Nui Review: Cryptocurrency token investment with pseudo-compliance

Nui has its origins in Divvee, a failed “access to discounts” MLM opportunity that launched in mid 2016.

Nui has its origins in Divvee, a failed “access to discounts” MLM opportunity that launched in mid 2016.

When Divvee’s original model failed, the company rebooted as a mobile app promotion platform.

That also failed, prompting Divvee’s descent into unregistered securities.

In late 2017 Divvee merged with Hodo Global. The merger created Nui, which focused on cryptocurrency related unregistered securities.

On July 11th the Texas Securities Board issued Nui and associated companies with a securities fraud cease and desist.

Nui has vowed to challenge the notice, however at the time of publication that’s still playing out.

In the meantime Nui has “restructured” and is heavily pushing pseudo-compliance.

Today we publish an updated Nui review and see where the company is at.

Nui Products

Nui has no retailable products or services, with affiliates only able to market Nui affiliate membership itself.

Nui affiliate membership provides access to

- Core and Reach (part of Symatri, which enables affiliates to acquire Kala tokens)

- “1-year training”

- Nui Blockchain Education and

- access to the Mintage Mining passive ROI opportunity (costs an additional $500)

The Nui Compensation Plan

Nui affiliates sign up, pay a fee and are paid to recruit new affiliates who do the same.

Additional compensation plan components include Kala investment through Core and Reach, as well as direct investment into Mintage Mining.

Commission Qualification

A Nui affiliate must be “active” to qualify for commissions.

As per the Nui compensation plan;

To be active, you must have an active subscription order and have either a $100 Mintage Mining agreement, purchase of a

Kala Rig, or 1,000 points in CORE per month.A Mintage Mining agreement and Kala Rig purchase makes you active for 52 weeks.

Recruitment Commissions

When recruited affiliates pay their $150 annual fee, Nui pays a direct and residual recruitment commission.

The direct recruitment commission is a set $30 to the recruiting affiliate.

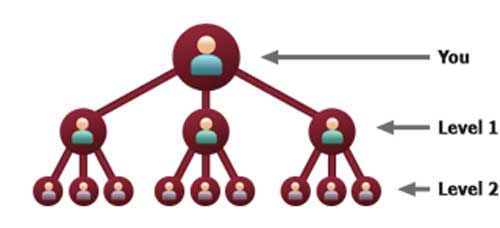

Residual recruitment commissions are paid via a 3×10 matrix.

A 3×10 matrix places a Nui affiliate at the top of a matrix, with three positions directly under them:

These three positions form the first level of the matrix. The second level of the matrix is generated by splitting these first three positions into another three positions each (9 positions).

Levels three to ten of the matrix are generated in the same manner, with each new level of the matrix generating three times as many positions as the previous level.

Positions in the matrix are filled via direct and indirect recruitment of Nui affiliates.

Nui take $30 of annual fees paid by affiliates in a matrix and split the commission 10% over 10 levels ($3 per level).

To earn on each level of the matrix requires personal recruitment of active Nui affiliates (see commission qualification).

One active affiliate personally recruited unlocks the first matrix level. Two active affiliates personally recruited unlocks the first two matrix levels and so on and so forth up to ten levels.

Investment Commissions

Investment into Kala equipment and Mintage Mining pays direct and residual commissions.

- the Kala direct commission rate is not disclosed

- Kala residual commissions (exact amounts are not disclosed) are paid out 10% on each level of the 3×10 matrix.

- Mintage Mining investment attracts a 10% direct commission

- 20% of Mintage Mining investment is paid out residually through the 3×10 matrix (2% per level)

Core Commissions

The Core platform provides Nui affiliates with offers and activities to complete in exchange for Kala tokens.

Commissions generated via Core activity completed by matrix commissions.

Generated commissions are split between an affiliate and nine upline levels (reverse unilevel).

Joining Nui

Nui affiliate membership is available at five price-points:

- Free – no cost

- Member – $15 a month

- Pro – $1150 (includes $1000 Mintage Mining investment position)

- Elite – $2650 (includes $2500 Mintage Mining investment position)

- Executive – $6700 (includes $2500 Mintage Mining investment position and purchase of Kala mining rig)

- Premiere – invitation only, costs not disclosed

Paid Nui affiliate memberships all cost $150 a year to maintain.

