Auratus launches “Storage Boxes”, 3rd unregistered securities offering

Auratus Gold has launched its third unregistered securities offering; “Storage Boxes” built around its TGP token.

Auratus Gold has launched its third unregistered securities offering; “Storage Boxes” built around its TGP token.

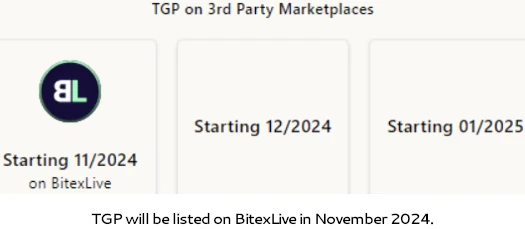

TGP, or Tas Gold Points, is scheduled to be dumped on the BitexLive exchange in November. BitexLive is owned by Josip Heit’s longtime business partner Leon Filipovic.

Auratus Gold’s Storage Boxes unregistered securities offering coincides with a bungled promotional event in Australia last week.

Originally billed as an Auratus marketing extravaganza hosted by “corporate”, the events transitioned into a three-day circlejerk for Martene Wallace’s Auratus downline.

Josip Heit, suspected owner of Auratus, revealed he was in Brisbane on Sunday, October 13th.

Sometime between Sunday and Wednesday Heit then represented he was back in Dubai.

What caused Heit (right), a convicted fraudster, to abruptly leave Australia just before the Auratus marketing event remains unclear.

What caused Heit (right), a convicted fraudster, to abruptly leave Australia just before the Auratus marketing event remains unclear.

In any event, this left sidekicks Dirc Zahlmann (GSPartners CEO) and Bruce Hughes (GSPartners Corporate Trainer) to front the events alone.

Well, sort of. While Zahlmann and Hughes did briefly speak at Yot Club’s hosted Auratus event on Thursday…

…they appear to have otherwise spent most of their time avoiding cameras.

Dirc Zahlmann and Bruce Hughes are Respondents in standing GSPartners securities fraud enforcement orders from Texas, New Hampshire and California.

The pair are additionally cited as persons of interest in GSPartners fraud enforcement actions from Kentucky, Arkansas and Alabama.

