GSPartners launches GEUR as G999 & LYS tokens collapse

GSPartner’s G999 and LYS Ponzi shit tokens are collapsing.

GSPartner’s G999 and LYS Ponzi shit tokens are collapsing.

In an attempt to create the illusion that affiliates haven’t mostly lost their money, GSPartners has come up with GEUR.

G999 is GSPartners’ original Ponzi coin. Gullible investors were lead to believe if they bought G999 investment packages through GSPartners, they’d be bajillionaires because reasons.

Here’s how that’s going:

As it became evident G999 was a Ponzi shitcoin that wasn’t going anywhere, GSPartners sought to launch more shitcoins. After some turbulence with foiled Dubai property scams, GSPartners settled on an NFT grift they called Lydian World.

Lydian World is attached to LYS and XLT tokens, although these days nobody talks about the latter.

Anyway, here’s how Lydian World is going:

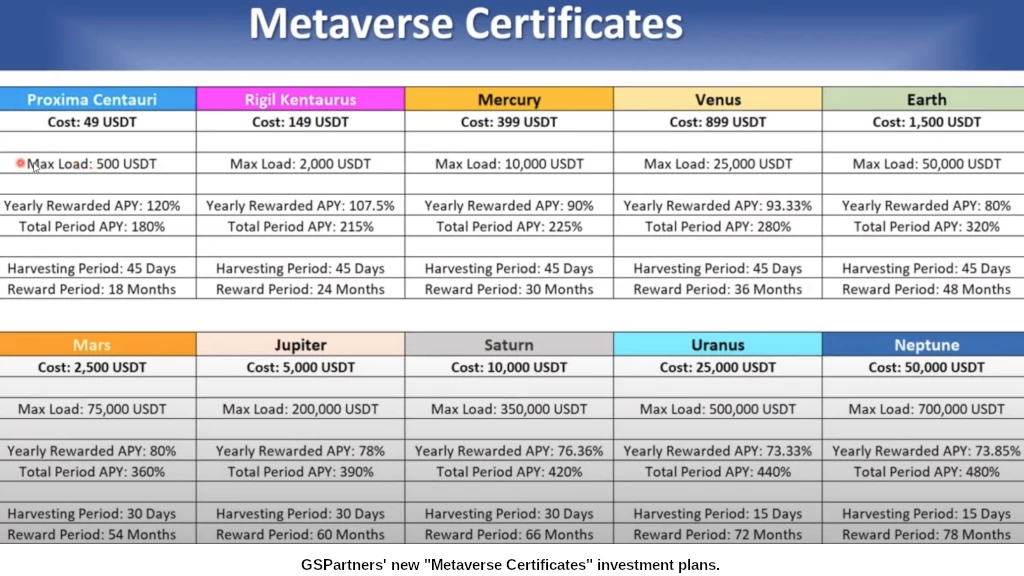

Once it became clear nobody was interested in a Ponzi cash grab NFT “game”, GSPartners launched a “metaverse certificates” scheme.

Not surprisingly, GSPartners’ metaverse certificates scheme has nothing to do with the metaverse.

The metaverse certificates scheme is a simple Ponzi; GSPartners affiliates pay a fee and then invest up to 700,000 USDT on the promise of a 480% annual ROI (click to enlarge):

On a GSPartners webinar directed at US investors held a few days ago, here’s how US-based CEO Michael Dalcoe described GSPartners’ metaverse certificates;

We put our money on the blockchain, and our trading partner trades the funds for us and it grows it at a rate of around 72% a year and higher.

Yes, I did not stutter. Around 72% per year and even higher. I can’t even give you real numbers. That means your money doubles every year.

And honestly, your money really doubles about every six or seven months.

Metaverse certificate returns are paid in USDT but they aren’t withdrawable.

Instead GSPartners affiliates have to put the USDT towards LYS token mining, allowing them to eventually cash out in LYS.

Here’s the problem:

To remedy the Ponzi scheme coming undone, GSPartners has launched GEUR.

GEUR doesn’t exist outside of GSPartners and is represented to have parity with the euro.

If a GSPartners affiliate cashes out their metaverse certificate ROI to GEUR, they then have to convert GEUR to USDT through the GSPartners backoffice.

Up to 5000 GEUR can be cashed out in one transaction and GSPartners takes a 2.5% cut of all transactions.

GSPartners’ GEUR webinar was hosted by Steven London Morris, one of Dalcoe’s downline based in California.

If you’re wondering how GSPartners is funding withdrawals and why now, that’s answered through GSPartners’ recent website stats:

GSPartners has been busy recruiting US investors over the past year. Those investors want to cash out and, up until recently, all GSPartners has been able to do is watch LYS decline and their attempts to wash trade pump G999 fail.

As you can see in the SimilarWeb data above, GSPartners has spread to Cuba, South Africa (this is a resurrection after GSPartners already collapsed in SA), and Switzerland.

This new injection of funds directly correlates to the launch of GSPartners’ metaverse certificates investment scheme.

