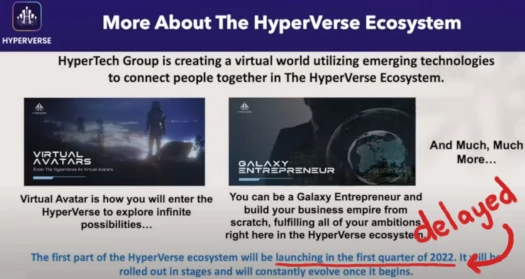

Hyperverse NFT Ponzi launch delayed till 2022

![]() After announcing a December 10th launch deadline that came and went, Hyperverse has delayed launch of its NFT Ponzi game until Q1 2022.

After announcing a December 10th launch deadline that came and went, Hyperverse has delayed launch of its NFT Ponzi game until Q1 2022.

Rather than make the announcement themselves, owners Ryan Xu and Sam Lee had “community presenters” announce the delay.

Pitched as a “Global Presentation Launch” (of what we’re not sure), top HyperFund net-winners took to webinars on Monday.

For reference we have:

- Keith Williams, London UK

- Brenda Chunga, US

- Goran Hemstrom, Melbourne Australia and the Netherlands

- Kalpesh Patel, UK hiding out in Dubai

- Tami Jackson, NJ US

- Mick Mulcahy, Cork Ireland

Hyperverse was initially supposed to launch sometime between December 6th and 10th.

That has now been pushed back to “the first quarter of 2022”.

That went down like a ton of bricks, prompting HyperTech Compliance Officer Hope Hill (aka Ronae Jull), to issue a follow up announcement yesterday.

IT originally estimated that the full upgrade to HyperVerse would be completed by 10 December. Obviously that estimate was not met.

There are more than 1,000 IT professionals working round the clock to sort the glitch that seems to affect some people and not others.

Nothing is known about Hyperverse’s IT department. Let alone the 1000 “professionals” Jull claims are employed there.

Based on its website being a cheap off-the-shelf $79 template, it’s doubtful Hyperverse IT is anything more than a handful of outsourced devs.

How exactly Hyperverse’s NFT Ponzi game will play out remains to be seen. The company has only announced it’ll feature avatars and running around pewpew’ing planets.

Personally I wouldn’t expect anything above the usual cheap mobile gaming experience. That’s if anything launches at all.

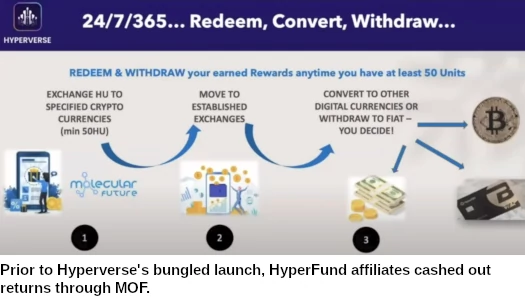

With Hyperverse delayed, effectively the Ponzi scheme has had to fall back on its original HyperFund model.

The Hyperverse twist is nobody can withdraw. HyperTech disabled withdrawals in late November.

Transitioning MOF, the internally owned token HyperFund investors cash out through, saw its trading value plummet by 98.98%. From ~$2 in HyperFund, Hyperverse’s bungled launch has MOF sitting at $0.0035 (roughly a third of a cent).

This saw HyperTech scramble to disable MOF withdrawals. Investors fell back HDAO, another internally owned shit token, until HyperTech disabled HDAO withdrawals too.

That’s what actually happened. Here’s the fiction Jull from compliance put out:

Here’s what we know for those with failed withdrawals: it is not about a browser issue, it has nothing to do with rank, it has nothing to do with the size of withdrawals, and IT has not turned off withdrawals for certain members.

So what we do NOT know yet is what the exact glitch is (that’s the job of the IT team) or what it will take to sort it (again, the job of the IT team). If they had a clear estimate of when they believe they’ll have this done, they would tell us.

