GSPartners disables ROI payouts, holds funds hostage

GSPartners has disabled ROI payouts.

GSPartners has disabled ROI payouts.

Instead of addressing investors himself, GSPartners founder Josip Heit had Bruce Hughes deliver the bad news.

It’s important to note that there are two classes of investors within GSPartners, those who compound and those who withdraw.

GSPartners who compound are unaffected by the disabling of ROI payouts. This is because they’re compounding monopoly money that doesn’t exist and not withdrawing.

GSPartners disabling ROI payouts is to stop withdrawals, which affects the rest of the investor-base.

To that end, GSPartners has framed disabling ROI payouts as “the next chapter of our ecosystem and … consolidation of the smart contract”.

The Metaportfolio accounts have recently taken some loss trades in the market.

For those who didn’t adopt a regular compound strategy, they absorbed some of the losses and had their loads DROP below 100%, thus causing their weekly rewards to pause.

GSPartners investors who have been withdrawing have been given three options:

- Do nothing. Wait for contract period to end. Receive balance.

- Top up load, and re-activate weekly reward. Receive LYLs.

- Wait and see IF there is an exchange option into Blockchain Bonds.

- do nothing and wait for their contracts to end, at which point they’ll receive whatever is in their backoffice;

- invest new money and continue to receive ROI payments in LYL; or

- “wait and see if there is an exchange option into BlockChain Bonds” (read: hope new investors join to steal from)

GSPartners’ Metaverse Certificates investment scheme launched in mid 2022. Returns of up to 480% were promised over 78 months.

I believe these returns were paid in GEUR, which GSPartners investors were able to convert and withdraw as tether in their backoffice.

The second option above re-enables withdrawals but now in LYL tokens. LYL is part of GSPartners’ failed Lydian Lions’ NFT investment scheme.

It’s unclear whether LYL can be converted to USDT and withdrawn, or whether GSPartners affiliates who invest new USDT will be left bagholding LYL.

Following failed recruitment drives in India and Asia, GSPartners is currently trying to drum up new investment in Trinidad and Tobago.

GSPartners disabling ROI payouts follows securities fraud warnings from multiple regulators in Canada. These include Alberta (GSPartners, G999, GSTrade), Quebec, British Columbia, Saskatchewan and Ontario.

Nonetheless Canada remains GSPartners’ second largest source of new investors. US residents make up GSPartners largest investor-base, prompting the likelihood of an ongoing SEC and/or DOJ investigation.

The SEC warns consumers that securities fraud and Ponzi schemes go hand-in-hand.

Any investment in securities in the United states remains subject to the jurisdiction of the SEC.

We are concerned that the rising use of virtual currencies in the global marketplace may entice fraudsters to lure investors into Ponzi and other schemes.

Ponzi schemes typically involve investments that have not been registered with the SEC or with state securities regulators.

Federal US authorities and regulators do not issue public fraud warnings while investigations are active.

In an attempt to dodge further regulatory attention after the Canadian warnings, GSPartners rebranded its website to Swiss Valorem Bank in May 2023. The company still goes by GSPartners in its marketing.

Looking forward GSPartners’ first round of metaverse certificates, offering 180% over 18 months, are set to expire towards the end of 2023. The next certificate tier, offering 215% over 24 months, will expire towards mid 2024.

In an attempt to keep investors reinvesting instead of withdrawing, GSPartners has continuously added new and higher certificate tiers.

The current “elemental” batch were released in May 2023 and offer up to 5% a week for 52 weeks.

It’s expected more withdrawal restrictions will be introduced as GSPartners’ ongoing ROI liabilities spiral further out of control.

