How Josip Heit set up GS Chain & duped the London Stock Exg

One of the pieces in GSPartners’ new Meta Certificates Ponzi puzzle is GS Chain.

One of the pieces in GSPartners’ new Meta Certificates Ponzi puzzle is GS Chain.

Evidently for some time now, GSPartners has been awarding LSC shares based how much affiliates invested. They’re now being doshed out as a recruitment incentive.

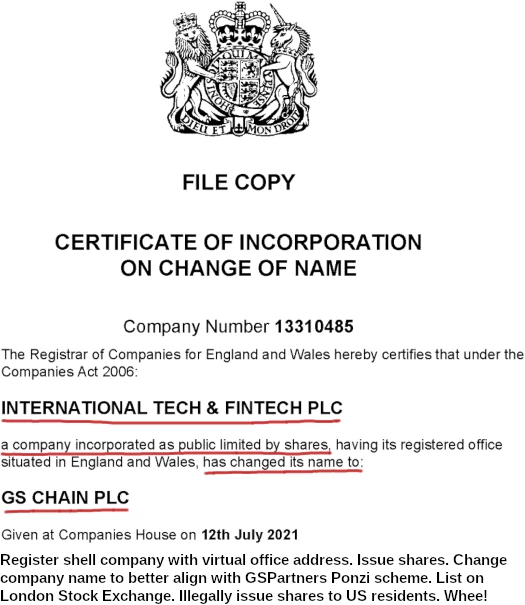

GS Chain is a UK incorporation, which in and of itself is nothing remarkable. Companies House signs off on fraud all the time.

GS Chain is also however listed on the London Stock Exchange.

By no means itself a sign of legitimacy, how Josip Heit fooled the LSE into listing his shell company is nonetheless worth documenting.

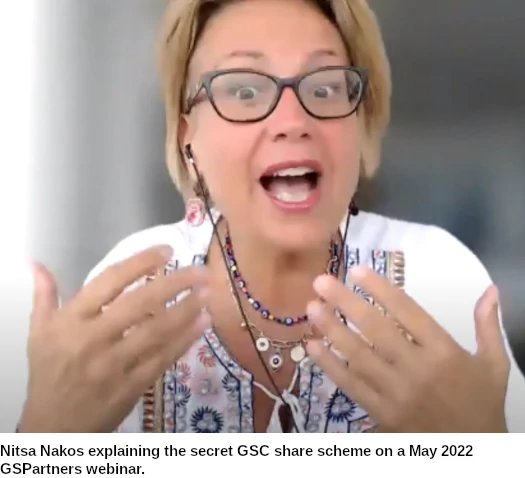

According to Canadian GSPartners promoter Nitsa Nakos, GSPartners affiliates were previously awarded LSC shares based on how much they invested.

That recently changed to affiliates being awarded GSC shares based on investor recruitment.

To fly under the regulatory radar, GS Chain was initially incorporated as International Tech & Fintech PLC. Josip Heit fronted £1,049,900 to get the ball rolling. On paper though this was paid by his hired shareholders.

International Tech & Fintech PLC was incorporated through a UK virtual office address.

Leon Filipovic (right), through the same virtual address, was listed as the company’s sole Director.

Leon Filipovic (right), through the same virtual address, was listed as the company’s sole Director.

Filipovic isn’t some random Heit plucked out of thin air.

From 2016 to 2018 he was the head of compliance and CFO for IFLS Corporate Services Ltd and from 2018 and 2019 Mr. Filipovic was responsible for education in blockchain technology and development of trading software for the Pameroy Group. More recently, from 2019 to 2021 he was head of software development for BL Enceladus Ltd.

IFLS Corporate Services and Pameroy Group specialize in assisting acquisition of financial licenses in jurisdictions where regulation is lax to non-existent.

IFLS Corporate Services Ltd is the world’s market leader for the acquisition of financial licenses. Asset Management, Forex, Brokerage, Payment Services, Crypto ICO launches or Hedge Funds are typical activities IFLS’ clientele is conducting.

More than 700 successfully established financial entities during the last 15 years in the Seychelles, Vanuatu, Georgia, Czech Republic, Belize, Panama or New Zealand should reflect our professionalism unlike no other provider on the market.

