How Australian promoters violate ASIC’s Auratus fraud warnings

Despite the Australian Securities and Investment Commission (ASIC) issuing two fraud warnings, a group of die-hard investors continue to promote Auratus and Billionico.

Despite the Australian Securities and Investment Commission (ASIC) issuing two fraud warnings, a group of die-hard investors continue to promote Auratus and Billionico.

Today we take a look at how Australian investors are violating ASIC’s Auratus and Billionico fraud warnings.

Most of the Australian Auratus and Billionico promoters are leftovers from the collapsed GSPartners fraudulent investment scheme.

GSPartners was tied to parent company Gold Standard Corporation AG, or GSB. Auratus and Billionico are GSB adjacent, with the same people involved at the top.

ASIC issued a GSPartners fraud warning in November 2023. This was followed by an Auratus fraud warning in August 2024. ASIC issued a second third “digital gold vaults” warning in September 2024, pertaining to Auratus’ since collapsed “gold in a vault” marketing ruse.

Our source material is from “The Legacy Project”, a group of Australian Auratus and Billionico promoters led by Kirsten Duggan, Jessica Catherine Schembri (aka Jessica Sol), Lorien Cameron and Nyoni Holm.

At time of publication, The Legacy Project’s private FaceBook group numbers 369 members.

The Legacy Project’s marketing material claims, again in spite of ASIC’s multiple fraud warnings, that there are “many methods” to invest into Auratus and Billionico.

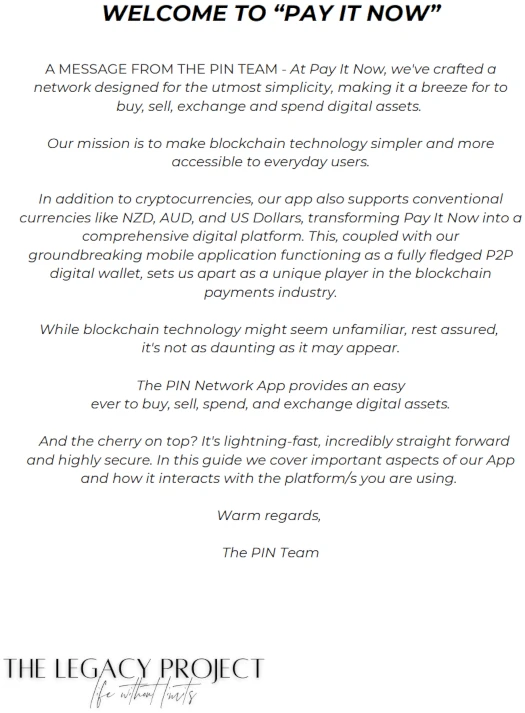

The recommended method however is “Pay It Now” (PIN).

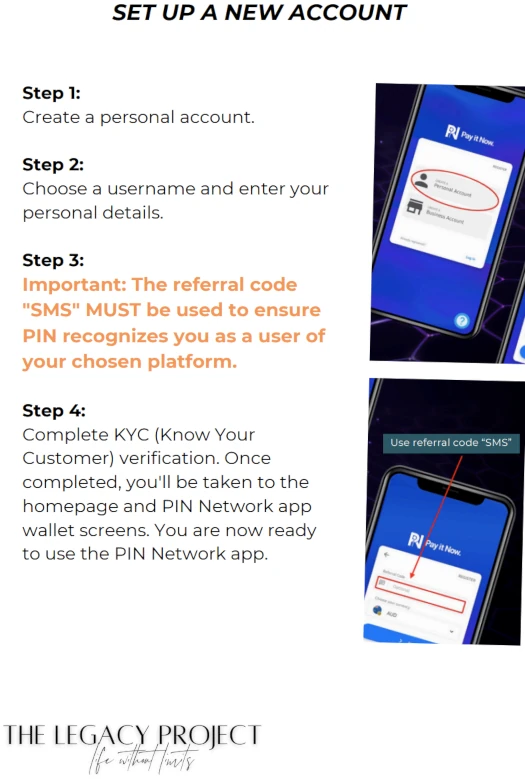

The Legacy Project instructs newly recruited investors to obtain PIN’s app via the Google Play or Apple app stores.