Conclusion

Having been pinged for unregistered securities, Nui seem to believe they’ll be able to pseudo-compliance their way out of it.

This includes the addition of a $500 fee Members affiliates have to pay if they wish to invest in Mintage Mining.

Affiliates who pay the fee are provided an Ant Router mining rig, which is capable of mining a small amount of LiteCoin each day.

This naturally has nothing to do with Mintage Mining’s passive ROI payouts to affiliates. Nor does it have anything to do with Kala investment, or investing in and then cashing out Kala tokens based on Nui’s set internal value (Kala is not publicly tradeable).

And so with unregistered securities the basis of Nui’s offering, around that we have pyramid recruitment by way of commissionable affiliate fees.

Pyramid recruitment and unregistered securities is not a good combination for regulatory compliance, and is primarily why Nui is in the mess they’re in now.

The company pretends what they’re doing isn’t regulated, however the fact of the matter is securities regulation in the US has existed since 1933.

Leave alone the fact that when you’ve been served a securities fraud cease and desist, claiming what you’re doing isn’t regulated is ridiculous.

Next we’ll address Nui’s post cease and desist drive towards pseudo-compliance.

No matter how the company dresses its offering up, affiliates are investing in Mintage Mining and Kala on the expectation of a passive ROI.

Nowhere is Nui’s facade more exposed than in the company’s own internal communications.

In an official Nui affiliate webinar held earlier this week, hosts Jim Paré and Casey Combden explained the $500 Mintage Mining fee as follows;

A lot of people say, “Well why do we have to pay $500 to (access Mintage Mining)?

You’re not paying anything. You’re putting your money into a mining unit and you’re getting paid on it.

It’s not money coming out of your pocket, it’s… we’re not allowed to say investment but that’s the closest thing I can say.

No matter what Nui bundles with Mintage Mining and Kala investment, funds are still deposited on the expectation of a ROI.

There’s simply no getting around that,leaving Nui with two options;

Either abandon the current investment ROI model and start again from scratch or register with the SEC and provide investors with full disclosure.

It should go without saying that signing up and investing in an MLM company that has an open securities fraud cease and desist against them is a bad idea, but I’ll throw that in also as a final thought.

So is this another USI-TECH with no mining going on or equipment?

Seems the whole lets mine or create our own currency thing is the wave that pulls money in.

No disclosure. Kala is not publicly traded meaning it could all be pre-generated.

Mintage Mining provides a ROI. No details or evidence of actual mining.

Instead of registering with the SEC and providing full disclosure, Nui think giving everyone Ant Routers will legalize unregistered securities.

I was hoping to have more time to comment today but I’ll just share one little fun fact. The Kala mining rig is an AntMiner V9 4Th/s.

Nui was (is?) selling them for $3,500 and while they are no longer listed on Bitmain’s product page they are still selling them for $260 on Amazon. In both instances the price includes the power supply.

Of course the Nui version comes preconfigured to mine Kala and prevented from mining anything else.

That is not correct. As upcoming companies will have their ICOs on the Kala Blockchain People owning Kala Rigs will have first movers advantage to mine those coins aswell.

Nui justifices the high rig price simply with the Chance to mine Kala before the public can as the mining difficulty is very low right now.

Uh, be it Kala blockchain or Kala tokens, the rigs are still locked to Kala one way or another.

And what upcoming companies? Kala was first announced June/July 2018 give or take.

Thank you for your feedback boeder, it’s appreciated.

I was just going by the Kala Rig spec sheet:

s3.amazonaws.com/kalarigs/Kala-Spec-Sheet.pdf

And that indicates the rig is preconfigured to mine only Kala.

I had not heard that Nui/Mintage has claimed that other companies were going to use Kala blockchain to launch their ICOs and that these companies were also going to give Nui/Mintage members an advantage over the general public when it came to mining their ICOs.

But perhaps we can agree that as of now, the $260 rigs that Kala sells for $3500, can only mine Kala.

Fresh bargle from a Nui upline leader:

That is John Johnson of Project Ethereum “fame”:

behindmlm.com/mlm-reviews/project-ethereum-review-2×8-matrix-ether-gifting/

As to the post itself, few facts much fluff. Darren Olayan and other principles in Nui/Mintage are obviously following their lawyers advice and not speaking publicly about their Texas C&D or anything else for that matter.

