Auratus fraud continues with Zai Cards & “gold points”

Following the collapse of its original TAS Vault scheme, Auratus has rebooted with Zai Cards.

Following the collapse of its original TAS Vault scheme, Auratus has rebooted with Zai Cards.

Details of Auratus’ new Zai Card investment scheme were revealed on a secret August 5th webinar hosted by Annie Starky.

Starky, an Australian Auratus promoter, is part of Martene Wallace’s “leadership” group.

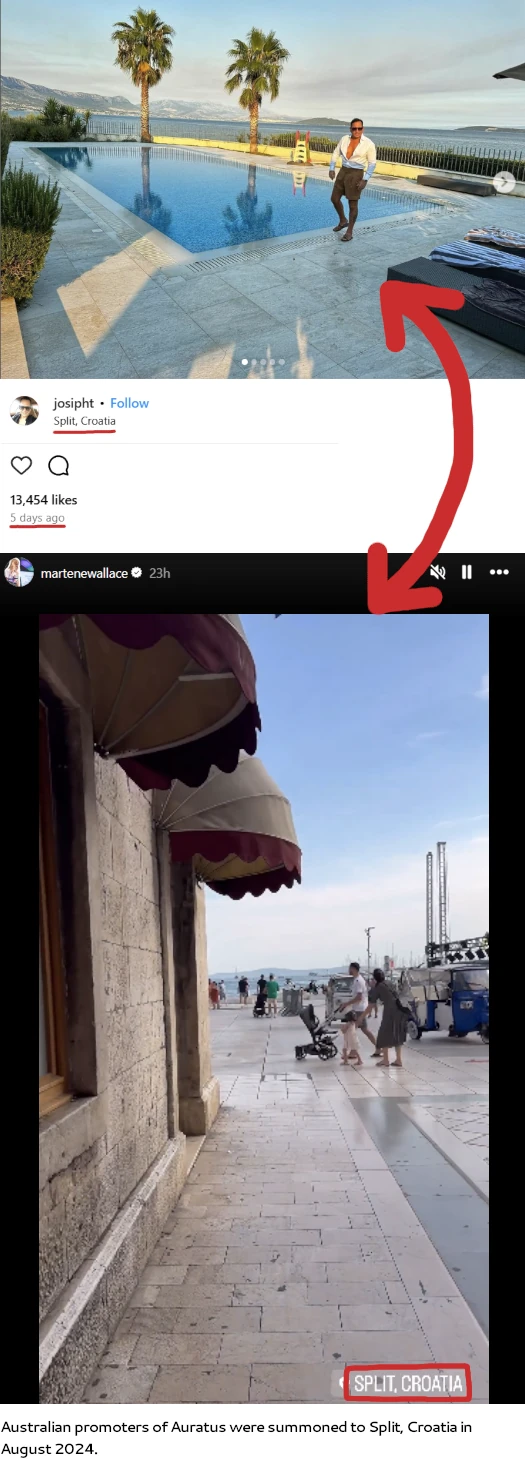

Starky was actually filling in for Wallace and using her Zoom account, owing to Wallace and other Auratus promoters being summoned to a secret meeting with Josip Heit in Croatia.

Josip Heit owns GSB Gold Standard Corporation, through which he directly and indirectly has run and runs multiple fraudulent investment schemes. These include GSPartners, Swiss Valorem Bank, GSPro, Billionico and Auratus.

Heit is originally from Croatia and is believed to hold a Croatian passport. Like many countries, Croatia does not extradite passport holders.

After blabbing on about world economies and gold for twenty minutes (note Auratus doesn’t have anything to do with actual gold), Annie Starky gets into Auratus’ new Zai Card investment scheme.

Note that from here on out anything in a green box is quoted from Starky directly.

The underlying premise of Auratus’ Zai Card investment scheme is the same as its collapsed TAS Vault scheme.

This company takes the gold and puts it into a decentralized space. It’s actually physical gold held on a digital platform.

Auratus investors are led to believe they’re investing in gold, which of course they never see and no verifiable proof it exists is provided.

What Auratus investors are in fact investing in are “gold points”, created out of thin air and completely worthless outside of Auratus itself.

This happens through Auratus’ relatively new Zai Cards.

[You] buy something called a Zai Card, which is a smart-contract.

Buy a Zai Card and then store [and] earn more gold, as a result of storing it on that Zai Card.

Note that although they’re depicted as physical cards, Auratus’ Zai Cards don’t actually exist. They’re nothing more than a marker to track how much an Auratus investor can invest.

Before we get further into Auratus’ new Zai Card investment scheme, there’s a few things going on here I want to tie to together.

The whole invest in fake gold ruse is essentially a reboot of Karatbars International, a collapsed pyramid turned crypto Ponzi that Josip Heit was closely involved in.