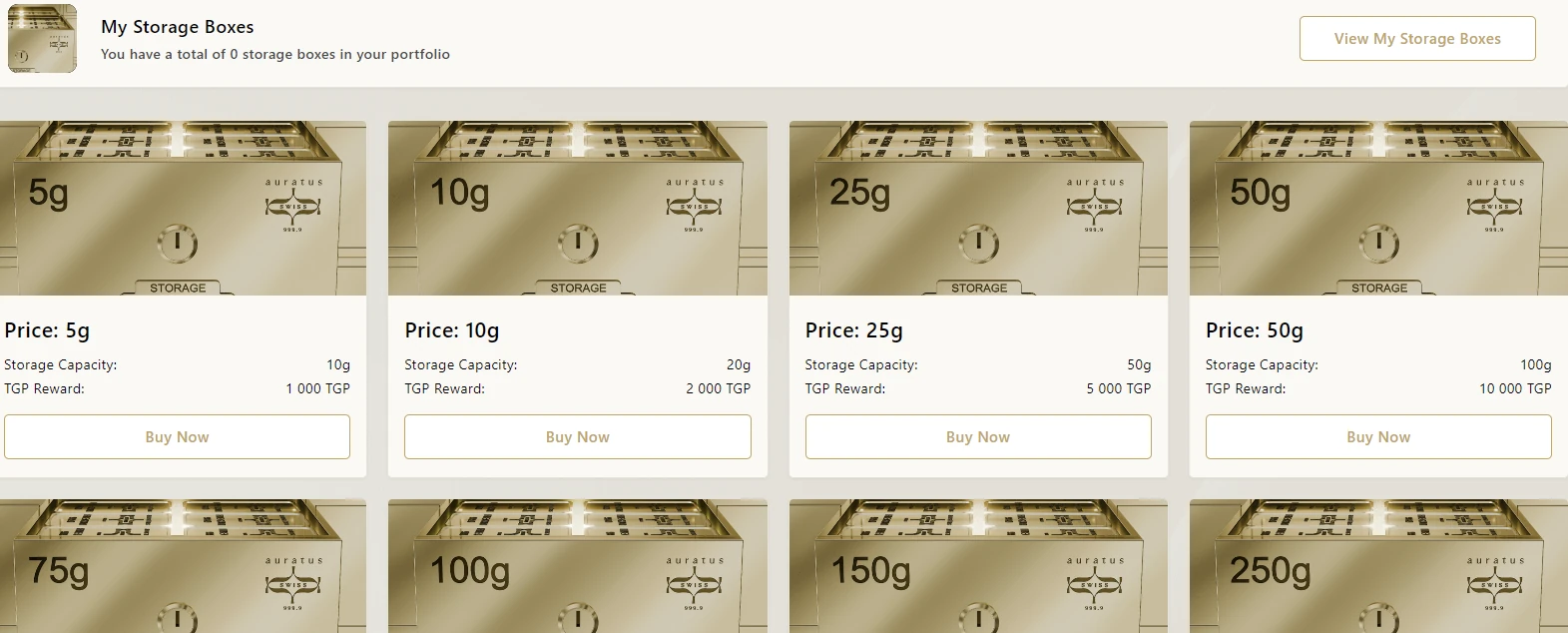

Either just before, during or just after the marketing events last weekend, “storage boxes” popped up in the Auratus Gold backoffice (click to enlarge):

As above, Auratus Gold’s “storage boxes” scheme sees affiliates invest in TGP (note “g” refers to grams of gold but investors pay USD equivalents in cryptocurrency).

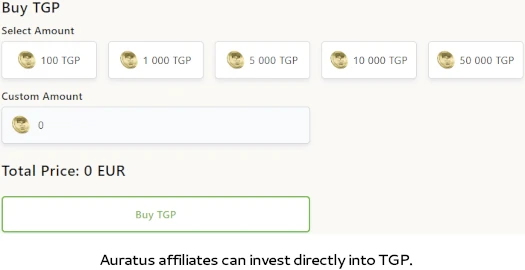

TGP can also be directly invested into through Auratus:

Currently TGP has an internal 0.82 EUR value within Auratus.

Currently TGP has an internal 0.82 EUR value within Auratus.

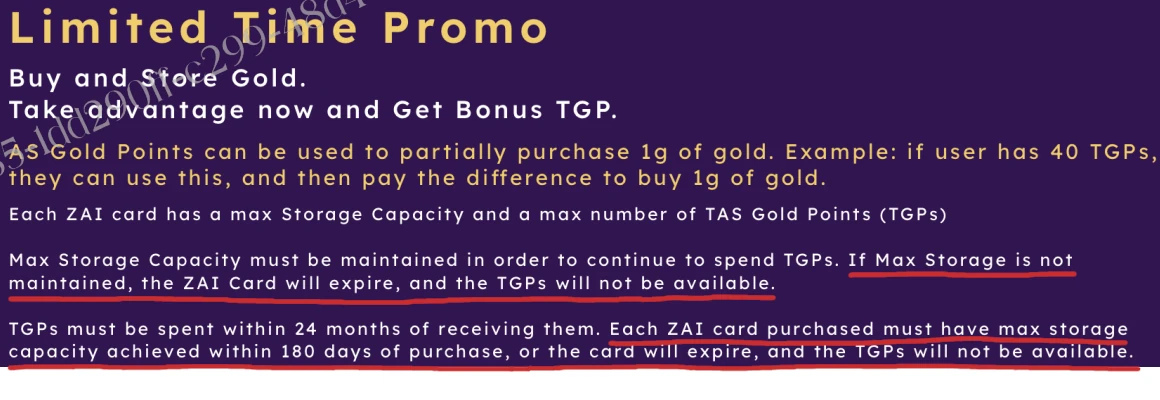

“Spending” TGP requires Auratus investors to max out Zai Card.