They still have four days to respond if they haven’t done so already and I expect they will, and ask for a trail date as far into the future as possible.

Their pigeons wont pluck themselves and they have a bunch of $30 antrouters left to sell for $500 (free with a fresh out of pocket purchase of $500 worth of Mintage Mining credits). But, and I can not stress this enough, this is being done for COMPLIANCE.

Compliance with what is a legitimate question. Mintage affiliates have expressed frustration that their mining contracts have fallen to about 1% per week (52% ROI per annum) so an AntRouter cranking out a few cents per week doesn’t materially affect the nature of the investment.

Full disclosure: I say this as someone who isn’t selling $30 worth of hardware for $500 so it may affect my perspective.

Internal exchange that allows Nui to set the internal value of Kala and manipulate it accordingly?

Give the SEC even more ammunition why don’t you.

Nui and the SEC Texas came to an agreement. Press Releases are released approx. within 48 hours.

i have been waiting for almost two years for this, the date that kala will finally be live on an exchange is set: 5th may 2020.

we will be informed of the name next week.

Also nui was bought 100% by appliqate, a public traded company.

For people who don’t know that means they got report to the SEC and their books are open, so no scam here.

Ah, so it’s to be a public exchange exit-scam. Nice.

Have you thought about what a public exchange listing actually means? I know the marketing is “to the moon!” and lambos, but who’s actually going to buy KALA?

There’s literally zero interest outside of desperate Nui investors.

Anyone can look up Appliqate on the SEC’s Edgar database. To date the company has made no financial report filings.

Appiqate’s last SEC filing was August 2019. None of their filings detail the KALA investment scheme.

But uh yeah, their “books are open”. Sorry for your loss.

Don’t worry Oz,i am not one of those people who are blinded because they want to believe in their mlm NO MATTER WHAT,]

if it’s a scam i will be the first to say it, i will report good or bad news starting from the 5th.

Due to the announcement of * Appliqate Inc *, of the launch of * Kala * to the Public Exchange * PROBIT *, on May 5, its shares on the Stock Exchange rose 101.61%, going from $ 1.24 to $ 2.50._

First comes the pump, then comes the …

That’s what I am afraid of.. But members seem to be raisonnable and they are not planning on selling all their coin on the 5th.

US Kala miners have been sitting on millions of Kala, some for close to two years now. There will be downward price pressure coming out of the gate.

“Nui International” is selling a securities offering specifically excluding the US market which means it isn’t legal anywhere and they know it.

Foreign punters have been buying Kala at eight cents a piece, an increase from the former US price of two. Have they manufactured enough interest in the developing world to bank roll US coin holders? I doubt it.

We’ll find out starting on the 5th when Kala gets listed on an exchanged based in the Seychelles.

And.,…Kala is Live:

probit.com/app/exchange/KALA-USDT

It opened trading 15 minutes ago at about 10 cents (in USDT) and is now struggling mightily to climb back to one penny.

over 200K Kala have changed hands. Join the Goldrush.

i was about to sell when i saw kala at 10 cents but i decided to hold… i hope i will not regret it.

it’s a long journey.

If it’s any consolation you wouldn’t have been able to sell at 10 cents even if you’d wanted to.

The pump stages of a public shitcoin listing generally consist of the scammers trading their coins between each other, so no actual money changes hands.

Scammers aren’t going to hand you real money in exchange for your made up Ponzi points, that’s not the way the money flows.

So if an investor tries to sell their points for 10c, they’ll find there aren’t actually any buyers. Once the scammers have stopped bothering with their pretend trades, the investors start offering lower and lower offer prices in the desperate hope of getting anything back, and the dump stage is away.

Total trading volume of $20k? Even for an obscure Ponzi scheme, that’s basically nothing.

Well not counting the millions of Kala coins held by the company , didnt they have a “pre-sale” back in like 2017, quick google search

=

so i wouldent hold my breath for any “moooning” on this shit ponzi alt in the near future (=numbber of generations before stupidity is forgoten and/our the “precoins” and “company coins”s are all dumped.

If I’m reading the current chart correctly… 0.3 cents?

Lulz.

For whatever little it’s worth I’m recording Kala’s first 24 hour bench marks. Believe it or not, they could be far worse.