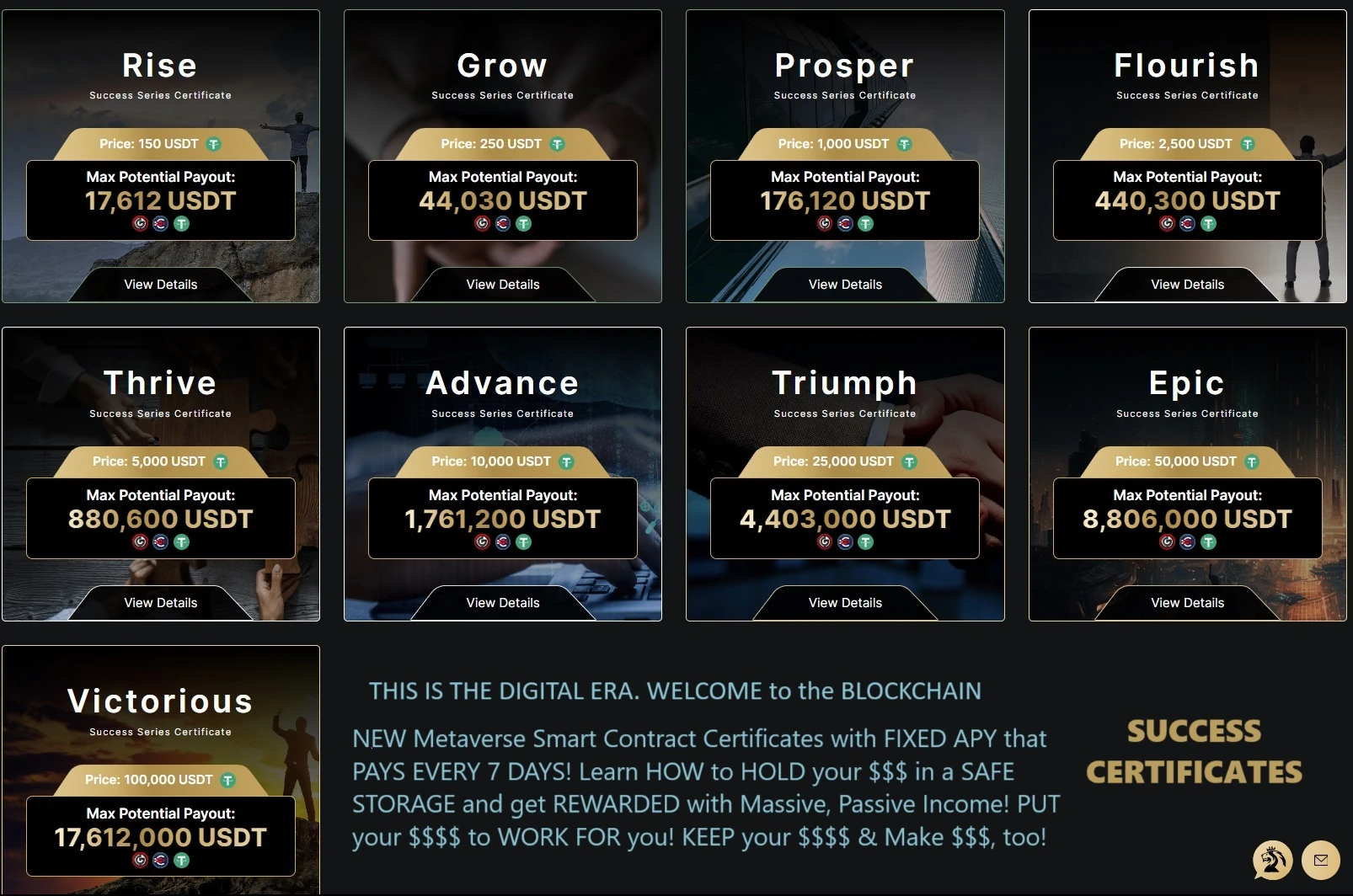

Update 3rd October 2023 – Coinciding with GSPartners disabling ROI payouts was the introduction of new “Success Series” certificates (click to enlarge):

Through its Success Series certificates, GSPartners is now pitching a 17,612 USDT ROI off a 150 USDT investment.

On the top end GSPartners pitches a 17.6 million USDT return off a 100,000 USDT investment.

Update 4th October 2023 – GSPartners has now applied a 50% withholding fee on all investor withdrawal requests.

Andrew Eaton and Tony de Gouveia is already setting themselves up to jump ship.

They are using paid articles to push out the negative articles online and game the SEO to make themselves look like saints.

Well that’s going to put a dampener on Bruce Hughes and Andrew Andrew Eaton’s World Cup Rugby tour.

The investors in G999 have sponsored the trip for them and their boys as they follow South Africa around France!

The dirty rats prepare to leave the sinking ship!

Unless they can convince gullible new investors in the Caribbean, with more money than common sense, GS Partners will collapse within the next six months or less.

And rats like Michael Dalcoe will board the next bad ship Ponzi and start all over again with a new crew of Ponzi pirates.

I would love to the thoughts of Victor Matfield, Herschelle Gibbs and Lucas Radebe who were paid a small fortune to market the Scam in South Africa.

So apparently after disabling ROI payouts earlier today, GSPartners scheduled a leadership webinar with Heit and his cronies.

Investors thought this was an emergency webinar to discuss the disabled ROI payouts.

The webinar went ahead a few hours ago and… was just a regular marketing hype webinar. There was no mention of the disabled payouts.

Also not sure if it’s universal but 27% of the initial investment is the figure going around to re-enable ROI payouts (to LYL token).

This will of course wipe out anyone who’s invested in the last few months (as intended).

edit: And a new round of “Success Series” investment certificates went live yesterday too. No withdrawals, only new investment plz.