Those two things: figure out what the glitch is and fix it – is the total focus of the IT team right now.

So uh, “1,000 IT professionals working round the clock” can’t fix a week-long withdrawal “glitch”?

Have they tried just turning withdrawals back on?

Whereas rank-and-file Hyperverse investors are unable to withdraw, top earners don’t seem to be having any issues.

In another social media post made earlier today, Burton gushes over a gaudy selection of watches in Dubai:

HyperTech/Hyperverse owners Ryan Xu and Sam Lee haven’t been seen in public for months.

The pair are on the run from liquidators in Australia, seeking to recover $48.9 million AUD in Blockchain Global losses.

Website traffic analysis suggests the majority of Hyperverse victims are based in the US, followed by the UK and Canada.

While UK authorities have issued securities fraud warnings against HyperFund and Hyperverse, the US and Canada have yet to take action.

1,000 IT professionals?????….lol….just lolzzz….

How can it be that you can write stuff like that, without even checking things up?

It´s so obvious that you trie to understand and just hammer out something you might think is correct (and always in a negative way). I will NOT comment or even try to discuss anything with you, because it´s absolutley impossible. (Ozedit: cool, bye)

Here comes the butthurt…

1. Why waste everybody’s time leaving a comment stating you’re not going to comment or engage with the content of the article?

2. My sources are provided. Try reading the article next time instead of rushing to defend your Ponzi scheme kthx.

3. So how much have you lost?

You actually deleted my post and did what you are a pro on doing (taking stuff out of it´s context). My enire post was commenting on the rubbish and the false info you write here. I will post it again, without the text that i want comment.

That’s better. This isn’t FaceBook. Dummy spit = GTFO.

Or they just wanted to go from 100 million to 100 billion tokens, ala OneCoin. Or both.

Cool story bro. MOF still plummeted 98.98%+ in value.

Except there is no trading outside of HyperFund and nobody can withdraw MOF (lolololol).

Except the only thing anyone in a Ponzi scheme cares about, withdrawals (lolololol).

Watch withdrawals magically get turned on again after the Christmas shopping period.

And Hyperverse, as it stands, is just a $79 website template attached to the HyperFund backoffice Ponzi scheme.

1000+ programmers to upload an off-the-shelf website template and change some backoffice logos (lololololol).

My agenda isn’t hidden. It’s popcorn and lulz, always has been.

Your comments clearly says it all, you have absolutley no clue whatsoever on what is going on (which is the reason I do not comment your stories). I will however make an exception, because I cant stay silent.

The MOF is not a story, it´s all in the books and you could read up on it (if you had some tiny knowledge).

YES, you can trade MOF on the exchanges that support it (OKEX, HOO, BITTREX). Swap is done and all holders of MOF got x1000, and it´s now on TRC_20 (earlier on ERC_20).

All holders of MOF are very happy, beacuse they 2-3X on this swap, thanks to people like you thinking it was a drop (when it was +-0). Oh and btw, Onecoin was a scam and never even a real token.

(Ozedit: derails removed)

Ponzi go boom. It’s not rocket science.

Of course it is. The Ponzi shitcoin HyperFund investors used to cash out gets tanked isn’t a story? Damn son, lay off the copium.

You can’t “crypto bro math” your way out of the fact MOF tanked 98.98% after the botched Hyperverse launch. And MOF withdrawals were and remain disabled.

OneCoin was a Ponzi scheme, with or without a token. The only reason the non-existent token became a big deal is because they lied about it.

Kinda funny how the world’s largest crypto Ponzi scheme figured it was easier to scam people using a MYSQL database than waste time with dAh BlOcKcHaIn.

Forget round the clock; these pretend IT people need to be working round their laptops until this glitch is fixed! Leave the clock alone.

Bah-dumm-tssss!

Oz, if the loss in value was from $2 to $0.0035, that’s a drop of 99.825%, not 98.98%. (Or maybe I’m using the wrong numbers.)