Price: .00344 USDT (-95.09% from it’s open of 0.10047)

Volume(Kala): 27,390,380.858

Amount(USDT): 91,031.908

People spent over $91K on Kala today, that’s why I say the otherwise abysmal numbers could be worse.

Think about this, if you bought a $260 piece of mining hardware from Nui/Mintage and paid $3500 for it, you would only need to sell a bit better than a million Kala to break even. This of course doesn’t include either hosting fees or electrical bills, neither of which are inconsiderable.

So it isn’t impossible to break even, at least at today’s valuations. Let’s see what one or more tomorrows bring.

@GlimDropper, @Malthusian

Thank you guys for the knowledge,i really appreciate. i’m glad that i have nothing to regret.

i really hope that appliqate/nui will make annoucement that prove the utility of kala, otherwise i will be sorry for those 2 years of investment

You cannot give a shitcoin “utility” by announcing that it has utility.

Kala will never have utility. The problem is not that Kala is inherently useless. The problem is that any use you can think of can be better served by a cryptocurrency that doesn’t have thousands of desperate bagholders who will try to dump their Kala as soon as somebody puts more money into the system.

The best option is to be sorry now and write off the investment. The other option is to let them string you along a bit more, then be sorry and write off the investment. The second option is strictly inferior to the first.

You’ve already given them 2 years of your life, why give them more?

@Malthusian

i can’t say i gave them two years of my life, since the only time i was thinking about it was couple months ago when the exchange date was about to be known.

only invest what you can afford to loosepeople say, my fees for the mining are paid until september so right i am good.

i still believe in the project, not because i put money in it, but because i think it is a good one. you are right, the thousands bagholders are a problem.

Kala at 48 Hours:

Price: 0.00195

Volume(Kala): 25,464,833.705

Amount(USTD): 64,957.958

The money (USDT) is drying up, down almost 30% from yesterday. That, even more than the precipitous price drop, should concern investors.

Where is Darren Olayan? Is he making his famous bilingual videos to buck up the troops? Not that I can find.

Too soon to say exit scam?

Time for our third and final edition of Diary of a MLM Shitcoin.

Kala at 72 Hours:

Price: 0.00100

Volume(Kala): 34,277,418.355

Amount(USDT): 46,559.365

Dull, wet thud. My condolences to all who invested.

Kala is not dead yet!! Even if the value is a fraction of a penny (the fault of some desperate kala holders) the volume of transaction was good so that brought some attention.

on friday may 22nd, probit invited some investors to introduce kala to them. also i have talked to some leaders and Nui/Appliqate is negociating with others exchanges that are interested in kala.

we also try to talk to many kala holders to stop giving away kala,for sure nui/appliqate need to give use cases to kala but it’s also us, kala holders who decide the price that we want o sell.

The goal is to get back at a value between 0.05 and 0.10.

You can set your goals however you wish. Nobody outside of Nui is interested in Kala.

Getting KALA listed on other dodgy exchanges in the hope of dumping won’t matter, because there’s no external buyers.

At the end of the day you’re stuck bagholding a worthless coin.

I see Wilfrid’s chosen option 2. Sad but par for the course for get-rich-quick scam victims.

The fact that he’s trying to spin everyone desperately dumping Kala as a good thing because the trading volume was high (trading volume which consisted entirely of desperate bagholders in a race to the bottom scrabbling for the tiny amount of money left on the table) shows that there is literally nothing they won’t spin.

i agree with Oz, if nobody is interesting in kala and Nui/Appliqate doesn’t prove the utility, nothing probit or others exchanges can do will matters.

But i can’t disclose what some leaders told me but if it’s true kala will have use cases, i have no reason to think otherwise since everything they told me so far actually happened.

Don’t forget that Appliqate have bought several compagnies that will have purpose in the kala ecosysteme..All i am saying is that there is nothing bad about the value of kala since the launch of kala just happened recently, just wait a little longer to call kala dead.

I wrote this review almost two years ago. It doesn’t take two years to come up with a problem for a solution.

Appliqate, the new parent company of Nui, finally got around to filing their 2019 annual reports. All the financials are unaudited so may as well be written in chalk but there was one note of interest:

Olayan is still listed as owning 5.50% of Appliqate’s outstanding stock so I’m not 100% sure what is going on here.

He may have took one for the team or perhaps he got out before any potential fallout hits from Nui International’s “not available in the USA” passive income opp.

