As requested by SEC, iX Global fraud case dismissed

Following a motion from the SEC, its $49 million securities fraud case against iX Global and Debt Box has been voluntarily dismissed.

Following a motion from the SEC, its $49 million securities fraud case against iX Global and Debt Box has been voluntarily dismissed.

The court ordered the dismissal on May 28th, also ordering the SEC to pay costs.

The SEC’s bungling of the iX Global case is rooted in attorneys handling the case getting cited dates wrong, and then failing to rectify the error with the court.

Involved attorneys have since resigned from the agency.

In a bid to get away with an alleged $49 million in securities fraud, Debt Box and iX Global argued the SEC’s case should be dismissed “with prejudice”. This would leave the SEC unable to refile a new case.

Reasoning that the underlying alleged securities fraud was sanctionable, the court sided with the SEC and dismissed the case without prejudice.

Defendants effectively urge the court, based on conduct already addressed, to further sanction the Commission by dismissing with prejudice. The court declines the invitation.

Owing to the SEC bungling the case, the court ruled the regulator foot the bill for associated legal costs. This amounts to:

- $8239 to relief defendants Calmes & Co In.c and Calmfritz Holdings LLC

- $19,015 to defendant Matthew D. Fritzsche

- $252,315 to iX Global

- $153,365 to FAIR Project

- $34,259 to Debt Box’s local attorneys

- $565,259 to Debt Box’s lead attorney

- $42,190 to defendant Brendan Stangis and

- $746,941 to the Debt Box Receiver

Noting that the SEC “will likely be able to repurpose the research, discovery, and legal arguments prepared in the initial stages of this

litigation for use in a subsequent case”, the court further advised;

The Commission argues dismissal without prejudice is appropriate because it will protect investors and the public interest, and will not cause Defendants legal prejudice.

The Commission seeks to dismiss this case to allow a new team of attorneys to “analyze and assess the existing record, take additional investigative steps as appropriate to ensure the record is accurate and complete, engage with Defendants and Relief Defendants, and determine whether it is appropriate to recommend the Commission proceed with a new complaint, and, if so, the scope of any new complaint.”

In summary, the SEC’s case against Debt Box and iX Global has effectively been reset. The underlying $49 million in alleged securities fraud, which is the basis of the SEC’s case, remains intact.

We don’t have a timeline but, pending an internal review of the case, it’s expected the SEC will refile. The court has ordered any refiling of the SEC’s case take place in Utah.

As for Debt Box and iX Global, the scheme attached to the alleged underlying securities fraud has collapsed.

The money laundering side of the business was dismantled by Indian authorities. The Indian criminal investigation into iX Global resulted in an outstanding warrant against iX Global CEO Joseph Martinez (right).

The money laundering side of the business was dismantled by Indian authorities. The Indian criminal investigation into iX Global resulted in an outstanding warrant against iX Global CEO Joseph Martinez (right).

Accomplice Viraj Patil, an Indian national who relocated to Dubai but still visited India, was arrested by Indian authorities in December 2023.

Patil remains in custody and is believed to be assisting Indian authorities.

In the wake of the SEC’s lawsuit, Debt Box and iX Global attempted to double down on securities fraud with IN8 NFTs.

IN8 NFTs launched in January 2024 and collapsed in March.

Today iX Global markets itself as a “self betterment platform”.

As of April 2024, SimilarWeb tracked monthly visits to iX Global’s website at less than 8000.

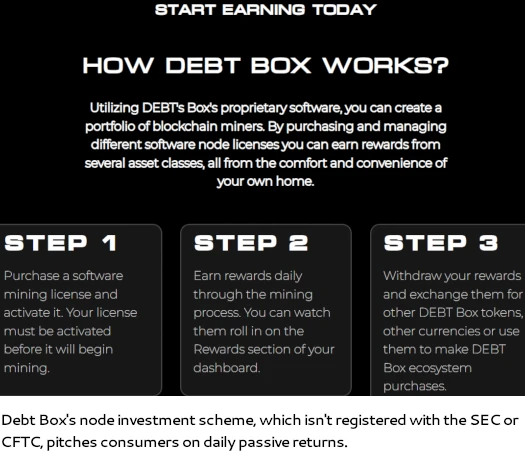

Debt Box is pitching a “crypto meets commodities” investment scheme on on its website.

The scheme, which is not registered with the SEC or CFTC, is built around “node” investment positions.

Utilizing DEBT’s Box’s proprietary software, you can create a portfolio of blockchain miners.

By purchasing and managing different software node licenses you can earn rewards from several asset classes.

Earn rewards daily through the mining process. You can watch them roll in on the Rewards section of your dashboard.

Debt Box monthly website visits, again tracked by SimilarWeb for April 2024, sits at ~39,200 visits.

The majority of traffic to Debt Box’s website originates from Peru (20%), the US (14%, down 71% month on month) and India (10%).

As noted in SEC filings, Debt Box’s US founders have fled to Dubai. Their current status is unknown.

@OZ – you should have someplace to upload pics and videos regarding the frauds.

the video which I had pointed to in case of crypto land has been deleted from you tube where Joseph was pointing out a generation of USD $ 20-50 per day.

Viraj Patil though a snitch is still locked up and has more charges on him than earlier along with Joseph.

ix global showing this as victory over sec to collect more money in pockets of india. they are now calling it oneX.

There’s already plenty of places you can upload pics and videos to on the internet.

I document screenshots when required but I don’t think at this point anyone is disputing iX Global’s securities fraud.

Isn’t “banning of unregulated deposit schemes act” evoked in case of unregistered securities in india ?

x.com/Tapan_tehlan/status/1795715802353877047

looks like ix global had it coming from much before us sec.

what happened about India relief fund which declared by ix global few months back .. nobody received mail or refund uptil now…. is there any update?

India relief fund? You invested into a Ponzi scheme and your money is gone.

Social media suggests Joe Martinez is using your money to fly between the US and UAE for… reasons.