What is even more disgraceful how the boys on the world cup tour use their families as marketing.

Andrew Eaton – Constantly using his childrens’ autism to target the good nature of most people and ignore his efforts in multiple failed Ponzi schemes (dragon mining, lifestyle galaxy, karatbars, etc).

This is disgusting and offensive to all people that actually have loved ones with Autism.

Bruce Hughes – Markets himself as a “Wolfpack dad” of three sons and posts all his family activities on social media. Again, using the “I am doing good” approach to cover up the dirty work they’re doing behind the scenes.

The chickens will come home to roost soon and these guys will be exposed.

The snowball is getting heavier. Only accepting new investment is a sure sign for me that at worst, this is the final rug, unless somehow they manage to get in funds that will cover the latest withdrawals.

Lots to speculate at this point but if they have disabled withdrawals, its game over for many or at least the beginning.

Hyper did the same thing, disabling withdrawals for sections of the population at a time, so as to continue with the ruse that there was a glitch.

I wonder what the next excuse will be.

And IF they will be able to pull a rabbit out the hat.How can people NOT see what is happening. Is it hope causing them to be trapped or greed?

My first comment is ” no matter how much you warn people they WILL always fall for an easy way to make money” second: why warn them? (Ozedit: derails removed)

Greed makes people do stupid things. That and if investors get caught publicly complaining about GSPartners they’ll terminate their account.

I suppose and could be wrong here, it is the same as bringing the company you work for in disrepute by publicaly complaining and getting yourself fired for it.

Well only time will tell what the actual truth will be. Me, i do not invest in ANY scheme. If its not visible or tangible i pass thank you!

Nah. MLM + securities fraud = Ponzi scheme. Every time.

With all due respect to the speculation that there isn’t valid trading going on here, that there can’t be the kind of returns being promised, that there is already sufficient evidence to state for a fact that this is undeniably a ponzi scheme, why couldn’t there be actual trading going on here that is simple experiencing losses and related draw-downs or diminished return targets? (Ozedit: snip, see below

@MaryD

Feel free to provide evidence GSPartners has registered with financial regulators and filed audited financial reports. This is the only way to verify trading revenue is being used to pay withdrawals.

Legitimate companies engaged in trading don’t commit securities fraud and operate illegally. Ponzi schemes falsely representing they are trading do.

When I woke up in the morning BehindMLM came to mind and I said I to myself I don’t think they’ll be that stupid to write something without knowing the full story but you’ve proved me wrong. BehindMLM doesn’t care about the truth.

In 2022 I invested in a bank (Ozedit: derails removed)

I agree with this. If you’re in GSPartners and don’t know anything about securities law and securities fraud, don’t come on here spewing misinformation.

Sit down, shut the fuck up and learn something.

The truth is GSPartners has disabled weekly ROI payouts for those withdrawing money. GSPartners now wants them to reinvest to wipe out paid withdrawals, and they’ve now slapped on a 50% withdrawal fee penalty.

They’re doing this because, like in all Ponzi schemes, the unsustainable math is piling up – right on cue as the first round of certificates are about to expire.

GSPartners’ passive returns is an investment contract as per the Howey Test. This makes it a securities offering.

Whether GSPartners refers to its passive returns investment scheme as a securities offering is neither here nor there.

Crying about tHe BaNks doesn’t change these facts. Sorry for your loss.

Gold Standard Partners and its various guises is an illegal crypto Ponzi scam set up by the criminal Josip Heit, who was previously involved ih the now collapsed Karatbars Ponzi scam and a Bitcoin-related scam.

Josip Heit has connections to East European Mafia; in particular, Alex Bodi.

The GS Partners scam has been rebooted several times; the G999 shit-coin, the GEUR shit-coin, the non-existent real estate shit-coin, the shitty Lydian Lions NFT, and now the elemental certificates.

Neither Karatbars nor GS Partners were/are registered with any financial regulatory authority.

I pity you if you have given money to the criminal Josip Heit through any of his criminal Ponzi scams.

Without new investment from other potential victims, this Ponzi will collapse within the next six months.

Dear Mr. OZ,

Thanks for your reply.

Why did you edit my comment to remove the section where I detailed, for what it might matter in the total record of actual fact here, that all other certificates are still paying out and that there’s been no other draw-down (or “margin call” type events) across the balance of all member portfolios.

Thanks for not editing, curtailing, or removing this reposting of the point.

Also, I have directly messaged management with demands for independent audit, even if there’s currently no international body overseeing crypto trading at this time.

Dear @Gertrude

Regarding your comment/info:

While all you are sharing, if true, is very concerning and I’d like to learn more, a could follow-up questions if I may:

1. To your knowledge, has Mr. Heit ever been tried and convicted of a crime or named in any other criminal conviction (whether related to the companies or relationships you have named or otherwise)?