Yet another state cease and desist order against Olayan may have played a role in the feeble attempt to try and dissociate Olayan from Nui/Appliqate (even though he still hasn’t updated his LinkedIn page).

On April 4th, 2020, the Michigan regulator issued a C&D to Olayan and two of his companies, Mintage Mining LLC and BC Holdings and Investments LLC, for offering and selling unregistered securities.

Both these companies were also included in the 2018 Texas C&D, the second one in the 2019 Montana C&D. Weeks after the Montana one, the ‘acquisition’ (which Olayan also called a ‘merger’) by Appliqate happened. The Texas and Montana ones also included Nui Social LLC, the new Michigan one doesn’t.

It’s an absolutely brilliant idea to sell off a company (per their own press release, Oct. 8, 2019, “This final acquisition will make APQT the 100% owner of NUI.”), but only the assets, not the liabilities.

No company will ever have to pay debts again. Just every so often set up a new company, have that acquire all the assets but not the liabilities of the old one for nothing (no payment was mentioned), and let the old one go bankrupt.

Business as usual continues, but under a new name and now debt-free. Darren Olayan must be an absolute financial genius, to be the first one to have thought of this brilliant ruse.

Meanwhile, on the one exchange where it’s traded, the Kala token is now worth $0.00096 (in USDT). That’s great news, it means it’s still a whole two orders of magnitude away from running out of available digits.

Wasn’t Appliqate just a shell company? Who are the other players here?

On paper Una Taylor is running the show but I don’t claim to know what that really means.

The Michigan C&D (thanks PassingBy) came after Appliqate absorbed Nui which puts a kink in their “it all happened before the merger” cover story.

The filings are a formatting mess, you can’t even read the balance sheets. Which might mean something if the numbers were audited. That being said there are issuance histories and a list of shareholders here:

backend.otcmarkets.com/otcapi/company/financial-report/249507/content

The strands don’t seem to lead too far so I guess we have to wait to see what Nui International does next.

Given their history (traced back to Divvee), probably nothing until the SEC shuts them down.

I might have fallen victim to Poe’s Law and you may already know this, but this is a very common practice. It is known as “pre-pack administration” or “phoenixing”.

As long as people are dumb enough to keep lending money and ignoring the string of failed companies behind the directors, there is nothing stopping the ruse continuing indefinitely.

The only other thing stopping phoenixing is a creditor of one of the former companies suing for wrongful trading or for the liquidators failing in their duties (i.e. Company #N didn’t pay full value to acquire the assets of Company #N-1, which could then be distributed to creditors).

That almost never happens because it’s almost impossible to prove and it would almost certainly be throwing good money after bad. The creditors generally just suck up their losses.

As a general rule anyone with enough money to make it worthwhile to block an attempt at phoenixing (e.g. a big bank), and enough wherewithal to pull it off, doesn’t lend money to directors with a string of failed companies behind them without cast-iron security.

Very few, it seems. Besides Olayan, the Texas and Montana C&Ds mention two other people each. One in each case is identified as an affiliate selling the securities in those states. One of the other two, Reid Tanaka, is supposedly “NUI’s president”, and the other one, Douglas Whetsell, is only described as “affiliated with NUI Social”. Those last two share the Lehi, UT address of Olayan and all the companies. The Michigan order only mentions Olayan.

All the company names seem to be nothing more than factual doing-business-as aliases of Olayan, with a different selection out of his repertoire appearing in each state (Symatri LLC, NUI Social, Social Membership Network Holding LLC, BC Holdings and Investments LLC, Mintage Mining LLC). The regulators certainly don’t feel the need to try and distinguish between their activities, and say they’re all controlled by Olayan.

It’s hard to tell what role Appliqate ever played in his dealings. Perhaps it wasn’t a shell company after all, but a separate bunch of people, on whom he managed to unload some worthless supposed “intellectual property”, including Kala. In which case he’s simply carrying on as he did before, using some of the other company aliases he still owns (the Michigan one no longer mentions Nui). After all, he’s only got C&Ds from 3 states, there are 47 left to go.

The Appliqate website deepens the mystery: they’re apparently running an MLM of their own, CompAffiliates (“Appliqate has recruited and trained a significant blockchain salesforce across 108 countries”). Those will be selling stuff somehow linked to their own blockchain, CompChain, which is “the world’s first publicly available, working blockchain payment, processing system”.

