Trusted Smart Chain Review: TSC token securities fraud

![]() Trusted Smart Chain fails to provide ownership or executive information on its website.

Trusted Smart Chain fails to provide ownership or executive information on its website.

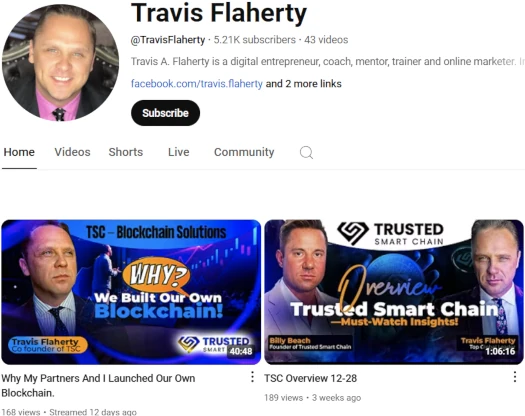

I came across Trusted Smart Chain when an IN8 marketing video linked to in one of BehindMLM’s articles was flagged as deleted.

The video was uploaded by Travis Flaherty. To confirm I visited Flaherty’s YouTube channel and found the videos had been deleted.

IN8 started off as an NFT grift spinoff of iX Global, an unregistered investment scheme sued by the SEC and subject of two criminal investigations by Indian authorities.

Flaherty was a named defendant in the SEC’s $110 million iX Global fraud lawsuit;

Flaherty is an iX Global “Brand Ambassador” and, as such, has solicited investors to purchase DEBT Box crypto asset securities.

Flaherty is also the Registered Agent for Relief Defendant Flaherty Enterprises, LLC.

After IN8 collapsed a few months after launch, owner and wanted fugitive Joe Martinez rebooted it as a failed DAO project.

Getting back to Flaherty’s YouTube channel, after IN8 Flaherty uploaded marketing promo videos for Shoply and Nuway Healthcare.

Neither of those seem to have panned out, with Flaherty uploading videos on “TSC” from late 2024.

“TSC” stands for Trusted Smart Chain. In the video description of “TSC Overview 12-28”, uploaded on December 29th, 2024, Flaherty confirms he is a Trusted Smart Chain co-founder.

I am thrilled to officially announce my acceptance as Co-Founder and Chief Marketing Officer of Trusted Smart Chain (TSC).

The thumbnail of Flaherty’s video cites Billy Beach as Trusted Smart Chain’s other co-founder:

Billy Beach, aka Mark Williams Schuler, was also a named defendant in the SEC’s iX Global fraud lawsuit.

Schuler is an iX Global “Brand Ambassador” and, as such, has solicited investors to purchase DEBT Box crypto asset securities.

Along with Defendant Benjamin Daniels, Schuler is the co-founder and a member of Defendant Core 1 Crypto, an entity that partnered with DEBT Box to solicit DEBT Box investors.

In addition, along with Defendants Alton Parker and Benjamin Daniels, Schuler is a co-founder of the FAIR Project, and has solicited investors to purchase crypto assets offered by the FAIR Project.

Whether there are other Trusted Smart Chain co-founders is unclear. Given both Flaherty and Schuler were recently named defendants in a US regulatory fraud lawsuit, this non-disclosure is a significant red flag.

Trusted Smart Chain’s website domain (“trustedsmartchain.com”), was privately registered on October 2nd, 2024. Trusted Smart Chain’s website was put together in November 2024.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Trusted Smart Chain’s Products

Trusted Smart Chain has no retailable products or services.

Affiliates are only able to market Trusted Smart Chain affiliate membership itself.

Trusted Smart Chain’s Compensation Plan

Trusted Smart Chain affiliates invest $1500 to $125,000 in TSC tokens.

- Founding Member positions are $1500 for “friends and family” and $2500 for everyone else

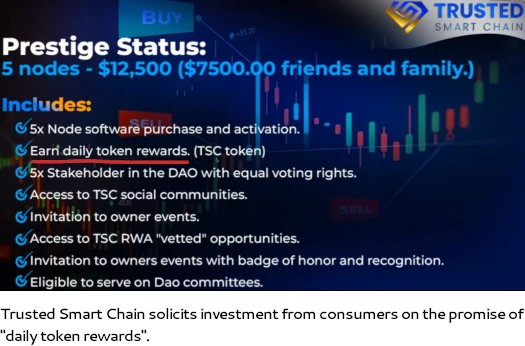

- Prestige Status positions are $7500 for “friends and family” and $12,500 for everyone else

- Luminary Status positions are $30,000 for “friends and family” and $50,000 for everyone else

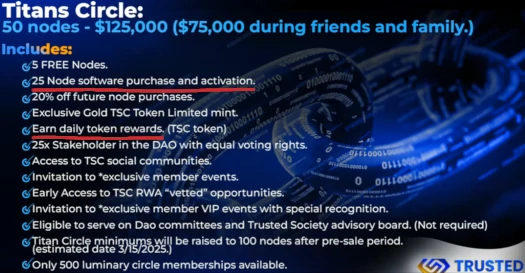

- Titans Circle positions are $75,000 for “friends and family” and $125,000 for everyone else

Investment in TSC tokens is done on the promise of “daily token rewards”. Note that specific TSC token amounts per investment made are not disclosed.