PAMEROY MANAGEMENT LTD is the world’s leading acquirer for financial licenses and operates in the Comoros, Vanuatu, the Marshall Islands, The Republic of Georgia, the Cook Islands, Seychelles, Belize, St. Vincent and the Grenadines, Bahamas, Singapore, Hong Kong, Malaysia and Gibraltar.

There appears to be a link between the two companies, with the text “IFLS Corporate Services Ltd: Register 99123” appearing on Pameroy Group’s website.

Pameroy claims its “focus is on the European Market, especially the German speaking countries”. Although he’s from Croatia, Josip Heit lived in Germany for decades before relocating to Dubai last year.

Pameroy setting up shell companies in the Comoros of is particular interest. In mid 2021 BehindMLM documented GSB Gold Standard Bank’s bogus Mwali banking license.

Mwali is part of the Union of the Comoros. GSB Gold Standard Bank is a German shell company within the GSPartners Ponzi scheme.

Pameroy also sets up shell companies “in Kazakhstan for entrepreneurs who wish to offer Forex, Crypto and Payment Processing.”

Tying all of this together is an October 2020 press-release, titled “G999: Josip Heit and the GSB Gold Standard in the cosmos of the blockchain financial industry“;

GSB Gold Standard Banking Corporation AG (GSB), one of Germany’s leading software, IT and block chain groups, has launched an unprecedented technology that makes transactions of crypto currencies much easier and above all much faster.

GSB Gold Standard Banking Corporation AG is an independent company, the group includes GSB Gold Standard Pay KB (Sweden), GSB Gold Standard Bank Ltd. (Comoros Union), GSB Gold Standard Pay Ltd. (Kazakhstan).

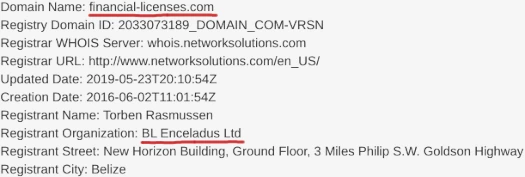

Filipovic’s last cited gig was at BL Enceladus Ltd. They appear to have renamed themselves “BL Group” and “BL Corporate Services” in mid 2021.

BL Group and BL Corporate services run “financial-licenses.com”, through which they provide “offshore financial licenses of any kind”.

Kazakhstan again pops up on the BL Group’s Financial Licenses website:

Perhaps you’re spotting the pattern in Filipovic’s employment history. Why Heit got Filipovic to front the International Tech & Fintech PLC shell incorporation should be obvious.

Filipovic represents he was from Croatia. Heit is also from Croatia, so there might be an additional personal connection there.

International Tech & Fintech PLC was incorporated on April 3rd, 2021. International Tech & Fintech PLC quickly got itself a company registration number and Legal Entity Identifier.

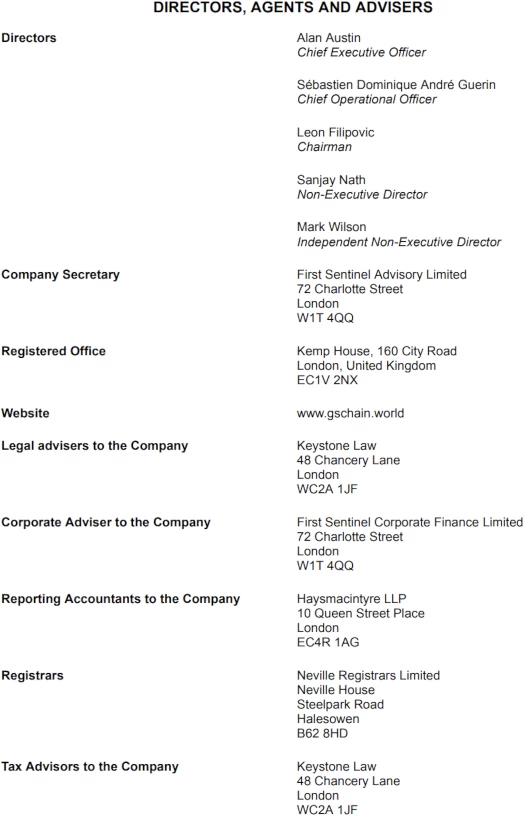

To keep his name off the books, Heit (likely indirectly) hired the UK firm First Sentinel to assist.

