Qbule Review: Speak Asia survey Ponzi clone

There is no information on the Qbule website indicating who owns or runs the business.

There is no information on the Qbule website indicating who owns or runs the business.

The Qbule website does feature an “about us” link, however clicking on it reveals a broken link. I tried clicking the link using multiple locale variations of the Qbule website to no avail.

The Qbule website domain (“qbule.com”) was registered on the 24th of January 2012, however the domain registration is set to private.

Qbule list a corporate address on their website for “Qbule Technologies America” in the US state of Washington.

The address provided, “565 Andover Park W, Tukwila Washington”, is a big unmarked office building. Additionally no suite number is provided, which raises raising the question of whether or not Qbule is actually based there.

Upon browsing Qbule’s website, it wasn’t long before this messaged popped up:

Despite the promised 15th September completion date, a quick visit to “qmybid.com” reveals an unfinished auction site:

There’s no information on the QMyBid website indicating who owns it, with the “about us” page marked “under construction”.

The QMyBid website domain, like Qbule, is also registered privately.

If one looks at the source-code for the website though, clues as to who might be running Qbule and QMyBid are evident:

The site is running the same backend as “bestpricebid.com”, which is a domain owned by a “Parvinder Singh” from “BPS Network Pvt Ltd”. An address in the Indian city of Chandigarh is also provided.

Now we’re getting somewhere.

Whether or not Singh and BPS Network are behind Qbule was initially unclear, however it’s highly probable that Qbule is either based out of India or from elsewhere by somebody with a connection to India.

A few Google searches later and I confirmed that Parvinder Singh was indeed behind Qbule:

I didn’t check the Indian local site of Qbule in my initial checks, but when I went back and had a look sure enough Parvinder Singh’s name popped up in the “about us” section.

Why this information is not available on other local Qbule sites is a mystery.

As per Singh’s Qbule corporate bio, he claims to have ‘a vast experience in the industry of Direct Selling and Retail Marketing‘.

No explicit examples are provided and, possibly due to a language barrier I was unable to locate any myself.

The specifics of Parvinder Singh’s “vast experience” in the MLM industry remain unclear.

Read on for a full review of the Qbule MLM business opportunity.

The Qbule Product Line

Four services are mentioned on the Qbule website: strategy and consulting, online marketing, design & development and mobile development.

If one clicks “more” on any of the advertised services however, nothing happens.

Further down the Qbule website two sign up options appear, one for “advertisers” and one for “publishers”.

This would appear to be some sort of advertising network. Both sign-up pages however redirect to the domain “viralmedias.com”. Whether or not the actually have anything to do with Qbule isn’t clear.

As a standalone opportunity, based on what information is available on their website, Qbule do not appear to offer any retail products or services.

The Qbule Compensation Plan

The Qbule compensation plan is not available on the company’s website.

As such, the following analysis has been put together from an affiliate presentation dated July 2014.

Note: Regardless of how much is earned, Qbule withhold 30% of all affiliate commissions. These funds are converted into an internal virtual currency which can only be spent on products Qbule sell via an in-house storefront.

Package Investment ROIs

Qbule affiliates invest in “packages” which then pay out an advertised 52 week ROI.

- Assistant Silver Package ($125) – $8 a week ($416 annual ROI)

- Silver ($250) – $20 a week ($1040 annual ROI)

- Gold Package ($495) – $45 a week ($2340 annual ROI)

- Platinum Package ($990) – $100 a week ($5200 annual ROI)

In order to collect their weekly ROI, Qbule affiliates are required to “complete surveys, or watch a commercial and give feedback and other tasks that are simple”.

Package Investment Referral Commissions

Referral commissions on package investments in Qbule are paid out down seven levels of recruitment.

This is tracked via a unilevel compensation structure:

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1).

If any of these level 1 affiliates go on to recruit new affiliates of their own, they are placed on level 2 of the original affiliate’s unilevel team. If any level 2 affiliates go on to recruit new affiliates they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

How many levels of recruitment an affiliate receives commissions on depends on how much they invest:

- Assisted Silver Package investment = $1 on level 1 and 50 cents on levels 2 and 3

- Silver Package investment = $1 on level 1 and 50 cents on levels 2 to 4

- Gold Package investment = $1 on level 1 and 50 cents on levels 2 to 5

- Platinum Package investment = $1 on level 1, 50 cents on levels 2 to 5 and $1 on levels 6 to 7

Package Investment Residual Commissions

Daily residual commissions in Qbule are paid out on investments made by a recruited downline, using a binary compensation structure.

A binary compensation structure places an affiliate at the top of two binary teams, left and right:

Positions in the binary are filled via direct recruitment and the recruiting efforts of an affiliate’s up and downlines.

When recruited affiliates in the binary teams invest in packages, they are paired on either side of the binary using a 1:1 ratio.

For every 1:1 package pairing on either side of the binary, a Qbule affiliate is paid out between $10 (Assistant Silver Packages) to $80 (Platinum Packages).

- Assistant Silver Package pairing = $10

- Silver Package pairing = $20

- Gold Package pairing = $40

- Platinum Package pairing = $80

Binary commissions are capped depending on how much a Qbule affiliate invests.

