CashFlow NFT fraud continues with BG Lifestyle Club

CashFlow NFT’s latest grift is BG Lifestyle Club, a “CPU ownership” fraudulent investment scheme.

CashFlow NFT’s latest grift is BG Lifestyle Club, a “CPU ownership” fraudulent investment scheme.

The launch follows an email from owner Micah Theard making excuses for CashFlow NFT investor losses.

“I’m so frustrated with Miracle Cash & More! I invested two years ago, and I still haven’t seen a return!”

We understand that sentiment, and we’ve heard it from others as well. It’s natural to feel this way, so we wanted to take the time to address it directly.

In attempting to explain away investor losses, Theard trots out nonsense about “regulatory challenges”.

This ruse is centered around new MiCA laws in Europe.

Things fall apart upon consideration MiCA has nothing to do with securities law and securities regulation. Notwithstanding it was the same ruse used to collapse the Mavie Global Ponzi scheme.

Of additional note in Theard’s email is the claim;

Collectively, our community owns over 30% of Miracle Technologies/Metaterra, and as we push in the next 3 years toward a $100 billion valuation, the community’s stake could grow to over $30 billion, solidifying our place in history.

And that CashFlow NFT is

days away from delivering our capitalization contract to the SEC to capitalize the company to 500 million.

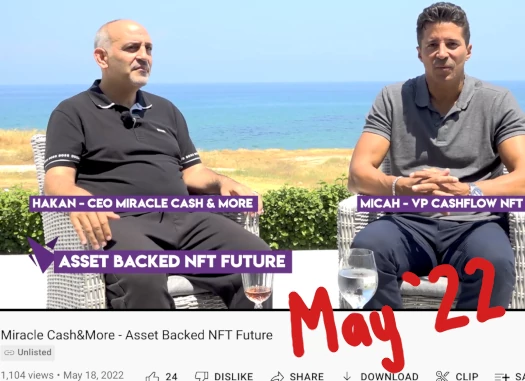

Miracle Technologies, aka Miracle Cash & More, is associated with CashFlow NFT, they are effectively one and the same.

MetaTerra, a shell company CashFlow NFT acquired as part of efforts to create legitimacy around its unregistered investment scheme, is currently delinquent in its SEC filings.

MetaTerra’s Annual 10-K report for the financial year ending December 2023 was due on April 1st, 2024. It is now seven and a half months overdue.

There is also no mention of any of CashFlow NFT’s investment schemes in any of MetaTerra’s filings. Officially, MetaTerra’s filed business description with the SEC is “selling auto parts”.

Moving on to BG Lifestyle Club, Theard and business partner Hakan Törehan are soliciting investment on claims of purported

agreements with two of the world’s largest merchant processing companies, with access to 100 million active terminals in 120+ countries.

The ruse is that these companies aren’t accepting crypto payments, which is where CashFlow NFT and begging more for more investment comes in.

To earn from these terminals, merchants must be notified about their option to accept crypto. This expansion requires funding, and that’s where you come in.

The business model sees already rinsed CashFlow NFT investors deposit $900 on the promise of $30 or more “per asset per month and growing with network success”.

I.e. the more people invest, the higher the returns.

BG Lifestyle Club has its own referral commissions, paid out down three levels of recruitment:

- level 1 (personally recruited affiliates) – 8%

- levels 2 and 3 – 3%

Note that Theard doesn’t specify the investment amount but does provide referral commission rate examples:

Tier 1 (10 referrals at 8%): $720.00

Reverse math’ing the above we get $900 per investment.

Finally there’s also a shit token ROI component to BG Lifestyle Club;

Every member starts with daily earnings of at least $1 in Phoenic tokens. Over time, this income can grow as the network expands and the token value increases.

CashFlow NFT launched Phoenic token last year and, not surprisingly, so far it’s gone nowhere. Watch for trouble when BG Lifestyle Club starts only paying out in Phoenic tokens.

Pending any further updates, in particular the SEC taking action on MetaTerra’s delinquent filings, we’ll keep you posted.

Definitely not a scam…

Obviously reading comprehension is not one of your strong suits. A word of advice: Quit while you are behind. You are too ignorant to be doing any kind of investing.