Recruits are then told to complete PIN’s KYC process, which includes bank account verification.

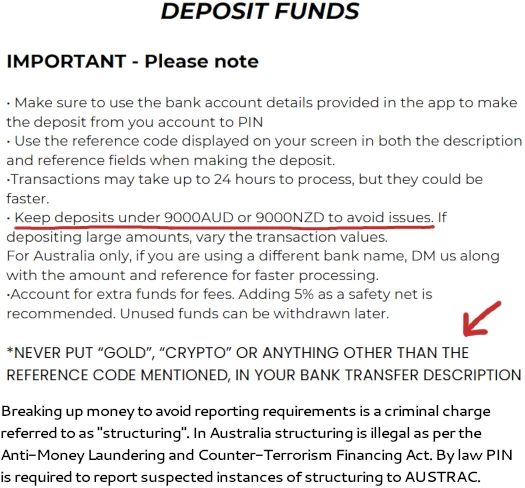

Once set up, recruits are instructed to keep transactions below $9000 AUD or NZD to “avoid issues”.

To deceive Australian banks, The Legacy Project instructs new recruits;

Never put “gold”, “crypto” or anything other than the reference code mentioned in your bank transfer description.

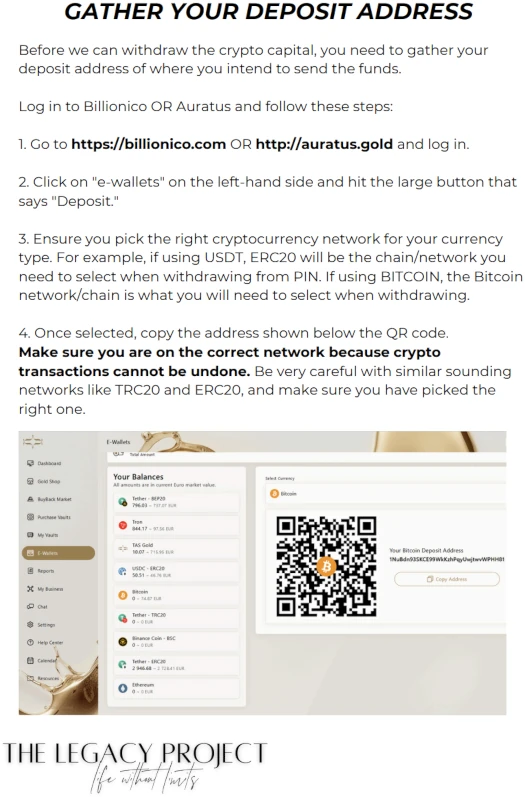

Once funds have been transferred from Australian banks to PIN, possibly in violation of Australian finance law, recruits must “gather [a] deposit address” from Billionico or Auratus.

Withdrawing sees recruits transfer from Billionico or Auratus to PIN, who then transfer funds to local Australian bank accounts, again in possible violation of Australian finance law.

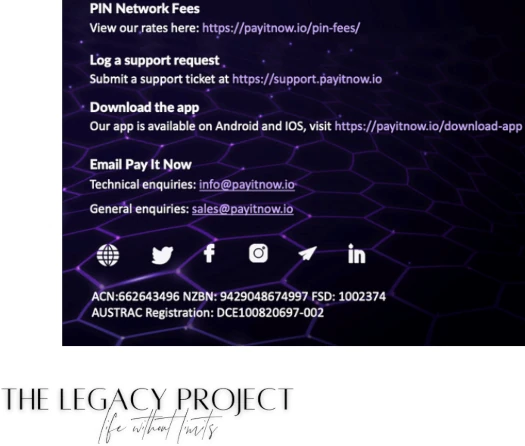

In their marketing guide The Legacy Project provides financial licensing details for PIN.

This includes an

- Australian Company Number (ACN);

- Financial Services Provider number for New Zealand (FSD, although I think that’s supposed to be FSP); and

- AUSTRAC registration number

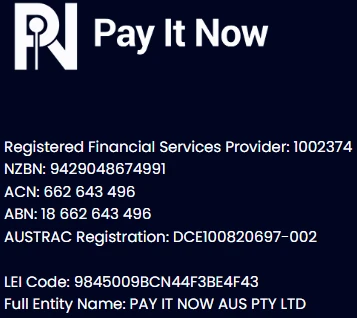

A visit to PIN’s website (“payitnow.io”), reveals an additional Legal Entity Identifier number (LEI code):

A LEI code is required in Australia when a company participates in certain trading markets (OTC, commodities, CFDs, securities and self-managed superannuation funds).

