USI-Tech’s Horst Jicha on the run, now a fugitive

USI-Tech co-founder Horst Jicha has violated the terms of his release and gone on the run. [Continue reading…]

USI-Tech co-founder Horst Jicha has violated the terms of his release and gone on the run. [Continue reading…]

Mind Capital’s David Kagel sentenced to 5 yrs probation

Mind Capital’s David Lee Kagel has been sentenced to five years probation.

Mind Capital’s David Lee Kagel has been sentenced to five years probation.

The former securities law attorney will also have to pay back $13.9 million in restitution. [Continue reading…]

The GSB securities fraud cease and desist

Back in mid September BehindMLM received a cease and desist from Avi Perry, an attorney at Quinn Emanuel Urquhart & Sullivan (Quinn Emanuel), acting on behalf of GSB Gold Standard Corporation and owner Josip Heit.

Back in mid September BehindMLM received a cease and desist from Avi Perry, an attorney at Quinn Emanuel Urquhart & Sullivan (Quinn Emanuel), acting on behalf of GSB Gold Standard Corporation and owner Josip Heit.

In a nutshell, Perry objected to BehindMLM’s ongoing reporting on GSB’s and Heit’s alleged securities fraud.

While I did respond to the cease and desist I didn’t publicly report about it at the time. The notion that Heit’s attorneys would stand before a Judge and argue GSB and Heit hadn’t committed securities fraud, in light of receiving over a dozen regulatory fraud warnings and enforcement actions pertaining to securities fraud, was ridiculous.

On October 10th Quinn Emanuel published a press-release titled “Multiple U.S. and Canadian regulators agree to drop fraud charges against Josip Heit and GSB Germany as part of expanded settlement“.

Cited as a “related matter”, Quinn Emanuel stated;

In a related matter, Mr. Heit and GSB Germany also served a cease-and-desist notice on BehindMLM.com, a website that has published false and defamatory statements about Mr. Heit and his companies.

Many of BehindMLM’s posts about GSB Germany and Mr. Heit have been subject to injunctions and take-down orders in courts throughout the world.

First on a matter of principle, BehindMLM is certainly not a “related matter” within the context of GSB’s and Heit’s fraud charges. Dropped or no, GSB’s and Heit’s fraud charges are theirs alone.

Evidently what I thought was too silly to make public last month, is now a marketing point to deflect from GSB’s and Heit’s pending fraud charges settlement with North American regulators.

In the interests of transparency and allowing consumers to make up their own minds, today BehindMLM will be publishing Quinn Emanuel’s cease and desist. This includes subsequent email communication between myself and Avi Perry. [Continue reading…]

TrageTech securities fraud warning from Texas (+GSPartners)

TrageTech has received a securities fraud warning from the Texas State Securities Board (TSSB).

TrageTech has received a securities fraud warning from the Texas State Securities Board (TSSB).

TSSB’s October 10th enforcement order also cites promoter Eric Ture Muhammad, cited as a GSPartners and Billionico promoter. [Continue reading…]

Allianz settles with Profit Connect Receiver

Allianz Life Insurance has entered into a settlement with the Profit Connect Receiver.

Allianz Life Insurance has entered into a settlement with the Profit Connect Receiver.

As per the terms of the settlement, Allianz will pay $125,250 to the Receivership, from which $2500 to four Profit Connect investors. [Continue reading…]

