CashFlow NFT’s founder is OneCoin scammer Micah Theard

The public face of the CashFlow NFT is Swedish resident Daniel Wood.

The public face of the CashFlow NFT is Swedish resident Daniel Wood.

The actual founder of the Ponzi scheme however is career scammer Micah Theard.

You won’t find Micah Theard’s name anywhere on CashFlow NFT’s website though.

Despite having launched and begun soliciting investment, CashFlow NFT’s website is still just a signup form.

The only public connection you’ll find between Theard and CashFlow NFT, is a crypto shill event held in Texas back in June:

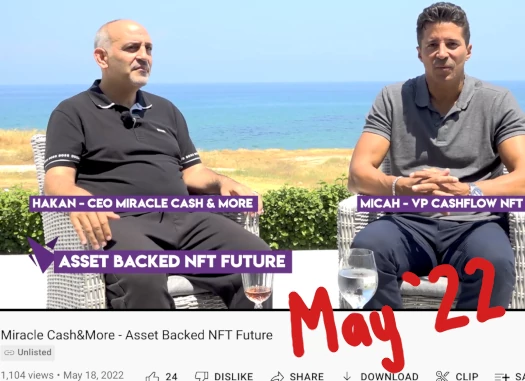

To confirm Theard is in fact CashFlow NFT’s founder, we turn an unlisted video on Miracle Cash&More’s YouTube channel:

Hi, my name is Micah. I am the founder of CashFlow NFT.

It seems in addition to founding the company, Theard has made himself Vice President.

This tracks with Daniel Wood (right) being the public face of the company.

This tracks with Daniel Wood (right) being the public face of the company.

Miracle Cash & More is a crypto wallet company, run by CEO Hakan Törehan. CashFlow NFT runs its Ponzi scheme through Miracle Cash & More’s wallet services.

Both Torehan and Wood have ties to Cyprus, a scam-friendly jurisdiction… for the most part.

Back in 2017 Torehan was arrested in connection with an “illegal gambling ring” and association with “organized crime”. Specifically, Torehan was charged with “providing financing for illegal online gambling sites”.

Torehan was released on bail in February 2018 and, as I understand it, hatched a plan to avoid reporting to authorities through a fake doctor’s certificate.

When that fell through Torehan disappeared in June. He surrendered himself to authorities in September.

Torehan maintains he was kidnapped by Osman Aydeniz, who at the time was on Interpol’s red notice and the UK’s “most wanted” lists for drug trafficking and theft.

Aydeniz maintained Torehan

came of his own free will, he is a family friend. We don’t have any bad blood between us.

Beyond that I was unable to trace what happened. Even outside of MLM Cyprus is a known dodgy jurisdiction, they play loose with the law.

Case in point, in January 2021 Torehan resurfaced as a crypto bro.

6 Turkish Cypriots came together and created a cryptocurrency called “Miracle”.

Hakan Törehan, one of the founders of the company, which started to serve in Nicosia, Famagusta and Girne in the TRNC, said that their goal is to create the bank of the future, and that they are the first and only licensed company.

Miracle as a cryptocurrency doesn’t appear to have gone anywhere but it did lead to Miracle Cash & More, launched on or around December 2021.

Since BehindMLM tied Miracle Cash & More to CashFlow NFT on August 4th, Miracle Cash & More’s website has been disabled:

Not sure what the story is there. Anyway, it appears that Torehan has gone from “financing illegal gambling sites” to “financing illegal MLM crypto Ponzi schemes”.

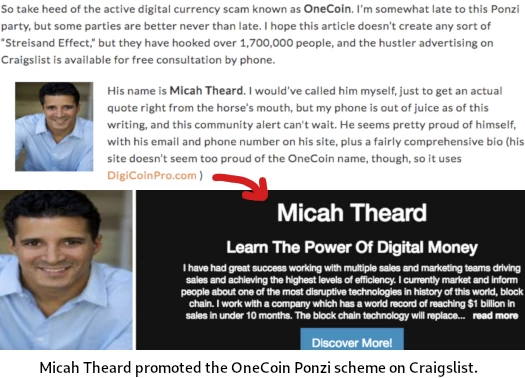

That leads us to Micah Theard, CashFlow NFT’s founder.

