The Advert Platform Review: My Advertising Pays’ third Ponzi reboot

My Advertising Pays was initially launched in 2013 by Mike Deese.

My Advertising Pays was initially launched in 2013 by Mike Deese.

The premise was simple enough, invest $50 and receive a $55 ROI. Wash, rinse and repeat.

Unfortunately the only verifiable source of revenue entering My Advertising Pays was affiliate investment, making it a Ponzi scheme.

My Advertising Pays first collapsed in mid 2015. In an effort to keep the scam going, US investor ROIs were cancelled and Deese (right) relaunched in Europe.

My Advertising Pays first collapsed in mid 2015. In an effort to keep the scam going, US investor ROIs were cancelled and Deese (right) relaunched in Europe.

That lasted about a year, with My Advertising Pays again collapsing in mid 2016.

Another reboot was announced last month, however that appears to have already been scrapped.

A consistent theme with My Advertising Pays’ relaunched is the fact that most affiliates aren’t paid. This doesn’t seem to affect the top investors, who regularly boast about luxury purchases on social media:

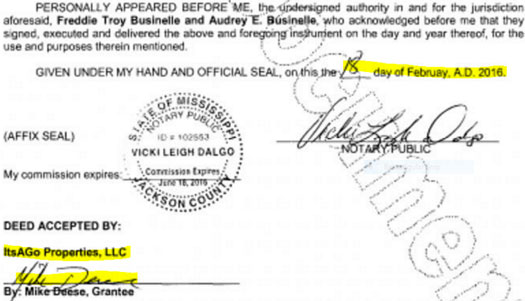

Mike Deese himself seems to be flush with cash, as evidenced by the purchase of a $600,000 home in Mississippi earlier this year:

Affiliates meanwhile are told My Advertising Pays can’t pay them because VX Gateway, their former payment processor, ran off with $60 million in invested funds.

A lawsuit has been filed to that effect and is still playing out in court.

Now under the name “The Advert Platform”, My Advertising Pays is gearing up to relaunch for a third time.

The Advert Platform Product Line

The Advert Platform has no retailable products or services, with affiliates only able to market The Advert Platform affiliate membership itself.

The Advert Platform Compensation Plan

The Advert Platform sees My Advertising Pays relaunch at half capacity.

Affiliates this time around are investing €25 EUR on the promise of a €27.50 EUR ROI.

In order to receive a daily ROI, The Advert Platform will be required to click on supplied ads and post spam social media.

A 10% referral commissions is also paid out on funds invested by personally recruited affiliates.

Joining The Advert Platform

The Advert Platform affiliate membership is free, however free affiliates can only earn referral commission.

Full participation in The Advert Platform opportunity requires a minimum €25 EUR investment.

Conclusion

After collapsing three times already, My Advertising Pays are basically launching the same Ponzi scheme halved. Well, almost.

Whereas the original Ponzi model paid a $60 ROI on $50 investments ($10), it’s now €2.50 EUR. The investment amount has been halved bu the ROI quartered.

The overall business model is the same though, with newly invested funds to used to pay off existing investors.

This means The Advert Platform will inevitably collapse, as has already happened three times.

The fact that early investors in the scheme appear to be the only ones who have profited is telling, and typical of the Ponzi business model.

These guys will have all positioned themselves at the top of The Advert Platform, so don’t delude yourself into thinking that by investing early this time around you’re actually getting in early.

The Advert Platform will play out much the same as My Advertising Pays:

Mike Deese, Simon Stepsys and friends will withdraw most of the money… everyone else gets screwed.

So when is SEC or UK police going to step in and shut this ponzi down. Why have they not done something by now?

This is getting silly now. Where are the SEC when you need them? Can they only manage one ponzi case every 3 years?

hello sorry but police in London should not stop simon steps, whether it is a ponzi? once the ponzi ends, why these subjects are getting away with it?

If you check their website, you will find that the SEC has initiated 272 Federal Court enforcement actions in 2016 alone:

sec.gov/litigation/litreleases.shtml

Contrary to what the Ponzi-player whiners like to believe, the D.C. office and the 11 regional offices receive no funds that the suckers “invested” in the SCAMS once they get closed down. Their budget is a tiny fraction of one percent of the total US budget and comes entirely from tax dollars.

With the SEC’s mission being:

Protecting investors

Maintaining fair, orderly, and efficient markets

Facilitating capital formation

it has occured to me that an incentive to pursue more Ponzi SCAMS faster might be if they stop treating the victims of the SCAMS like they are “regular investors” and allow them to pay a price for their folly by allocating half of recovered funds to the coffers of the SEC and dedicating those funds to the mission of pursuing more SCAMS.

SD

I am genuinely baffled sometimes as to how these human-sized rodents aren’t dead or in hospital by the hands of some seriously disgruntled ripped off victims or festering in prison for whatever is left of their pathetic, soul-sucking lives.

Can y’all just FEEL the festive love from Jack here?

You should.

There’s just no love for Ponzi scum.

I wish Oz and everyone good tidings and all that jazz. Another year of shining a well deserved spotlight on these roaches. Keep fighting the good fight.

Take care, folks and wishing you a scam-free new year for 2017.

P.S. In the unlikely event that Simon Stepsys should ever read this, I hope you fall on a spike for Christmas x

Couldnt have worded it better Jack, you said it all, death to the ponzi scum merry xmas Oz.

Thanks for the support guys.

i think the investment has been halved because the target audience this time around is asian countries.

participants in relatively poorer asian countries will find it easier to invest 25 euro, and then recruit like hell, leveraging their relatively higher populations.

deese still has africa and latin america to run his ponzi train though, so i guess he will have a busy ponzi career for the next few years.

my advertising pays [MAPs], is registered in anguilla [??] and does not transact any business in the US, though mike deese is a US citizen who lives there. all participants are from outside the US.

thus [IMO] MAPs and deese do not fall under the jurisdiction of the SEC.

this is similar to the problem encountered in the traffic monsoon case. only 10% of traffic monsoon’s business was transacted in the US, and there is a question about whether the SEC has jurisdiction over the business. the judge has taken the matter under advisement and we are awaiting an order in that case.

more international cooperation is required to tackle scams which have registration in one country, banking in another, servers in a third, participants from all over the world etc, as jurisdiction in such cases is hard to figure.

Unfortunately a Donald Trump presidency is likely to work both ways.

Less regulation remember…

Hey all, there’s a new group being run by some ex leaders, there is some quite revealing info being posted with some screenshots and news we knew nothing about.

I would urge everyone to join this group, use a fake FB account if you have to.

(Ozedit: Link to closed Facebook group removed)

Please don’t link to non-publicly accessible resources.

PS. If any My Advertising Pays affiliates want to know where their invested funds have gone, here’s a good place to start:

facebook.com/permalink.php?story_fbid=1522448391117826&id=788704724492200

With all due respect Oz, this scam page does very little to halt this ponzi, maybe one or two posts a week sometimes less, I don’t go there anymore….

this group has far more damning evidence than this scam page, just join it, anyone is accepted, it is closed for a reason.

This is a review of The Advert Platform. Best you don’t project your personal agenda onto it.

If it’s not a publicly accessible resource, don’t link to it.

Reader sent in this heads up:

mirror.co.uk/news/uk-news/promoter-denies-advert-platform-rich-9603176

Join a Ponzi, ask Simon Stepsys he knows them all. The biggest liar and scum bag to ever hit the Internet, the more pain he can give the more he laughs in your face.

I have had words with this asshole and he fronts himself kindly but beneath lies an evil bastard.