As per their website, First Sentinel

specialises in corporate and commercial law, as well as corporate finance law, for SMEs, pre-IPO and listed companies.

That last part fit into Josip Heit’s plans for International Tech & Fintech PLC.

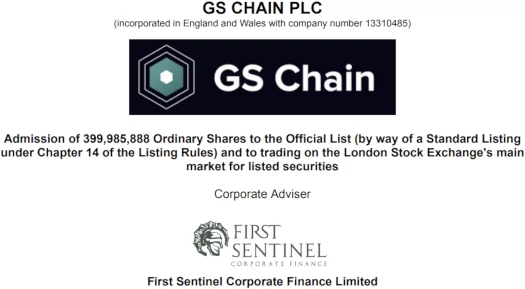

First order of business was changing International Tech & Fintech PLC’s name to GS Chain PLC. That took place via a 9th July resolution.

First Sentinel Advisory Limited was appointed as a Secretary of PLC on July 14th.

A GS Chain PLC trading certificate was obtained on July 28th.

His job done setting up Heit’s shell company, Leon Filipovic and his UK shell company GS&IB Fintech LTD were terminated as Director and Secretary, on 30th September and 29th September respectively.

That not to say Filipovic cashed out and parted ways. He stayed on as GS Chain PLC’s Chairman and, at least on paper, owns 28.3% of GS Chain PLC shares.

Sébastien Dominique André Guerin, GS Chain’s COO, owns another 28.3%. Guerin is a Director/Partner in Josip Heit’s GSB Gold Standard Corporation AG German shell company.

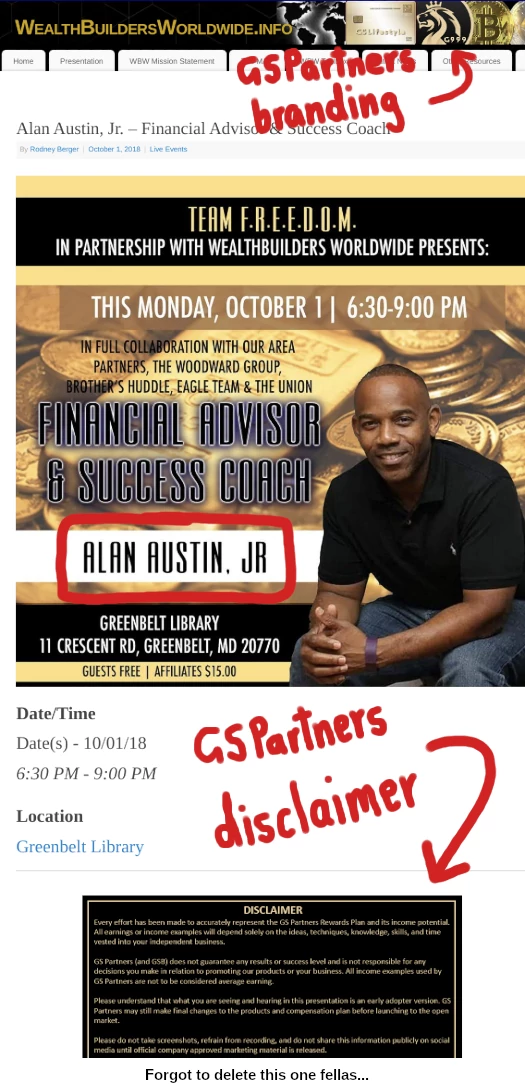

Here I’ll briefly mention GS Chain’s appointed CEO, US citizen and resident Alan Austin.