Co-founders Craig Duffield and Jitendra Maharaj launched Pay It Now in New Zealand in 2021. The company has ties to the US through PIN USA and Director Trenton Stanley.

Why PIN would risk its financial licenses with clearly inadequate KYC tied to servicing of fraudulent investment schemes is unclear.

In an attempt to find out, BehindMLM has reached out to PIN for comment. We’ve provided PIN with a copy of The Legacy Project’s marketing guide and a link to this article.

Tying in to PIN’s ACN and FSD (FSP?) registrations, we’ve also reached out to ASIC and New Zealand’s FMA for comment. The FMA issued its own Auratus securities fraud warning in September 2024.

Pending any responses from PIN, ASIC or FMA I’ll leave an update below.

It should be noted that, for the most part, Auratus and Billionico have been ditched for recently launched DAO1.

While the underlying unregistered securities fraud is the same, DAO1 is a clear attempt to hide ties to GSB.

Whether PIN is being used to solicit investment from Australian consumers into DAO1 is unclear.

Update 24th January 2025 – Shortly after this review was published Daniel Rawiri from Pay It Now reached out.

Rawiri provided a corporate response to this article. When I asked if I was good to publish the response, Rawiri stated;

Pay It Now is not associated with the companies referenced in your article.

To which I replied on Monday, January 20th;

Thanks, Not quite what I was asking though. I am going to update the article to acknowledge you reached out to respond.

What I was asking is am I right to quote you? Failing which I’ll respect your decision not to be quoted on the matter.

As at the time of this update I have not received a response to my last email. Note that I was responding to Rawiri’s full email, not just the quoted sentence.

I have quoted one (what I believe to be neutral) sentence from one of Rawiri’s email for context, but will otherwise leave it there. I can’t speak to why Pay It Now wouldn’t want to publicly disassociate themselves from fraud.

Hat tip to Danny de Hek for the heads up on this one – youtube.com/watch?v=zyhkES7qstQ

Just to add to this, having seen the document, it’s author is listed as Sarah Kolak.

I’m thrilled to see this detailed exposé on Auratus Gold on BehindMLM — it’s a testament to the power of truth and persistence.

I was the primary whistleblower behind this confidential information, providing critical documents that laid bare the manipulative tactics and fraudulent behavior of those promoting this Ponzi scheme. My database includes videos of 36 Australians openly committing these crimes.

Interestingly, I personally know the owner of this app and will be showing them this article. With luck, their accounts will be blocked, further preventing them from cycling funds out of this MLM scam.

This is a victory for transparency and accountability, and I’m proud to have played a key role in bringing this evidence to light. Let this serve as a warning to others involved in these shady operations—you’re not untouchable.

The Auratus.gold group is known for using their children to market scams but now Nyomi Holm and Lorien Cameron have introduced Andrew Tate into their Instagram reel mix too.

The behaviour is becoming more extreme and worrisome.

Article updated with response from Pay It Now’s Daniel Rawiri.

Yesterday this detailed article appeared on OCCRP. Is this the same person?

occrp.org/en/news/andrew-tate-allowed-to-fly-to-us-despite-human-trafficking-charges-in-romania

The following petition was launched yesterday on change.org. Partial quote:

postimg.cc/WFw5FRCs

change.org/p/demand-the-uk-home-secretary-to-extradite-andrew-tristan-tate-for-serious-charges

Do you know if ASSIC is aware of these scamer’s .or if they will bother to investigate them.? Most people who give them there money ( I can’t say invest ) are too gullable.

to even belive they will never see there money again .

ASIC is aware of the GSB fraud up to DAO1, as evidenced by their securities fraud warnings.

Unfortunately ASIC doesn’t have a notable track record when it comes to going after individual promoters. Anything beyond that you’d have to contact ASIC for answers.