CFTC secures Fundsz Ponzi asset-freeze, owners charged

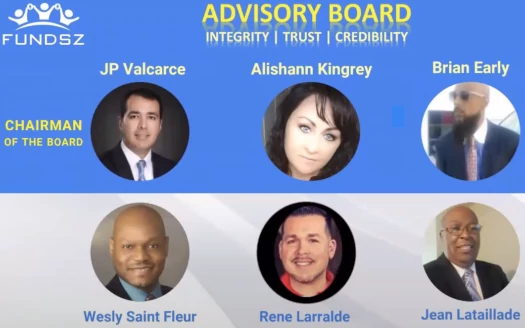

The CFTC has secured an asset-freeze against Fundsz and owners Rene Larralde, Juan Pablo Valcarce, Brian Early and Alisha Ann Kingrey.

The CFTC has secured an asset-freeze against Fundsz and owners Rene Larralde, Juan Pablo Valcarce, Brian Early and Alisha Ann Kingrey.

As alleged by the CFTC, Fundsz owners

have fraudulently solicited, accepted, and pooled potentially millions of dollars of contributions.

Juan Pablo Valcarce (Florida), Brian Early (Louisiana), Rene Larralde (Florida) and Alisha Ann Kingrey ( Arkansas), appeared on Fundsz marketing material as members of its Advisory Board.

Based on Fundsz’ marketing, the CFTC estimates the Ponzi scheme solicited “millions of dollars” from “more than 14,000” participants.

BehindMLM reviewed Fundsz in June 2022. We correctly identified Fundsz as a Ponzi scheme, offering investors a weekly passive ROI.

Fundz Ponzi ruse was the “staking” model, purportedly funded by “proprietary algorithm” trading.

As alleged by the CFTC, in reality Fundsz “did not trade at all.”

The truth is found in Fundsz marketing materials that recently began to be posted in the Fundsz Telegram group, which state: “[w]e do not trade.”

The returns that Fundsz projected and reported were not based on actual profits from trading participant funds. Rather, each week the Defendants simply made up a fictional return for the preceding week to report to participants.

Defendants also made other misrepresentations of material fact, including that Fundsz had made on time and accurate payments to participants for over seven years, and that the prices of cryptocurrencies like bitcoin and ether, also known as digital asset commodities, were increasing dramatically during periods in which the prices of those coins had actually fallen.

The lie that Fundsz had been around and making payments for 7 years was central to its marketing:

The CFTC notes Fundsz only “came into existence in 2020”.

Instead of trading, Fundsz’ owners used invested funds to financially enrich themselves.

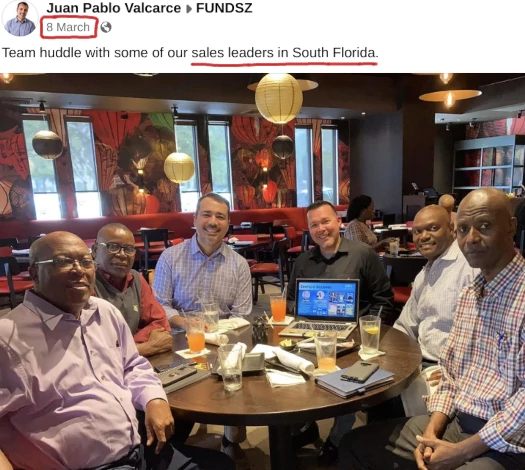

The CFTC cites Rene Larralde, sitting behind the laptop in the photo above, as an example;

Between approximately September 14, 2021, and October 5, 2022, Defendant Larralde made 35 deposits of digital asset commodities valued at $216,398 from certain digital asset wallets associated with Fundsz into an account in Larralde’s name at Digital Asset Trading Platform A.

And between approximately December 7, 2021, and October 9, 2022, Larralde made 34 withdrawals of U.S. dollars from that same account at Digital Asset Exchange A, sending $210,388 in fiat currency to his personal account at a separate financial institution, Bank B.

Fundsz insiders will know that in June 2023 Fundsz disabled withdrawals and exit-scammed.

Turns out this was a direct response to subpoenas issued by the CFTC.

On or about June 23, 2023, after the Individual Defendants learned of the Commission’s investigation by virtue of having received subpoenas from the Commission, Defendants halted all participant withdrawals and refused to allow participants to withdraw their money.

An announcement in the Fundsz Telegram group stated:

“[E]ffective immediately all withdrawals have been placed on hold until we are able to address our compliance obligation.”

After participants apparently complained that they were not able to withdraw money, on June 23, 2023, Defendant Kingrey responded, in the official Fundsz Telegram group:

“First of all, watch how you talk to me. Fundsz is my Company and FUD [fear, uncertainty, and doubt] will not be tolerated.”

As part of the “we’re a private company” ruse, Fundsz’s owners also escalated attempts to conceal Fundsz’s fraud.

After she became aware of the Commission’s investigation, Defendant Kingrey also instructed Fundsz members to take down all social media posts or videos about Fundsz, saying “[i]f you find a Fundsz video and you know the person who owns it, contact them and tell them to unlist it.”

Defendant Early echoed this sentiment, stating “ALL FACEBOOK POSTS WITH THE FUNDSZ LOGO HAVE TO BE DELETED IMMEDIATELY.”