Not surprisingly, Austin is a GSPartners investor:

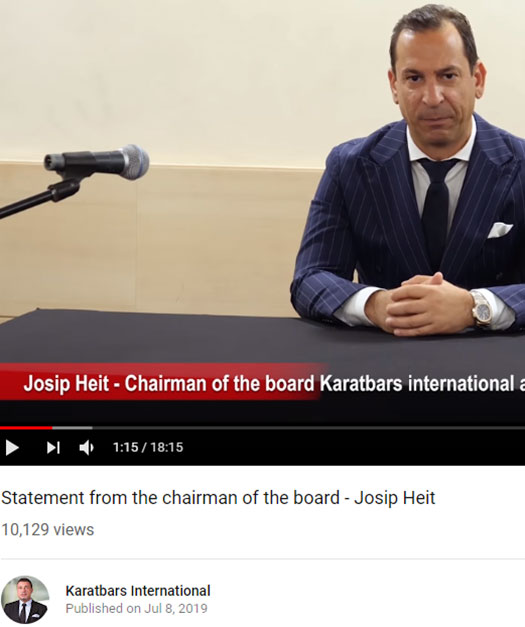

Austin is an OG Harald Seiz era Ponzi promoter, dating back to Karatbars:

Karatbars International of course being where Josip Heit’s MLM crypto Ponzi scamming began.

Austin is joined on GS Chain’s executive board by Sanjay Nath, a Director/Partner in yet another of Josip Heit’s shell companies GSB Gold Standard PLC:

Nath (right) holds 2.25% of GS Chain’s shares. Nath’s son and daughter hold 0.25% each respectively.

Nath (right) holds 2.25% of GS Chain’s shares. Nath’s son and daughter hold 0.25% each respectively.

Despite GSPartners affiliates purportedly being issues GS Chain shares attached to their investments, none of them are recorded in GS Chain’s financial filings.

The mob that signed off on all this nonsense was UK accounting firm Haysmacintyre LLP.

GS Chain PLC’s shell company filings stopped on December 19th, 2021. For more information we turn to GS Chain’s prospectus.

Here we find GS Chain’s shell company cover;

The Company intends to identify opportunities within the technology sector, to conduct the necessary due diligence and subsequently complete an Acquisition.

While the Directors will consider a broad range of technology sectors, those which the Directors believe will provide the greatest opportunity and which the Directors will initially focus on include the use of technologies in real estate, banking, finance, fintech,

telecommunications, automotive and blockchain industries.

But of course, being a shell company created for the sole purpose of furthering GSParners’ Ponzi scheme through securities fraud;

The Company has not yet commenced operations, other than in respect of its proposed listing.

The Company has no operating business and has not yet identified any potential target company or business for an Acquisition.

The Company has no operating business and currently, there are no plans, arrangements or understandings with any prospective target company or business regarding an acquisition.

The Company will not generate any revenues from operations unless it completes an Acquisition.

And unless Heit has GS Chain “acquire” one of his other shell companies, or vice-versa, that’s unlikely to change. All the investment fraud action is going down at GSPartners and Lydian World.

With the ruse in place and the London Stock Exchange none the wiser, GS Chain submitted its application for a public listing.

It is expected that Admission will become effective and that dealings in Ordinary Shares will commence at 8.00 a.m. on 13 May 2022.

The London Stock Exchange website allows to confirm GS Chain shares were indeed issued on May 13th.

Funnily enough, without any business operations or revenue, the shares have gone from 3.63 GBP to 5.45 GBP as of May 30th.

Also funnily enough, all of the listed GS Chain shares were traded “off-book”.

In light of the majority of GSPartners investors being US residents and the company doshing out GS Chain shares to top investors and now top recruiters, the following disclosures in GS Chain’s prospective are of significant importance.

The Ordinary Shares have not been and will not be registered under the US Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state or other jurisdiction of the United States or under applicable securities laws of Australia, Canada, Japan or the Republic of South Africa.

Subject to certain exceptions, the Ordinary Shares may not be, offered, sold, resold, transferred or distributed, directly or indirectly, within, into or in the United States or to or for the account or benefit of persons in the United States, Australia, Canada, Japan, the Republic of South Africa or any other jurisdiction where such offer or sale would violate the relevant securities laws of such jurisdiction.

What’s the point of stating that if, through virtual shares or otherwise, you’re going to go ahead and do the opposite?

