Cloud Token confiscates affiliate investor’s CTO Ponzi points

A Cloud Token affiliate investor has been “fined” 1000 CTO points, purportedly for failing to explain the opportunity to someone they recruited.

A Cloud Token affiliate investor has been “fined” 1000 CTO points, purportedly for failing to explain the opportunity to someone they recruited.

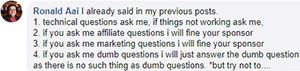

According to a recent Facebook post by Cloud Token admin Ronald Aai, an affiliate was “fined” 1000 CTOs for ‘fail(ing) to explain … how (Cloud Token’s) affiliate program works‘.

In terms of what that means practically, Cloud Token transferred 1000 CTO from an affiliate’s app wallet.

At the last known internal value, 1000 CTO is worth $412 within Cloud Token.

Despite CTO points being worthless outside of Cloud Token, Aai (right) claims confiscated CTO points will be put in a “charity fund”.

Despite CTO points being worthless outside of Cloud Token, Aai (right) claims confiscated CTO points will be put in a “charity fund”.

Whether this will require a charity to sign up to the Ponzi scheme, or whether Aai will convert the points to real money for donation is unclear.

Cloud Token affiliates invest in CTO points. The company arbitrarily increases the internal value of CTO points, allowing affiliates to cash out more than they originally invested.

In the absence of a verifiable external revenue source, Cloud Token pays withdrawal requests with subsequently invested funds.

Going forward, Aai warned the rest of the Cloud Token affiliate-base he’d be dishing out fines to “lazy sponsors” from June 8th.

Going forward, Aai warned the rest of the Cloud Token affiliate-base he’d be dishing out fines to “lazy sponsors” from June 8th.

If you ask me affiliate questions I will fine your sponsor.

If you ask me marketing questions I will fine your sponsor.

Aai also suggested affiliates who request password resets might also be fined in the future.

Putting aside the fact that a legitimate MLM company wouldn’t get away with stealing money from affiliates, Aai’s actions shed light on what might be an eventual exit-scam strategy.

Cloud Token are evidently able to manipulate CTO app wallet balances at whim.

When the time comes to do a runner (new investment dries up), all Aai has to do is issue a company-wide wallet reset.

Something something “we got hacked”, you know how it goes.

Can’t get scammed if your backoffice says you don’t have any Ponzi points to cash out, right?

Whaddaya mean, that’s a legitimate MLMs basic business model. They just make it more complicated to prove in court.

I meant affiliates wouldn’t stand for it. In a Ponzi scheme the admins can get away with anything.

Investors aren’t going to run to the authorities (until it’s too late).

In the ponzi schemes we see here, a significant number of the participants are fully aware that its full on fraud, they’re just hoping to get their cut.

Still, even the majority of the ones who know still lose money. They’re arguably encouraged to take the knowing risk by receivers, trustees and regulators who set to reimburse net victims if they lose.

Sadly, the current common outcome is if they lose, they get some of their losses back.

If they win, they get to keep at least some of their winnings if they’re stubborn enough, and all of their winnings if they’re lucky.

When the ones who have ever been on the list of participants in older scams are excluded from recovery if they lose and from any partial settlement if they win, they might learn and starve the scams out.

In a simple pyramid MLM the admins can get away with anything either, given the kind of people who join.

People generally don’t sue MLMs for taking money off them, they just walk away nursing their losses. This still applies if part of the loss is from an arbitrary “fine”.

This is a proof that they are not even a token. The point of token and Crytpo Wallet is that no one can come and confiscate you money.

This is another central SQL bulshit hind behind token and crypto..

The mere fact they can remove funds from your wallet is proof it is not a decentralized wallet at all.

The fact they can reset passwords is also proof it is not a decentralized wallet.

… despite all their claims.