Cloud Token to continue securities fraud with ASIC’s help

In a bid to continue to entice investment into their illegal unregistered securities investment scheme, Cloud Token has registered itself with the Australian Securities and Investments Commission (ASIC).

In a bid to continue to entice investment into their illegal unregistered securities investment scheme, Cloud Token has registered itself with the Australian Securities and Investments Commission (ASIC).

Cloud Token has no physical business operations in Australia. Nor is Australia a significant source of investment revenue for the company (Alexa).

Rather Cloud Token is run by scammers in Singapore, who are currently soliciting investment primarily from Japan, the US and Brazil.

So why register with ASIC?

ASIC aren’t known for timely regulation of securities fraud. By the time they cotton on Cloud Token’s owners and top affiliate investors will be long gone with invested funds.

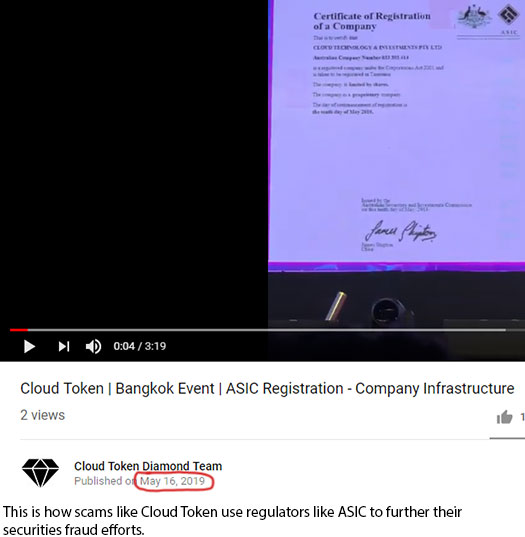

In the meantime Cloud Token can parade their May 10th “Cloud Technology & Investments” ASIC registration around, effectively making it a securities fraud marketing tool.

To be clear, the extent of Cloud Token’s registration with ASIC is at this stage nothing more than a three-page application for registration as a proprietary company.

This is otherwise known as a Form 201.

All that’s required in a Form 201 filing are general details about the company.

These can be made up or organized through a shell incorporation and local agents.

Again, by the time ASIC initiates a fraud investigation and tries to verify it’ll be far too late for Cloud Token investors.

As of yet Cloud Token has not filed any audited accounting reports with ASIC, so there remains no verifiable proof the company is using external funds to pay affiliate investor returns.

But let’s cut to the chase. Even if we take the ASIC registration at face value, it means absolutely bugger all outside of Australia.

Cloud Token is still an illegal investment opportunity in every other jurisdiction it solicits investment in. Namely the US and Japan.

Furthermore you have to wonder why Cloud Token hasn’t registered itself with financial regulators in Singapore itself.

Well, why is actually pretty obvious:

Cloud Token is another app-based MLM crypto Ponzi scheme.

While I’d like to assert this time ASIC won’t drop the ball and instead be quick to act on Cloud Token’s bogus registration, history has repeatedly shown us otherwise.

A recent example I can give you is the AWS Mining Ponzi scheme.

AWS Mining pulled the same “look we’re registered in Australia” bullshit as Cloud Token.

Despite receiving a securities fraud notice in Texas and then collapsing last month, AWS Mining is still registered with ASIC.

Worse still, they’ve been registered since 2017. And during all of that time, not once did AWS Mining file any audited accounting reports.

So uh yeah, take Cloud Token’s ASIC registration for what it’s worth. Less than used toilet paper.

And if you’re committed to actualdue-diligence, ask why Cloud Token hasn’t registered with the Financial Services Agency (Japan), the Securities & Exchange Commission (US) or the Monetary Authority of Singapore.

ASIC’s website uses cookies to expire search result links, so I can’t link directly to Cloud Token or AWS Mining’s ASIC registrations.

If you want to look them up yourself, head over to ASIC’s website and set “search within” to “Organisation and Business Names”.

Then enter either “Cloud Technology & Investments” (yes, they didn’t even use their actual company name), or “AWS Mining”.

Post a screenshot with a datestamp should suffice.

Psh. Next time 😀

That ship dit serial ponzi scammer Simon Stepsys is promoting this really hard and it looks like he’s recruiting more and more clueless victims who are joining under him in abundance as he’s just bought a new Bentley which he loves showing off…..

People like this make me sick, absolutely no morals whatsoever, it’s all about the money and no thought of the hurt it causes when these things eventually collapse.

I don’t understand why you are calling cloud token a ponzi scheme. They do not sell any packages. It’s a wallet to store coins that happens to pay you to hold your coins there.

Would you prefer holding coins on an exchange that use your coins to make money and not pay you anything?

If you put money in a bank that does not pay you, why not move money to one that does.

Even banks pay people to refer them customers. It is not coming out of the clients money.

“Selling packages” isn’t a required criteria for identifying a Ponzi scheme. Using newly invested funds to pay existing investors is.

The only verifiable source or revenue entering Cloud Token is new investment. Using new investment to pay CTO token withdrawals (through the app or otherwise) makes Cloud Token a Ponzi scheme.

Banks are registered as such to operate legally, are subject to auditing and generate verifiable revenue through loans and other activities.

Cloud Token isn’t registered with any financial regulator, operates illegally and has provided zero evidence of external funds being used to pay affiliates (because there is none).