(0.0035-2)/2 = -1.9965/2 = -.99825 = -99.825%

Last comment from me!

How can you withdraw MOF during a chainswap? Please tell us that. Chainswap is not handled by Hyperverse.

Company instead let members withdraw HDAO and you probably saw what happened to HDAO when that was announced *giggle*, more happy people that can drink champange.

All I wrote above around MOF is 100% true and what has happened, people can verify that.

Yeah it’s 0.0035 now. I came up with that figure a while back!

Does chainswap take 3 weeks? tHe FuTuRe Of MoNeY!

Yeah, they disabled it in less than 24 hours because Ponzi go boom.

Not much a champagne drinker but I’ll beer cheers to that! *clink*

Dude, just tell us if you’ve been able to withdraw cause you’re really talking around that question. It’s just MOF this and HDAO that.

Here’s a small tip that needs no fact checking: if withdrawals from an invest-erh…….membership is not active over the Christmas period (the time most people want to spend the money they invest-erh……used to buy their “membership”) it’s something that’s not going to end well for you.

Now you might say “Hyperfund or -tech or -verse (or whatever the hell they want to call it) has given me financial freedom”. Buddy, they’re already dictating how you can spend other people’s erh…..I mean your money.

So please stop trying to sound clever. Just tell us if you can withdraw or not. And if you can’t withdraw, maybe say less.

I’m a passive participant in HyperVerse. Facts are:

– MOF was still not integrated into the backoffice.

– HDAO withdrawals keep failing. Screenshots were already posted by other users.

Incredible LOLs over 1000 IT professionals. Man oh man, you have to be an idiot to believe that.

But, I want to say it IS normal that when a token’s value is /1000, that the hodlers get x1000 their amount so the portfolio value remains the same.

If the total supply of a coin goes x1000, obviously the value is rebased to /1000.

It happend with VeChain in 2018, when they went from VEN (ERC-20) to VET (VeChainThor). 1 VEN was worth 100 VET. So your amount of VET after the swap was your amount of VEN x 100 in order to keep your total asset value for investors the same.

Granted that all the other rest coming out of HyperTech is hyper-crap, but that part of the story sounds normal to me Oz.

Considering MOF is monopoly money attached to a Ponzi scheme, that’s what makes this hilarious.

There’s only so much money Hyper* can pay out via trades. That just got a hell of a lot more complicated with the ~98% reduction.

0.004 goes to 0.003? Your Ponzi ROI just lost 25%. And we’re mostly past the recruitment boom now, it’s mostly people cashing out (which is why HyperFund collapsed to begin with).

So what happens if number goes up to say $1 through manipulated trading to help promotion? How is Hyper* going to cover those exchange withdrawals with X1000 tokens created out of thin air?

The whole thing is lol to think about.

Nobody is voluntarily “hodling” MOF, it’s a vehicle to cash out HyperFund/Hyperverse Ponzi returns. Nobody uses it for anything else.

I agree, the split is normal. The 1000 IT workers is embarrassing. As if you’d even say that.

They fact they did shows the type of people they are Duping. ‘Leaders’ are currently partying in Duabi. They make me sick.

Absolutely sickening indeed.

There are loads of red flags, Blockchain Global was heralded as one of the vehicles which was providing the money that affiliates were earning, as they weren’t using new affiliates money to pay other affiliates.

Ryan XU was the chairman of the company when it collapsed owing investors $48m if he was earning so much from everywhere else why couldn’t he save the company and repay investors.

Hyperfund probably pays that every week. What companies funds are actually supporting Hyperfund payouts.

Remember these companies must be soley owned by Ryan XU and Sam Lee. Being a shareholder of other companies doesn’t give you the right to access their accounts and draw out money willy nilly.

By the same token companies that they own can’t have any shareholders as I don’t think they would be very happy in the company using profits to pay Hyperfund.

It was said that members would be given access to early opportunities that would be 30% below launch. What opportunities in the past year have members been made aware of.