This appears to be an attempt to both trap invested funds in the system and resuscitate Auratus’ second unregistered securities offering launch (click to enlarge):

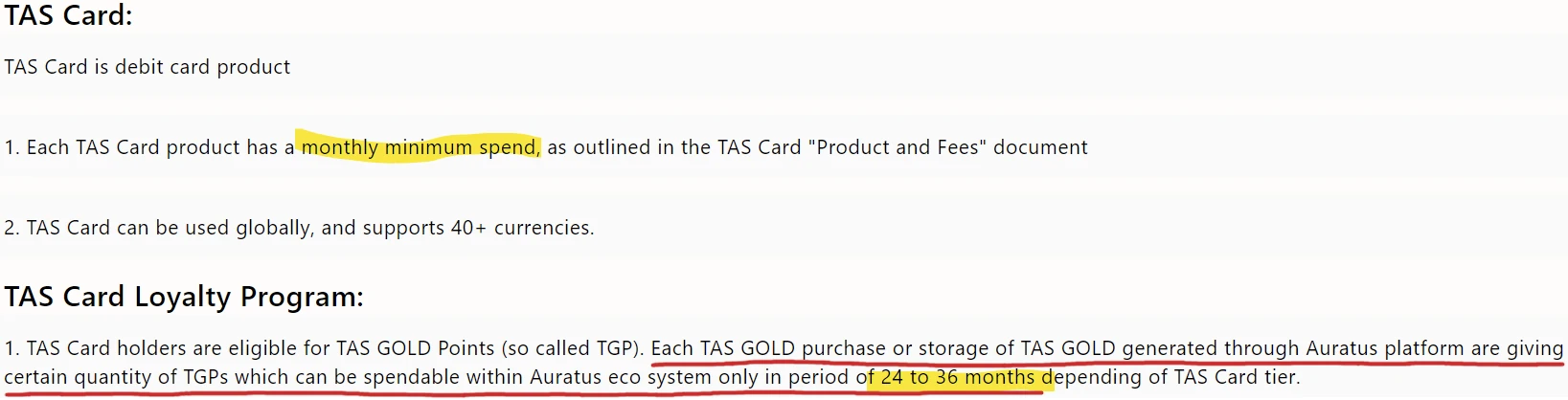

Regardless of how their acquired, Auratus solicits investment into TGP on the promise of a passive return over “24 to 36 months” (click to enlarge):

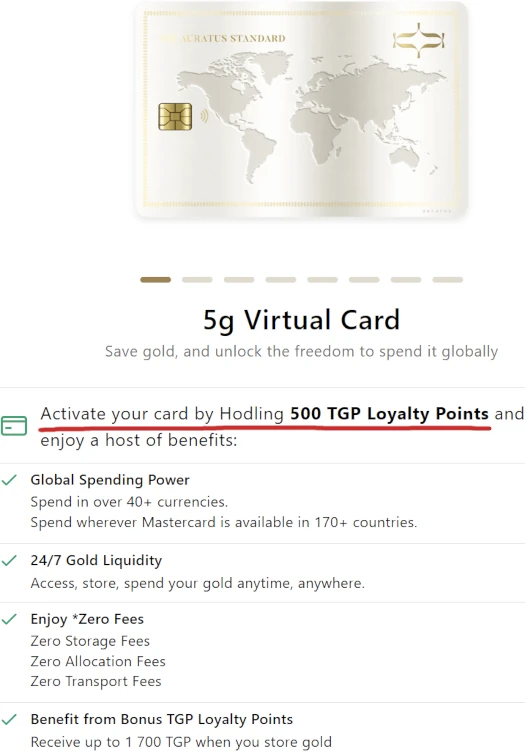

A minimum 500 TGP investment unlocks a “virtual card”, attached to MasterCard’s network through an undisclosed shell company:

Looking forward, Auratus plans to allow affiliates to cash TGP out through BitexLive next month:

Auratus presents BitexLive as a “3rd party marketplace” but it is anything but.