Here SimilarWeb’s current website statistics for GSPartners’ and Lydian World’s respective websites:

It is inconceivable that nobody from the US or South Africa doesn’t own GS Chain shares. You’re not going to find any direct paper evidence of that for the LSE to uncover, but we’ll again rely on statements made by GS Partners promoter Nitsa Nakos a few weeks ago;

Because of the special relationships that Gold Standard Chain company has with GS Partners (Editor: in that they’re both owned by Josip Heit), it means that the members of GSPartners have an opportunity to receive gifted shares.

Now in the first wave we received gifted shares for product acquisition (Editor: investing) and for sales efforts (Editor: recruiting investors).

Now in the second wave and with us already now being listed, we will be receiving shares for sales efforts (Editor: recruiting investors).

There will no longer be shares issued for product acquisition.

And if you’re wondering why Heit is going to so much effort to mask doshing out GS Chain shares to US residents, again of whom make up the majority of GSPartners affiliate investors, look no further than GS Chain’s prospectus;

The Ordinary Shares have not been approved or disapproved by the US Securities Exchange Commission, any State securities commission in the United States or any other US regulatory authority, nor have any of the foregoing authorities passed comment upon or endorsed the of this Document.

Any representation to the contrary is a criminal offence in the United States.

As they typically do with securities fraud, the UK authority responsible for reviewing GS Chain’s listing application absolves itself of any responsibility.

IT SHOULD BE NOTED THAT THE UK LISTING AUTHORITY WILL NOT HAVE THE AUTHORITY TO (AND WILL NOT) MONITOR THE COMPANY’S COMPLIANCE WITH ANY OF THE LISTING RULES WHICH THE COMPANY HAS INDICATED IN THIS DOCUMENT THAT IT INTENDS TO COMPLY WITH ON A VOLUNTARY BASIS, NOR TO IMPOSE SANCTIONS IN RESPECT OF ANY FAILURE BY THE COMPANY TO SO COMPLY.

The FCA have jurisdiction…

HOWEVER THE FCA WOULD BE ABLE TO IMPOSE SANCTIONS FOR NON-COMPLIANCE WHERE THE STATEMENTS REGARDING COMPLIANCE IN THIS DOCUMENT ARE THEMSELVES MISLEADING, FALSE OR DECEPTIVE.

But… well, for the most part they’re hopeless. Heit chose the UK to fraudulently issue shares from for a reason.

As it stands each and every person and company on this list is in some way complicit to the fraud being perpetrated through GSPartners, Lydian World and GS Chain:

How complicit is up to an investigating authority to determine, be it in the UK or US. Heit runs GSPartners from and spends most of his time in Dubai.

Dubai is the MLM crime capital of the world. There’s diddly-squat chance of authorities there doing anything.

I’ve been asked by a friend in the US to consider investing in a BD Swiss MetaBroker account. Assured no MLM aspect just straight investment with lucrative ROI increasing as it builds.

My initial thought was maybe 10K and no more. But the push is on to get me to invest before the July 1st deadline. And I know virtually nothing about GSPartners except what I’ve read from you guys.

And it will keep me away from investing unless my friends group leaders (almost all African Americans) can convince me that your accusations and facts are untrue and misinformation.

My friend said something about them winning a lawsuit recently and I’m assuming it was against you.

You can verify GSPartners and its shell companies aren’t registered with the SEC. No need to listen to Ponzi scammers trying to sweet talk you into their scam.

Instead of blindly swallowing whatever nonsense your friend feeds you, ask them for proof.

You can personally verify anything presented to you here on BehindMLM. Not so much the BS coming from the Ponzi recruiters.

If you’re not happy to lose 11k of your money to scammers and fund organised crime, what’s so great about losing 10k?

Scammers have won lawsuits multiple times, typically by filing Mickey Mouse cases in scam-friendly backwaters like Ukraine or the United Kingdom. It doesn’t stop a scam being a scam.

Thanks.

What does it mean if I have pre IPO stock & I’m in the U.S?

It means you got scammed. Sorry for your loss.

There is no such thing as pre-IPO stock. It’s an oxymoron.

Looks like Leon Filipovic is the registered owner of Bitexlive

bitexlive.com

IBBP Pay Services Kazakhstan Ltd.

statsnet.co/companies/kz/59843416