Of course the owners could silence Behind MLM very easily and increase their recruitment numbers. All they have to do is get a 3rd party in to audit their accounts and prove once and for all this isn’t a ponzi scheme.

Just for fun, I looked up the number of developers working on

Instagram: 300+

Call of duty: 500+

Minecraft: less van 600

Fortnite: less than 700

Hyperverse: THOUSAND 😀

I feel bad for most of the victims, but I live for the butthurt ones too stupid to realize they have been scammed.

The whole saga with Hyperfund/Hyperverse is like a badly written soap opera. There’s new twists and turns everyday – you couldn’t make it up.

Maybe somebody should turn it into a movie. There are certainly enough interesting characters/villains to keep the audience on the edge of their seats until the end.

The only concern about this is that people would think it was too unbelievable.

HDAO withdrawal is still working for many. Takes around 24 hours though.

Doesn’t work for most affiliates. Even after 24 hours.

It’s worked for me. Managed to get half my money out so far.

A lot of members and ‘leaders’ are in Dubai at the moment. Kalpesh is doing talks in a conference.

There is a massive push for Hyperverse. This ain’t going anywhere.

Said everyone in a Ponzi the day before it collapsed.

The fact that a lot of members and leaders have fled to Dubai is an indication that the end is near, not the opposite.

When Ponzis are at their height the leaders fly around the world raking in new money. They aren’t at material risk of prosecution as there aren’t any losers filing complaints, and there is no need to leave their homes and their friends/family to go hide out in a hot, sandy craphole.

That said, it is impossible to predict when a Ponzi will collapse by observing the movements of the top scammers, for the same reason that it is impossible to predict when a Ponzi will collapse at all. It is completely random.

All schemes that promise to pay out more money than they generate only go one place, down the drain.

The top scammers can push their crappy mobile games all they like, but once the pool of suckers has been exhausted and nobody is willing to put in new money, the curtain comes down.

Doesn’t mean it works for many. You managing to withdraw doesn’t change the fact most affiliates lost money and can’t withdraw.

Exactly. Ponzi schemes don’t go anywhere, other than the road to collapse. No matter how massive the push is, the outcome is always the same.

They are on a knife’s edge and had to re-invent Hyperverse to con more people whilst meeting old commitments, hence they blocked withdrawals waiting for this new scheme to perform.

Unfortunately for them, Hyperverse / Hyperfund is now found on a Google search on other sites, including Facebook, so their efforts to con more people and stay alive will be severly hampered and they may not survive now?

(Ozedit: links removed, content already covered on BehindMLM)

Party time it seems: youtu.be/x_tNDVTCPlk

I laugh at “Paul” Simon and the super CLOWN who wrote the original article full of lies!

As was stated above, Hyperverse was always slated to launch in 2022, with an EARLY date of 12/10/21. The reboot and change from H-fund to H-Verse was slated to be completed by 12/10/21..WHICH IT WAS!

The other thing is, stop lying about only certain members being able to do withdrwals, EVERYONE is able to withdraw their money if they need to! The lies and non factual information in this article are AmaZIng!

Now they’ve run to Dubai to hide out…Cut it out “Felicia!” They are attending a Crypto Conference with other leaders from around the world.

Sounds like you’re a bit upset because you weren’t invited?! Also, before you call something a ponzu scheme, look up the true definition of a ponzu scheme! Sounds to me like a lot of hating going on!

Who do you actually work for? You must be getting big bucks to spout these types of lies about this company…Hmmmm…when is your BS scheme going to launch itself?

Stop the lies people. The company is doing everything it said it would do! GET A LIFE. #HATERS!

Well Lifelover.

I’ve tried to do withdraws on 3-4 separate occasions during the last week, all were declined. Tried both to wallet on okex and hoo – so please spare us the bullshit of “withdraws always work” – because they’re not.