Before he got into Ponzi scamming, Theard worked in the textile industry.

I believe Theard’s first major MLM scam was Flexkom (circa 2013/2014).

Flexkom’s was a pyramid scheme hidden behind a merchant network. It was run by Turkish scammers.

After Flexkom Theard began promoting the notorious OneCoin Ponzi scheme.

Around this time someone going by “micah” showed up on BehindMLM, claiming to have “checked” OneCoin’s non-existent blockchain.

After OneCoin Theard got involved in Circle Society:

Circle Society was a $100 million crypto Ponzi scheme run by David Saffron. Saffron was arrested by US authorities in June 2022.

It seems Theard finally realized running Ponzi schemes is where the money is at. And so we have CashFlow NFT.

As at June 2022, CashFlow NFT was busy flogging $5000 NFT positions to gullible investors in Spain:

After Spain CashFlow NFT has been trying to flog similar NFT investment positions to UK residents.

A source tells me that last week, Daniel Wood claimed “the selling of these NFT’s has really slowed down.”

It seems his pomzi scheme has hit New Zealand and influencing people here to buy into Cashflow NFT.

There is too many anomiles for this company to be legitimate. How can I get the authorities here to close him down or how can I let these people know to tread softly?

New Zealand’s FMA is pretty active. Best to contact them with MLM securities fraud concerns.

In confronting Micah about this article, he said that this atricle is anonymous and that they were unable to respond to the alegations here.

So why don’t they respond if people can post to this blog?

That’s a load of garbage. The comments section is open to anyone.

There’s also a contact link at the top right of every page.

The reason Micah Theard can’t respond to this article is because there’s no response to verifiable securities fraud.

i’m from australia, my wife’s parents have invest nearly $20,000 into this and they don’t believe it’s a scam they have started convincing my wife and behind my back she gave $5000

they think actually they say they KNOW they will be millionaires in 2 years and i told them that’s not how crypto works !

what is undeniable proof i can show them ?

They’ve invested into a passive returns investment opportunity, which is a securities offering.

You can verify neither CashFlow NFT or Miracle Cash & More are registered with ASIC. This means they’re committing securities fraud.

MLM + securities fraud = Ponzi scheme.

Take a look at MiracleCashFacts.com. Micah Theard is raising $1.6 MM per month for a total of $25 Million according to him.

Cashflow NFT’s website received negligible traffic in September 2023 as per SimilarWeb. It’s not making any money.

Of course they can respond, but it’s pretty hard when the facts disagree with them and they can’t gishgallop and handwave away legalities.

Please help me to confront my potential downline prospects with logical answers to their questions on Micah Theard and Hakan Torehan possible ponzi scheme action.

Appreciate your help and response on this.

Logical answer:

CashFlow NFT commits securities fraud which lends itself to being a Ponzi scheme.

CashFlow NFT is not registered to offer securities in any jurisdiction. To date the company has also failed to file audited financial reports demonstrating external revenue.

I’m sorry for promoting unregistered securities and will stop committing securities fraud.

I am seriously concerned. I invested $10,000 in this company and all I see is fraud by Micah.

Can someone give me piece of mind that my investment isn’t a total loss because Micah is looking like a fraud professional.

Whatever you invested into Cashflow NFT was lost the moment you invested into an unregistered investment scheme.

Your best bet is filing a complaint with the SEC, referring to the direct MetaTerra registration link.

Seriously, who is reading this that isn’t pissed off because they were ignored by someone??? I just want to be heard by my best friend – you. If you can hear me, you can see me.

@ Nora

You seriously came here looking for ways to talk people into buying into what you know is a scam?

Is there a lot of lead in the water where you live?