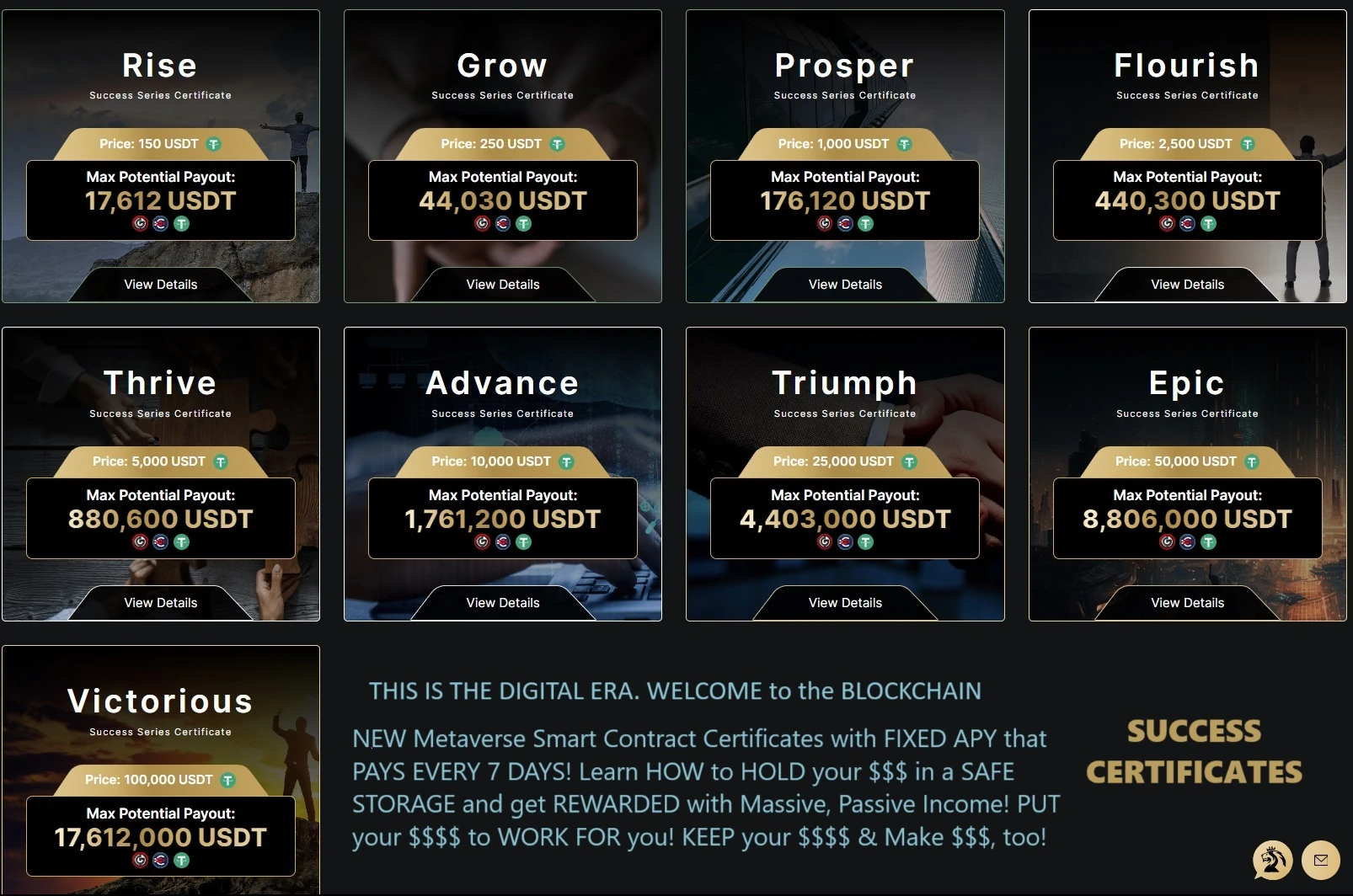

Zai Cards and the smart contracts purportedly attached to them are a rebranding of GSPartners’ fraudulent metacertificates (aka metaportfolios) investment scheme.

In a nutshell, investors invest cryptocurrency on the promise of returns paid out over a set period of time.

As GSPartners’ ROI liabilities spiralled further and further out of control, a “Victorious” certificate saw GSPartners promise 17.6 million USDT off a 100,000 USDT investment.

This was part of GSPartners’ final “success series” certificates, details of which you can see below (click to enlarge):

GSPartners’ certificates scheme has received over a dozen regulatory fraud warnings from multiple countries. A GSPartners promoter has also been arrested in South Africa as part of an ongoing criminal investigation.