Look at the hyperponzi Facebook page, ppl are begging to get their withdrawals, and all they get are hyperponzi fan boys from some odd country saying “pLeAse LeT oUr 1000 iT pROfesSioNal d0 tHeiR jOb *hand praise* x3”

This house of cards will soon either disappear, get hacked or the funds be converted into Hyper-nfts and we’ll all be sitting with worthless gifs and whatnot whilst the top teir spends our moonei in DuBAii.

Sites been taken down to complete the upgrade….

Seems like the update doesn’t seem to be the issue here, rather the Ponzi going kaboom. Might be wrong, though, if the update is real

Sites back up.

We need to take these bastards down. Reach out to me and tell me how I can help.

LMAO @ a bunch of good for nothing lowlifes hanging out in Dubai spending OPM (Other peoples money) trying to show off ill gotten fruits of nobody’s labor.

There are several Facebook Hyperverse pages. I wonder what will happen to the “Compliance Officer” Hope Hill, and if the authorities will track her down by her real name.

She needs to be flushed out into the open….. Ronae Jull.

One more interesting thing about the Hyperverse launch is the lucky draw winners … there is a video found who checked those addresses which I did on my own, I come to a separate result, that all 3 addresses exist in the TRON network, but only with a few bucks and not the promised 18k$ …

also I did not find anything in which coin/currency the winners were paid, Check here the addresses, I am not sure if those exist on another network, but I strongly doubt for all 3…but don’t know how to guarantee:

trx.tokenview.com/es/address/TXnbcjm56pwqebQiULRPYh2mopjr2wHNot

trx.tokenview.com/es/address/TCYnFib4GxX27yQv3DHyrGcrgGyWBCuH6A

trx.tokenview.com/es/address/TG6Dqax8f4KbMbYnCG41yWy8qXCoVsR7Lk

BR

Hi admin, can you please delete my last post, this was not correct, the prizes have been paid, I found the correct exporer.

See the inflow tab on dec 5th … so this raffle was legit:

explorer.bitquery.io/tron/address/TXnbcjm56pwqebQiULRPYh2mopjr2wHNot/inflow

explorer.bitquery.io/tron/address/TCYnFib4GxX27yQv3DHyrGcrgGyWBCuH6A/inflow

explorer.bitquery.io/tron/address/TG6Dqax8f4KbMbYnCG41yWy8qXCoVsR7Lk/inflow

Leaving it up as otherwise your second comment doesn’t make any sense.

It’s hardly a ‘legit’ raffle when the prize is paid out using stolen funds.

Did you know someone from hyperfund created a whole pdf about this site. Came across it today. Happy to share if you haven’t already seen it.

Does it change Hyper* being a Ponzi scheme?

Not worth the attention of readers here, I think.

Even without reading it, one can guess what it’s all about: coverage of HyperSomething is false, I know people from other companies labeled as Ponzi schemes there and they said the site is wrong, Oz is an Australian scammer promoting his own Ponzi.

The rest of contents is marketing BS that “proves” the affiliate’s opinion (in reality all this only proves HyperSomething is a collapsed Ponzi).

It doesn’t change Hyper being a Ponzi scheme but I thought being able to respond to the counter arguments in the pdf could help people who still things it’s legit business.

Just let me know where to send it if you’d like to see it and respond. I think it would be helpful to people.

@Anon

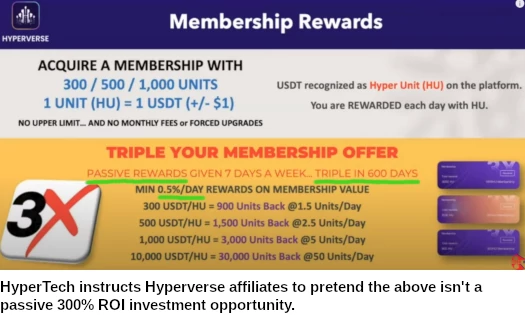

Hyper* is committing securities fraud and operating illegally because it’s a Ponzi scheme.

