3FO Review: Shavez Anwar’s AI ruse Ponzi scheme

3FO operates in the MLM cryptocurrency niche. The company operates from the domain “3fo.ai”, privately registered on June 25th, 2025.

3FO operates in the MLM cryptocurrency niche. The company operates from the domain “3fo.ai”, privately registered on June 25th, 2025.

3FO is based out of Dubai and headed up by serial fraudster Shavez Ahmed Siddiqui, aka Shavez Anwar.

Anwar (right) was a central figure in Sam Lee’s collapsed HyperFund Ponzi scheme.

Anwar (right) was a central figure in Sam Lee’s collapsed HyperFund Ponzi scheme.

After HyperFund collapsed, Lee and Siddiqui continued to defraud consumers through HyperOne (Siddiqui was HyperOne’s “Operation Head of Asia Pacific”).

After HyperOne Lee and Siddiqui teamed up on StableDAO, essentially HyperTech Group 2.0 (HyperTech was the parent company of Lee’s HyperCapital and HyperFund Ponzis).

Through StableDAO Lee launched StableOpinion, VidiLook (rebooted as ViviLook 2.0 and then again as VEND), WeAreAllSatoshi, Satoshi Math Club and Boomerang Trade (aka Boomerang Arbitrage Trading).

At some point Lee had a falling out with Siddiqui, prompting Siddiqui to take over We Are All Satoshi (WAAS) as his own Ponzi project.

Following multiple failed WAAS reboots, Siddiqui launched Lquid Finance and Lquid Pay.

BehindMLM never formally reviewed Lquid Pay but as per research by Danny de Hek, the scheme sold debit cards tied to Visa’s network.

Commissions were purportedly paid on affiliate recruit, residual commissions and funneling investors into other BTCC token scams.

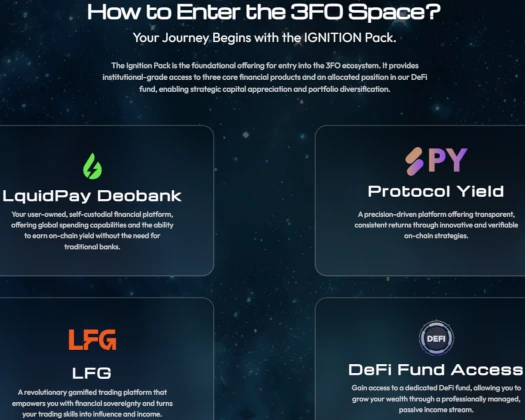

From 3FO’s own website, these include Deobank, Protocol Yield, LFG and DeFi Fund Access.

Multiple regulatory fraud warnings have been issued in relation to Siddiqui’s various schemes;

- California issued a We Are All Satoshi securities fraud desist and refrain order in September 2023;

- New Zealand issued a We Are All Satoshi and Boomerang Trade fraud warning in August 2024;

- Quebec issued a We Are All Satoshi securities fraud warning in November 2024;

- New Zealand issued a Lquid Finance securities fraud warning in May 2025; and

- Australia issued a Lquid Finance and LquidPay securities fraud warning in June 2025

Due to the proliferation of scams and failure to enforce securities fraud regulation, BehindMLM ranks Dubai as the MLM crime capital of the world.

BehindMLM’s guidelines for Dubai are:

- If someone lives in Dubai and approaches you about an MLM opportunity, they’re trying to scam you.

- If an MLM company is based out of or represents it has ties to Dubai, it’s a scam.

If you want to know specifically how this applies to 3FO, read on for a full review.

3FO’s Products

3FO has no retailable products or services.

Promoters are only able to market 3FO promoter membership itself.

3FO’s Compensation Plan

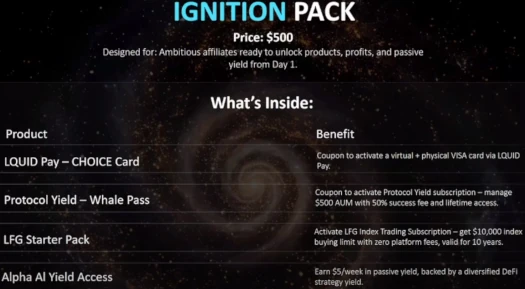

3FO promoters invest $500 of ethereum (ETH) into “Ignition Packs”. This is done on the promise of a $5 weekly passive return, capped at up to 400%:

- invest in one Ignition Pack and receive a 200% ROI

- invest in two Ignition Packs and receive a 300% ROI

- invest in three Ignition Packs and receive a 400% ROI

“Alpha Yield Plus Pack” investments of $500 can also be made. These pay a $1000 to $2000 ROI (not explained).

Note that MLM commissions count towards ROI totals, after which new investment is required to continue earning.

The MLM side of 3FO pays on recruitment of promoter investors.