These warnings and arrest are the reason Auratus is promoted in secret. You won’t find Heit or any promoters publicly acknowledging Auratus even exists.

As to the specifics of Auratus’ Zai Card investment scheme, investment is solicited under the ruse of purchasing gold.

This is framed as purchasing a Zai Card and then “loading” it with purchased gold (invested cryptocurrency). In GSPartners investors “loaded” purchased “metacerticates” in the same manner.

While cryptocurrency enters Auratus via investment, Zai Card returns are paid in “TAS Gold Points” (TGP).

One of the things we’ve got to be mindful of is, y’know we can’t say it’s an investment because that’s giving financial advice. We can’t say it’s income, because what they pay you… and it’s a bit like saying, um they pay you in loyalty points.

It’s called Tas Gold Points. So you get paid in loyalty points.

With Auratus, you earn gold points every time you buy your gold and you gold goes through a circuit system.

In Auratus’ first fraudulent investment scheme, the “circuit system” was called a “vault cycle”. It’s the same thing, they’ve just changed the name.

Every two weeks you will be earning gold points on your Zai Card, which you can then change into whatever you want.

To recap: cryptocurrency investment into a Zai Card –> a passive “gold points” ROI every two weeks –> cash out gold points on a “TAS Card” as long as Auratus lets you.

That’s Auratus’ “new” investment scheme. A whole lot of name-changing but the underlying securities fraud remains the same.

The key is to get in now and that’s why I say don’t procrastinate.

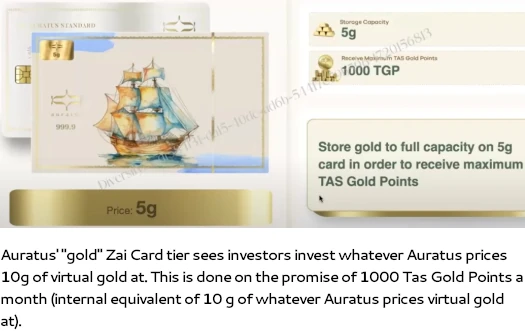

It’s $606 Australian Dollars to purchase the Gold Zai Card. And it takes, it’s 5 grams to load. And so you actually have to look at 5 grams to purchase, 5 grams to load.

So you do that twice, it’s about twelve hundred and thirteen dollars to purchase right now.

Now it tells you there, that you’re gonna get a monthly maximum reward of a thousand TAS Gold Points.

Well actually you’re not. You’re gonna get more, because we’re in a special promotion period right now and this is what I’m really excited about.

And that’s why I’m saying don’t procrastinate. Don’t think about this, just think “What have I got? What can I liquidate fast?” Y’know, sell gym equipment, sell stuff that you’re not using. Yeah sell the TV, it’s useless.

Um, so that’s interesting because what you get now is you actually receive um… well you’re actually gonna receive about 18.34 grams from your loyalty points. So 1834 as opposed to 1000 [grams].

So you’re gonna get 1834 Tas Gold Points for this, and so that works out to be around about $2203 AUD.

Now remember when I said you get these points delivered to you twice a month? They come in two payments. So in the course of a month they get paid to you … twice a month.

So if we liquidate that into Australian Dollars it’s about $95 [that] will come into your dashboard as gold, and you choose what you want to do with that.

And at the end of the two years, this works out to be 2.33x what you initially put in.

To summarize; Auratus’ Gold Zai Card tier costs around $1213 to invest in. This is on the promise of a $2203 passive return, paid out at approximately $95 every two weeks for two years.

There are cheaper/more expensive Zai Card investment tiers. A “horse” tier Zai Card multiplies the gold tier Zai Card investment and ROI amounts by ~525%.

Starky claims “horse” tier Zai Card investors receive $7542 AUD over a 12 month period.

You’re going to get about $390 AUD back per month when you sell or exchange. And at the end of the twelve months you’re approximately going to get um, times two more. You’re going to get twice as much as you put back in.

Above the “horse” tier Zai Card tier there’s the “panda” tier, which Starky claims pays “2.36x back”.

What’s the price of 75 grams in euro? Then what’s the price of 75 grams to store the gold?

You’re actually going to get back 2796 grams there, for the “panda” [tier]. Which works out to be 2.36x the amount of money you initially put in.

Above the “panda” Zai Card tier is the “fighting fish” tier.

The “fighting fish” [tier] at the moment is returning about 2.5x what you put in over twenty-four months. So in 24 months you get your money back.

Above the “bull Zai Card tier is the “bull” tier.

The “bull” [tier], the next one, is uh over thirty-six months. The last four cards goes over three years and you get 3.4x your return. And then the others are even bigger.

Starky runs through the rest of Auratus’ Zai Card investment tiers, wrapping up at “dragon”.