What you can also see in the chart above however is that overall visits to GSPartners’ website haven’t changed much. It’s stagnant.

Pending a dramatic increase in recruitment of new soon-to-be victims, GSPartners is just kicking exponentially increasing ROI liabilities down the road.

It’s one thing to trap people’s money in an endless chain of shit tokens. Once you represent something is pegged to real money, and allow investors to cash out that real money – you’ve just created a financial black hole that’ll drain invested funds.

It should be noted that, despite marketing representations to the contrary, GEUR isn’t pegged to the euro – it’s pegged to how much invested USDT GSPartners is willing to play out.

Michael Dalcoe of course knows this and so, on behalf of GSPartners corporate, discourages withdrawals by claiming it’s something only “poor and middle-class people do”.

How GSPartners’ inevitable USDT crunch manifests itself is yet to be seen, but watch for GEUR withdrawal problems over the next 6 to 9 months.

In violation of securities law in the US, neither GSPartners, owner Josip Heit, Michael Dalcoe or Steven London Morris are registered with the SEC.

External revenue to pay metaverse certificates is purportedly generated via forex trading by BDSwiss.

In violation of the Commodities Exchange Act, neither GSPartners or BDSwiss are registered with the CFTC.

GSPartners and its promoters are not registered to offer securities in any country.

GSWankers really are the grift that keeps of grifting

They’re good at getting investors to jump through hoops though. I’m not aware of an MLM crypto Ponzi with such a convoluted trainwreck of a business model.

Also coming up later today: Karatbars’ new Ponzi grift.

If you’re in a cage at the circus, all you can do is jump through the next hoop.

They are good at buzzwording their way through each scam-stage though. All the way from ICO to Crypto-apps to NFT to Metaverse and now Stablecoin (well, I say these loosely as all their versions are perverted watered down copies of course).

Here comes the new scam; same as the old scam! They will get fooled again!

Oz, the new GSP scam sounds awfully like the Freeway/Aubit Ponzi scam.

“Give us your money and we’ll ‘invest it’ for you on the promise of unrealistic ROI.”

All the “annual yield” crypto Ponzis are the scam (MLM and non-MLM).

Crypto fuckboys switched out ROI for “yield” and think they created a new finance niche. And all the young people who don’t know any better with zero financial literacy keep falling for it.

tO tHe MoOn!

tee hee

Is there a Russian element to this? The LinkedIn link on the site footer is for the ru domain variant.

Could be. I came across a fair few English spelling mistakes.

Dunno why Russians would be pretending to be Indians though.

Yeah looks like there’s a Russian element to this.

I pulled up one of the MineBase PDFs and, while there’s no author, this came up as the creator software:

Now I’m wondering if Seiz sold the Karatbars database (again) to Russian scammers. That’d explain the Dr. Alphabet Seiz bullshit.

I think this is worth a followup article. YaaaaAAArrrgh fucking blockchain.

Good catch though!

edit: Website was created by “Digital Arts”, a Russian mob.

Put $60,000 in and get 330,000 numbers on screen after 18 months…

Michael “I’m not a financial advisor” Dalcoe:

youtu.be/EmzxRQ-we8s?t=712

Michael Dalcoe knows GS Partners is a criminal Ponzi scam; having previously promoted Karatbars.

Michael Dalcoe is as complicit as Harald Seiz and Josip Heit, and should be prosecuted by the SEC.

Heit sounds like affiliates are onto him, he mentions patience 6 times in this 15min video.

According to him, portfolios are performing (25%) but you cannot see as “API is in progress”

Something about G999 moving to a smart contract something by the end of the year. Sounds like they want to bring it fully in-house and not have the weird up-down value public

Also, some talk about GEUR to FIAT conversions held up because of “legal documents”

Sounds like a man making excuses for too many “where is my money gone” questions.

youtube.com/watch?v=dEO_MHjix8I

If they pull G999 and LYS they can give them bullshit values but what are GSPartners affiliates going to cash out?

The money isn’t there, hence the GEUR flop. The nonsense returns the certificates are paying out in monopoly money just compounds the problem.

All rhetorical of course but this is the garbage MLM crypto Ponzi end-games are made of.

Most things written in this article are not true. I will address one in particular that says you can’t withdraw your money, but must place it in the metaverse for spending there: this simply isn’t true.

I’ve been able to withdraw money weekly with no haste, and the transfers on GS Partner’s end are lightning fast. Sometimes my money is in my crypto wallet right away. Other times it may take an hour or two if the Bitcoin network is a little slow (or whichever network I choose to move my money through).

These types of articles aren’t really beneficial for anyone seeking accurate information. So if you read this, do more research.

As at the time of publication, August 2022, withdrawals to LYS was accurate:

April 2022 LYS was pumped to $1184. August 2022 the withdrawal pressure saw LYS to dump to $87.38.

Last week LYS was ~$2.60 or so. It’s been pumped over the past 7 days to $8.70.

If changes were made to metaverse certificate withdrawals after August 2022 I’m not surprised.

I agree. Research should begin and end with metaverse certificates being securities fraud.