swear before God that I am a crook”

FSCA: “Thank you for that. Get back to work. We will be in touch. Maybe”

“What’s that? You’re thinking of running away to Brazil? George here went last year!

He knows *the best* hotel and girlie bars to visit. Make sure you see Jeannie at the front desk for some international travel vouchers on your way out.

Thank you for stopping by to confess, we hope you enjoyed your time at the FSCA.”

-transcript of FSCA’s interrogation of Steynberg, probably

Given the language and content used, those emails are definitely from Cheri.

Johann is Afrikaans and too thick to be able to respond in such a manner.

That’s my thinking.

The FSCA know the Marks are behind MTI and… continue to do nothing.

I’m sure the Marks are busy working out how to best use the MTI client list for the next dodgy MLM.

Johann with his boep, thick accent, two-tone shirts and velskoen must have been really exotic in Brazil

I wonder if the above reply is from the the *actual* dipshit Peter Muller.

Yhr guy who made all sorts of claims of having “verified” MTI’s activity. The guy who tried to defend MTI on MyBroadband, only to swiftly get his ass handed to him.

Anyways, “Wow. This is insane. FSCA does not have any jurisdiction over you.” definitely has Cheri written all over it.

Ugh, if Muller is one of the MTI scammers then it’s not him.

Please don’t use the names of scammers when commenting. I’ll either spam-bin or remove.

When will payments done by liquidators? My big question is, how can Tax claim in general. It’s clear that I’m taxed twice on my income.

They should claim from the winners and not from us who struggles to make a living and have to loose our hard earned taxable income to our tax collectors again.

@ Frik

I’m not Johan or Muller you does.

You live in South Africa and complain you get taxed twice for your stupidity and not understanding how SARS operates?

You complain about crime like all white South Africans, and then suddenly bitch when you try it (even the regulator said to stay away), and it blows up in your face? You wouldn’t be whining if you were one of the “winners”.

You walked into this with your eyes wide open

While I agree Ponzi schemes shouldn’t be held liable for tax at the expense of victims, looking at it as being forced to pay tax twice is incorrect.

Once you hand over money to a Ponzi scheme it’s gone. It’s not your money any more. Any tax liability imposed on a Ponzi scheme is separate to personal tax liability on your end.

Although it hasn’t happened in a while the IRS in the US tried to collect tax on a few busted Ponzi schemes. To date they’ve withdrawn claims after engaging with a Receiver though.