Turbo Review: Forex trading bot securities fraud

Turbo, also marketed as “We Are Turbo”, fails to provide company ownership information on its website.

Turbo, also marketed as “We Are Turbo”, fails to provide company ownership information on its website.

Turbo’s website domain (“weareturbo.io”), was first registered in 2020. The private registration was last updated on December 8th, 2021.

Turbo’s website defaults to Spanish. The company’s marketing material is also all in Spanish.

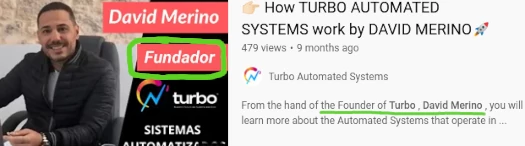

Further research reveals Turbo marketing material citing David Merino as founder and CEO of the company.

Why this information isn’t provided on Turbo’s website is unclear.

Prior to Turbo David Merino headed up Frequency as CEO:

Frequency was a trading bot MLM scheme. It appears to have collapsed on or around January 2021. This coincides with Turbo’s initial domain registration on December 8th, 2020.

Read on for a full review of Turbo’s MLM opportunity.

Turbo’s Products

Turbo has no retailable products or services.

Affiliates are only able to market Turbo affiliate membership itself.

Turbo’s Compensation Plan

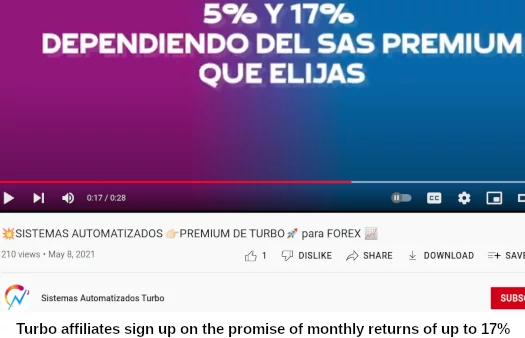

Turbo affiliates invest on the promise of a 5% to 17% monthly return.

Turbo claims to generate returns through trading bots, which it sells subscriptions to:

- SA1 – 5% to 7% monthly ROI, costs $119 and then $99 a month

- SA2 – 7% to 10% monthly ROI, costs $399 and then $149 a month

- SA3 – 10% to 17% monthly ROI, costs $999 and then $199 a month

- Premium SA1 – 5% to 7% monthly ROI, costs $1000 every 6 months

- Premium SA2 – 7% to 10% monthly ROI, costs $2500 every 6 months

- Premium SA3 – 10% to 17% monthly ROI, costs $3500 every 6 months

The non-Premium plans are significantly cheaper. The advertised returns are the same so I’m not sure what the difference between the two types of subscriptions is.

Note that regardless of which subscription is chosen, Turbo charges a 15% fee on generated returns.

The MLM side of Turbo pays on subscription fees paid by recruited affiliates.

Referral Commissions

Turbo pays a 20% commission on subscription fees paid by personally recruited affiliates.

- earn $150 on the sale of a Premium SA1 subscription

- earn $375 on the sale of a Premium SA2 subscription

- earn $525 on the sale of a Premium SA3 subscription

Residual Commissions

Turbo pays residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Turbo pays a 5% residual commission on returns paid across ten unilevel team levels.

Note that recruitment is required to qualify for residual commissions:

- recruit 1 affiliate and earn residual commissions on two unilevel team levels

- recruit 2 affiliates and earn residual commissions on four unilevel team levels

- recruit 3 affiliates and earn residual commission on six unilevel team levels

- recruit four affiliates and earn residual commissions on eight unilevel team levels

- recruit five affiliates and earn residual commissions on ten unilevel team levels

Recruited affiliates must have an active subscription to count towards residual commission qualification criteria.

HolderX Commissions

HolderX commissions appear to be a bonus paid on

the operations of the subscribers of your organization up to the 3rd level!

What this means is unclear. It sounds like it’s a straight up addition to residual commissions, but without the recruitment requirements.

In any event, commissions paid out on up to three unilevel team levels via HolderX are as follows:

- level 1 – 5%

- level 2 – 3%

- level 3 – 2%

ShareX Bonus Pools

Turbo takes 15% of monthly subscription fee revenue and places it into two rank-based bonus pools.

- 25K Entrepreneurs who have recruited one affiliate that month receive a share in a 5% ShareX bonus pool

- 50K Entrepreneurs who have recruited two affiliates that month receive a share in a 10% ShareX bonus pool

Note that Turbo do not provide rank qualification criteria.

Joining Turbo

Joining Turbo requires payment of either monthly or bi-annual subscription fees.

- SA1 – $119 and then $99 a month

- SA2 – $399 and then $149 a month

- SA3 – $999 and then $199 a month

- Premium SA1 – $1000 every 6 months

- Premium SA2 – $2500 every 6 months

- Premium SA3 – $3500 every 6 months

Note all payments within Turbo are made in bitcoin.

Turbo Conclusion

Turbo’s MLM opportunity presents a few immediate red flags.

The first is no information about the company’s trading bots is disclosed.

Turbo is essentially a continuation of Frequency under a different name. Same people are running the show and it’s the same trading bot opportunity.