2. Were there any lawsuits associated with the Karatbars enterprise failure which found the company, its business model, or its management/ownership guilty of any crimes?

3. Do you presume or have any evidence to support the assertion that there is in fact no investing/trading going on here or that there are not, if highly risky, domains of investments (eg private equity venture capital or contrarian public stock trading) and/or securities types (eg leveraged futures trading) which could deliver returns like those being detailed in GSP certificate performance targets?

Thanks for whatever you might be able to share, both factually and by way of your opinion (if the two can be separated as such).

MD

Oz literally stated the reason in his reply comment #13 (right after yours).

if only people will realize that there is no trading happening. When will they ? Its as if GSP is the only legitimate crypto mlm and all the others are scams!!

The GS Partners is being run by serial scammer and criminal, Josip Heit, who has links to East European Mafia.

Josip Heit was involved in the Karatbars Ponzi scam and the Bitcoin-POS Ponzi scam.

Josip Heit’s partner in crime is Alex Bodi, who is being investigated in his home country (Romania) for prostitution and human/sex trafficking.

GS Partners is NOT registered with ANY Financial Authority.

The GS Partners Ponzi scam has been rebooted several times; the G999 shit-coin, the GEUR shit-coin, the non-existent-real-estate shit-coin, the Lydian Lions NFT, and more recently the elemental certificates.

Your money is being used to fund Josip Heit’s lavish lifestyle and possibly also to fund other organised crime.

Sorry for your financial loss!

@MaryD

Because either GSPartners has registered with financial regulators and filed audited financial reports, or it hasn’t and is committing securities fraud and operating illegally.

Nothing you say is a substitute for registering with financial regulators and filing audited reports. Without which, the only conclusion to be made is GSPartners is not trading.

If you want to crap on about “draw-downs” etc., you need to first provide verifiable evidence GSPartners is actually trading (which you can’t).

Securities are regulated the world over.

Instead of asking people to prove a negative, see above.

It’s a shame that MaryD’s version of due diligence is only “Have they been convicted of a crime”, not “Is what they are selling even possible or have they proven as much”.

The lack of critical thinking is absolutely gobsmacking. The company has been caught lying dozens of times, so much so that their “banking” providers have banned and blacklisted them, their name is on watchlists the world over, and rather than prove they run a legitimate business (simple to provide an accredited audit which any company should do) they resort to Cease and Desists and lawsuits in Russia, the people have been involved in confirmed frauds such as Karatbars and BitcoinPOS – but obviously just because they have scammed people many times, doesn’t mean the next time is a scam hahahaha.

The main reason this company continues is because every time people stand up to them they go after them legally.

They won a case with my ISP to have a blog blocked in the Netherlands so people couldn’t read my information, apparently a custom $40,000. The information I received for thirdhand from my ISP.

Yes, GS Partners has been involved in lawsuits. Here are the details of the lawsuits:

* In 2014, GS Partners, L.L.C. filed a complaint in the Chancery Division against the shareholders of a defunct corporation seeking to collect on a default judgment plaintiff had obtained against the corporation.

The Chancery Division dismissed three counts of the plaintiff’s amended complaint alleging fraudulent transfer of the corporation’s cash to the shareholders on the ground that those counts were barred by a statute of repose, N.J.S.A. 25:2-31 .

* As of November 2023, GS Partners and owner Josip Heit are the subjects of multiple federal and state regulatory investigations in the United States.

* In October 2023, GS Partners disabled ROI payouts and held funds hostage, which led to investor dissatisfaction and potential legal actions.

* There have been warnings from Canadian authorities, such as the Autorite des Marches Financiers Quebec, the Alberta Securities Commission, the British Columbia Securities Commission, and the Ontario Securities Commission, for securities fraud related to GS Partners, GSB Gold Standard Pay Ltd, GSB Gold Standard Bank Ltd, Gold Standard Trade, Lydian World, G999, GSTrade, and Swiss Valorem Bank.

Good to know.

I am of those who were bitten. The amounts promised were Actually there. I was living off of my weekly ROI as I have not been able to work since being run off the road by a drunk driver into a semi.

In august of twenty twenty. I’m glad that I don’t have the capacity to have tried to buy those. Lydian lions and crap.

No one is really talking about this but I need my money back. There was some guy on youtube but she kind of looks like he’s ready to scam for my money.

I really only lost like $10000. But when you only have twenty, that was a lot of money.

I’m screwed aren’t I.

Pretty much. Ponzi schemes pay out until global withdrawals exceed global new investment.

Sorry for your loss.

Best you can do is report them to the police and the regulators and hope for the best. Unfortunately that horse bolted.