That said:

- Prestige Status returns are represented to be five times that of Founding Member investment positions

- Luminary Circle returns are represented to be a twenty-two times multiplier

- Titans Circle returns are represented to be a twenty-five times multiplier

Trusted Smart Chain affiliates are able to participate in a “staking” investment scheme, purportedly funded by 20% of daily returns paid out to affiliate investors.

Trusted Smart Chain offers additional passive returns through “vetted opportunities” (specific details are not disclosed).

The MLM side of Trusted Smart Chain sees it pay referral commissions on invested funds down two levels of recruitment (unilevel):

- level 1 (personally recruited affiliates) – 10%

- level 2 – 5%

Joining Trusted Smart Chain

Trusted Smart Chain affiliate membership is tied to a $1500 to $125,000 investment.

The more a Trusted Smart Chain affiliate invests the higher their income potential.

Trusted Smart Chain Conclusion

Trusted Smart Chain is a continuation of the fraudulent investment scheme Travis Flaherty and Billy Beach promoted through iX Global.

It’s the same node investment position setup with a different name (in iX Global the positions were “x-nodes”).

It should be noted that what made the iX Global and Debt Box node investment scheme illegal was securities fraud. Namely the scheme not being registered with the SEC and claims about external revenue generation to fund withdrawals being bogus.

It’s worth noting that in order to justify said fraud, Flaherty mischaracterizes the outcome of the SEC’s iX Global lawsuit.

[14:56] So we fought this battle with the SEC and we won. We actually won our case, the case was dismissed.

Not only was the case dismissed but the attorneys, the SEC was fined millions of dollars by the Judge, and the attorneys that brought the case forward against us, the actual attorneys were fired and they closed the Salt Lake City Office that brought the case against us.

More importantly, this was very public and there was vindication in the public’s eye because people saw that this was a witch hunt.

The SEC’s lawsuit against iX Global and Flaherty was voluntarily dismissed and the SEC attorneys involved resigned. But this wasn’t because iX Global and Flaherty won the case.

The SEC attorneys involved got some dates wrong and then failed to adequately remedy the error. This was picked up on by the defense’s legal team who presented it before the Judge.

That led to the case being voluntarily dismissed by the SEC on procedural grounds. It had nothing to do with the merits of the SEC’s allegations.

In fact when iX Global owner Joe Martinez learned the SEC intended to refile the case, he shut down iX Global.

Why?

Because regulation of securities fraud in the US is and has been materially the same since 1933. It’s a well-established area of financial law with a specific path anyone can follow to confirm fraud.

As with iX Global, in order to operate its node position investment scheme legally Trusted Smart Chain needs to be registered with the SEC.

Along with registration, Trusted Smart Chain needs to be filing periodic audited financial reports. This is crucial as it is the only way to verify any external revenue generation claims Trusted Smart Chain makes.

A search of the SEC’s public EDGAR database reveals that, as at time of publication, neither Trusted Smart Chain, Travis Flaherty, Mark Williams Schuler or his alias Billy Beach are registered with the SEC.

This is verifiable securities fraud and a repeat of iX Global.

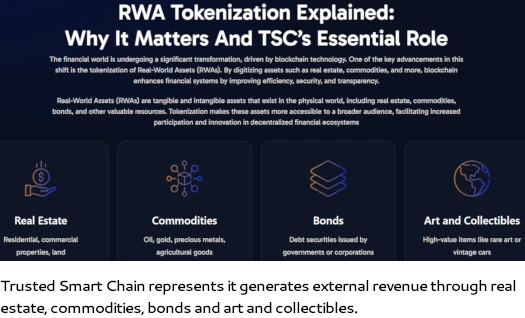

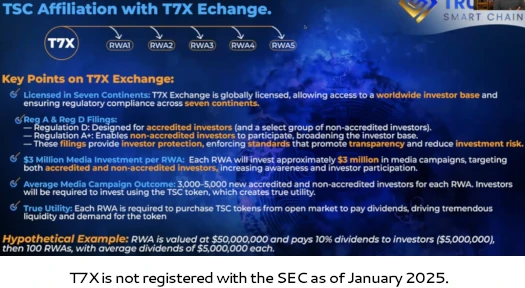

It is noted that Trusted Smart Chain appears to try and palm of regulatory compliance onto T7X. As per the FAQ section on Trusted Smart Chain’s website;

Will TSC Be Listed on Exchanges?