This begs the question why did Frequency collapse?

Also having operated for a few years under two company names, where are the audited trading results?

I suspect Frequency was abandoned after recruitment collapsed.

This would suggest Turbo’s trading bot is secondary to recruiting and earning off subscription fees. This would functionally make Turbo a pyramid scheme.

The second immediate concern is Turbo clearly offering a passive investment opportunity.

It appears to be the “lulz can’t touch our money!” model. That is affiliates pay for access to a bot, which is then connected to their trading account.

MLM companies offering passive returns need to register with financial regulators. Turbo provides no evidence it has registered with financial regulators.

David Merino appears to be based out of Spain. Securities in Spain are regulated by the Comisión Nacional del Mercado de Valores (CNMV).

Not registering with the CNMV or any other financial regulator means that, at a minimum, Turbo is committing securities fraud and operating illegally.

The third red flag is Turbo only accepting subscription fees in bitcoin.

Turbo represents its bots engage in forex trading:

Bitcoin being the only payment option comes off as an attempt to dodge regulation. When Turbo collapses like Frequency, it will also make it close to impossible for victim recovery.

The fourth red flag is Turbo touting a 10% to 17% monthly ROI. If that was consistently possible, David Merino would have been running these bots since Frequency.

The fourth red flag is Turbo touting a 10% to 17% monthly ROI. If that was consistently possible, David Merino would have been running these bots since Frequency.

With even a minimum capital amount, surely after 2+ years compounding monthly he’d be set?

“Lulz can’t touch our money” scams typically collapse when the admin(s) rig trades in their favor. This results in affiliates waking up one day to drained accounts.

“Our bot malfunctioned!” or “we got hacked!” are common cover excuses.

Either way the end result is the same: the majority of participants in trading schemes like Turbo lose money.

Update 13th June 2023 – Turbo has collapsed.

I have a hunch the difference between the Premium and non-Premium subscriptions is the non-Premiums are retail. I.e. if you don’t buy a Premium subscription, you don’t earn commissions.

Anyone in Turbo or who speaks Spanish able to confirm?

Their “audited trades” are false. They do trap by modifying the mt4 register with an app that is called “cheat engine” which is a very known software used to do this.

And then, all this modified trades are printed at MyFxbook or any site like that.

There is no high frequency trading, there is no bot trading. All of them are creating a piramid scheme, without knowing that those products doesn’t exists.

If so, they have would collapse forex markets with something like that.

Proof for us, instal the software and use on the mt4 or mt5 make a video, post at the YouTube showing the manipulation….

I’m sure you can look up MT fraud yourself.

Way to gloss over securities fraud though.

I have analysed the high frequency trades done by Turbo in MT5 with different brokers and they are all 1005 corrrect. there is no manipulation or fake trades.

Cool story bro.

Audited financial reports filed with regulators or GTFO.

I do confirm. Actually, Turbo works and the transactions done are actual and accurate.

Withdrawals from the broker (FxWinning) are fast and without a problem.

Don’t know anything regarding Frequency, maybe it was something different, I don’t know.

Yeah, securities fraud trading schemes work – until they don’t.

Anyone with a bot legitimately generating 17% a month isn’t selling you access. They’re running the bot themselves.

The MyFxBook, are totally, fake with most data unlock, you can see some few operations with 0s and +30 pips…. the equity graph also its totally linked to balance…. some days graph some -6k pips and the graph reamin in profit….

its totally modified with “MT4 Manager” and they use cheat engine.

FYI since December 2022, they are having problems with the withdrawals. They say

– in December, too many withdrawals, not enough employees in FXWINNING to process them. By next month we should be fine

– in January. Expect the withdrawals to take up to 10 business days

– in February, we will limit the number of withdrawals you can make per month, with a minimum amount of $500. Expect the withdrawals to take 10-15 business days

Thanks for the update. Sounds like Turbo collapsed in December 2022.

Adding more information from Turbo. This was sent on the 9 March. Keep in mind that the community is still waiting for withdrawals from Feb 2023

I wonder how many other MLM have used the same excuses.

Classic KYC exit-scam.

@Oz what can be done about this scam?

Your best bet is reporting to your local financial regulators. More reports, more chance of something happening.

@Oz

I’m from Florida but I have no idea who to report it to or how our financial regulators are.

SEC (federal): sec.gov/tcr

Office of Financial Regulation (state): flofr.gov/sitePages/fileacomplaint.htm

In March 2023, the broker FXWinning was going through an audit.

And then they said that all the clients of FxWinning have to go through the KYC and AML process.

FXWINNING is the broker of other similar programs like Turbo: CFT from Brazil, TWT from Mexico, Zeta group from Mexico.

During the time that the KYC are being submitted, Turbo suggested that we all should cancel our withdrawal requests so the capital can still work.

Now they made the promise that in June 7, all the investors will receive an email indicating if their KYC has been approved or not

… the lies will continue

Sounds like a classic KYC exit-scam.

Nobody got audited. The money is gone.

LoL .

After 6 months without paying anyone , “We are Turbo” become a “private club”. minimum investment 10k$ hahahahah.

Classic KYC exit-scam, that’s a wrap. Thanks for the update.

I told you 1 year ago. You were scammed again!