- Assistant Silver Package investment = 20 pairings a day

- Silver Package investment = 25 pairings a day

- Gold Package investment =30 pairings a day

- Platinum Package investment = 40 pairings a day

Maxout Overshoot Incentive Point Bonus

Maxout Overshoot Incentive (MOI) points are generated if an affiliate generates 50 binary pairs in a single day. Every time this happens, 1 MOI point is generated.

Each MOI point generated pays out $200.

How many MOI points an affiliate can generate in a day is determined by the highest package they have invested in:

- Assisted Silver Package investment = 2 MOI points

- Silver Package investment = 5 MOI points

- Gold Package investment = 10 MOI points

- Platinum Package investment = 20 MOI points

As a Qbule affiliate accumulates MOI points, the following rewards become available:

- 2 MOI points = a “trip to an exotic location”

- 10 MOI points = $5000 “for small car”

- 30 MOI points = $15,000 “for medium car”

- 60 MOI points = $60,000 “for luxury car”

- 200 MOI points = $200,000 “for luxury villa”

- 1000 MOI points = $1,000,000 “cash reward”

Chairman Club

If an affiliate accumulates 1000 MOI points, they are designated “Chairman” status.

This qualifies them for a share in a monthly bonus pool made up of 1% of all money invested in Qbule.

Joining Qbule

Affiliate membership to Qbule is $100

In addition to this package investment (required to earn commissions) will, at a minimum, result in additional costs of between $125 to $990.

Conclusion

Most if not all of the information presented on the Qbule website can be discarded as smoke and mirrors. The internet marketing services, the publisher network… all of it.

What we have here is a blatant resurrection of Speak Asia’s survey-based Ponzi scheme. I don’t know what it is about India, but for some reason this specific Ponzi model seems to gain traction there over and over again.

Speak Asia had affiliates invest $220 on the promise of a $20 a week ROI.

Affiliate investors were required to take surveys, which the company initially professed were commissioned by third-party clients.

The maths of course didn’t add up, with said clients being required to pay $3.8 million USD per survey if the ruse was to be believed.

Indian regulators eventually shut the company down, however a few weeks later, due to what can only be described as a resoundingly stupid decision made by a local Judge, the owners managed to siphon $108 million USD of invested funds out of India.

The money was never recovered, with Speak Asia’s owners going into hiding shortly thereafter.

The Mumbai High Court eventually ruled Speak Asia was a pyramid scheme, however the case is still playing out in Indian courts.

Particular to Qbule however, is the fact that one aspect of regulatory investigations into Speak Asia revealed that the company was lying about its third-party clients.

Following the arrest of Nayan Khandor, the man responsible for putting together Speak Asia’s surveys, it was revealed the company supplied him with

a list of topics that were to be considered for future surveys.

The topics included use of scooters, deodorants, talcum powder, washing machines, power saving etc

Khandor and his team would search information related to the above topics on Wikipedia and other sites on the Internet and prepare a survey.

There were no survey clients. There never was.

Qbule seeks to resurrect this fraudulent model, adding the watching of videos and other pointless tasks to Speak Asia’s original survey recipe.

And you can bet on there being a large cross-section of Qbule’s management and/or top investors who were involved in Speak Asia. That the two companies are nearly identical and based out of India is obviously not a co-incidence.

Whereas Speak Asia were content to restrict themselves to scamming Indians though, Qbule seeks to push the survey Ponzi model internationally. This includes the US.

In that sense Qbule is a grander vision than Speak Asia ever was, but other than that it’s a clone. At the time Speak Asia was shut down, they were purportedly on the verge of releasing a “Yug” branded store that would see affiliates forced to spend some of their ROIs on appliances.

The inspiration behind Qbule’s own in-house store, which it forces affiliates to spend 30% of their ROIs through, is clearly evident.

Additionally, just as new investors in both TelexFree (AdCentral Family) and Speak Asia (AdStation Trios) were encouraged to invest in multiple positions, so too are they in Qbule:

Oh, and if anyone still insists the fictional survey clients are legit, with each package corresponding to a survey task ask yourself: Why on Earth would a client require multiple instances of the same answers from one affiliate investor?

As with all Ponzi schemes, once new affiliate investment slows down, Qbule will find itself paying out more than it brings in.

The annual ROI model means that when this happens, most affiliates won’t see it coming, as 12 month ROIs gives owners and top-investors plenty of time to flee under the cover of confusion.

If one digs deep enough infact, there’s already signs of this taking place.

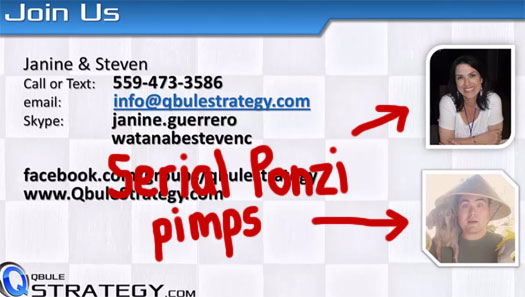

Exhibit A is a Facebook group communication from Janine Richards Guerrero, dated 12th September 2014:

UPDATE FOR USA QBULE AFFLIATES…..