They must have managed to do all that worldwide recruiting and blockchain building in almost total secrecy, since a Google search for “compaffiliates compchain” gives just 8 results, all of them coming directly from Appliqate.

From a quick glance, there doesn’t seem to be any mention of Nui, or Kala, on the Appliqate website. Perhaps this CompAffiliates thing is just a rebranding of Nui – but it happened in secret? If not, what did they buy Nui for?

@GlimDropper

Can you give the link where it says that Darren has stepped down from his position from appliqate?

I want the link not because I don’t believe you, It actually makes sense because we had a call couple days ago with Darren and he introduced Himself as CEO of symatri, not appliqate.

The news were great by the way.

OK so I have talked to big leaders who told me that Darren is still CEO of appliqate. I don’t know where you got that information GlimDropper.

Wilfrid, I found the quote in Appliqate’s recently published annual report. It’s near the end of section 8, Legal/Disciplinary History:

backend.otcmarkets.com/otcapi/company/financial-report/249507/content

Sounds like Appliqate aren’t being honest with their “big leaders”.

from Oz

Maybe, but i think that it is kind of wierd that we can’t find this information anywhere and also that GlimDropper can’t provide us the link. Normally in this website, it is all about proof.

Uh, it’s in the public filings Appliqate made with the SEC?

edit: researching this today (6/19), just wanted to clarify Appliqate hasn’t made and SEC filings for almost a year.

@GlimDropper

Thank you very much, members thought that I was lying. Darren is still denying this.

Malthusian:

From a quick look, “pre-pack administration” is something done openly and legally, whereas “phoenixing” is illegal.

But in this case, they seem to be ineptly trying to do phoenixing, without fully understanding how it works. The idea is to sell off everything of value in a company without anyone noticing, to another company controlled by yourself, then let the worthless husk that’s left with all the liabilities go bankrupt.

Not very publicly announce that you’ve bought a company as a going concern, even describing it as a “merger”. And then afterwards, suddenly proclaim that you only bought the assets, not the liabilities.

That’s simply a legal impossibility. Either Appliqate were lying back when they said they bought Nui, or they’re lying now about not being responsible for Nui’s liabilities from the past.

Maybe that’s how it dealt with in the anglosphere, but where I live the most important thing stopping it from being common is that fraudulent bankruptcy is a serious criminal offense.

It’s pretty hard to sell of all the assets just before a bankruptcy at a fraction of their real value, and not have the liquidator notice it and report it to the police.

Hello guys,can you look at this and tell me what you think? it’s one of the kala use case that nui is lauchching.. bitcoin ATM machines.

youtube.com/watch?v=etT1ojTQL_0&feature=youtu.be&fbclid=IwAR1Z4TFQidzQJNE7ajYaOdEwrOGfsoqvo3nPjCsRs-GgssXckZcKIQzb10k

Anyone can buy a bitcoin kiosk through Coinbridge Partners. How is a bitcoin ATM a use case for kala?

The end result is still nobody using kala. Not withstanding Nui International running an offshore Ponzi scheme.

It’s a machine operated by a company that has got nothing to do with Nui.

A singularly useless machine, because although they describe it as an ATM, the one and only thing you can do with it is put cash into it to buy bitcoin.

To do so, you must first register for an account with the machine’s operator, which includes providing them with a copy of a photo ID, plus a selfie.

So what’s the advantage over putting that cash into the bank account you already have, at an ATM or over the counter, and then buying bitcoin with a card, or a direct bank transfer, on any exchange you like, without having to pay a fee to the machine’s operator? You know, just the way you buy anything else you don’t pay for in cash?

And all without having to entrust your personal information to some small company you know absolutely nothing about, which has god-knows-what regulatory status, and which can from now on in link that personal information to one or more bitcoin wallets?

No wonder the makers have only managed to install six of them so far, five of them on their doorstep in Connecticut, and one with Nui.

Despite them putting a Nui decal on theirs, the only things it deals with are US dollars and bitcoin. If anything, it proves Nui’s own shitcoin is completely irrelevant, even to themselves.

PassingBy, maybe you can help me out. Did you watch the video Wilfrid posted the link to? Because there’s a bit I don’t quite understand.