As a community-driven blockchain, decisions about the listing of TSC tokens on exchanges are determined by the TSC community.

While there is no guarantee that TSC will be listed on any specific exchange, it is worth noting that the founders that launched the TSC Blockchain also founded T7X.io, an exchange specializing in Real-World Assets (RWAs).

The TSC community will play a key role in shaping the future of the TSC blockchain, including potential exchange listings.

What Is the Relationship Between T7X and TSC?

The founder of T7X also established and launched the Trusted Smart Chain (TSC) blockchain. TSC was developed to support regulatory compliance for Real-World Asset (RWA) trading across multiple platforms.

Putting aside failing to disclose who “the founder” is being a Securities and Exchange Act violation in and of itself, the presented ruse is “real world assets” are funding Trusted Smart Chain TSC ROI withdrawals.

I want to firstly note that T7X isn’t registered with the SEC either. And then even if it was, that doesn’t exempt Trusted Smart Chain from SEC registration requirements.

Taken at face value, Trusted Smart Chain is soliciting up to $125,000 from consumers on the promise of passive returns. This requires Trusted Smart Chain to register said investment scheme with the SEC (two investment schemes if you include the TSC “staking” scheme).

This hasn’t happened and one need only look at the underlying (and legally unresolved) allegations in the SEC’s iX Global lawsuit to confirm securities fraud.

To spell it out afresh though, under US financial law a securities offering is identified by confirming the existent of an investment contract.

This is done by applying the Howey Test, which states;

An investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

With respect to Trusted Smart Chain; consumers are investing up to $125,000 (an investment of money”) into Trusted Smart Chain (a common enterprise), with a reasonable expectation of profits (see passive returns marketing slides), derived from the efforts of others (purported “real-world assets”).

There is no exemption for cryptocurrency investment schemes in the Securities Exchange Act.

I want to stress there is no reason for Trusted Smart Chain to be committing securities fraud, unless they aren’t doing what they claim to be. That is, paying out TSC returns with external revenue.

The SEC warns consumers that securities fraud and Ponzi schemes go hand-in-hand.

Any investment in securities in the United states remains subject to the jurisdiction of the SEC.

We are concerned that the rising use of virtual currencies in the global marketplace may entice fraudsters to lure investors into Ponzi and other schemes.

Ponzi schemes typically involve investments that have not been registered with the SEC or with state securities regulators.

As it stands the only verifiable source of revenue entering Trusted Smart Chain is new investment.

Using new investment to pay TSC ROI withdrawals would make Trusted Smart Chain a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve Trusted Smart Chain of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

It should be noted that iX Global and Debt Box victim losses remain unaccounted for. Prior to dismissing their case, the SEC pegged said losses at $110 million.

Last we heard Debt Box’s owners, who are believed to have misappropriated the majority of invested funds, had, as the SEC predicted they would in legal filings, fled to Dubai.

Joe Martinez is still in the US but is wanted by Indian authorities in two separate iX Global criminal cases.

Bravo on the reporting. thank you oz!

Serial scammer Tim Darnell of Advantage Conferences fame who sued me and the Better Business Bureau and got laughed out of court and garnished is now pushing this crap.

5 conference schemes and numerous other MLM scams and the “Millionaire Mentor” can never just crawl back under his rock. Throw these clowns in jail already!

you re review is absolutely wrong about tsc. previous case was dismissed,as good as a win in a court of law, unless refiled of which it hasn’t been. secondly it is not an MLM.

get your facts correct and stop harming tsc an node holders in which i am one. Quite honestly a decease and desist order should be filed against you for defamation and slander.

cc Billy Beach

Travis Flaherty

Yeah so, tellingly, none of what you wrote addresses Trusted Smart Chain’s securities fraud.

Key here is the underlying securities fraud wasn’t prosecuted and remains unresolved. You might be willing to wave securities fraud for the chance at a quick buck but it’s a gigantic red flag honest consumers should factor into their decision to participate in Trusted Smart Chain’s securities fraud.

Debt Box and iX Global scamming consumers out of millions is absolutely part of any responsible due-diligence into Trusted Smart Chain.

MLM compensation plan = MLM company.

The fact is Trusted Smart Chain is committing securities fraud. Whether you personally lose money or not in an obvious fraudulent investment opportunity wasn’t and isn’t an editorial concern in publication of this review.

As an obvious TSC bagholder at this point, sorry for your loss.

Now that the TSC coin is in circulation and the blockchain’s Explorer reveals verification of transactions real time wouldn’t it be prudent that your year old report be updated and this blockchain be given fair re-evaluation? Just sayin…

Sure.

Fair reevaluation: Blockchain bullshit doesn’t address anything in the review, namely securities fraud. Nothing in the review needs to be updated.

Sorry for your loss.