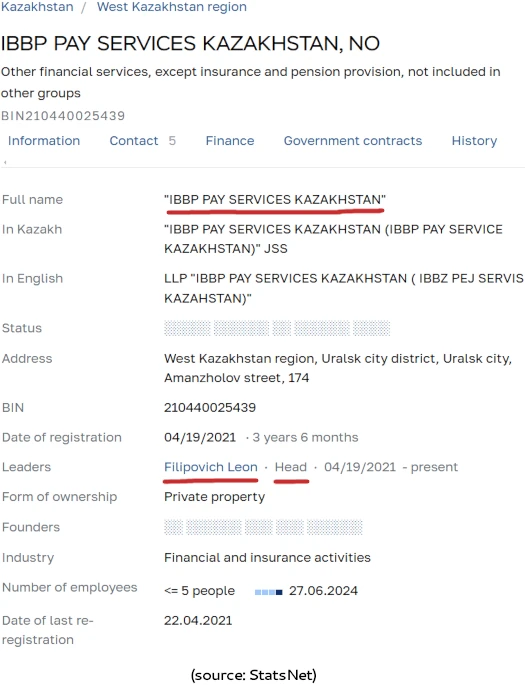

As per the footer of its website, BitexLive is tied to IBBP Pay Services Kazakhstan Ltd.

![]()

IBBP Pay Services Kazakhstan Ltd. is a Kazakhstan registered shell company tied to Leon Filipovich:

Filipovic (right) is believed to be tied to the money side of GSPartners. He’s been registering shell companies for Josip Heit’s various investment schemes for years.

Filipovic (right) is believed to be tied to the money side of GSPartners. He’s been registering shell companies for Josip Heit’s various investment schemes for years.

More recently, Filipovic surfaced the the sole director of Orbit Conceptum AG, a shell company attached to Billionico – another GSPartners spinoff adjacent to Auratus Gold.

The Texas State Securities Board cited Filipovic as a related non-respondent in their April 2024 Billionico securities fraud cease and desist.

TSSB cited Auratus in its Billionico cease and desist. Meanwhile the Australian Securities and Investments Commission issued a blanket Auratus fraud warning in August 2024.

A second fraud warning pertaining to Auratus’ original “digital gold vaults” investment scheme was issued in September 2024.

Looks like they aren’t even allowing ZAI Cards to be purchased anymore. The only available product on the store is “gold” and the new Storage Boxes are available inside the app.

Assuming there will be a mechanism to transfer ZAI Cards over to Storage Boxes as they did from the Vaults.

So…

TAS Vault –> collapsed

ZAI Cards “certificates” –> collapsed

Storage Boxes –> ???

Each Auratus investment scheme has only lasted a few months.

First Speculation: The product is not selling as well, and they need fresh ideas to market it or find new ways to get the same people to invest more.

Second speculation: The regulators are watching and they have to change things to try and stay a few steps ahead.

Josip flies home early to post a video showing us that the check engine light on his Bentley is on. Bruce and Dirc – “Guests of honour” – hide behind their downlines in photos at Yot Club and are no where to be seen at the Sea World event.

Bruce Flies home this week, after the event. He likely attended but took major precaution to be seen anywhere in the images OR maybe he just went to Brisbane to work out in the hotel and run on the promenade and this is all just a crazy coincidence.

Seems like the “warriors” are trying to decentralise themselves from Auratus.

Probably the uplines are under a lot of heat and Martene Wallace is stupid enough or brazen enough to not give a flying continental about being seen on photos. She seems to love the attention.

