Andre & Monique Vaughn ordered to pay $1.7M in taxes

![]() Andre and Monique Vaughn have been ordered to pay $1,776,626 in taxes. [Continue reading…]

Andre and Monique Vaughn have been ordered to pay $1,776,626 in taxes. [Continue reading…]

PoolPay$ Review: Gaming ruse MLM crypto Ponzi

![]() PoolPay$ fails to provide ownership or executive information on its websites.

PoolPay$ fails to provide ownership or executive information on its websites.

PoolPay$ operates from two website domains:

- poolpays.com – privately registered on September 9th, 2025

- poolpays.app – privately registered on an unknown date

Despite only existing for a few months, on its website PoolPay$ falsely claims it

has already moved over $80 million during its pre-launch from 2023 to July 2025.

Of note is PoolPay$’s website defaulting to Portuguese. This suggests whoever is running PoolPay$ is probably fluent in Portuguese.

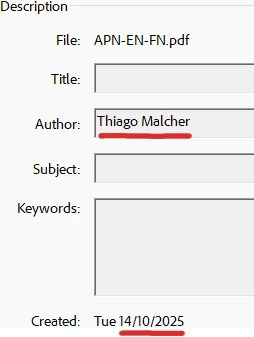

One name we can tie to PoolPay$ is Thiago Malcher, author of PoolPay$’s official marketing presentation:

I wasn’t able to find anything further on Malcher with respect to PoolPay$. Thiago however is a common Portuguese name.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

iBuumerang sold off to Dubai-based Risen Live

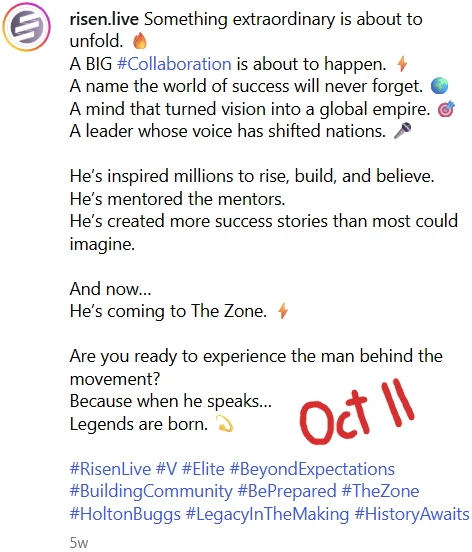

Holton Buggs appears to have sold what’s left of iBuumerang to Risen Live.

Holton Buggs appears to have sold what’s left of iBuumerang to Risen Live.

While Buggs began appearing in Risen Live marketing material in early October…

…Buggs waited till October 20th to break the news on an iBuumerang marketing webinar. [Continue reading…]

BitHarvest collapses, Dubai FTT token exit-scam

![]() The Bitharvest Ponzi scheme has collapsed.

The Bitharvest Ponzi scheme has collapsed.

Withdrawals have been disabled, plans to flee to Dubai have been revealed and there’s talk of an FTT token exit-scam. [Continue reading…]

Trey Knight sentenced to prison for bankruptcy fraud

![]() Trey Knight, aka Haskell Knight, has been sentenced to prison.

Trey Knight, aka Haskell Knight, has been sentenced to prison.

Following a guilty plea on a bankruptcy fraud charge back in January, Knight was sentenced on November 20th. [Continue reading…]

SaxAI Review: Crypto mining “click a button” Ponzi

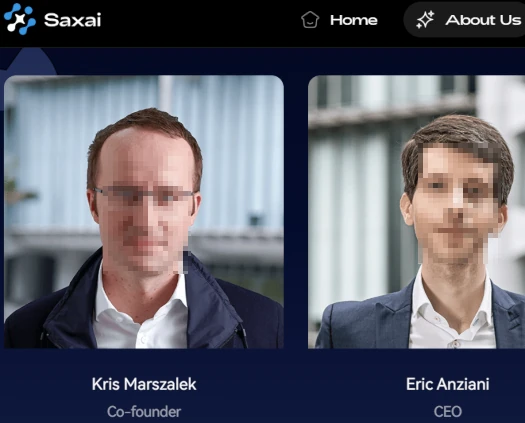

SaxAI provides bogus ownership and executive information on its website.

SaxAI provides bogus ownership and executive information on its website.

SaxAI operates from three known website domains:

- saxai.cloud (marketing) – privately registered on April 21st, 2025

- saxai.io (already abandoned) – privately registered on April 21st, 2025

- saxai.ai (app) – registered with bogus details on April 21st, 2025

On its marketing website, SaxAI cites Kris Marszalek as a co-founder:

Marszalek is CEO of Crypto.com and has nothing to do with SaxAI. The rest of SaxAI’s fake executives are also Crypto.com executives, complete with stolen profile photos.

This is in line with everything on SaxAI’s marketing website being straight baloney.

In an attempt to appear legitimate, SaxAI provides company registration details for SaxAI Financial Technology LLC. A FinCEN certificate is also provided.

Due to the ease with which scammers are able to incorporate shell companies with bogus details, for the purpose of MLM due-diligence these certificates are meaningless.

Within the context of MLM due-diligence, a FinCEN certificate is also meaningless. Anyone can register a shell company with bogus details and then register that shell company with FinCEN. FinCEN is not a financial regulator.

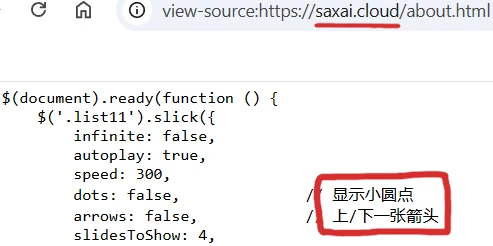

If we look at the source-code of SaxAI’s marketing website we find Chinese:

This suggests whoever is actually running SaxAI has ties to China.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money. [Continue reading…]

Vantage Payments prevails against TelexFree CA Plaintiff

![]() Vantage Payments and owner Dustin Sparman have prevailed against a former TelexFree class-action Plaintiff.

Vantage Payments and owner Dustin Sparman have prevailed against a former TelexFree class-action Plaintiff.

Furthermore, the court’s October 30th dismissal order raises questions about the validity of prior judgments. [Continue reading…]

25 suspects in Italian Ushare Ponzi investigation

![]() Italian authorities have concluded an investigation into Daniele Marinelli’s Ushare Ponzi scheme.

Italian authorities have concluded an investigation into Daniele Marinelli’s Ushare Ponzi scheme.

Including Marinelli, twenty-five suspects have accused of fraud, financial misconduct, money laundering and embezzlement. [Continue reading…]

Josh Zwagil signs up My Daily Choice under Immunotec

I’m prefacing this article by by stating both Immunotec and My Daily Choice are obfuscating the nature of their recent business arrangement. As such there’s a bit of guess work on my part, but I’m pretty sure I’ve nailed what’s going on.

I’m prefacing this article by by stating both Immunotec and My Daily Choice are obfuscating the nature of their recent business arrangement. As such there’s a bit of guess work on my part, but I’m pretty sure I’ve nailed what’s going on.

On November 17th Immunotec “welcomed” My Daily Choice owner Josh Zwagil to the company: [Continue reading…]

Lado Okhotnikov sentenced to 10 years prison in Georgia

Serial Ponzi scammer Vladimir “Lado” Okhotnikov has been convicted of fraud in Georgia.

Serial Ponzi scammer Vladimir “Lado” Okhotnikov has been convicted of fraud in Georgia.

The conviction has seen Okhotnikov, a Russian national, permanently flee to Dubai. [Continue reading…]