3FO Ranks

There are ten promoter ranks within 3FO’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Boot Sequence – recruit 3 promoter investors, build a total downline of 30 promoters and generate $15,000 in downline investment volume

- Data Uplink – recruit 4 promoter investors, build a total downline of 75 promoters and generate $45,000 in downline investment volume

- Grid Maker – recruit 5 promoter investors, build a total downline of 200 promoters and generate $125,000 in downline investment volume

- Pulse Operator – recruit 6 promoter investors, have a Grid Maker or higher in 3 separate recruitment legs and build a total downline of 500 promoters

- Synth Layer – recruit 7 promoter investors, have a Pulse Operator or higher in 3 separate recruitment legs and build a total downline of 1000 promoters

- Echo Prime – recruit 8 promoter investors, have a Synth Layer or higher in 3 separate recruitment legs and build a total downline of 2000 promoters

- Command Bridge – recruit 9 promoter investors, have an Echo Prime or higher in 3 separate recruitment legs and build a total downline of 4000 promoters

- Quantum Fork – recruit 10 promoter investors, have a Command Bridge or higher in 3 separate recruitment legs and build a total downline of 8000 promoters

- Meta Protocol – recruit 15 promoter investors, have a Quantum Fork or higher in 3 separate recruitment legs and build a total downline of 15,000 promoters

- Code Origin – recruit 20 promoter investors, have a Meta Protocol or higher in 4 separate recruitment legs and build a total downline of 30,000 promoters

Note that to count towards rank qualification, recruited promoters must have an active investment.

Residual Commissions

3FO pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places a promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new promoters, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

3FO caps payable unilevel team levels at fifteen.

Residual commissions are paid as a percentage of ETH invested across these fifteen levels as follows:

- level 1 (personally recruited promoters) – recruit two promoter investors to unlock 10%

- level 2 – recruit three promoter investors to unlock 5%

- level 3 – recruit four promoter investors to unlock 4%

- level 4 – recruit five promoter investors to unlock 4%

- level 5 – recruit six promoter investors to unlock 4%

- level 6 – recruit seven promoter investors to unlock 3%

- level 7 – recruit eight promoter investors to unlock 3%

- level 8 – recruit nine promoter investors to unlock 2%

- level 9 – recruit ten promoter investors to unlock 2%

- level 10 – recruit twelve promoter investors to unlock 2%

- level 11 – recruit thirteen promoter investors to unlock 2%

- level 12 – recruit fourteen promoter investors to unlock 2%

- level 13 – recruit fifteen promoter investors to unlock 1%

- level 14 – recruit sixteen promoter investors to unlock 1%

- level 15 – recruit twenty promoter investors to unlock 1%

ROI Match

3FO pays a ROI Match. The ROI Match uses the same unilevel team as residual commissions, again paid down fifteen levels (same unlock qualification criteria applies):

- level 1 – 10% match

- levels 2 to 4 – 5% match

- levels 5 to 9 – 3% match

- levels 10 and 11 – 2% match

- levels 12 and 13 – 1% match

- levels 14 and 15 – 2% match

Rank Achievement Bonus

3FO rewards promoters for qualifying at Boot Sequence and higher with the following one-time Rank Achievement Bonuses:

- qualify at Boot Sequence and receive $1000

- qualify at Data Uplink and receive $3000

- qualify at Grid Maker and receive $5000

- qualify at Pulse Operator and receive $10,000

- qualify at Synth Layer and receive $25,000

- qualify at Echo Prime and receive $100,000

- qualify at Command Bridge and receive $500,000

- qualify at Quantum Fork and receive $1,000,000

- qualify at Meta Protocol and receive $5,000,000

- qualify at Code Origin and receive $10,000,000

Joining 3FO

3FO promoter membership is free.

Full participation in the attached income opportunity requires a minimum $500 “Ignition Pack” investment.

3FO solicits investment in ETH.

3FO Conclusion

We’re at the point now where Shavez Anwar has launched that many MLM crypto Ponzi schemes, it’s difficult to keep track of them all.

A major part of that is the ever-changing company names and spinoff launches. This convoluted mess can’t be good for marketing, so it’s assumes Anwar changes company names every few months in a bid to stay ahead of regulatory fraud warnings.

3FO itself is a simple AI trading ruse Ponzi scheme. Consumers are pitched on $5 a day passive returns on $500 investments.

Like any AI trading ruse, if 3FO’s trading actually existed Anwar would just run it for himself.

Beyond that, the only way consumers can verify any trading is actually taking place is through audited financial reported filed with regulators.

With 3FO there are no audited financial reports provided. Nor is 3FO or any of Anwar’s companies registered with financial regulators in any jurisdiction.

Beyond the simple $5 a week MLM Ponzi, 3FO appears to exist solely to funnel investors into Anwar’s other schemes:

Each new 3FO investment is bundled with a LquidPay Choice Card, a Protocol Yield “whale pass” and LFG starter package.

New stuff will likely be added as Shavez continues to launch new schemes (assuming 3FO isn’t the final hurrah).

As it stands the only verifiable source of revenue entering 3FO is new investment.

Using new investment to pay ROI withdrawals would make 3FO a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve 3FO of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

HyperFund and We Are All Satoshi are the two major collapses Anwar has been involved in. Subsequent schemes prey on a shrinking pool of “already deep in the hole” victims.

These are the people who will pitch you on 3FO and whatever new schemes Shavez comes up with after. Unless you want to join them and get caught up in having to recruit new suckers to recoup your losses, beware.

Hat tip to Danny de Hek for the heads up on this one:

dehek.com/general/scam-fraud-investigations/3fo-ai-pre-launch-warning-shavez-ahmed-siddiquis-latest-mlm-ponzi-scheme/