At 1:38 Baldy has his phone-cameraman “focus in” (i.e., walk towards) the screen where it says he has $4,900 left after putting a $100 bill into the machine. Then he says, “So once again: five thousand dollars a day in cash.” (points to head) “Think about it.”

Think about what? Color me baffled, but it seems like he’s implying the machine will pay out $5k a day in cash, but it looks to me like that balance just means there’s a $5k daily limit on Bitcoin purchases. So I’m asking myself, “So f—ing WHAT??”

Am I missing something, here? Is he just trying to appeal to money launderers, or is he trying to imply there’s money to be earned with this silly machine?

thanks guys for your honest opinion as always!

@Amos_N-Andy

I didn’t think about that but now that you pointed this out it surely can be understood that way!!

I’d only looked at enough of the video to see the name of Coinbridge Partners, who operate the machine. Now that I’ve looked at it in full, yes, Darren Olayan (for it is he) seems to try and imply that you can somehow get money out of this machine. Obviously that makes no sense.

If the machine allowed someone to turn $5000 of cash into bitcoin every day, untracably, there might be some appeal to small-scale money launderers, but since everything goes through an account with Coinbridge, who require a copy of a photo ID, plus a functioning phone number for every transaction, that doesn’t work either.

But when I wanted to take another look at the Coinbridge website, to see if there’s anything there about that $5000 limit, it was gone. It now says:

So this suspension happened in the hours between me posting comment #51 and this one.

Coinbridge Partners’ website working for me here (“coinbridgepartners.io”).

And it’s back for me, too. Clearly they contacted their provider and whatever was wrong was immediately fixed. It could have been someone at that provider screwing up, of course. I presume all it would take is someone clicking on the wrong customer name.

@Oz

i ask about the utility since Nui brings nothing new, it seems that the fees will be much lower than the competition.

What fees? Transaction fees?

What does Nui whitelabelling some ATM machines and keeping transaction fees do for Kala (other than perhaps generate a tiny amount of revenue to put towards withdrawal requests)?

Wilfrid, it is time to face the facts: Kala is dead. It is as dead as a frog’s leg: you can make it twitch with a battery, but it is still dead.

All the scammers are doing is making a big show of the occasional leg-twitch, hoping you don’t notice them working the wires. But it is all smoke and mirrors, a spectacle to keep false hopes alive, and any money you invested is gone.

I sorry for your loss, but the sooner you accept it, the sooner you can get on with your life.

@Amos_N_Andy

i hope you are wrong and they are still working on some stuff:

the kala walet will soon be able to receive btc,insurance of your crypto in the wallet.

even if you are right, it’s been a long time since i haven’t put money in there so i am fine. i will be disappointed but i knew the risk.

@Oz

Honestly i don’t and i don’t see how it can help kala, we should know more in couple weeks.

Kala will be released on another exchange, whitebit. It seems this is a good exchange.

The Kala wallet and coindbridge signed a partnership.

And?

And Kala’s price soars on the news. All the way up to 0.00085 USDT. It was about 0.0005 last time I bothered to look, it’s mooning.

@Oz

Would coindbridge signed a partnership with a scamming company? That’s a real question,I am not trying to prove something.

@Wilfrid

You brought this up in August (#49). Nothing has changed.

Companies sign agreements because money. Nui can’t “partnership” its way out of securities fraud. Nor do partnerships make Kala any less of a worthless shitcoin.

@Wilfried,

NUI signed up as a Coinbridge affiliate. Pet near anyone could do it:

coinbridgepartners.io/contact-us/84-coinbridge-partners.html

And Coinbridge isn’t all that impressive. Here’s their current location list:

coinbridgepartners.io/btm-locations.html

Four in Connecticut, one in Massachusetts and one more in Lehi Utah, guess who’s office that one is in?

Either that list is out of date or Coinbridge has half a dozen ATM machines in their network.

Sorry but that wont save Kala.

@GlimDropper and Oz

thanks for the honest response as always.

So what is the latest on this Nui project? Some people in Africa just began to market Nui and Kala as the next big thing. Can anyone update on the status please?

It’s the same shitcoin Ponzi they can’t market in the US because securities fraud.

Africa tends to be easy picking for shitcoin scams so looks like that’s the game-plan.

PGI Global is also in the process of initiating an exit-scam through Kala – https://behindmlm.com/companies/pgi-global-collapses-initiates-exit-scam-through-nuis-kala/