The CFTC has charged Fundsz, Larralde, Valcarce, Early and Kingrey with violating the Commodity Exchange Act.

The CFTC is seeking a permanent injunction against the Fundsz Defendants, as well as disgorgement of ill-gotten gains, restitution and a civil monetary penalty.

The CFTC’s Complaint was originally filed under seal on July 31st. Accompanying the Complaint was an emergency motion, requesting entry of an ex-parte statutory restraining order (SRO) and preliminary injunction.

The SRO was granted on August 2nd. As per the SRO order;

The CFTC has made a prima facie showing that since October 2020, Defendants Rene Larralde, Juan Pablo Valcarce, Brian Early, Alisha Ann Kingrey, and Fundsz have made material misrepresentations regarding the use of participant funds, expected investment returns, and historical investment returns.

Based on this conduct, there is good cause to believe that Defendants, have, are, or are about to engage in conduct in violation of 7 U.S.C. § 9(1) and 17 C.F.R. § 180.1(a)(1)–(3).

Under the terms of the SRO, the Fundsz defendants’ assets have been frozen till August 23rd. A Temporary Receiver has been put in charge of Fundsz and the frozen assets.

The Fundsz Defendants, having been served, have been directed to attend a Show Cause hearing, also scheduled for August 23rd.

Defendant Rene Larralde isn’t too happy about the upcoming expected steamrolling in court.

Defendant Rene Larralde isn’t too happy about the upcoming expected steamrolling in court.

On August 11th Larralde (right) filed an emergency motion, requesting the granted SRO be dissolved.

Larralde is head of household and provides for his wife and three children.

Due to the SRO, Larralde has little to no remaining financial resources to cover necessary living expenses and attorney’s fees.

The SRO was entered by this Court on an ex parte basis – despite Larralde’s ongoing rolling production of documents in response to a subpoena issued by the Commodity Futures Trading Commission (“Plaintiff”) – based upon a one-sided presentation of allegations asserted by Plaintiff.

Plaintiff’s memorandum in support is absolutely bereft of any appropriate basis for the issuance of the relief sought and obtained.

Typically we don’t see carveouts when it comes to MLM fraud asset freezes.

Furthemore, Larralde’s motion was accompanied by a sworn declaration.

Pounced on by the CFTC within hours, Larralde’s declaration might now have implications for the rest of the Fundsz Defendants.

Following Larralde’s declaratory filing, the CFTC filed a notice claiming a hearing on its Motion for a Preliminary Injunction wasn’t needed.

The CFTC believed it had determined that defendant Fundsz was not actually a legal entity, but rather a d/b/a.

However, defendant Larralde’s declaration indicates that he is “an owner” of Fundsz, implying that it is a legal entity.

Since Larralde is an owner of Fundsz, service on Fundsz was accomplished by service Larralde pursuant to Fla. Stat. §§ 48.061(1), 48.062(2)(a), or 48.081(1)(a).

No evidentiary hearing is necessary to determine that the CFTC has satisfied its burden for a preliminary injunction.

And to enjoin future violations, the CFTC must only “show a reasonable likelihood of future violations in addition to a prima facie case of illegality.”

This low standard is easily satisfied by the evidence the CFTC has already presented, as well as by additional evidence the CFTC may attach to an additional filing in support of its motion.

In fact, Larralde’s motion to dissolve the SRO and declaration in support essentially establishes the illegality that took place in Fundsz.

For example, Larralde admits that Defendants claimed Fundsz traded through a proprietary algorithm and admits there was no “literal algorithm.”

Larralde admits that Defendants that Fundsz marketing materials falsely claimed that cryptocurrencies had appreciated by wildly inflated percentages, but argues that those false statements were just “generalized figures” that were somehow “expressions of opinion on the market.”

Larralde implicitly admits that Fundsz has reported false weekly returns of 3% to its members “throughout its existence,” noting that “at various times” trading was “stopped,” and therefore there was no way for Fundsz to have actually achieved 3% returns.

And Larralde even essentially admits that he misappropriated money from Fundsz investors, stating “I made several transfers from Fundsz accounts to accounts in my name” for purposes that include “general distributions [to Larralde] as an owner.”

If this is the evidence Defendants intend to present, then the preliminary injunction can be issued on the papers. Live testimony is unnecessary.

If the preliminary injunction hearing remains scheduled, the CFTC goes on to advise it intends to call defendants Larralde and Valcarce as witnesses.

The CFTC anticipates that it would be able to present its evidence in an hour or less.

Being an emergency motion, it’s expected Larralde’s motion will be ruled on early next week. Stay tuned…

Update 15th August 2023 – The CFTC has filed its response to Larralde’s emergency-motion.

Update 24th August 2023 – The CFTC has secured a preliminary injunction against the Fundsz Defendants.

Update 12th September 2023 – The CFTC initial Complaint against the Fundsz Defendants has been dismissed.

The CFTC has until October 6th to file an Amended Complaint, failing which the case will be dismissed.

In related news, defendant Rene Larralde passed away on September 6th.

There’s no such thing as a “private group” Ponzi scheme you dum dums.

Ponzi go boom.

Glad.