ASIC also regulates advice givers to protect end users. I think a few people may need to read the below below link to see what constitutes as an advice giver. They might be surprised how general it is.

asic.gov.au/regulatory-resources/financial-services/giving-financial-product-advice/

There is also some interesting info on disclosures which are regulated by the corporations act.

I assume they give their downlines detailed disclosures as required by the corpowrations act and ASIC?

Everybody gangsta till the cuffs come out (see: South Africa).

Don’t trust anyone who tells you to use a bottom rank crypto exchange like BitexLive. Trust level 1/10 on Coingecko.

Josip, it’s not 2017 anymore, no-one wants to be in the same room as dirty crypto which can be traced back to you and your scams.

Looks like desperation.

I worry about all the children. Imagine reaching adulthood and realising your parents used you to market products they knew were fraudulent.

Not only were you part of deceiving others, but your childhood memories and experiences were turned into marketing tools – genuine moments transformed into sales opportunities.

It’s not uncommon for ponzi parents to abuse their children in this way. There’s quite an interesting video of Cheri Ward (of MTI fame) giving a tutorial on how to run a ponzi, with at least one of her children passing the camera.

It is a form of child abuse really but what do you expect from some of these people?

Some of those kids will have serious trust issues and a distorted sense around privacy and personal boundaries.

I watched an Auratus affiliate training session where they coached promoters on social media strategy. The approach involved deliberately mixing potential viral content featuring their children’s activities and antics with Auratus/investment posts.

How long before they all decide to whiz the kids off to Dubai to be groomed and raised amongst their circle of scammers and human traffickers.

There is a common trend among the central promoter circle in Australia. Their content is often littered with anti-vax, anti-gov, home schooling, anti-big bank and other general anti-establishment rhetoric.

I have even heard the Rothschild conspiracy thrown around! These are the common threads they use to attract others that share similar worldviews and are thus more likely to trust them.

Sitting on a few of the sessions it is still surprising to me how technologically illiterate most of them are, even though they are supposed to be pioneers of the Web3 “decentralised” space.

@Aurelius There’s Disney conspiracy videos as well (the ones claiming to find Epstein and illuminati “evidence” in children’s cartoons) to connect with people who already distrust mainstream systems.

Then they exploit those legitimate concerns, positioning themselves as guardians of secret knowledge while actively discouraging any independent fact-checking – it’s always “don’t research online, just ask us, we know what’s really happening.”

They’re technically incompetent but are knowingly funnelling families toward criminal underworld scams while portraying themselves as financial and family protectors.

Meanwhile, they’re creating permanent digital records of their children’s lives and mistakes, dismissing concerns with casual mantras – “it doesn’t matter what people think of you” or “the kids like it” – completely ignoring how the content could impact their children’s future relationships, friendships, and dreams.

Looks like they are getting more desperate for new actual cash injection.

Running a loyalty card promotion which by any other name is the same as a ZAI or Storage Box. Buy a card with your real money and then load it with points that will come back double in 24 months.

Literally give me real money and some amount of loyalty points and after 24 months I will give you double loyalty points (ignore the fact you don’t get your real money back or if you try and touch it within 24 months you forfeit everything…)

Transcript from Martene’s Facebook:

facebook.com/stories/1284106054971672/UzpfSVNDOjEwNzYxMDQyNDA2MjI4MDA=/

facebook.com/stories/1284106054971672/UzpfSVNDOjEwNzYxMDQyNDA2MjI4MDA=/

That sounds very much like they’re pulling the plug on Auratus.gold. Common exit scam.

Sell points created by Auratus, held by Auratus, price manipulated by Auratus, listed as a token on (bottom tier) exchanges which steal KYC info before refusing to hand over funds or crypto. Token price is dropped by 99% and it’s marked as a scam. The end.

Fun fact: recent zoom calls by Terry and Raphael have suggested Auratus is being revived. They have mentioned a merger with a “German” company.

Now that Apertum is linked into the Bitexlive dotc platform I wonder if TGP tokens will soon be available there too