That’s about $1.5 million to purchase the Zai Card, about $1.5 million to load and to get an extraordinary amount back, which I have here somewhere.

You get, on that one, you get uh the dragon? Yep, 2.2x what you originally put in.

Owing to the fraudulent nature of its Zai Card investment scheme, Auratus doesn’t disclose any of this on its website.

GSPartners’ promised “metacertificates” returns were of course never paid out. As prior certificates reached expiry, GSPartners released new certificates and promotions to mask previously invested funds had been stolen.

GSPartners collapsed in December 2023 and began terminating investor accounts shortly after. Hundreds of millions is believed to have been lost and remains unaccounted for.

If Auratus even lasts that long, expect new Zai Card tiers to be trotted out as previous tiers expire.

On the promotion side of things I believe Auratus’ Zai Card investment scheme uses the same MLM compensation plan as its collapsed TAS Vault scheme.

Neither Auratus’ initial TAS Vault or its Zai Card reboot investment scheme are registered with financial regulators in any jurisdiction.

Owing to US authorities already issuing an Auratus Gold securities fraud warning in relation to its collapsed TAS Vault scheme, Auratus blocks its website in Texas.

Auratus’ website remains accessible elsewhere in the country.

Owing to massive US investor losses incurred through GSPartners’ collapse however, Auratus has no known promotion in the US. Instead the scheme, along with sister pyramid scheme Billionico, is primarily being promoted in Australia.

Billionico and Auratus was being promoted in South Africa but that came to a halt following Neil de Waal’s arrest in June. South African GSPartners and Billionico/Auratus promoters have since deleted their social media and scattered.

Australian authorities issued a GSPartners fraud warning in November 2023. ASIC has yet to issue a follow up Billionico/Auratus fraud warning.

Footnote: Martene Wallace and her Auratus downline regularly host marketing webinars but they are routinely deleted shortly after going live.

It is for this reason that I haven’t directly linked to Annie Starky’s August 5th Auratus webinar.

Update 7th August 2024 – Annie Starky’s incriminating Auratus marketing webinar was indeed marked private a few hours after this article was published.

GSP has a call in the coming weeks with promised good news. The reports from upline members are everyone will be paid in full as promised and GSP will either re-open or re-brand and operate in the US as normal in the coming weeks.

This from an upline member of mine. Not sure if this is the “good news” or not.

Sounds like desperate uplines have come up with a bunch of fiction based on GSPartners getting securities fraud legalized in AZ at the September 16th hearing.

Good luck with that.

@ OZ

Did not elaborate other than saying a settlement was reached. A call to make things offical would be occuring withing the next few weeks. Everyone would be paid in full by end of Sept and that GSP would reopen and begin to operate as per normal in the US.

That was all the news our upline was comfortable sharing. This was last week. I’ve continued to search online and here for updates to confirm or deny what we are being told. This is the first thing I have seen GSP related in months.

Yeah so this is complete bullshit. Your upline is either making up or regurgitating lies.

I agree. I’ve searched for settlements and cases and have seen nothing. Was shocked to hear this from the upline. Have been regularly updating this page to see if anything new had come up.

I’ll post if we get any other news from the upline, as of now its nothing more than Ive posted above.

Managed to snag an invite to one of the private webinars last night, probably the worst one I have seen. Rambling, ambiguous claims around Web3 and Blockchain with little to no specifics.

These people who are supposed to be pioneers in the crypto investment space can’t even share screen on a zoom call without issues.

Big slip up when questioned about how the wealth is actually generated by the “loyalty points”- all current promoters are being paid out of the marketing budget!

There is no evidence of real returns. The bonus offers they are running now will dry up.

Interestingly enough there was little mention of the MLM referral side of the house, not even touching on commission tiers or anything.

One point here however was the fact that Billionico is still being offered as the gateway to be a distributor so they are undoubtedly recycling the course fees into returns for new Auratus sign ups or paying out old GSP investments.

Andrew Hawkes (second from right in picture) is now calling himself “Doc Drew” on his Instagram reels (andrewhawkesonline) advertising a Financial Freedom video.

His “Doctorate” is from a university which is not linked with the French Ministry of Higher Education, does not follow the official French curriculum and does not have accreditation from recognised educational bodies. It is listed on FraudWiki.net for “the sale of its fake diplomas and degrees”.

His LinkedIn profile reads:

Rivera University

Doctorate, Business Administration, Management and Operations

Jun 2017 – Dec 2023

Making a note of the FaceBook group “The Freedom Formula”.

Created on August 11th, 2024 and used to promote Auratus to Australians.

Admins are: Andrew Hawkes Mell B Balment, Cathy Sandeman, Neil Morrison, Skye Poore and Sarah Hawkes.