US BitConnect promoters sued by SEC

Top US promoters of the BitConnect Ponzi scheme have been sued in a securities fraud lawsuit filed by the SEC.

Top US promoters of the BitConnect Ponzi scheme have been sued in a securities fraud lawsuit filed by the SEC.

Defendants on the chopping block are Trevon Brown (aka Trevon James), Craig Grant, Joshua Jeppesen, Ryan Maasen, Michael Noble (aka “Michael Crypto”).

Jeppesen’s fiancee, Laura Mascola, is the sole named relief defendant.

As described by the SEC, these were BitConnect’s “most successful promoters in the United States”.

- Trevon James (31) is a resident of Myrtle Beach, South Carolina

- Craig Grant (46) is a resident of Kissimmee, Florida

- Joshua Jeppesen (37) and Laura Mascola (33), are residents of East Falmouth, Massachusetts

- Ryan Maasen (39) is a resident of Tulsa, Oklahoma

Michael Noble (51, right) is a resident of Pacific Palisades, California

Michael Noble (51, right) is a resident of Pacific Palisades, California

The SEC’s promoter lawsuit marks the first BitConnect judicial action taken by US authorities.

As alleged by the SEC,

From approximately January 2017 to January 2018, BitConnect, an unincorporated organization, raised approximately $2 billion by conducting an unregistered offering and sale of securities in the form of investments into BitConnect’s “lending program.”

Defendants Brown, Grant, Maasen, and Noble, along with BitConnect itself and others, offered and sold the lending program as securities without registering the offering with the SEC as required by the federal securities laws and without a valid exemption from this registration requirement.

Brown, Grant, Maasen, and Noble promoted and touted investments into the lending program to potential retail investors, including by creating “testimonial”-style videos advertising the merits of investing in the program and then publishing the videos on YouTube, sometimes multiple times a day, with a referral link to the BitConnect lending program.

For each new loan that Brown, Grant, Maasen, or Noble brought in, BitConnect paid the respective promoter a percentage of that new investment as “referral commissions.”

When confronted with similar allegations in a civil class-action lawsuit, Ryan Maasen (right) trotted out a malarkey religious defense.

When confronted with similar allegations in a civil class-action lawsuit, Ryan Maasen (right) trotted out a malarkey religious defense.

[1:55] The world, the people in the world … have the ability to think what they want to about me.

But um… I can’t allow myself to get caught up in that.

I have sympathy for those that were hurt… but I have to remember who I really am. And that’s what I want to focus on here and that’s what I’m trying to stay focused on every day.

I’m a child of god.

Whether he tries the same shtick with the SEC remains to be seen.

The SEC’s lawsuit seeks to claw back those referral commissions, as well as any returns made through BitConnect’s BCC Ponzi scheme.

Brown obtained at least $480,000, Grant over $1.3 million, Maasen over $475,000, and Noble over $730,000 as “referral commissions” and “development funds” from promoting and touting investments into BitConnect’s lending program to retail investors

The SEC identifies Joshua Jeppesen as “Bitconnect’s Continental Promoter”, meaning he liaised directly with BitConnect’s admins.

The SEC identifies Joshua Jeppesen as “Bitconnect’s Continental Promoter”, meaning he liaised directly with BitConnect’s admins.

By aiding and abetting BitConnect’s unregistered offers and sales of its lending program investments, Jeppesen obtained over $2.6 million, of which he transferred over $500,000 to Mascola, his fiancée.

Jeppesen is also credited as having a hand in developing BitConnect’s MLM opportunity.

In approximately October 2017, the BitConnect Founder, with Jeppesen’s assistance in his role as “continental promoter,” developed “promoter rules” for national promoters and regional promoters.

BitConnect’s top promoters were instructed to “sell small amount(s)” of their provided development fund “through out week [sic]”, so as not to crash the Ponzi scheme.

One interesting tidbit from the SEC is what happened in the aftermath of BitConnect’s Texas and North Carolina cease and desists.

In January 2018, BitConnect asked Jeppesen to hire a United States lawyer who specialized in securities law, given the cease-and-desist orders.

BitConnect sent Jeppesen 200 Bitcoin (then worth approximately $2.87 million) to be used for a legal retainer.

Jeppesen kept ten Bitcoin from that amount, although BitConnect did not ultimately retain a United States lawyer.

The SEC’s claims of relief against the US promoter defendants include

- violations of the Securities Act

- violations of the Exchange Act

- aiding and abetting violations of the Securities Act (Jeppesen)

- unjust enrichment (Mascola)

The SEC is seeking a permanent injunction against the defendants.

The requested injunction will prohibit the defendants from committing further securities fraud violations, as well as

permanently prohibiting Defendants from

(a) offering, operating, or participating in any marketing or sales program in which the participant is compensated or promised compensation solely or primarily

(1) for inducing another person to become a participant in the program, or

(2) if such induced person induces another to become a participant in the program; and

(b) participating, directly or indirectly, in any offering of digital asset securities.

There is an exemption carve out for personal cryptocurrency transactions.