The only counter-argument I’ve seen to that is “our passive investment opportunity isn’t a security because we call

investors –> members

investment –> memberships and

returns –> benefits/rewards

This is pseudo-compliance BS that doesn’t hold up to regulatory scrutiny.

If that’s all that’s in there then there’s no point. Ditto if the Howey Test is not addressed (US standard for identifying an investment contract).

A lot of woowoo in the Arab news. Let’s see what really happend in the next years. I would say if these shitcoin sellers scamming the wrong people, it could become a nightmare.

thenationalnews.com/uae/courts/2021/12/24/cyber-criminals-face-five-years-in-jail-and-dh1-million-fine-over-cryptocurrency-scams/

You are so full of shit. Just a couple of things you fail to mention – out of many – First withdraw;s continued using one of their other cryptos while the conversion from ERC to TRC took place.

Second, that crypto went up in price 10x. There was no loss in MOF since the split ratio was 1000:1 so yes it ddi de-value 1000x but no the value of each holding remained the same due to the increase in tokens – re-tokenisation is very common in crypto.

Also MOF trades on numerous exchanges, contrary to hat you say.

There is lots more but I can’t be bothered with a dick like you – the person who should be in front of regulators is you for writing an incessant stream of rubbish whilst running your own Ponzi scheme.

Till I see them go after one MLM crypto Ponzi I’m not holding my breath.

No they didn’t. Withdrawals were completely disabled.

Then MOF came back, collapsed and was disabled again. Then it was HDAO, which they kept disabling and reenabling because it too kept collapsing (had to pause to manipulate on the backend).

Right. And where’s the money going to come from when you go to withdraw?

Cool. The only people who use it are Hyperverse Ponzi investors trying to cash out their monopoly money returns. Doesn’t matter if MOF is on 1 exchange or 500.

That’s not how regulation works champ. Sorry for your loss.

Why arfe you making up fake garbage and you know you’re in Hyperverse though? WTF.

The reason Ponzi scammers like Ryan Xu “make up fake garbage” is money.

The real question is why do gullible schmucks such as yourself keep falling for the same Ponzi scheme in different wrapping?

I was doing withdrawals for my group of investors all December 2021 through…

people who post comments such as yours must be just trying to get more followers by posting unverified, nonsensical and misinformed information… Please post things that actually factual…

It is a fact that HyperFund/Hyperverse disabled withdrawals, collapsed MOF and HDAO and then initiated withdrawal failures throughout December.

Either you’re an early investor with withdrawal privileges or you’re lying.

Whilst I agree this is a Ponzi scheme it’s not true everyone is losing money.

There are many people making money still. Morally so wrong and is basically theft but as you say until they run out of new members this will keep going.

Unfortunately there is so many more people out there that will fall for their shit.

Numbers on a screen != making money.

Hyperverse RNG lets a the odd withdrawal few so people run around going bUt I’m GetTiNg PaId! Everyone else can’t withdraw.

Maybe Oz but I saw a whole whatsapp group full of them before they threw me out. Many people withdrawing on a regular basis with no issues.

I can’t speak to randoms on Hyperverse shill groups but I’ve provided a few screenshots of failed withdrawals leading up to Jan 2022.

Let me please correct something.

The MOF token was switched from ERC20 to TRC20 blockchain during Christmas. Meanwhile, they enabled the withdrawal via the HDAO to compensate and still give the opportunity to withdraw.

This was not a crash and ofc withdraw was unavailable for 1 day during the merge because it was a major technical upgrade which in the end reduced the network fees from withdrawing by ALOT.

On the old Ether Blockchain, you had to pay around $20 gas fees, which is not related to Hyervere but the Ether Blockchain itself.. Now on the new Blockchain it’s only cents…

The money volume stayed exactly the same, it’s just glitched on some graphs.

If you owned $1000 in MOF on ERC20 blockchain, you still owned $1000 in MOF on the TRC20 blockchain after the merge.