SDT Quant Review: Quantitative trading “click a button” Ponzi

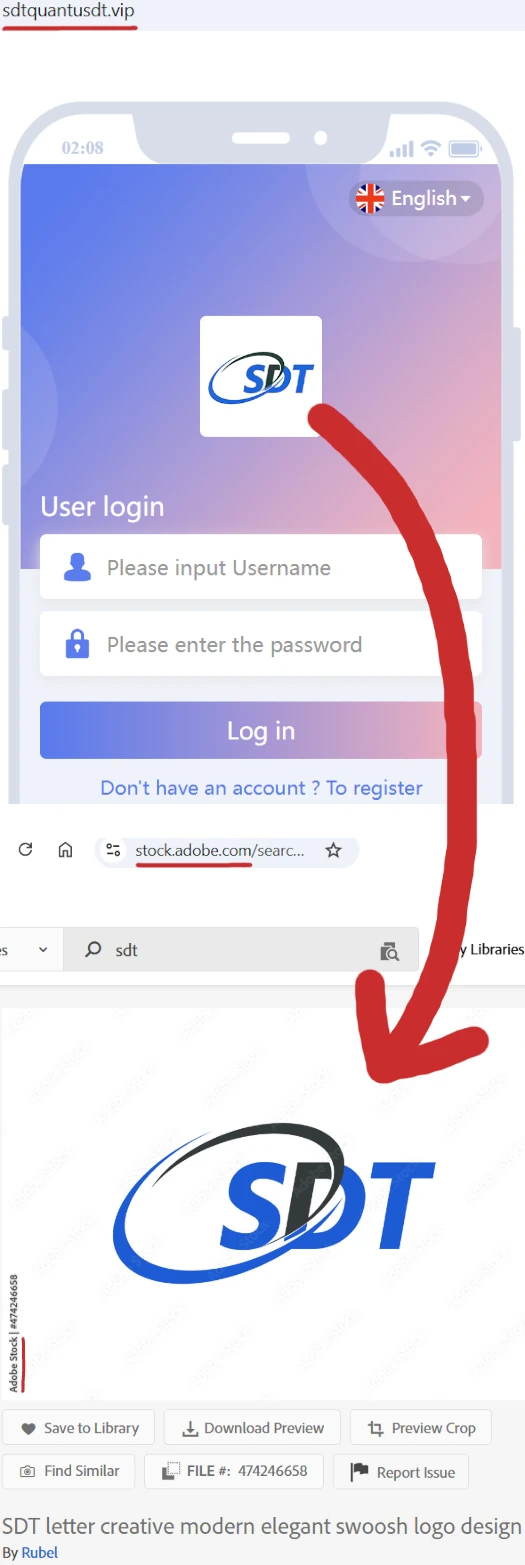

SDT Quant fails to provide ownership or executive information on its website.

SDT Quant’s website domain (“sdtquantusdt.vip”), was registered with bogus details on September 19th, 2024.

Of note is SDT Quant’s logo being an Adobe stock image:

SDT Quant has already attracted the attention of financial regulators. The Central Bank of Russia issued a SDT Quant pyramid fraud warning on October 3rd, 2024.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Dan Putnam continues securities fraud with Avasar

As part of what appears to be ongoing efforts to defraud consumers through securities fraud, Dan Putnam has launched Avasar.

As part of what appears to be ongoing efforts to defraud consumers through securities fraud, Dan Putnam has launched Avasar.

Through Avasar, Putnam is pitching consumers on passive monthly returns – purportedly paid from the profits of Amazon storefronts. [Continue reading…]

Robin Enos settles Krstic Ponzi empire charges with SEC

![]() Robin Enos has settled Krstic Ponzi empire fraud charges with the SEC.

Robin Enos has settled Krstic Ponzi empire fraud charges with the SEC.

Enos’ SEC settlement was filed as a pending consent judgment on September 30th. The court approved the consent judgment later the same day. [Continue reading…]

Federation Network Ponzi collapses for third time

Federation Network has collapsed for a third time.

Federation Network has collapsed for a third time.

On October 9th the Ponzi scheme advised investors it was disabling withdrawals. [Continue reading…]

A8 Quantization Review: Quantitative trading “click a button” Ponzi

A8 Quantization (aka A8 QuantSystem) fails to provide ownership or executive information on its website.

A8 Quantization (aka A8 QuantSystem) fails to provide ownership or executive information on its website.

A8 Quantization’s website domain (“a8quantsystem.vip”), was registered with bogus details on September 23rd, 2024.

A8 Quantization has already attracted the attention of financial regulators. The Central Bank of Russia issued a A8 Quantization pyramid fraud warning on October 2nd, 2024.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]