Thank you for your extreme patience in this trying situation. The reason why withdrawals are still pending and for how long remains an unanswered question.

Reggie Acedera Celoza, newly appointed VP for Qbule International and QViral Medias is expected to address all affiliates of Qbule USA with an update on the current state of affairs.

We have not been made privy as to why this situation has happened nor have we been addressed by Qbule management in any public manner. All parties involved are aware of the fact that our USA Team is awaiting answers and guidance from corporate.

Thank you for your patience and for your patronage to Qbule…

Looking at some of Guerrero’s archived updates, it appears payment processor problems began back in late August. The status of Qbule’s ROI payouts elsewhere in the world is unclear.

Prior to Qbule, Guerrero, along with her son Steven Watanabe were heavily invested TelexFree.

TelexFree saw investors pump $299 investments into the company on the promise of a $20 week return. Sound familiar?

Whereas Qbule and Speak Asia use surveys and the watching of advertisements as their facades though, Speak Asia had affiliates spam the internet daily to market the opportunity.

Shut down in Brazil back in June 2013, the US followed with the SEC taking action against TelexFree in April 2014.

Following regulatory action, it was revealed TelexFree was a billion dollar Ponzi scheme.

In the aftermath of TelexFree, the bizarre behavior of Guerrero’s recruited TelexFree investors referring to her as “mom” was observed.

Guerrero responded by defending her participation in TelexFree and contributing to the loss of a billion dollars by thousands of investors globally, describing it as an act of “helping everyone and being kind to people” (paraphrased).

With their weekly Ponzi income severed following the shutdown of TelexFree, it’s easy to see what Guerrero and Watanabe find attractive about Qbule.

With payment processor problems already on the horizon though, how soon before either Indian or US regulators get involved?

Good ol Mom and Steven, sure are making names for themselves. I could add a few company names to the list but a picture says a thousand words:

I kinda like Faith with Ronald McDonald red hair.

THE OTHER SIDE OF THINGS:

What you fail to write about here is my heart for people. You also fail to write about the other 100’s of thousands of people promoting it just like us.

We all want a little more in this life and so we search and hope what we read is legal, after doing our due diligence is true.

So we picked wrong. So kill us. I lost and so many others lost. None of us feel good about that. No one knows the prayers or tears for others I have cried.

It was hard what happened in Telexfree and when I saw it going south I stopped bringing people in. Same in Qbule. I have not brought in anyone in a few months and am turning people away.

Before I read this I did a lot of searching. I am tired of these companies reeling us in only to screw us over so I quit all 11, yes I said 11 to focus on two businesses. The first one is an incredible honorable company.

(Ozedit: recruitment spam removed)

MOM

P.S. I like Faiths hair, what color is yours? and who says your color is the right one anyway. you big bully. Shame on you for making fun of people anyway.

You were actively promoting TelexFree until regulators came in and shut it down.

Immediately after, you were holding recruitment webinars with your son trying to push your downlines into a quickly changing rotation of questionable opportunities.

11 companies in and you’re still picking compliance nightmares? Try harder.

Janine is the most honest person that I can think of. She advised me, not to invest more into a business, because she wasn’t sure about it.

She could have made the money, but denied, because she helps people and is not only after the comission. What happens to some companies, is certainly not her fault.

The coment concerning faith sloan hairstyle is just tasteless.

@Valentin

A few acts of advising investors not to join does not weigh against the ripping off of hundreds (thousands?) of investors up until that point.

The company’s Janine has a track record with see any money she earnt directly stolen from others in the scheme.

Honest my ass.

She picked them to join and recruit people into. Did she not?

Looks like the US aren’t the only ones experience problems, money seems to be running out in Asia too.

This update was recently sent out to Qbule affiliates in Malaysia:

TLDR: Using the usual “we got hacked” Ponzi excuse BS, Qbule have decreed all Malaysian and Indonesian investors who are net-winners will have their investment ROIs terminated.

If they wish to continue to participate in the scam they need to re-invest as if they were new affiliates.

Those who have been paid nothing or partially will be made full (with the idea being existing affiliates will fund their ROIs).

They’re also pushing the fiction that “new owners are on board”, and maximum monthly withdrawals have been capped further.

Honestly, why don’t they just state they’ve run out of money and spare everyone the lengthy waffle BS?

Whether or not they’ll trot out the same excuse in the US remains to be seen.

My thanks to the Qbule affiliate who sent the notice in.

I did a Whois on qbule.com and qbuleus.com before the site shut down, and it showed this person as the owner:

Registrant: Emmanuel Erwin Raj

Address: 6, Sri Pateling Kuala Lumpur KUALALUMPUR Wilayah Persekutuan Kuala Lumpur 57000 MY

Phone: +60.676767676

He was the same guy who set up the Philippines office and managed the Philippines office indirectly with the help of his Filipina girlfriend Aprelle Canete, who was in charge of IT and Accounting.

The bank account of QBule in the Philippines had her as sole signatory. She reported straight to Erwinraj. They stopped paying members compensation around September 2014.