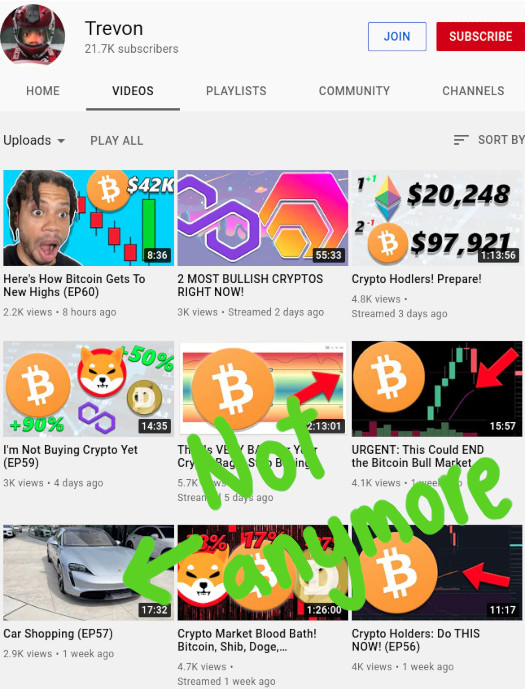

This should be of particular concern to Trevon James, who since BitConnect has relentlessly continued to promote unregistered securities on YouTube.

James’ latest scam is OurGlass, a Binance SmartChain smart-contract Ponzi scheme.

Additionally the defendants will have to disgorge their ill-gotten gains, as well as pay a to be determined civil penalty.

Unfortunately the SEC don’t unmask who is behind BitConnect, only referring to the individual as “BitConnect’s founder”,

an Indian citizen and resident who founded, managed, and controlled BitConnect at all relevant times.

We believe this individual is Satish Kumbhani (right), as reported back in 2018.

We believe this individual is Satish Kumbhani (right), as reported back in 2018.

Noticeably absent from the defendant list are Grenn Arcaro, Nicholas Trovato (aka “Crypto Nick”) and Ryan Hildreth.

While he’s not a defendant, Glenn Arcaro does feature in the SEC’s lawsuit.

He is credited as “United States National Promoter;

a California resident who served as BitConnect’s national promoter in the United States from approximately August 2017 to January 2018.

In that role, he was responsible for, among other things, communicating information and instructions from BitConnect to its regional promoters in the United States, including Defendants Brown, Grant, Maasen, and Noble.

Arcaro fled the US in January 2018, a week before BitConnect collapsed.

Arcaro fled the US in January 2018, a week before BitConnect collapsed.

I’m assuming there will be a separate SEC lawsuit pertaining to Arcaro filed at some point.

I’d also be very surprised if parallel criminal proceedings haven’t been prepared by the DOJ.

Nicholas Trovato (aka “Crypto Nick”) I believe was a minor during BitConnect’s run.

I’m not sure if that had any bearing on the SEC’s decision not to include him as a defendant.

Trovato hasn’t been seen or heard from since BitConnect collapsed.

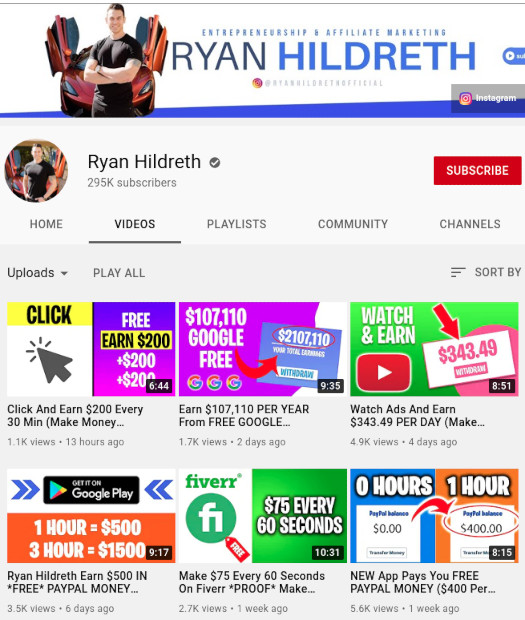

Ryan Hildreth doesn’t appear to have made enough to qualify as a top US BitConnect promoter.

He’s still on YouTube representing himself as an “entrepreneur” and shilling various income opportunities.

In case anyone’s wondering where Carlos Mattos is, while he undoubtedly became the face of BitConnect post collapse through memes (see below), I don’t believe he was an actual net-winner.

BehindMLM first learned of the SEC’s investigation into BitConnect back in July 2018. We’ve been doing our best to keep you updated since.

Confirmation by the SEC that BitConnect was a Ponzi scheme is welcome. In 2018 Glenn Arcaro equated BitConnect to gambling, arguing it wasn’t a securities offering.

BehindMLM maintains any MLM passive investment cryptocurrency opportunity is a securities offering.

Stay tuned for updates as we continue to monitor the US BitConnect promoter case docket.

Update 9th July 2021 – Joshua Jeppesen, Ryan Maasen, Michael Noble and Laura Mascola have reached settlements with the SEC.

BUH MUH BLOCKCHAIN!

Some popcorn seasoning:

Apparently Trevon also tweeted out a video response, in which he played the race card.

Was quickly deleted.

Trevon was on Coffeezilla a while ago:

youtube.com/watch?v=uIcE5cfFA_4

If you had any sympathy for him ever, you’d be over it after watching this, the level of denial could power the planet for centuries.

James has been hilariously naive regarding securities since he got involved in BitConnect.

I don’t know how much of it is an act but watching him get steamrolled in court will be amusing.

What’ll be particularly interesting to see is whether he attempts to lie about his current financial status, and how much the SEC has on his financials.

James strikes me as the kind of guy to transfer crypto onto a wallet, bury it in his backyard and then try the ol’ ‘I got hacked lulz’ routine (again).

Given the length of time the SEC has taken to file this case, hopefully they’ve done their homework and have been monitoring everything.

I do feel sorry for James’ kid. He hasn’t got a hope in hell with James in his life.