$1000 = 400 MOF at 2.50 ERC20

$1000 = ~166.666 MOF at 0.006 TRC20

No one cashed out, it’s simply the value change of the blockchain merge from Ether to Tron link blockchain.

I can confirm that withdrawals before and after the merge are continuously working with no failures at all with highly reduced withdrawal fees.

Stop being so defensive, you are sad that you missed the train. (Ozedit: recruitment spam removed)

Try harder scammers. Withdrawals were disabled in late November.

Because they couldn’t, any anyone cashing out now is losing a ton because blockchain. Lulz.

Sorry for your loss.

Warning on a portal by German lawyers:

anwalt.de/rechtstipps/hyperfund-hyperverse-betrug-bei-krypto-netzwerk-aufsichtsbehoerden-warnen-197119.html

Hi Oz,

came across this links in a Hyperverse group chat:

(Ozedit: links removed, see below)

What is this all about? Would love your response especially on the “evernote” link.

Thx D

@Dorian

I ran a search for “securities” on the Evernote link and this came up:

That was the only instance, I didn’t look at the rest of it (waste of time “whataboutism” or points that are addressed elsewhere in our HyperFund/Hyperverse coverage).

I believe this has already been addressed but I’ll repeat here:

1. ASIC don’t audit companies.

2. HyperFund/Hyperverse has not filed any audited reports with ASIC or any other financial regulator pertaining to their investment scheme.

3. ASIC only covers Australia. At time of publication Alexa ranks top sources of traffic to Hyperverse’s website as the US (44%), Canada and Saudi Arabia.

Why isn’t Hyperverse registered with the SEC and filing audited financial reports?

You know why.

4. Calling a passive investment scheme “a membership” doesn’t change what it is.

5. Running a crypto Ponzi scheme committing securities fraud is absolutely nothing like “airlines miles or credit card points”. I don’t think needs further explanation.

The other links had nothing to do with Hyperverse so were ignored (derails).

If there’s anything specific pertaining to Hyperverse you want addressed, point it out. Don’t ignore what’s already been published, link to some wall of text document and expect a response.

Hey Oz,

relax, I’m on the Anti-HyperCrap Side. I’ve read all of your articles on the HyperCrap topic, many of them several times, I know its securities fraud what they do.

Buddy of mine tried to talk me into this, but my first thought was, that its a ponzi, thanks to you and other sources I now know it really is one, but my buddy is religious about it, no chance to make it clear to him, that they commit securities fraud.

Sad thing is, he talked several douzents of people, including family, friends and business partners into this.

Regarding the links, just wanted you to know, that they now hand out those papers in their groups and it would have been nice to see your counter arguements.

Scams have to come up with strawmans to counter the fact that they’re called out as scams on here.

What do you do when a mountain of verifiable evidence proves you’re running a fraudulent business? You deflect.

What you’ll never see them address is securities fraud or the fact that they’re Ponzi/pyramid schemes.

If they did I’d be happy to address it. Anything else is irrelevant with respect to due-diligence of the company in question.

If people swallow a scam’s misdirection, there’s not much to be done. They’re clearly just looking for any excuse to steal money.

Beyond creating their own recruitment circle of victims, the truly sad thing is they themselves will more than likely also lose money.

As it stands, unless you’re willing to withdraw cents on whatever you invested and jump through crypto subscription pool hoops, you can’t withdraw out of Hyperverse. Or they might let you withdraw, but then you’re left bagholding some random shitcoin you can’t do anything with.

There is information getting around that Brenda Chunga has been arrested for questioning and has become an informant.

Getting around from where? Brenda Chunga represents herself to be a resident of Maryland in the US.

US authorities don’t “arrest people for questioning”.

Chunga in Spanish is slang for poor quality, ugly, of poor taste, unsophisticated.

So LOL Una estafadora chunga XD, a poor quality/unsophiscated scammer